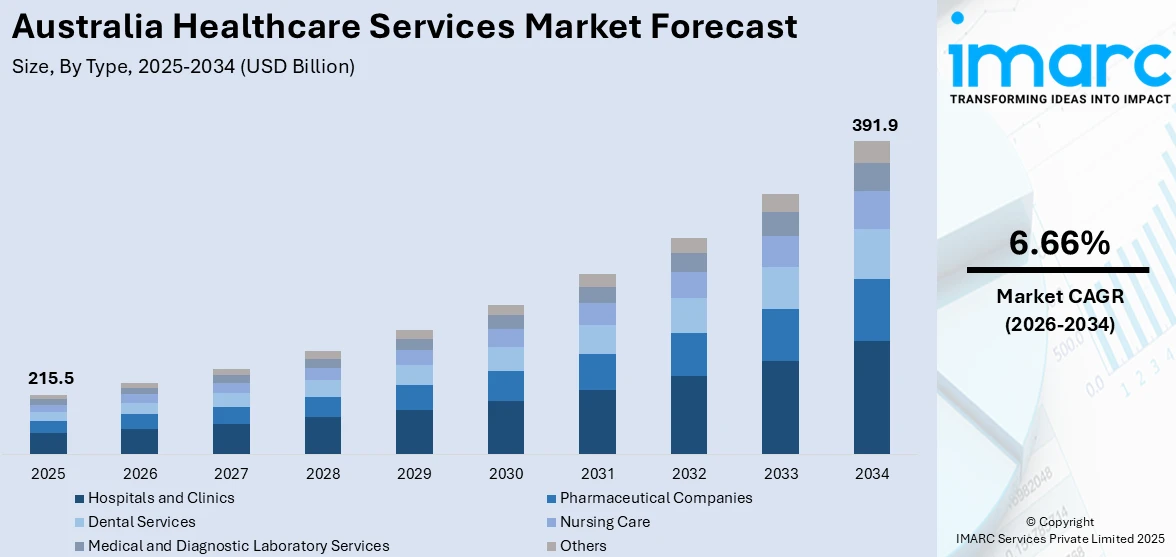

Australia Healthcare Services Market Report by Type (Hospitals and Clinics, Pharmaceutical Companies, Dental Services, Nursing Care, Medical and Diagnostic Laboratory Services, and Others), Expenditure (Public, Private), and Region 2026-2034

Australia Healthcare Services Market Size and Share:

The Australia healthcare services market size reached USD 215.5 Billion in 2025. Looking forward, the market is projected to reach USD 391.9 Billion by 2034, exhibiting a growth rate (CAGR) of 6.66% during 2026-2034. The market is propelled by the rising geriatric population, increasing prevalence of chronic diseases, such as diabetes, cardiovascular diseases, and cancer, government initiatives and policies, and innovations such as telemedicine, electronic health records.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 215.5 Billion |

| Market Forecast in 2034 | USD 391.9 Billion |

| Market Growth Rate 2026-2034 | 6.66% |

Key Trends of Australia Healthcare Services Market:

Aging Population

The market is primarily driven by the aging population as they create demand for age-related health services, especially chronic disease management, long-term care, and preventive health. As per the Australian Institute of Health and Welfare (ABS 2020b), there were an anticipated 4.2 million older Australians (those 65 and over) as of June 30, 2020, making about 16% of the country's overall population. It is anticipated that the proportion and total number of older Australians would rise further. According to ABS (2018), the proportion of elderly individuals in Australia's population is expected to rise from 21% to 23% by the year 2066. This, in turn, would raise demand for healthcare infrastructures, healthcare facilities, care providers with skilled capabilities, and investments in healthcare technologies. Government policies and programs aimed at supporting the aging population, such as the National Disability Insurance Scheme (NDIS) and aged care reforms, further add to the growth in healthcare services. The increasing healthcare needs make the aging population a very crucial component in shaping the future of the Australia healthcare services market.

To get more information on this market Request Sample

Rising Prevalence of Chronic Diseases

The rising prevalence of chronic diseases, such as diabetes, cardiovascular diseases, and cancer, is a major driver of the healthcare services market in Australia. As per the Australian Bureau of Statistics, in 2017-18, just less than half (47.3%) of Australians had one or more chronic diseases, up from 42.2% in 2007-08. These conditions require long-term management and continuous medical care, leading to an increased demand for healthcare services, including diagnostics, treatment, and rehabilitation. The growing incidence of lifestyle-related diseases, fueled by factors such as poor diet, lack of physical activity, and obesity, is putting additional pressure on the healthcare system. To address this challenge, there has been a significant focus on preventive healthcare, early diagnosis, and patient education. The government and healthcare providers are investing in programs that promote healthy living and disease prevention, which in turn, drives the need for healthcare services. The ongoing management of chronic diseases also necessitates the development of specialized healthcare facilities and the adoption of advanced medical technologies, further contributing to the market's growth.

Increased Digital Health Adoption

In Australia, the use of digital health technologies is transforming the healthcare industry. Telemedicine and electronic health records (EHRs) are becoming integral parts of healthcare provision, improving access by patients, particularly those in remote areas. Telemedicine facilitates consultations with healthcare providers without requiring physical visits, effectively bridging geographical limitations. EHRs enhance patient information management, allowing healthcare professionals easier access to and sharing of necessary data for better and more accurate care. The expansion of digital health tools also encourages preventive treatment and enables remote patient monitoring that can decrease hospital visits and allow for individualized care. This trend is contributing to the expansion of the digital healthcare sector, positively impacting the Australia healthcare services market share, as more institutions and individuals adopt these innovations.

Growth Drivers of Australia Healthcare Services Market:

Government Policies and Funding

In Australia, policies such as the Medicare system are essential for ensuring fair access to healthcare services across the country. Medicare functions as a universal healthcare safety net, covering various medical services, including hospital treatment, doctor consultations, and vital therapies. Continuous healthcare reforms aim to enhance service delivery, improve patient outcomes, and decrease waiting times. These reforms involve funding initiatives that target workforce shortages, expand access to healthcare in rural areas, and elevate the quality of aged care. Government financial support helps create a stable healthcare environment, promoting private investments and innovative solutions within the industry. This holistic strategy is key to sustaining and advancing the healthcare services market in Australia.

Technological Advancements

Healthcare delivery in Australia is being revolutionized by technological innovations, making services more efficient and accessible. Digital health technologies, including telemedicine systems, allow patients to remotely reach healthcare providers, enhancing access particularly in remote regions. Electronic health records (EHRs) allow for the easy transfer of medical data between providers, promoting coordination and reducing errors. AI-based diagnostics enhance treatment and early diagnosis by analyzing patient information faster and more correctly than the conventional approach. These technologies make healthcare processes smooth and cost-effective by eliminating unnecessary visits to clinics. With ongoing technological advancements, it will continue to improve healthcare efficiency and accessibility, helping the Australian healthcare services market grow tremendously.

Workforce Demands

The health industry in Australia is experiencing an escalating demand for health professionals as services grow and the patient pool rises. With an aged population and an increase in chronic disease, there is an increased demand for experienced doctors, nurses, allied health workers, and support staff. This mounting demand is also fueled by the ongoing expansion of health services, especially in rural and remote areas. As a response to the shortages in the workforce, enormous investments are being placed in employee training, professional development, and retention programs. Additionally, competitive wages, enhanced working conditions, and creative workforce designs are being implemented in efforts to attract and retain healthcare talent. These initiatives are essential for meeting the rising Australia healthcare services market demand and ensuring the delivery of sustainable, high-quality care.

Opportunities of Australia Healthcare Services Market:

Healthcare Technology Integration

Innovations in healthcare technologies, including artificial intelligence (AI), robotics, and wearable devices, are revolutionizing the healthcare sector in Australia. AI is enhancing the precision of diagnoses, analyzing patient information, and customizing treatment approaches, which results in better patient outcomes. Robotics is increasingly employed in surgical procedures and rehabilitation, facilitating more accurate operations and quicker recovery times. Meanwhile, wearable devices like fitness trackers and smartwatches allow for ongoing monitoring of patients' health indicators, offering healthcare professionals immediate access to data. These advancements enhance patient care and boost operational efficiency, leading to reduced costs and shorter waiting periods. As these technologies become more embedded in healthcare services, they offer substantial growth opportunities. The Australia healthcare services market analysis indicates that such technological innovations are propelling the future development of the industry and transforming the delivery of care.

Preventive Health Initiatives

Preventive health initiatives are becoming increasingly prominent in Australia as the focus transitions from treatment to prevention. Wellness initiatives promoting physical activity, nutritious diets, and mental health are on the rise, as they contribute to alleviating the long-term demands on the healthcare system. Additionally, there is a growing emphasis on regular screenings for diseases such as cancer, diabetes, and heart conditions, facilitating earlier detection and intervention. Programs aimed at managing chronic illnesses are also in demand, helping individuals effectively control conditions like diabetes and hypertension. This shift towards preventive care presents healthcare providers with the chance to broaden their services, enhance patient outcomes, and lower overall healthcare expenses by addressing health issues proactively.

Growth of Private Healthcare

Increasing out-of-pocket costs and lengthy wait times in the public healthcare sector are opening significant opportunities for private healthcare services in Australia. More individuals are pursuing timely, specialized care, leading to the expansion of private hospitals, specialist clinics, and diagnostic facilities to address this demand. Patients are increasingly inclined to pay for quicker access to healthcare professionals, elective procedures, and advanced treatments that often experience delays in the public system. The private sector’s capacity to deliver personalized care and reduce wait times positions it as a vital component in bridging the gaps within public healthcare. This trend towards private healthcare creates opportunities for providers to enhance their offerings and meet the rising demand for efficient, high-quality care.

Key Sectors of Australia Healthcare Services Market:

Primary Care

In Australia, primary care serves as the cornerstone of the healthcare system and is mainly delivered by general practitioners (GPs) and allied health professionals. GPs provide a wide array of services, including routine health checks, vaccinations, preventive measures, and management of minor health issues and injuries. They are typically the first point of contact for patients, ensuring continuity of care and offering referrals to specialists when necessary. Allied health professionals, such as physiotherapists, dietitians, and psychologists, are also crucial in enhancing patients’ overall health and wellness. The primary care sector plays a vital role in alleviating the demands on hospitals and specialized services by enabling early detection and intervention, thereby promoting better health outcomes for the population.

Aged Care

The aged care sector in Australia is rapidly growing in response to the increasing number of elderly citizens. This sector encompasses residential aged care, home care assistance, and specialized care for dementia, catering to the varied needs of older Australians. As the elderly population rises, so does the demand for high-quality care services, particularly in the management of chronic health conditions and support for independent living. Residential aged care provides 24/7 help with daily activities, while home care services enable seniors to remain in their homes with necessary support. With the rising incidence of dementia, specialized care services are becoming increasingly important to enhance the quality of life for those affected. Consequently, the aged care sector is poised to remain a critical component of Australia’s healthcare landscape.

Mental Health Services

Australia's mental health services are witnessing a surge in demand as public awareness about mental health issues grows. These services encompass counseling, therapy, psychiatric treatment, and crisis intervention, focusing on conditions like depression, anxiety, and PTSD. This heightened recognition of mental well-being's significance has led to enhanced funding and increased access to mental health resources. The rise of telehealth services has improved access to care, especially for individuals in rural regions, allowing them to receive support remotely. As the demand for mental health assistance continues to grow, the sector must address challenges such as securing adequate resources, training professionals, and providing timely care. Prioritizing mental health is essential for improving overall public health and reducing the stigma associated with mental illness.

Challenges of Australia Healthcare Services Market:

Rising Healthcare Costs

One of the biggest challenges for the Australian health system is the ever-increasing cost of healthcare. The demand for medical services, the cost of new technologies, and rising drug costs are some of the factors that drive the financial pressure. Consequently, both the government and patients feel the brunt of the financial burden. While the government provides financing in the form of Medicare, patients themselves tend to face increased out-of-pocket payments for services such as specialist visits, dental treatment, and some elective services. These rising costs predominantly burden lower-income people and jeopardize the sustainability of the health system. To counter this challenge, it's crucial to strike a balance between providing access to healthcare and enforcing cost constraints, which can be achieved through policy reform, reforms, or better resource management.

Mental Health Services

The need for mental health services in Australia has been on the rise, yet there remains a substantial shortfall of resources and trained professionals to meet this growing demand. As awareness of mental health concerns continues to grow, a rising number of people are looking for support for issues like depression, anxiety, and PTSD. However, the mental health sector frequently suffers from a shortage of resources, resulting in lengthy wait times for appointments and insufficient facilities, particularly in rural areas. The shortage of trained professionals, like psychologists and psychiatrists, worsens the problem. This disparity in service provision underscores the urgent need for increased investment in mental health education, workforce development, and access to timely services to enhance care delivery and better meet growing needs.

Aged Care Sector Pressure

The aged care sector in Australia is experiencing significant strain due to challenges related to care quality, workforce shortages, and changing regulatory demands. As the population ages, the need for aged care services is rising rapidly. However, concerns regarding care quality stemming from issues like insufficient staffing, training, and facility standards have raised serious concerns. Moreover, adherence to new regulations, prompted by recent high-profile reports, has increased operational costs for service providers. The sector also faces workforce challenges, including difficulties in recruiting and retaining staff, as care workers often contend with high stress and low wages. Tackling these issues will necessitate better working conditions for staff, investments in care facilities, and stricter regulatory oversight to guarantee high-quality care.

Australia Healthcare Services Market News:

- In September 2024, The Moree Hospital Redevelopment Project is receiving a funding of total $105 million from the Australian government. The project will feature a new clinical service building on the existing hospital site, designed to integrate with the current campus structures to ensure all services remain connected.

- September 2024: The Department of Health and Aged Care is launching a Virtual nursing in aged care project. This project will support the development and testing of a framework for the delivery of safe and high-quality virtual nursing support in aged care.

Australia Healthcare Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type and expenditure.

Type Insights:

- Hospitals and Clinics

- Pharmaceutical Companies

- Dental Services

- Nursing Care

- Medical and Diagnostic Laboratory Services

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes hospitals and clinics, pharmaceutical companies, dental services, nursing care, medical and diagnostic laboratory services, and others.

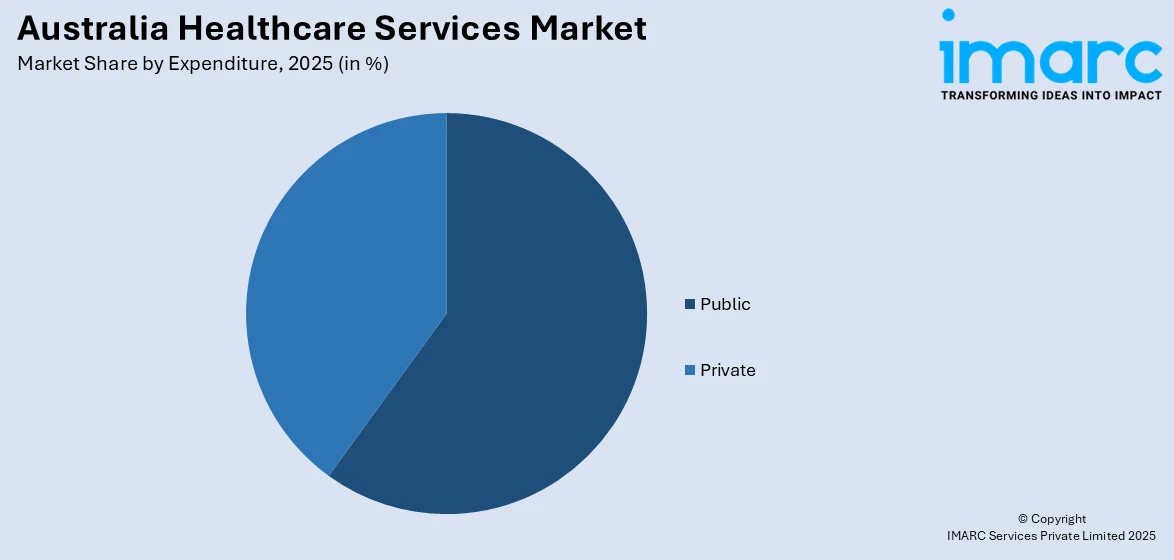

Expenditure Insights:

Access the comprehensive market breakdown Request Sample

- Public

- Private

A detailed breakup and analysis of the market based on the expenditure have also been provided in the report. This includes public and private.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Healthcare Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Hospitals and Clinics, Pharmaceutical Companies, Dental Services, Nursing Care, Medical and Diagnostic Laboratory Services, Others |

| Expenditures Covered | Public, Private |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia healthcare services market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia healthcare services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia healthcare services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The healthcare services market in the Australia was valued at USD 215.5 Billion in 2025.

The Australia healthcare services market is projected to exhibit a compound annual growth rate (CAGR) of 6.66% during 2026-2034.

The Australia healthcare services market is expected to reach a value of USD 391.9 Billion by 2034.

The aging population is driving demand for aged care services and chronic disease management. Technological advancements, including telemedicine and AI, are improving healthcare accessibility and efficiency. Government policies and funding continue to support healthcare system expansion. Additionally, increasing public awareness of preventive care is fueling the demand for health services.

The Australian healthcare services market is experiencing growth in telehealth, providing remote consultations, especially in rural areas. There is a stronger focus on aged care due to the aging population, alongside increased mental health support services. Preventive healthcare initiatives, including wellness programs, are also gaining prominence.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)