Australia Healthcare Big Data Analytics Market Size, Share, Trends and Forecast by Component, Analytics Type, Delivery Model, Application, End User, and Region, 2025-2033

Australia Healthcare Big Data Analytics Market Overview:

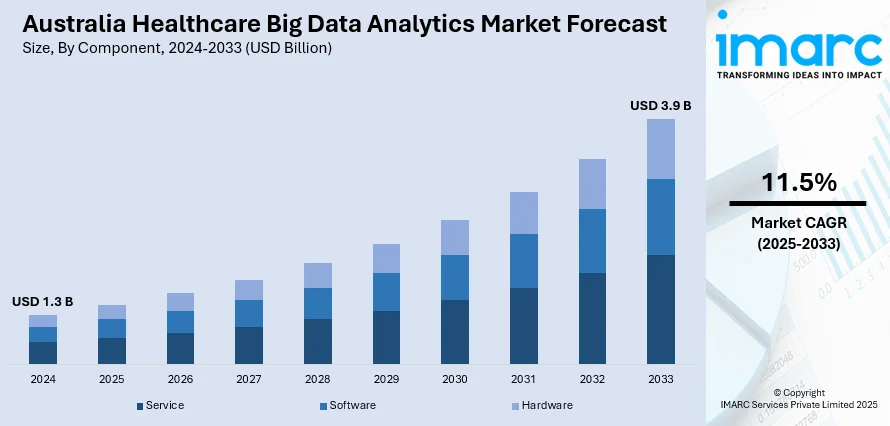

The Australia healthcare big data analytics market size reached USD 1.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.9 Billion by 2033, exhibiting a growth rate (CAGR) of 11.5% during 2025-2033. The market is driven by the growing need for cost-efficient healthcare, improved patient outcomes, and government initiatives promoting digital health transformation. Additionally, the rise in chronic diseases, adoption of electronic health records (EHRs), and advancements in AI and machine learning technologies are accelerating the demand for data-driven decision-making across healthcare providers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.3 Billion |

| Market Forecast in 2033 | USD 3.9 Billion |

| Market Growth Rate 2025-2033 | 11.5% |

Australia Healthcare Big Data Analytics Market Trends:

Rising Demand for Personalized Medicine

The growing emphasis on personalized medicine in Australia is a significant driver for healthcare big data analytics. As medical treatments increasingly move towards customization based on an individual’s genetic profile, lifestyle, and clinical history, the need for sophisticated data analytics tools becomes imperative. Genomic data, when combined with patient health records, allows healthcare providers to tailor treatment strategies more effectively. This trend is particularly evident in oncology, rare disease management, and pharmacogenomics. Analytics platforms are being employed to identify biomarkers, predict treatment responses, and detect adverse drug reactions before clinical symptoms arise. In line with this, investments by public institutions and research organizations into genomics programs, such as the Australian Genomics Health Alliance, is boosting the Australia healthcare big data analytics market share. In 2025, the Australian government committed USD 143.4 million to strengthen two key precision oncology initiatives. The ZERO Childhood Cancer Program received USD 112.6 million to expand its services nationwide, covering not only all children diagnosed with cancer but also extending support to young adults up to the age of 25. Alongside this, the PrOSPeCT Initiative was allocated $30.8 million to continue delivering advanced genomic profiling and tailored therapies for adults battling advanced cancers.

To get more information on this market, Request Sample

Growing Implementation of Electronic Health Records (EHRs)

The widespread adoption of electronic health records (EHRs) across Australia’s healthcare facilities is catalyzing the demand for advanced analytics solutions, which is one of the key factors supporting the Australia healthcare big data analytics market growth. EHR systems generate a continuous flow of structured and unstructured clinical data, encompassing patient histories, diagnostic reports, prescriptions, and treatment outcomes. To extract actionable insights from this data, healthcare providers are increasingly integrating analytics platforms that support both retrospective evaluations and predictive modeling. The My Health Record initiative, a national digital health platform, exemplifies this shift by enabling consolidated patient data access across providers. Apart from this, healthcare institutions are using analytics to detect care variations, minimize medical errors, and optimize clinical workflows, ultimately enhancing both patient safety and operational performance within the Australian healthcare ecosystem.

Government Support for Digital Health Transformation

Policy-level support from the Australian government plays a pivotal role in advancing the healthcare big data analytics market. The Australian Digital Health Agency (ADHA) has laid out a strategic framework to foster a connected and digitally enabled healthcare system, where data sharing and analytics are integral components. Programs such as My Health Record, the National Digital Health Strategy, and associated interoperability standards are designed to create a unified digital ecosystem. These initiatives promote real-time data exchange across providers, facilitate remote monitoring, and enable analytics-driven decision-making. Government grants and public-private partnerships are also driving investments in infrastructure, cybersecurity, and analytics innovation. Furthermore, policy measures aimed at improving transparency and accountability in care delivery are encouraging the use of analytics for reporting, benchmarking, and compliance monitoring, which is creating a positive Australia healthcare big analytics market outlook.

Australia Healthcare Big Data Analytics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on component, analytics type, delivery model, application, and end user.

Component Insights:

- Service

- Software

- Electronic Health Record Software

- Practice Management Software

- Workforce Management Software

- Hardware

- Data Storage

- Routers

- Firewalls

- Virtual Private Networks

- E-Mail Servers

- Others

The report has provided a detailed breakup and analysis of the market based on the component. This includes service, software (electronic health record software, practice management software, and workforce management software), and hardware (data storage, routers, firewalls, virtual private networks, e-mail servers, and others).

Analytics type Insights:

-

- Descriptive Analytics

- Predictive Analytics

- Prescriptive Analytics

- Cognitive Analytics

A detailed breakup and analysis of the market based on the analytics type have also been provided in the report. This includes descriptive analytics, predictive analytics, prescriptive analytics, and cognitive analytics.

Delivery Model Insights:

- On-Premise Delivery Model

- On-Demand Delivery Model

The report has provided a detailed breakup and analysis of the market based on the delivery model. This includes on-premise delivery model and on-demand delivery model.

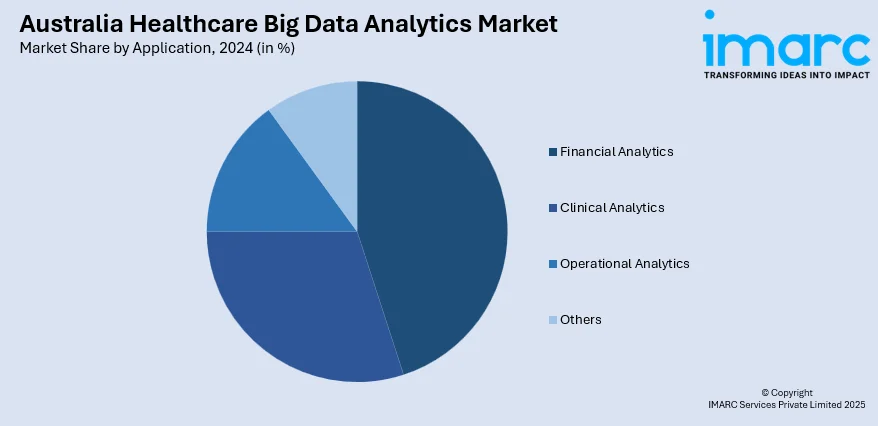

Application Insights:

- Financial Analytics

- Clinical Analytics

- Operational Analytics

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes financial analytics, clinical analytics, operational analytics, and others.

End User Insights:

- Hospitals and Clinics

- Finance and Insurance Agencies

- Research Organizations

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals and clinics, finance and insurance agencies, and research organizations.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Healthcare Big Data Analytics Market News:

- In 2025, Beamtree secured approximately USD 600,000 in contracts across Australia, Canada, and the UK. These deals aim to automate hospital clinical coding, improving data accuracy and efficiency using the company’s RippleDown technology and decision-support systems.

- In 2025, Alcidion partnered with Google Cloud to integrate generative AI into its Miya Precision platform. The collaboration aims to improve clinical workflows by using advanced AI to streamline data access, support decision-making, and enhance the efficiency of healthcare delivery across hospital systems using Alcidion’s digital health tools.

Australia Healthcare Big Data Analytics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Analytics Types Covered | Descriptive Analytics, Predictive Analytics, Prescriptive Analytics, Cognitive Analytics |

| Delivery Models Covered | On-Premise Delivery Model, On-Demand Delivery Model |

| Applications Covered | Financial Analytics, Clinical Analytics, Operational Analytics, Others |

| End Users Covered | Hospitals and Clinics, Finance and Insurance Agencies, Research Organizations |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia healthcare big data analytics market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia healthcare big data analytics market on the basis of component?

- What is the breakup of the Australia healthcare big data analytics market on the basis of analytics type?

- What is the breakup of the Australia healthcare big data analytics market on the basis of delivery model?

- What is the breakup of the Australia healthcare big data analytics market on the basis of application?

- What is the breakup of the Australia healthcare big data analytics market on the basis of end user?

- What is the breakup of the Australia healthcare big data analytics market on the basis of region?

- What are the various stages in the value chain of the Australia healthcare big data analytics market?

- What are the key driving factors and challenges in the Australia healthcare big data analytics market?

- What is the structure of the Australia healthcare big data analytics market and who are the key players?

- What is the degree of competition in the Australia healthcare big data analytics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia healthcare big data analytics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia healthcare big data analytics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia healthcare big data analytics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)