Australia Hydropower Market Size, Share, Trends and Forecast by Size, Application, and Region, 2025-2033

Australia Hydropower Market Overview:

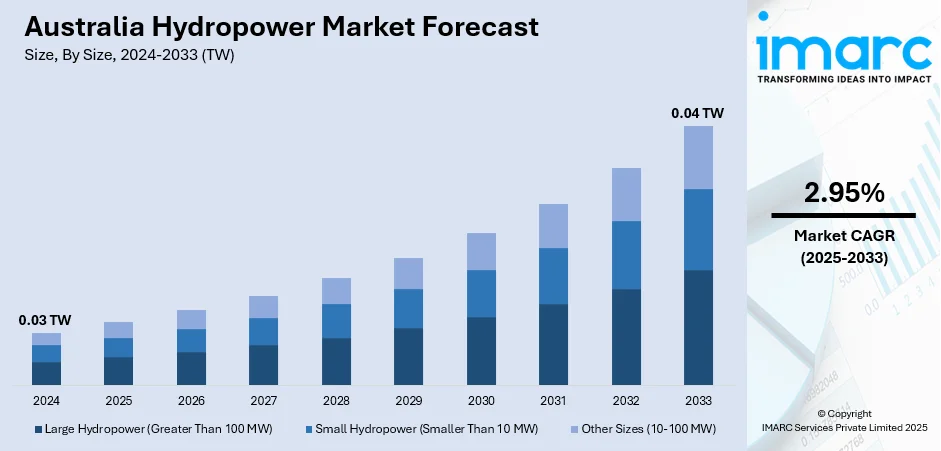

The Australia hydropower market size reached 0.03 TW in 2024. Looking forward, the market is projected to reach 0.04 TW by 2033, exhibiting a growth rate (CAGR) of 2.95% during 2025-2033. The market is rapidly expanding as a result of the country's increased focus on expanding its renewable energy portfolio, the implementation of favorable government policies and initiatives, rapid technological advancements in energy storage, and the growing demand for clean energy from both industrial and residential consumers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

0.03 TW |

|

Market Forecast in 2033

|

0.04 TW |

| Market Growth Rate 2025-2033 | 2.95% |

The market is propelled by regulatory support, natural resource availability, and rising energy demands. Additionally, the country’s long-standing experience with hydroelectric generation and the availability of well-established infrastructure provide a strong base for ongoing developments. As per industry reports, Australia’s current Nationally Determined Contribution (NDC) outlines three key targets, which include cutting greenhouse gas emissions by 43% from 2005 levels by 2030, maintaining a cumulative emissions cap of 4381 Mt CO₂-e over 2021–2030, and reaching net zero emissions by 2050. This commitment to reducing carbon emissions under international agreements drives investment into low-emission technologies, with hydropower being a stable and mature option. Furthermore, fluctuations in fossil fuel prices have intensified the shift toward renewables, encouraging grid operators and energy providers to diversify generation portfolios.

To get more information on this market, Request Sample

In addition to this, one of the significant Australia hydropower market trends is the modernization of aging infrastructure, as utilities upgrade older systems for better efficiency and reliability. Moreover, Australia’s vast river systems and suitable topography in regions like Tasmania and New South Wales offer practical and economic sites for both large-scale and pumped hydro storage projects. For instance, the Snowy 2.0 pumped hydro expansion in New South Wales, Australia, involves the construction of 27 kilometers of underground tunnels to link the Tantangara and Talbingo reservoirs. It also adds 2 GW of generation capacity to the Snowy Mountains Scheme. The project, valued at AUD 5.1 Billion (USD 3.62 Billion), is set to end by December 2028 (with full operation by December 2029). Once operational, Snowy 2.0 will provide 350 GWh (≈175 hours) of energy storage, enough for around 500,000 homes, significantly enhancing grid reliability and helping lower wholesale electricity prices. Also, ongoing collaboration between public and private stakeholders, including feasibility studies and pilot projects, ensures continuous momentum for both existing capacity improvements and new project launches.

Key Trends of Australia Hydropower Market:

Renewable Energy Expansion and Hydropower’s Role

The country’s focus on expanding its renewable energy capacity is a key driver for the hydropower market. According to the Clean Energy Council, renewable energy sources accounted for 39.4% of total electricity generated in Australia in 2023. With the government's goal to transition to a low-carbon economy, hydropower offers a stable and consistent energy source that balances the variability of other renewables like solar and wind. Unlike solar power, which depends on daylight, or wind power, which requires favorable wind conditions, hydropower provides continuous electricity generation, ensuring energy security and reliability. Hydropower also supports grid stability, offering an essential backup during periods of high demand or when other renewable sources fail to produce sufficient power. Furthermore, Australia's geography, which includes vast rivers and suitable terrain, is ideal for hydropower projects, providing significant opportunities for Australia hydropower market growth.

Government Policies and Incentives

The market is significantly influenced by government policies aimed at reducing carbon emissions and promoting clean energy solutions. The government has implemented various initiatives, including renewable energy targets, subsidies, and incentives for renewable energy investments, which create a favorable environment for hydropower development. For instance, the 2024-25 budget allocated over USD 22 Billion to expand renewable energy in Australia, as per industry reports. Policies such as the Renewable Energy Target (RET) are designed to ensure a substantial portion of Australia's electricity comes from renewable sources. As per industry reports, the Renewable Energy Target (RET) allocates approximately USD 2.7 Billion every year for large-scale and small-scale renewable energy projects. Additionally, state-specific incentives and funding for hydropower projects have been introduced to accelerate the deployment of these systems. These efforts help ease the financial burden of new projects and encourage private investment in hydropower infrastructure, which is enhancing the Australia hydropower market outlook.

Technological Advancements in Energy Storage

Technological advancements in energy storage, particularly in pumped hydro storage, are fueling the growth of the market in Australia. Overall, the energy storage market in Australia reached 4.0 GW in 2024 and is expected to reach 17.8 GW by 2033, growing at a CAGR of 18.0% from 2025-2033, according to a report published by the IMARC Group. Pumped hydro storage systems store energy by moving water to a higher elevation when electricity demand is low then release it to generate power when consumption increases, making hydropower more flexible and responsive to fluctuations in energy supply and demand. This technology enhances the role of hydropower in stabilizing the electricity grid, especially as Australia integrates more intermittent renewable energy sources like wind and solar. Innovations in turbine efficiency and water management systems also improve the performance and reliability of hydropower plants. Additionally, advancements in remote monitoring and automation are reducing operational costs and increasing the lifespan of hydropower assets.

Growth Drivers of Australia Hydropower Market:

Abundant Water Resources

Australia boasts a vast array of rivers, dams, and reservoirs, which offers a significant advantage for establishing hydroelectric power initiatives. These plentiful water resources facilitate the development of hydropower plants, both large and small, enabling local regions to efficiently satisfy their electricity needs. The consistent availability of water ensures dependable power generation, reduces dependence on fossil fuels, and strengthens the country’s renewable energy mix. Implementing seasonal water management techniques alongside reservoir storage allows for improved control of the electricity supply throughout the year. This rich natural resource base lowers operational risks and promotes investment in hydropower infrastructure. By utilizing these water resources, Australia can diversify its renewable energy sources and bolster energy resilience, fostering long-term growth in the market.

Energy Security and Stability

Hydroelectric power is vital for ensuring energy security and maintaining grid stability in Australia. In contrast to fluctuating energy sources like solar and wind, hydropower delivers a consistent and reliable electricity supply that can adapt to demand fluctuations. This predictability makes hydro plants an indispensable complement to other renewable energy sources, facilitating a smoother integration into the national grid. Pumped storage systems further improve grid adaptability by accumulating energy during low-demand times and releasing it when demand is high. By providing steady base-load power and rapid-response capabilities, hydropower decreases the likelihood of blackouts and bolsters the resilience of the energy infrastructure. These characteristics position it as a key element in Australia’s ambition for a stable, low-carbon energy future.

Sustainability and Carbon Reduction Goals

The drive toward sustainability and decreasing greenhouse gas emissions significantly propels the development of hydroelectric power in Australia. As governments, corporations, and individuals push for cleaner energy options, hydropower stands out as a low-carbon, renewable substitute for electricity derived from fossil fuels. By producing electricity without the combustion of coal or gas, hydro plants contribute to alleviating climate change effects while addressing rising energy demands. Additionally, hydropower aids in the integration of other renewable energy sources by offering flexible storage and backup capabilities. This commitment to national and global carbon reduction initiatives fosters public and private investments in hydroelectric projects. As a result, transitioning to hydroelectric power enhances Australia’s environmental standing and propels its shift toward a sustainable energy landscape.

Opportunities of Australia Hydropower Market:

Development of Small-Scale and Mini Hydropower Projects

The growth of small-scale and mini hydropower facilities presents considerable prospects for the Australian market. These projects are especially suitable for regional and isolated areas where access to centralized electricity grids is scarce. Smaller hydro installations require less capital investment than large dams, making them more viable for local communities and private investors. Their environmental impact is also lower, and they can be executed with minimal disturbance to natural ecosystems. By generating electricity near the consumption point, micro and mini hydro projects help decrease transmission losses and improve energy reliability. This strategy fosters local energy independence and aids in the overall increase of renewable energy capacity within Australia’s diverse energy landscape.

Pumped Storage Expansion

Pumped storage facilities offer a significant growth avenue for Australia’s hydroelectric sector. These systems store surplus energy by elevating water to reservoirs during periods of low demand and releasing it to produce electricity when demand is high. This functionality makes pumped storage an efficient method for balancing the fluctuations of renewable energy sources like solar and wind. Expanding these facilities enhances grid flexibility, bolsters energy reliability, and facilitates the integration of larger renewable energy capacities. Moreover, pumped storage can deliver ancillary services such as frequency regulation and reserve power, contributing to the stability of the electricity network. Investments in state-of-the-art pumped storage technology enable effective energy management, positioning Australia to meet increasing electricity demand while advancing toward a low-carbon energy system.

Integration with Other Renewables

Hydropower presents considerable potential as a complementary energy source to solar and wind power in Australia. Its capability to provide consistent, dispatchable electricity helps to mitigate the variability of other renewables, ensuring grid stability and a dependable power supply. The integration of hydroelectric plants with solar and wind farms facilitates better management of peak loads and energy storage, which enhances overall system efficiency. Such hybrid arrangements can lessen dependence on fossil fuel backup and maximize the use of renewable energy. Additionally, advancements in smart grid management and digital monitoring improve coordination between hydro and other energy sources. By serving as a stabilizing backbone, hydropower strengthens the integration of renewable energy, supporting the growth and resilience of Australia’s sustainable electricity sector.

Challenges of Australia Hydropower Market:

Environmental and Ecological Impact

Large-scale hydroelectric initiatives, while advantageous for generating renewable energy, can lead to considerable environmental and ecological repercussions. The construction of dams and reservoirs frequently modifies the natural flow of rivers, which impacts water quality, sediment transport, and aquatic life. Fish migration routes may be disrupted, and the habitats of local wildlife can either be submerged or fragmented, resulting in a decline in biodiversity. These environmental issues can provoke opposition from conservation organizations, local residents, and environmental regulators, potentially causing delays or cancellations of projects. Moreover, alterations in water flow can influence agriculture and fishing downstream, creating socio-economic challenges. To mitigate ecological disruptions, developers must embrace sustainable planning, environmental conservation measures, and careful selection of sites. These challenges underscore the importance of finding a balance between energy development and ecosystem preservation in Australia.

High Capital and Maintenance Costs

The establishment of hydroelectric power infrastructure demands significant initial capital expenditure. Building dams, reservoirs, turbines, and related transmission networks entails considerable engineering, labor, and material costs. In addition to construction expenses, ongoing upkeep, periodic renovations, and the modernization of equipment contribute significantly to operational costs. Hydropower projects also necessitate spending on safety protocols, regulatory compliance, and environmental management. The high capital demands can complicate financing, especially for smaller developers or private investors, and may prolong the payback period for projects. Unexpected expenses stemming from technical difficulties, natural calamities, or design adjustments can also affect profitability. Such financial challenges require thorough feasibility assessments, long-term planning, and strategies for risk mitigation to ensure the sustainable and economically viable operation of hydroelectric projects.

Climate Variability and Water Availability

The generation of hydropower is highly reliant on a stable water supply, rendering it susceptible to climate variability and water scarcity. Seasonal variations, extended periods of drought, or changes in rainfall patterns due to climate change can considerably reduce the water levels in rivers and reservoirs, which in turn limits electricity generation. This variability influences the dependability of energy output, complicates grid management, and may lead to a need for alternative energy sources during dry spells. Areas experiencing lower rainfall face operational difficulties and reduced efficiency, which can adversely affect revenue and confidence among investors. To address these challenges, developers must adopt effective water management practices, optimize reservoir functioning, and consider hybrid systems that integrate other renewable energy sources. Managing uncertainties related to climate is essential for ensuring the stability and sustainability of the hydroelectric power sector in Australia.

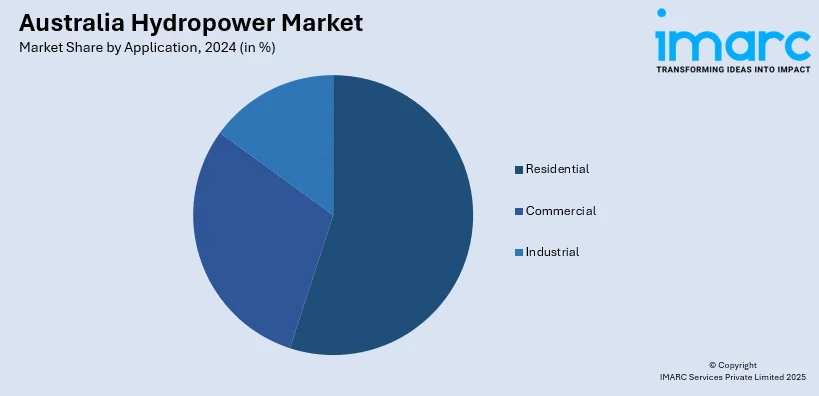

Australia Hydropower Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Australia hydropower market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on size and application.

Analysis by Size:

- Large Hydropower (Greater Than 100 MW)

- Small Hydropower (Smaller Than 10 MW)

- Other Sizes (10-100 MW)

Large hydropower (greater than 100 MW) leads the market with around 90.3% of market share in 2024. Their importance lies in their ability to generate vast amounts of electricity consistently, often forming the backbone of renewable energy output in states like Tasmania and New South Wales. These facilities play a key role in grid stability by providing baseload power and rapid-response backup when intermittent sources like wind and solar dip. Snowy Hydro, one of the most prominent examples, highlights how large-scale hydro is being used not just for generation but also for storage through pumped hydro schemes. This allows excess renewable energy to be stored and dispatched when needed, supporting the broader shift toward low-carbon energy. As Australia accelerates its transition to clean energy, large hydropower remains a strategic asset, less visible than wind and solar but critical in keeping supply reliable during periods of demand fluctuation.

Analysis by Application:

- Residential

- Commercial

- Industrial

Residential leads the market with around 53.4% of market share in 2024. While large-scale hydropower stations supply power to the grid, households indirectly benefit from stable, low-emission electricity. This matters most in regions like Tasmania, where hydropower accounts for nearly all electricity generation, and residents rely on it for everyday needs. In off-grid and remote communities, micro-hydro systems also serve residential clusters directly, offering a more reliable alternative to diesel generators. These systems are particularly useful in areas with consistent water flow and minimal access to centralized energy infrastructure. Residential interest in clean energy has grown, and although rooftop solar dominates the personal renewable space, hydropower's role in keeping grid electricity low carbon helps meet consumer demand for greener sources. Hydropower is becoming a vital part of home energy solutions, as it supports the broader sustainability goals that many households now prioritize.

Regional Analysis:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

In 2024, Australia Capital Territory & New South Wales dominated the market. Australia Capital Territory leans heavily on clean energy imports, much of which comes from hydro generation in NSW and other states. New South Wales (NSW) is home to major infrastructure like the Snowy Mountains Hydroelectric Scheme, one of the largest and most iconic renewable energy projects in Australia. This scheme not only provides substantial electricity but also plays a central role in pumped hydro energy storage, which is essential for managing fluctuations in renewable supply. NSW's varied terrain and access to reliable water sources make it well-suited for large-scale hydro development. Together, the two regions contribute to national renewable targets, with NSW acting as a power generator and the Australia Capital Territory as a policy leader in clean energy adoption. Their combined role supports grid stability and accelerates the country's renewable transition.

Competitive Landscape:

The market is shaped by a mix of established operators managing large-scale assets and newer participants exploring small and micro-hydropower opportunities. Competition is driven by access to water resources, project financing capabilities, and alignment with government's energy strategies. Operators are focusing on modernizing existing infrastructure, improving turbine efficiency, and integrating digital monitoring systems to optimize performance. There is a gradual shift toward hybrid models where hydropower supports variable renewables like wind and solar, strengthening its value in the national grid. Regulatory compliance, environmental approvals, and stakeholder engagement remain critical for project development and operation. Market participants are also seeking partnerships to mitigate risk and reduce capital burden. According to Australia hydropower market forecast, the sector is expected to expand steadily due to ongoing investments in energy transition initiatives and increasing recognition of hydropower’s role in delivering low-emission, dispatchable power.

The report provides a comprehensive analysis of the competitive landscape in the Australia hydropower with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: The Australian Gas Light Company (AGL) purchased complete control of two early-stage pumped storage hydropower projects in Australia's Upper Hunter region of New South Wales. The projects were formerly owned by Upper Hunter Hydro Top Trust (UHH) and are located at Glenbawn and Glennies Creek. The Glennies Creek project is anticipated to supply 623MW of 10-hour storage, while the Glenbawn project is planned to supply 770MW of 10-hour storage.

- April 2025: The Government of Queensland announced an investment of USD 30.1 Million via the government-owned firm CleanCo in a pumped hydropower energy storage (PHES) project with an approximate 20 GWh capacity. The project, which is a 50/50 joint venture between the advising firm ICA Partners and gold miner Evolution Mining, involves the conversion of Evolution's Mt Rawdon gold mine into a pumped hydropower plant.

- March 2025: AGL applied for federal environmental approval for its 400 MW/3.2 GWh Muswellbrook pumped-storage hydropower project, which is situated in New South Wales's Hunter Valley. The Muswellbrook Pumped Hydro will be constructed atop a former coal mine, as suggested by AGL and Idemitsu Australia, a division of the Japanese petroleum corporation Idemitsu.

- February 2025: ACEN AUSTRALIA, a division of ACEN Corporation, announced plans to proceed with the development of an 800-megawatt (MW) pumped hydropower project in Australia after obtaining a long-term energy service agreement established under the New South Wales Electricity Infrastructure Roadmap. The ACEN Phoenix Pumped Hydro project is anticipated to be fully operational by 2031. The plant will also be capable of storing enough energy to last for about 15 hours.

Australia Hydropower Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | TW |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sizes Covered | Large Hydropower (Greater Than 100 MW), Small Hydropower (Smaller Than 10 MW), Other Sizes (10-100 MW) |

| Applications Covered | Residential, Commercial, Industrial |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia hydropower market from 2019-2033.

- The Australia hydropower market research report provides the latest information on the market drivers, challenges, and opportunities in the regional market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia hydropower industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The hydropower market in Australia reached 0.03 TW in 2024.

The growth of the Australia hydropower market is driven by Government support for renewables, demand for clean energy, long-term cost benefits, energy security needs, grid reliability improvements, and phasing out of fossil fuels are driving market growth. Hydropower also supports peak load management and rural electrification, aligning with Australia’s emission reduction goals and transition to sustainable energy systems.

The hydropower market in Australia is projected to exhibit a CAGR of 2.95% during 2025-2033 reaching a volume of 0.04 TW by 2033.

Large Hydropower (greater than 100 MW) account for the largest share of the Australia hydropower market size. This segment's dominance is driven by its high capacity, grid stability benefits, and strong output. These projects attract investment, are favored by national energy plans, and are often located in resource-rich regions like Tasmania and New South Wales. Their scale makes them efficient for long-term electricity supply.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)