Australia Freight and Logistics Market Report by Logistics Function (Courier, Express and Parcel, Freight Forwarding, Freight Transport, Warehousing and Storage, and Others), End Use Industry (Agriculture, Fishing and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, and Others), and Region 2026-2034

Market Overview:

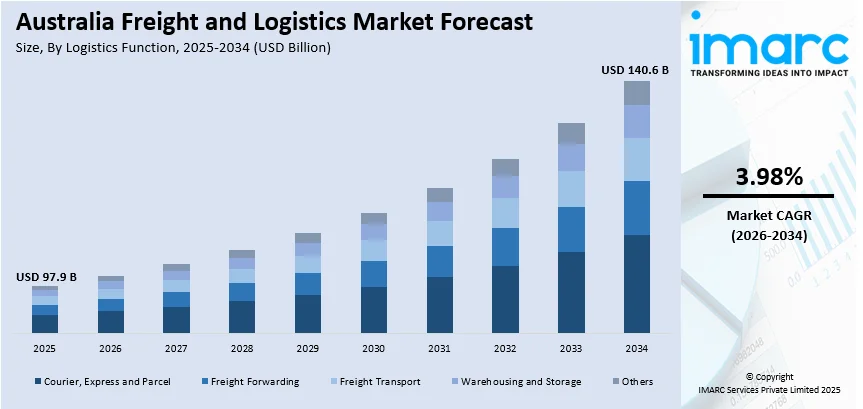

Australia freight and logistics market size reached USD 97.9 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 140.6 Billion by 2034, exhibiting a growth rate (CAGR) of 3.98% during 2026-2034. The growing adoption of electric vehicles (EVs), energy-efficient warehouses, and the use of renewable energy sources for transport operations, rising focus on safety and compliance, and increasing demand for products from international online retailers, are some of the factors driving the market demand.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 97.9 Billion |

| Market Forecast in 2034 | USD 140.6 Billion |

| Market Growth Rate (2026-2034) | 3.98% |

Freight and logistics are essential components of the supply chain, facilitating the movement of goods from manufacturers to consumers. Freight refers to the physical cargo being transported, encompassing various types such as raw materials, finished products, and commodities. On the other hand, logistics involves the coordination and management of the entire supply chain process, encompassing transportation, warehousing, inventory management, and distribution. Efficient freight and logistics systems are crucial for businesses to meet customer demands and remain competitive. This industry employs diverse modes of transportation, including trucks, ships, trains, and planes, depending on the nature of the cargo and the distance it needs to travel. Advances in technology, such as GPS tracking and automated systems, have greatly improved the precision and speed of logistics operations. Overall, a well-functioning freight and logistics network is pivotal for the seamless flow of goods in the marketplace, impacting economies and businesses. The Australia freight and logistics market share is projected to grow due to increasing trade volumes, advancements in transport infrastructure, and rising e-commerce activity across the region.

To get more information on this market Request Sample

Australia Freight and Logistics Market Trends:

Growing Focus on Safety and Compliance

Regulatory bodies are enforcing higher standards in areas such as vehicle emissions, driver safety, and the handling of hazardous materials, encouraging logistics companies to upgrade their fleets and invest in safety training for employees. Compliance with these regulations not only helps avoid fines and legal issues but also improves the overall safety and reliability of the supply chain. Companies are adopting technologies like fleet management systems to monitor driver behavior, ensure vehicle maintenance, and meet environmental standards. This focus on safety and regulatory compliance is driving investments in more modern, efficient, and safer logistics operations, helping to maintain the integrity of the supply chain and support market growth. In 2024, a Sydney logistics startup called Ofload secured $31 million in funding to introduce its Carbon Analytics Platform (CAP), designed to assist Australian businesses in monitoring carbon emissions across their supply chains. This platform seeks to lessen the compliance burdens on businesses as new federal regulations on emissions reporting are about to be enforced.

Sustainability Initiatives

The rising focus on eco-friendly logistics practices, as companies aim to reduce their carbon footprint is bolstering the Australia freight and logistics market growth. This includes the adoption of electric vehicles (EVs), energy-efficient warehouses, and the use of renewable energy sources for transport operations. Green logistics is becoming a priority, driven by both government regulations and individua demand for environmentally responsible business practices. Additionally, companies are optimizing their supply chains to minimize fuel usage and reduce emissions, such as through route planning and the consolidation of shipments. These sustainability efforts are also leading to investments in alternative fuels, such as hydrogen and biofuels, for freight transportation. More businesses are committing to sustainability goals, which is making green supply chain solutions popular. In 2024, Team Global Express revealed intentions to incorporate more than 300 electric trucks, vans, and mobile chargers into their fleet, supported by a $190 million financing agreement led by the Clean Energy Finance Corporation. This action helps them achieve their aim of developing a more environmentally friendly transportation system and grows their already large collection of electric vehicles used for last-mile deliveries.

Rise of Cross-Border E-Commerce

Many people are purchasing products from international online retailers, which is driving the need for efficient cross-border logistics solutions. This includes customs clearance, international shipping, and last-mile delivery services. Logistics providers are focusing on streamlining cross-border processes, improving transit times, and reducing costs to meet the rising demand. The emergence of online marketplaces is also facilitating the entry of smaller businesses into international markets, further driving the need for robust international logistics networks. Many individuals are looking beyond domestic borders for a wider range of products, which is making cross-border e-commerce sector a crucial driver for freight and logistics services, leading to higher investment in infrastructure and technology. The Australia freight and logistics market analysis highlights the growing demand for cross-border logistics, driven by international online shopping and increased investment in shipping infrastructure and technology. In 2024, CIRRO E-Commerce initiated its international shipping services from Australia, allowing packages to be shipped to places such as New Zealand, North America, and Europe. The service provides effective customs clearance, comprehensive management, and thorough shipment tracking, improving the cross-border shipping process for Australian companies.

Australia Freight and Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on logistics function and end use industry.

Logistics Function Insights:

- Courier, Express and Parcel

- By Destination Type

- Domestic

- International

- By Destination Type

- Freight Forwarding

- By Mode of Transport

- Air

- Sea and Inland Waterways

- Others

- By Mode of Transport

- Freight Transport

- By Mode of Transport

- Air

- Pipelines

- Rail

- Road

- Sea and Inland Waterways

- By Mode of Transport

- Warehousing and Storage

- By Temperature Control

- Non-Temperature Controlled

- Temperature Controlled

- By Temperature Control

- Others

The report has provided a detailed breakup and analysis of the market based on the logistics function. This includes courier, express and parcel [by destination type (domestic and international)], freight forwarding [by mode of transport (air, sea and inland waterways, and others)], freight transport [by mode of transport (air, pipelines, rail, road, and sea and inland waterways)], warehousing and storage [by temperature control (non-temperature controlled and temperature controlled)], and others.

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Agriculture

- Fishing and Forestry

- Construction

- Manufacturing

- Oil and Gas

- Mining and Quarrying

- Wholesale and Retail Trade

- Others

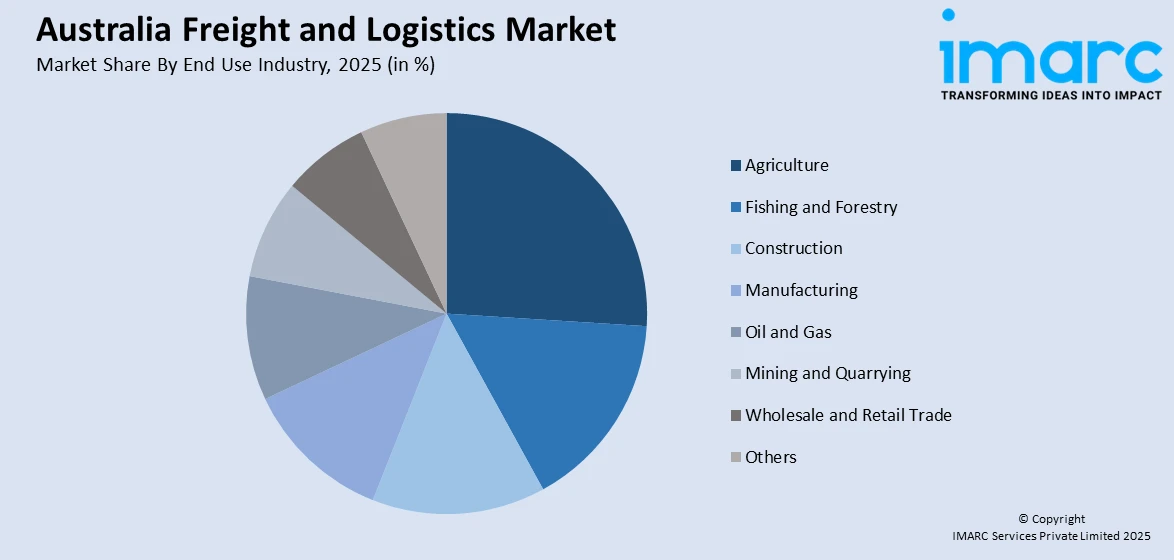

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes agriculture, fishing and forestry, construction, manufacturing, oil and gas, mining and quarrying, wholesale and retail trade, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Freight and Logistics Market News:

- October 2024: The Our Future Freight event in Brisbane will highlight progress in technology and sustainability within the freight industry. It seeks to tackle issues concerning emissions, efficiency, and innovation in Australia's expanding freight sector.

- October 2024: Melbourne-based Hawk Logistics announced a partnership with Big W to handle general freight across 16 retail stores in South Australia. This five-year agreement involves transporting goods from Victoria to Adelaide using high-performance A-double vehicles, reinforcing Hawk Logistics' capabilities and its relationship with Primary Connect and the Woolworths Group.

- June 2024: Team Global Express revealed a $480 million, seven-year agreement with Texel Air Australasia to enhance internal air freight services in Australia. This involves adding four Boeing 737-800 BCFs to enhance cargo capacity and delivery efficiency on regional routes.

Australia Freight and Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Logistics Functions Covered |

|

| End Use Industries Covered | Agriculture, Fishing and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia freight and logistics market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Australia freight and logistics market?

- What is the breakup of the Australia freight and logistics market on the basis of logistics function?

- What is the breakup of the Australia freight and logistics market on the basis of end use industry?

- What are the various stages in the value chain of the Australia freight and logistics market?

- What are the key driving factors and challenges in the Australia freight and logistics?

- What is the structure of the Australia freight and logistics market and who are the key players?

- What is the degree of competition in the Australia freight and logistics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, Australia freight and logistics market forecast, and dynamics of the market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia freight and logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia freight and logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)