Australia ICT Market Report by Type (Hardware, Software, IT Services, Telecommunication Services), Size of Enterprise (Small and Medium Enterprises, Large Enterprises), Industry Vertical (BFSI, IT and Telecom, Government, Retail and E-commerce, Manufacturing, Energy and Utilities, and Others), and Region 2025-2033

Australia ICT Market Overview:

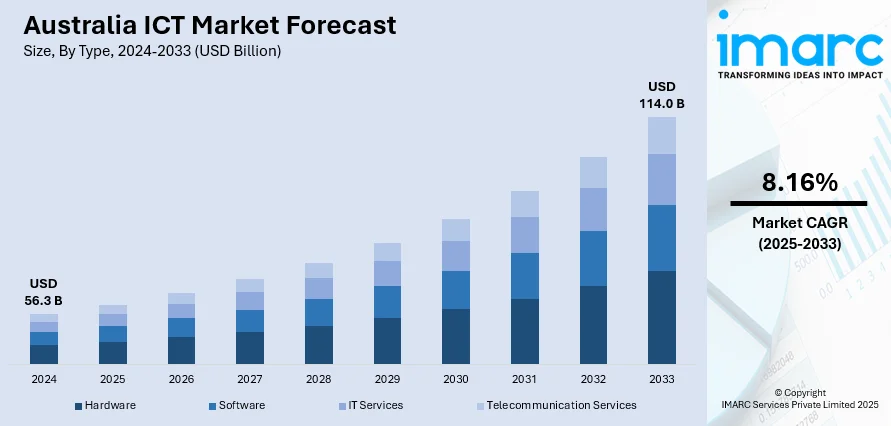

The Australia ICT market size reached USD 56.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 114.0 Billion by 2033, exhibiting a growth rate (CAGR) of 8.16% during 2025-2033. The market is primarily driven by the increasing demand for digital transformation across numerous end-use industries, considerable growth in the e-commerce sector, rapid expansion of high-speed internet and 5G networks, and the widespread adoption of advanced technologies like cloud computing, big data analytics, and automation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 56.3 Billion |

| Market Forecast in 2033 | USD 114.0 Billion |

| Market Growth Rate 2025-2033 | 8.16% |

Australia ICT Market Trends:

Progress of high-speed internet and 5G networks

The development of the ICT industry in Australia depends greatly on the progress and accessibility of high-speed internet and 5G networks. Having a fast internet connection is crucial for efficiently utilizing various ICT solutions such as cloud computing, video conferencing, and online collaboration tools. The expected arrival of 5G networks is predicted to lead to a revolution in connectivity. The upcoming 5G networks are anticipated to transform connectivity by providing quicker speeds, reduced latency, and the ability to link multiple devices at the same time. As these networks grow, they will offer the needed support for various new technologies, ultimately driving more growth and innovation in the ICT market.

To get more information of this market, Request Sample

Growth in the e-commerce sector

The expansion of e-commerce has a major impact on the information and communication technology (ICT) sector in Australia. These developments positively affect the ICT sector by offering essential resources and assistance for the expansion of online transactions. With the increasing popularity of online shopping, there is a growing need for robust ICT infrastructure to support the digital market. As a result, companies are increasingly investing in solutions like secure payment systems, CRM software, and logistics management solutions. Furthermore, the augmenting popularity of mobile commerce (m-commerce) and the increase in the use of smartphones and tablets for online shopping are further propelling the need for mobile app development and responsive web design services.

Australia ICT Market News:

- May 21, 2024: Telstra, a major Australian telecommunications company, signed a significant multi-year ICT deal with Infosys to modernize and simplify its application landscape, focusing on enhanced customer experiences and operational efficiency. The partnership will leverage Infosys's expertise in digital and cloud technologies to drive Telstra's strategic goals.

- April 17, 2024: The Australian Department of Defence is planning a $15 billion investment in enterprise data and ICT systems over the next decade. This investment will cover a range of initiatives, including upgrading networks, enhancing data management, and implementing new ICT infrastructure. The goal is to improve operational capabilities and ensure secure, efficient communication within Defence.

- January 31, 2024: Amazon's "Just Walk Out" technology, which allows shoppers to skip the checkout process by automatically detecting items taken from shelves, is being introduced to university campuses in Australia. This move marks the first deployment of the technology outside the United States, providing a streamlined shopping experience for students and staff. The introduction of this advanced retail technology highlights the growing demand for innovative digital solutions in the Australian ICT market, showcasing opportunities for local companies to develop and integrate similar technologies.

Australia ICT Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, size of enterprise, and industry vertical.

Type Insights:

- Hardware

- Software

- IT Services

- Telecommunication Services

The report has provided a detailed breakup and analysis of the market based on the type. This includes hardware, software, IT services, and telecommunication services.

Size of Enterprise Insights:

- Small and Medium Enterprises

- Large Enterprises

A detailed breakup and analysis of the market based on the size of enterprise have also been provided in the report. This includes small and medium enterprises and large enterprises.

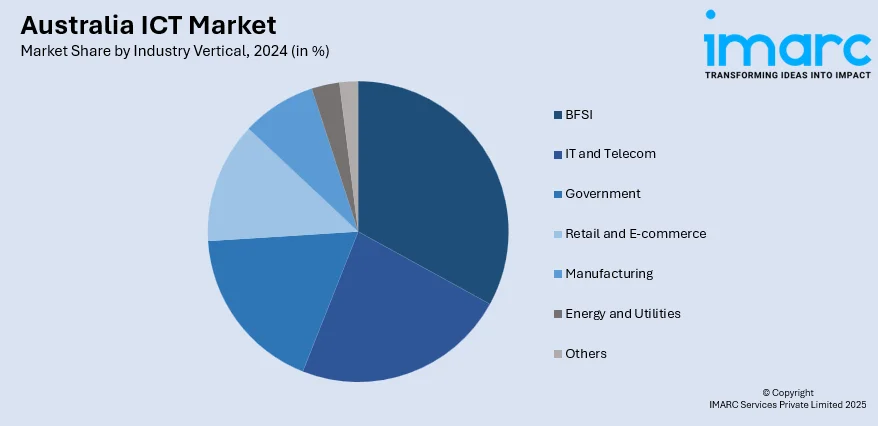

Industry Vertical Insights:

- BFSI

- IT and Telecom

- Government

- Retail and E-commerce

- Manufacturing

- Energy and Utilities

- Others

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes BFSI, IT and telecom, government, retail and e-commerce, manufacturing, energy and utilities, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia ICT Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Hardware, Software, IT Services, Telecommunication Services |

| Size of Enterprises Covered | Small and Medium Enterprises, Large Enterprises |

| Industry Verticals Covered | BFSI, IT and Telecom, Government, Retail and E-commerce, Manufacturing, Energy and Utilities, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia ICT market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia ICT market on the basis of type?

- What is the breakup of the Australia ICT market on the basis of size of enterprise?

- What is the breakup of the Australia ICT market on the basis of industry vertical?

- What are the various stages in the value chain of the Australia ICT market?

- What are the key driving factors and challenges in the Australia ICT?

- What is the structure of the Australia ICT market and who are the key players?

- What is the degree of competition in the Australia ICT market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia ICT market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia ICT market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia ICT industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)