Australia Food Processing Market Size, Share, Trends and Forecast by Equipment Type, Category, Application, and Region, 2025-2033

Australia Food Processing Market Overview:

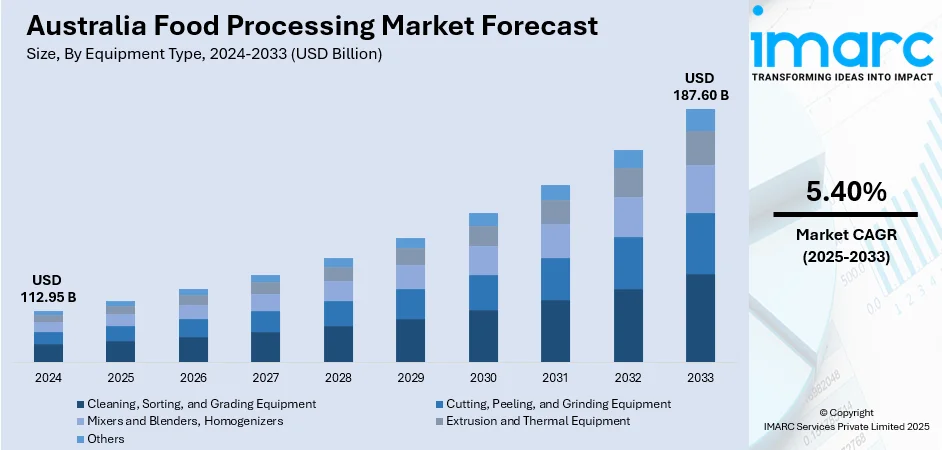

The Australia food processing market size reached USD 112.95 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 187.60 Billion by 2033, exhibiting a growth rate (CAGR) of 5.40% during 2025-2033. The market is driven by the increasing consumer demand for convenience and healthy products, significant technological advancements, innovations in packaging, rising exports and a growing focus on sustainability and food safety.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 112.95 Billion |

| Market Forecast in 2033 | USD 187.60 Billion |

| Market Growth Rate (2025-2033) | 5.40% |

Australia Food Processing Market Trends:

Rising Consumer Demand for Convenience and Healthier Products

The growing consumer preference for convenience and healthier foods in Australia is driving significant changes in the food processing market. As lifestyles become busier consumers increasingly demand ready-to-eat (RTE) meals that are both nutritious and easy to prepare. For instance, in 2023, McDonald’s Australia significantly boosted its local supply chain support purchasing over 330 million kilograms of Australian produce an increase of 29 million kilograms from the previous year. This investment totaling over $1 billion includes 150 million kilograms of potatoes 80 million kilograms of beef 20 million kilograms of chicken and various other ingredients. This initiative not only supports local farmers and boosts regional economies but also reflects McDonald’s commitment to sourcing high-quality Australian ingredients for its products. Similarly, in August 2024, Fonterra announced that it is entering the alternative protein market through a partnership with Superbrewed Food to develop a novel biomass protein derived from lactose. This collaboration aims to enhance the value of dairy by integrating Superbrewed's Postbiotic Cultured Protein a non-GMO allergen-free ingredient into Fonterra's product lineup. Both initiatives underscore the food industry's response to evolving consumer preferences for healthier convenient options and innovative nutrient-rich products.

To get more information on this market, Request Sample

Rapid Technological Advancements and Innovations

Technological advancements are a key driver in the Australian food processing market enhancing efficiency, quality and cost-effectiveness. Innovations such as automation, data analytics and advanced processing technologies improve product safety and production processes. For instance, in September 2024, Bickford’s Australia reported significant efficiency gains through technology. Over the past decade automation including five automated guided vehicles (AGVs) cut stocktake variances from $50,000 to $50 and lowered labor costs. Recent upgrades like aseptic PET and glass filling systems have diversified products. Bickford’s is now integrating robotics and AI for better inventory and sales forecasting while valuing skilled personnel for ongoing innovation. Similarly, Too Good to Go’s launch in Melbourne leverages technology to address food waste connecting consumers with surplus food and aiming to reduce Australia's 7.6 million tonnes of annual food waste. Both instances highlight how technological innovations are shaping the industry by boosting efficiency and addressing significant challenges like food waste.

Focus on Sustainability and Food Safety

Sustainability and food safety are increasingly critical drivers in the Australian food processing market. Consumers, regulators and businesses are placing a heightened emphasis on sustainable practices, such as reducing waste, energy consumption, and carbon footprint. Food processors are adopting eco-friendly packaging solutions, implementing waste reduction strategies, and sourcing ingredients responsibly to meet environmental expectations. Concurrently, stringent food safety regulations and standards require processors to maintain high levels of hygiene, traceability, and quality assurance. For instance, the New South Wales government's Return and Earn recycling scheme has achieved a significant milestone by processing 12 billion bottles, cans, and cartons since its inception, resulting in $1.2 billion in container refunds. The scheme has become a prominent example of circular economy success, leading to a 54% reduction in drink container litter and recycling over 1 million tonnes of materials. Moreover, CSIRO and Murdoch University have launched an $8 million Bioplastics Innovation Hub at Murdoch University’s Perth campus to develop fully compostable bioplastics. These bioplastics will degrade in compost, land, or water, tackling global plastic waste. The Hub will leverage microbiology, genetics, and biochemical engineering to create sustainable packaging, including sprays, films, and bottles. Notably, it will partner with Ecopha Biotech to make compostable water bottles from food waste, supporting CSIRO's goal to cut plastic waste in Australia by 80% by 2030. Moreover, in September 2024, McKenzie’s Foods announced its partnership with Tetra Pak to launch a new line of pre-cooked pulses in Tetra Recart packaging. This eco-friendly packaging boasts up to six times less climate impact than cans, is 60% lighter, and reduces shelf and transport space by 30% and 20% respectively. Tetra Recart’s practical design helps keep food fresh longer and reduces waste without preservatives, aligning with McKenzie’s commitment to convenience and sustainability.

Australia Food Processing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on equipment type, category, and application.

Equipment Type Insights:

- Cleaning, Sorting, and Grading Equipment

- Cutting, Peeling, and Grinding Equipment

- Mixers and Blenders, Homogenizers

- Extrusion and Thermal Equipment

- Others

The report has provided a detailed breakup and analysis of the market based on the equipment type. This includes cleaning, sorting, and grading equipment; cutting, peeling, and grinding equipment; mixers and blenders, homogenizers; extrusion and thermal equipment and others.

Category Insights:

- Semi-Automated

- Fully Automated

A detailed breakup and analysis of the market based on the category have also been provided in the report. This includes semi-automated and fully automated.

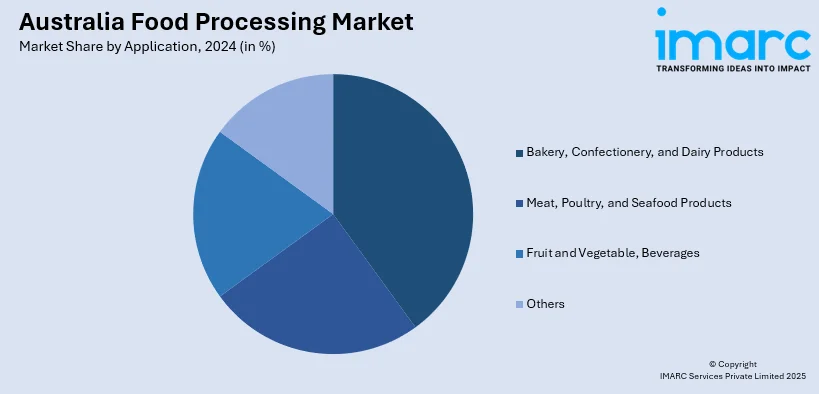

Application Insights:

- Bakery, Confectionery, and Dairy Products

- Meat, Poultry, and Seafood Products

- Fruit and Vegetable, Beverages

- Others

A detailed breakup and analysis of the market based on the applications have also been provided in the report. This includes bakery, confectionery, and dairy products; meat, poultry, and seafood products; fruit and vegetable, beverage and others.

Regional Insights:

- Australian Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & South Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australian Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & South Australia and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Food Processing Market News:

- In September 2024, Fonterra announced that it is investing $150 million in constructing a new Ultra High Temperature (UHT) cream plant at its Edendale site in Southland to meet the rising demand in Asia. The plant will initially have a capacity of 50 million litres, with potential to expand to over 100 million litres by 2030. This investment aims to support Fonterra's Foodservice business and extend the shelf-life of products like cakes and beverages. The plant is expected to start production in August 2026.

- In August 2024, Coca-Cola Europacific Partners (CCEP) is investing $105.5 million in a new warmfill beverage bottling line at its Moorabbin, Victoria plant, marking its largest single investment in manufacturing. The new line, set to boost the plant’s capacity by 23% to produce up to 17.8 million unit cases annually, will serve Powerade and Fuze Tea products and is expected to increase production efficiency with a rate of 640 bottles per minute. The upgrade will also cut transportation distances by 2.9 million kilometers annually, reducing CO2 emissions by approximately 3,785 tonnes.

Australia Food Processing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered | Cleaning, Sorting, and Grading Equipment; Cutting, Peeling, and Grinding Equipment; Mixers and Blenders, Homogenizers; Extrusion and Thermal Equipment; Others |

| Categories Covered | Semi-Automated, Fully Automated |

| Applications Covered | Bakery, Confectionery, and Dairy Products; Meat, Poultry, and Seafood Products; Fruit and Vegetable, Beverages; Others |

| Regions Covered | Australian Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & South Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia food processing market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia food processing market on the basis of equipment?

- What is the breakup of the Australia food processing market on the basis of category?

- What is the breakup of the Australia food processing market on the basis of application?

- What is the breakup of the Australia food processing market on the basis of region?

- What are the various stages in the value chain of the Australia food processing market?

- What are the key driving factors and challenges in the Australia food processing market?

- What is the structure of the Australia food processing market and who are the key players?

- What is the degree of competition in the Australia food processing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia food processing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia food processing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia food processing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)