Australia Gaming Market Size, Share, Trends and Forecast by Device Type, Platform, Revenue, Type, Age Group, and Region, 2026-2034

Australia Gaming Market Size and Share:

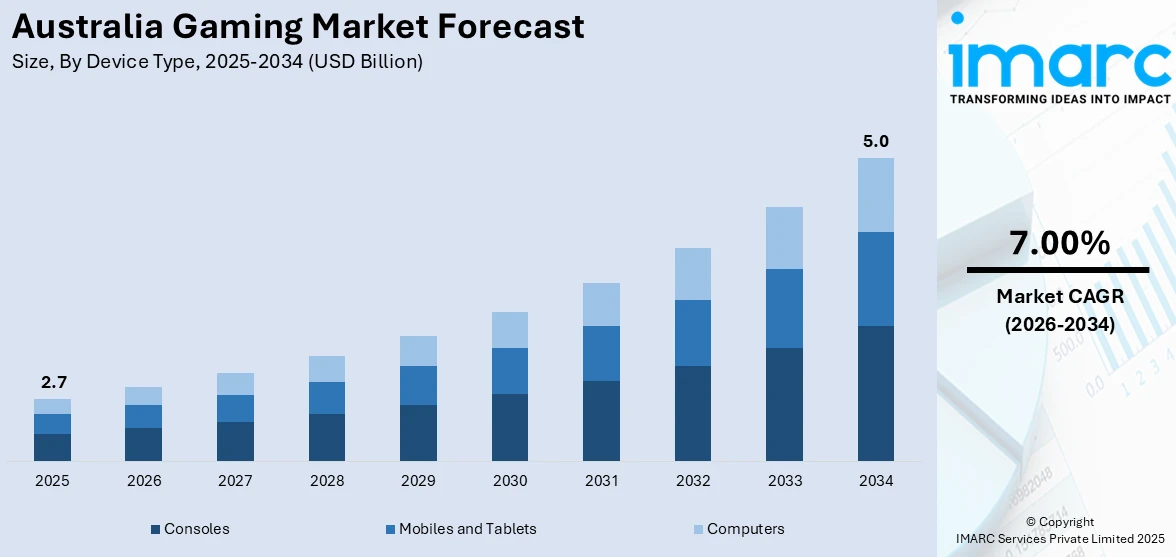

The Australia gaming market size was valued at USD 2.7 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 5.0 Billion by 2034, exhibiting a CAGR of 7.00% from 2026-2034. The market is driven by the growing reliance on smartphone for playing games, as users of smartphones can play games whenever it's convenient for them, along with the integration of artificial intelligence (AI) due to the capability of AI to adjust games according to the abilities and tactics of players.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.7 Billion |

| Market Forecast in 2034 | USD 5.0 Billion |

| Market Growth Rate (2026-2034) | 7.00% |

Millions of people watch e-sports competitions and live broadcasts, which increases the number of people playing the games that are part of these events. Popular video games with devoted fan bases include League of Legends and Dota 2. E-sports events promote social contact in-person and online, which builds interest in games and strengthens the gaming community. Both casual gamers and non-players who like watching matches and interacting with players are among the varied audiences that e-sports serves. The demand for the games played in tournaments is rising because of people being more interested in gaming after seeing professional players. Aspiring gamers play games to hone their talents, which increases player engagement and spending on associated gaming goods. As per the IMARC Group’s report, the Australia esports market is expected to reach USD 246.73 Million by 2032.

To get more information on this market Request Sample

5G networks and high-speed broadband reduce latency, which is essential for competitive and multiplayer online gaming. Unbroken gaming is ensured by dependable internet access, especially for cloud gaming, e-sports, and real-time strategy games. Players can download updates and big game files more quickly and effectively with faster internet rates, which cuts down on waiting periods. Mobile gamers benefit from faster load times, more fluid gameplay, and enhanced graphics with 5G, which increases the allure of mobile gaming. With the help of cloud gaming services, 5G enables gamers to stream top-notch games without the need for pricey gear. The bandwidth and low latency required for seamless operation are provided by advanced telecom services, which enable immersive augmented reality (AR) and virtual reality (VR) gaming experiences. The IMARC Group’s report shows that Australia telecom market is expected to reach USD 27.9 Billion by 2032.

Australia Gaming Market Trends:

Smartphone penetration and mobile gaming

Users of smartphones can play games whenever it's convenient for them, whether at home, during breaks, or during commutes. Compared to traditional PC or console gaming, mobile games frequently offer free-to-play options, which lowers the cost and increases accessibility. Immersive gaming experiences are made possible by the strong processors, GPUs, and high-resolution screens found in modern smartphones. Australia's 5G rollout facilitates fast, low-latency connections, which improve cloud gaming and real-time multiplayer games. Longer gaming sessions are made possible by cellphones' improved battery technology, which raises user engagement. By appealing to casual players, mobile games broaden the market beyond conventional gaming demographics. Users who might not devote time to intricate gaming experiences are drawn to hyper-casual games with straightforward principles. According to the IMARC Group’s report, Australia smartphone market is projected to exhibit a growth rate (CAGR) of 1.60% during 2024-2032.

Cloud computing

Cloud gaming platforms remove the need for pricey gaming PCs or consoles by enabling players to stream games straight from the cloud. More gamers may now access high-quality gaming due to cloud gaming's compatibility with a variety of devices, such as smartphones, tablets, and smart TVs. Players can experience fluid gameplay and high-resolution graphics without depending on local hardware limitations by utilizing cloud servers. Cloud computing lowers development costs and time-to-market by giving game makers access to scalable resources for testing, rendering, and deployment. Games can be deployed on international cloud networks by developers, guaranteeing a smooth gaming experience for users in Australia. Development teams can work remotely owing to cloud systems, which promote creativity and quicker iterations. The data published on the website of the IMARC Group shows that the Australia cloud computing market is expected to reach USD 30.24 Billion by 2032.

Integration of artificial intelligence (AI)

Artificial intelligence (AI) makes it possible for games to adjust to the abilities and tactics of players, providing individualized difficulty settings that maintain player interest. AI-driven NPCs act more naturally, which enhances the realism and immersion of in-game challenges and interactions. AI produces dynamic levels, objectives, and locations, guaranteeing new content and cutting down on monotonous gameplay. To suggest games, modify plots, or produce customized in-game content, AI examines user behavior and preferences. AI-powered systems use input patterns or facial recognition to identify player emotions and modify gameplay or offer feedback. AI chatbots and assistants help players navigate challenging games, provide advice, and improve new player onboarding. AI lowers development costs and time-to-market by automating time-consuming tasks like environment building, character animation, and testing. IMARC Group’s report predicted that Australia artificial intelligence market will exhibit a growth rate (CAGR) of 15.80% during 2024-2032.

Australia Gaming Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Australia gaming market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on device type, platform, revenue, type, and age group.

Analysis by Device Type:

- Consoles

- Mobiles and Tablets

- Computers

The popularity of high-performance devices like the PlayStation, Xbox, and Nintendo Switch is making console gaming a significant portion of the Australian gaming market. Devoted gamers looking for immersive experiences with cutting-edge graphics, unique games, and multiplayer features may find this section appealing.

The fastest-growing market is mobile and tablet gaming, which is driven by the popularity of smartphones and the accessibility to free-to-play and reasonably priced games. Many people, particularly casual gamers, are drawn to it by its ease of use, variety of games, and connectivity with cloud gaming platforms.

In Australia, PC gaming is still quite popular because of its ability to support e-sports, high-end gaming, and game modification communities. Both casual and die-hard gamers are drawn to this market because it offers access to well-known gaming platforms and gear that can be customized.

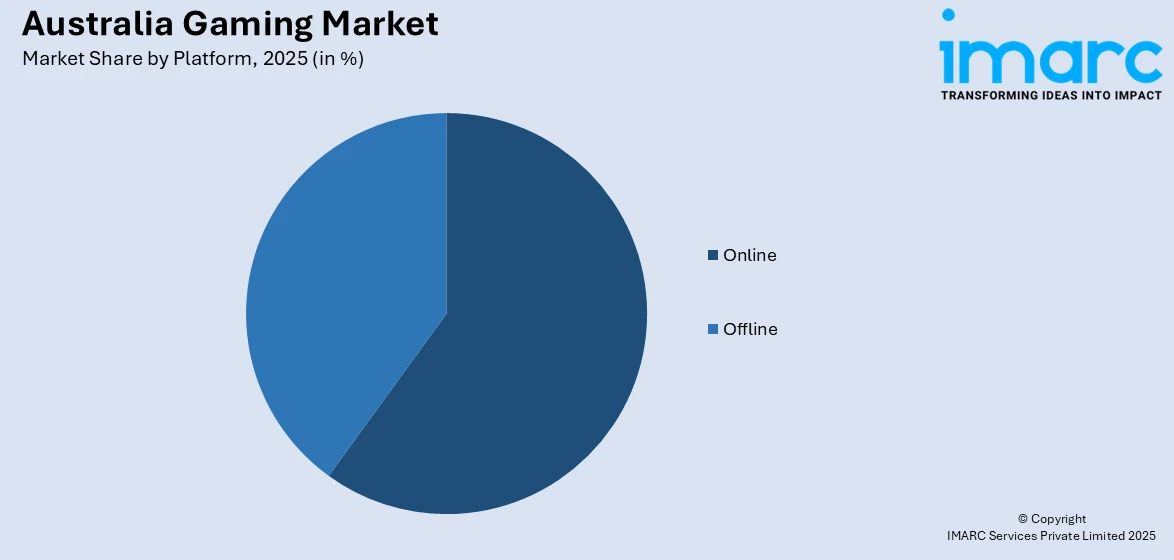

Analysis by Platform:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

Due to the rising popularity of e-sports, multiplayer games, and cloud gaming services, the online gaming sector can control the majority of the Australian gaming business. 5G connectivity and improvements in internet infrastructure allow for smooth gameplay, in-game purchases, and live-streaming capabilities.

In Australia, offline gaming is still popular because it appeals to players who like narrative-driven games or live in places with spotty internet. Console and PC games that provide great single-player experiences without requiring continual connectivity cater to this market.

Analysis by Revenue:

- In-Game Purchase

- Game Purchase

- Advertising

In-game purchases, which include microtransactions for virtual items, skins, characters, and power-ups, provide a substantial source of income for the Australian gaming industry. As users spend money to improve their gaming experiences, the popularity of mobile and free-to-play games is increasing.

Due to the upfront sales of console, PC, and mobile games, game purchases are traditional source of income. Blockbuster releases, exclusive games, and high-end games with excellent visuals and narrative are helping this market to expand.

Particularly in online and mobile gaming, where advertisements are included into free-to-play models, advertising is a growing revenue source. While providing consumers with free game access, developers make money through sponsored content, banner adverts, and video ads.

Analysis by Type:

- Adventure/Role Playing Games

- Puzzles

- Social Games

- Strategy

- Simulation

- Others

Due to its large settings, character development, and captivating plots, adventure and role-playing games are well-liked in the Australian gaming market. Devoted gamers who want intricate storylines and the potential to influence game results through in-game choices will find these games appealing.

In Australia, puzzle games are very popular, especially with casual players and smartphone users. They are a popular choice among a variety of groups due to its ease of use, captivating mechanics, and capacity for rapid entertainment.

Connectivity is essential for social games since it allows Australian players to communicate, work together, and compete with friends or international communities. Social networking platform integration and multiplayer features in mobile and browser-based games are factors driving this market.

Strategy games have a dedicated player base in Australia, focusing on planning, resource management, and tactical decision-making. They are popular across both PC and mobile platforms, appealing to players who enjoy intellectual challenges and competitive gameplay.

Simulation games are highly versatile, offering players the opportunity to experience virtual representations of real-world activities like city building, farming, and life management. Their appeal lies in their ability to provide both relaxation and creativity, attracting a wide range of Australian gamers.

Analysis by Age Group:

- Adult

- Children

Action, role-playing, strategy, and simulation games are among the many game genres that underpin the adult segment's dominance of the Australian gaming business. This demographic is attracted to social interactions via e-sports and multiplayer platforms, competitive gaming, and immersive experiences.

The instructive, engaging, and age-appropriate activities in the children's section are meant to amuse and foster cognitive abilities. Popular among this demographic are mobile devices and gaming consoles, which offer a secure gaming environment due to parental settings and kid-friendly material.

Regional Analysis:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Due to its dense population and sophisticated digital infrastructure, Australia Capital Territory & New South Wales region accounts for a substantial share of the Australian gaming business. Sydney attracts a sizable gaming community and promotes business growth as a center for technology and gaming events.

With Melbourne serving as a center of culture and technology, Victoria plays a significant role in the gaming industry by housing many game development studios and e-sports competitions. Despite being smaller, Tasmania is experiencing consistent increase in mobile gaming as a result of rising smartphone accessibility and usage.

A robust e-sports scene and an increasing number of game production firms support Queensland's gaming industry. Due to the region's young population and strong internet infrastructure, mobile and online gaming are also very popular there.

The gaming market in Northern Territory & Southern Australia region is growing steadily, with an increasing focus on mobile gaming due to rural accessibility. South Australia's initiatives in supporting creative industries, including game development, are contributing to the market expansion.

Western Australia showcases a dynamic gaming community, with a preference for online and mobile gaming due to its expansive geography. Local gaming events and developer networks in Perth further enhance the region's contribution to the national gaming market.

Competitive Landscape:

To improve their market position, major participants in the Australian gaming industry are aggressively utilizing strategic alliances, cutting-edge business models, and technology developments. Big businesses are spending money on creating engaging, top-notch games for console, PC, and mobile platforms that cater to a wide range of user preferences. To improve user experiences and reach a wider audience, many key players are concentrating on incorporating cutting-edge technology like cloud gaming, virtual reality (VR), augmented reality (AR), and artificial intelligence (AI). Additionally, through hosting competitions, creating competitive gaming platforms, and cultivating gaming communities, these businesses are increasing their footprint in the quickly expanding e-sports industry. Key players are adapting their games for smartphones and tablets and implementing in-game monetization techniques to take advantage of the growing demand for mobile gaming. They are also introducing gaming lounges to expand their customer base. For instance, in October 2024, IKEA Australia unveiled gaming lounge designed to replicate a real living room where gaming is taking center stage, the display blends comfort, functionality and style.

The report provides a comprehensive analysis of the competitive landscape in the Australia gaming market with detailed profiles of all major companies.

Latest News and Developments:

- September 2024: Screen Australia announced over $2 million in funding to support for 12 games through the Games Production Fund, 27 games through the Emerging Gamemakers Fund and funding for three events through the Games Event Fund.

Australia Gaming Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Device Types Covered | Consoles, Mobiles and Tablets, Computers |

| Platforms Covered | Online, Offline |

| Revenues Covered | In-Game Purchase, Game Purchase, Advertising |

| Types Covered | Adventure/Role Playing Games, Puzzles, Social Games, Strategy, Simulation, Others |

| Age Groups Covered | Adult, Children |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia gaming market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Australia gaming market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia gaming industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Gaming refers to the act of playing electronic games on various platforms, such as consoles, computers, mobile devices, or arcade systems. It encompasses a wide range of genres, including action, strategy, simulation, and puzzles, providing entertainment, cognitive challenges, and social interaction for players of all ages.

The Australia gaming market was valued at USD 2.7 Billion in 2025.

IMARC estimates the Australia gaming market to exhibit a CAGR of 7.00% during 2026-2034.

The Australia gaming market is driven by factors, such as rising smartphone penetration, advancements in internet connectivity, and the popularity of e-sports. Integration of cloud computing, artificial intelligence (AI), and immersive technologies like virtual reality (VR), along with the increasing demand for social and mobile gaming experiences, is further fueling the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)