Australia Financial Services Market Size, Share, Trends and Forecast by Type, Size of Business, End User, and Region, 2025-2033

Australia Financial Services Market Size and Share:

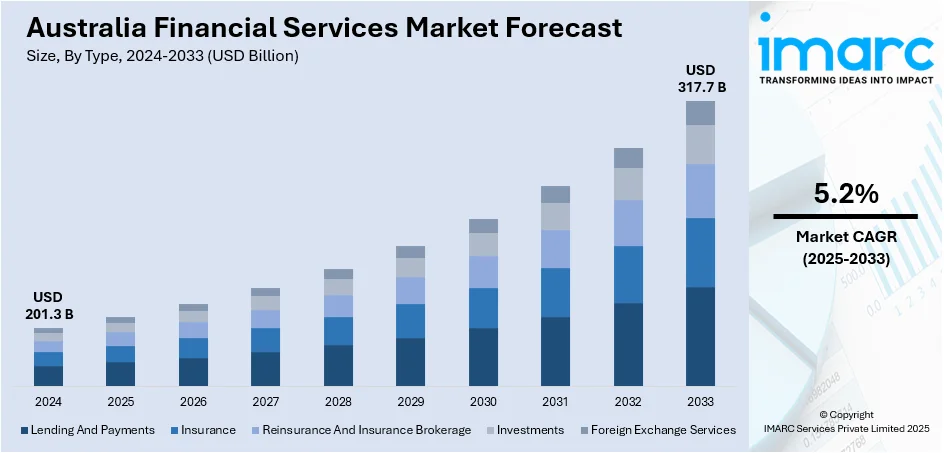

The Australia financial services market size reached USD 201.3 Billion in 2024. Looking forward, the market is expected to reach USD 317.7 Billion by 2033, exhibiting a growth rate (CAGR) of 5.2% during 2025-2033. The market is driven by increasing demand for digital banking, regulatory advancements, strong economic performance, rising investment in fintech, growing consumer awareness, and enhanced adoption of financial technology and services across industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 201.3 Billion |

|

Market Forecast in 2033

|

USD 317.7 Billion |

| Market Growth Rate 2025-2033 | 5.2% |

Key Trends of Australia Financial Services Market:

Digital Banking and Fintech Expansion

The use of digital banking and financial technology is one of the primary themes driving development in Australia's financial services industry. Australians are rapidly adopting digital-first solutions because of their simplicity, quickness, and the ongoing improvement of customer experience provided by both fintech companies and traditional banks. The proliferation of smartphone applications, digital wallets, contactless payments, and the shift to digital-only banking models has changed how Australians access financial services. As reported by the Australian Communications and Media Authority (ACMA), it is projected that by December 2024, 83% of Australians aged 15 and older will be using the Internet for banking services. Furthermore, Australia's robust cybersecurity standards promote the digital transformation of the financial services business by ensuring the safety of online transactions. Furthermore, by 2024, Australian venture capital firms, institutional investors, and technology businesses would have spent more than $2 billion in India's fintech ecosystem. These investments are accelerating breakthroughs in digital payments, blockchain technology, and AI-powered financial systems. Macquarie Group, an Australian financial services firm, has emerged as a major participant, sponsoring digital infrastructure initiatives including data centers and payment gateways. Australia's fintech ecosystem continues to develop, thanks to increased official assistance, including the establishment of the Australian government's Digital Finance Strategy. Fintech adoption among Australian firms is expected to reach 30% by 2024, driven by the desire for more efficiency and lower costs in financial transactions.

To get more information on this market, Request Sample

Sustainable and Green Finance Initiatives

The financial services industry in Australia is being impacted by sustainable finance more and more. This includes socially responsible investments (SRI), green bonds, and environmental, social, and governance (ESG) investing. Australian financial institutions are responding to customer demand for ethical investment products, adopting sustainable practices, and aligning with global climate objectives as a result of the worldwide movement towards sustainability. Green finance projects are expanding as financial institutions in Australia are using sustainability analytics and ESG data to guide investment decisions. An important factor in this development is the Australian Government's Green Bond Framework, which assists the country in issuing green bonds to finance ecologically friendly initiatives. With more than $13 billion in green bonds issued in the first half of 2023—the highest annual total recorded—the Australian green bond market has experienced significant growth. The ESG integration action strategy drove the value of responsible investing assets under management (AUM) in Australia, which reached AUD 977 billion in 2023. Moreover, in the same year, investments with a sustainability theme reached AUD 292 billion. As Australia strengthens its commitment to achieving net-zero emissions by 2050, investors are increasingly focusing on companies and projects that align with environmental sustainability goals. Additionally, stricter sustainability reporting requirements imposed by Australian regulators are pushing businesses to adopt sustainable finance practices, further driving the industry’s growth.

Growth Drivers of Australia Financial Services Market:

Robust Superannuation and Wealth Management Sector

Australia’s mandatory superannuation system has led to the accumulation of one of the world’s largest pension fund pools, creating strong momentum within the financial services sector. As retirement savings grow, there is a rising demand for expert financial guidance in areas such as portfolio diversification, investment planning, and wealth preservation. Financial advisors and wealth management firms are increasingly offering personalized services to cater to varying risk appetites and life stages, which is driving the Australia financial services market growth. The consistent flow of super contributions provides a stable foundation for long-term investment strategies, benefiting both fund managers and institutional investors. This dynamic has fostered innovation in financial products, including managed funds and retirement income solutions, making wealth management a central pillar in the continued expansion and resilience of Australia's financial services industry.

High Financial Inclusion and Consumer Engagement

Financial inclusion in Australia is high, and most of the population accesses banking, credit, insurance, and investment services. This wide access is coupled with increased financial literacy, where consumers are making informed choices in the aspects of saving, borrowing, and investing. Citizens are spending more time dealing with their financial planning, measuring spending, portfolio management, and comparison of financial products using online-based tools, apps, and websites. This shift toward proactive money management is fueling demand for more customized and user-friendly financial solutions, which is further driving the Australia financial services market demand. As consumer expectations rise, providers are innovating with tailored offerings and seamless digital experiences. High customer engagement supports product diversification while strengthening competition within the sector, making financial services more accessible and adaptable to evolving lifestyle and economic needs.

Regulatory Reforms and Market Confidence

Australia’s financial services industry continues to benefit from a strong regulatory framework designed to protect consumers and maintain market integrity. Oversight by bodies such as the Australian Securities and Investments Commission (ASIC) and the Australian Prudential Regulation Authority (APRA) has led to the implementation of reforms that emphasize transparency, accountability, and fair conduct. These changes have included tighter lending standards, strengthened disclosure requirements, and enhanced governance protocols. As a result, investor confidence has improved, and financial institutions are more focused on ethical behavior and long-term stability. While compliance costs have risen, the overall effect has been a more resilient and trustworthy financial ecosystem. This solid regulatory environment not only supports sustainable industry growth but also ensures Australia remains an attractive destination for both domestic and international investors.

Opportunities of Australia Financial Services Market:

Open Banking and Consumer Data Access

Australia’s implementation of Open Banking, as part of the wider Consumer Data Right (CDR) initiative, is reshaping the landscape of financial service delivery. This framework enables consumers to safely grant access to their banking information to authorized third-party providers. As a result, Open Banking is driving greater innovation and fostering healthy competition throughout the financial sector. Financial institutions and fintech companies can now leverage this data to offer hyper-personalized financial solutions, improve product recommendations, and optimize pricing strategies. Enhanced data transparency helps build consumer trust and encourages greater engagement with digital platforms. It also supports better credit risk assessments and cross-platform financial management tools. As the ecosystem matures, Open Banking is expected to drive a new wave of data-driven services that improve customer experience, promote financial wellness, and increase loyalty across both traditional and digital financial institutions.

Expansion into Underserved and Regional Markets

Australia’s regional, rural, and Indigenous communities often face limited access to mainstream financial services, making them a key area of opportunity for market expansion. By offering tailored financial products, such as microloans, flexible insurance options, and culturally appropriate banking services, institutions can better meet the unique needs of these populations. Mobile banking units, digital outreach, and local partnerships with community organizations are helping overcome geographic and technological barriers. These initiatives not only promote financial inclusion but also support local economic development by providing businesses and individuals with the tools they need to grow and manage finances. Expanding into underserved areas allows financial institutions to tap into previously overlooked markets while fulfilling social responsibility goals, which is further fueling the Australia financial services market share. As infrastructure improves, these regions are becoming increasingly viable for long-term investment and service innovation.

Rise in Demand for Financial Advisory Services

As Australia's financial environment becomes more complex, there is growing reliance on professional financial advice from both individuals and small businesses. Consumers are seeking expert guidance on a range of issues, including retirement planning, tax strategies, investment diversification, estate management, and risk mitigation. The increasing availability of wealth and rising financial literacy are pushing more Australians to take a proactive approach to financial decision-making. This demand is creating new opportunities for financial advisors, accountants, and planners to offer specialized, fee-based services tailored to different life stages and income levels. Additionally, evolving regulations and market volatility are driving interest in personalized, trustworthy advice. Institutions that integrate human advisory services with digital tools can better cater to this need, creating strong customer relationships and long-term revenue streams.

Challenges of Australia Financial Services Market:

Stringent Regulatory Compliance and Costs

Australia’s financial institutions are operating in an increasingly complex regulatory environment, marked by stricter compliance obligations across areas such as anti-money laundering (AML), Know Your Customer (KYC), and data protection. Regulators like ASIC and AUSTRAC continue to introduce and enforce rules aimed at increasing transparency, consumer protection, and system integrity. While these measures are essential for maintaining trust and market stability, they also place a significant financial and administrative burden on service providers. Institutions must allocate substantial resources to compliance systems, employee training, reporting protocols, and legal oversight. Continuous updates in regulation require ongoing investment in regtech (regulatory technology) to remain compliant. These rising compliance costs can limit agility and innovation, particularly for smaller players, and may lead to increased service fees or reduced margins industry wide.

Cybersecurity and Fraud Risks

With the rapid digitalization of Australia’s financial services sector, cybersecurity has become a top priority. Increasing volumes of online transactions, mobile banking activity, and digital identities have created more entry points for cybercriminals. Threats such as phishing, ransomware, data breaches, and identity theft are on the rise, posing significant risks to both institutions and consumers. Financial firms are compelled to invest heavily in robust security infrastructure, including multi-factor authentication, encryption technologies, and real-time fraud detection systems. At the same time, maintaining seamless customer experience and system reliability is essential. Cyber resilience must extend across all digital channels and third-party partnerships. Failing to effectively manage these risks can erode consumer trust, attract regulatory penalties, and lead to reputational damage, making cybersecurity a critical operational and strategic challenge.

Rising Competition from Non-Traditional Players

Australia’s financial services landscape is being reshaped by the entrance of non-traditional players such as technology companies, e-commerce platforms, and telecom providers. According to the Australia financial services market analysis, these digital-first firms are leveraging their vast user bases and advanced technologies to offer financial services, such as payments, lending, and digital wallets, often with greater speed, lower fees, and more intuitive interfaces than traditional banks. This disruption is challenging legacy institutions that must now compete on innovation, user experience, and agility. Unlike conventional financial firms bound by legacy systems and strict regulatory processes, many new entrants can quickly roll out customer-centric services, using data and automation to personalize offerings. To remain competitive, traditional institutions must accelerate digital transformation, embrace partnerships with fintechs, and rethink their product delivery strategies to retain customer loyalty and market share.

Australia Financial Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, size of business, and end user.

Type Insights:

- Lending And Payments

- Insurance

- Reinsurance And Insurance Brokerage

- Investments

- Foreign Exchange Services

The report has provided a detailed breakup and analysis of the market based on the type. This includes lending and payments, insurance, reinsurance and insurance brokerage, investments, and foreign exchange services.

Size of Business Insights:

- Small And Medium Business

- Large Business

A detailed breakup and analysis of the market based on the size of business have also been provided in the report. This includes small and medium business and large business.

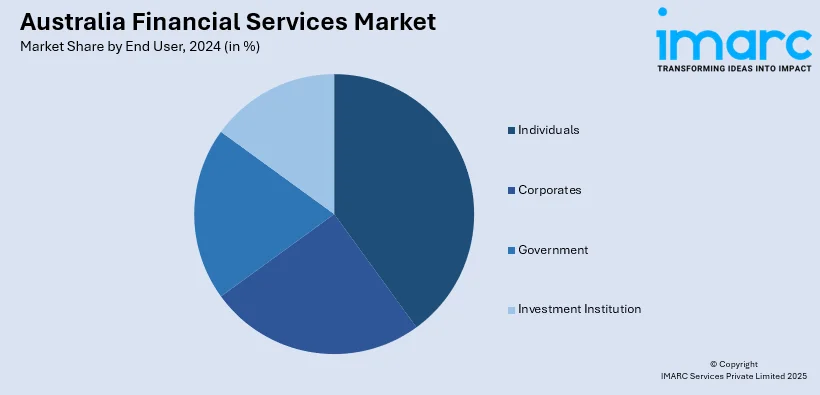

End User Insights:

- Individuals

- Corporates

- Government

- Investment Institution

The report has provided a detailed breakup and analysis of the market based on the end user. This includes individuals, corporates, government, and investment institution.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Financial Services Market News:

- February 2025: The New South Wales government has chosen Commonwealth Bank to offer financial services and assistance to the state's people, businesses, and communities. The bank will provide liquidity management, transaction banking, merchant acquisition, foreign exchange, cross-border payments, and transit transactions services. CBA will also supply transit ticketing services and help the state implement new technology for better travel planning, payment, and information access.

- January 2025: PayTo payment was introduced by Amazon and NAB to give Amazon.com.au consumers a safe and convenient option to make purchases straight from their bank accounts. Customers may now begin one-time or regular payments with a single click by authorizing PayTo arrangements through their online banking account with support of the new payment option.

Australia Financial Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Lending And Payments, Insurance, Reinsurance And Insurance Brokerage, Investments, Foreign Exchange Services |

| Sizes of Business Covered | Small And Medium Business, Large Business |

| End Users Covered | Individuals, Corporates, Government, Investment Institution |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia financial services market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia financial services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia financial services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The financial services market in Australia was valued at USD 201.3 Billion in 2024.

The Australia financial services market is projected to exhibit a CAGR of 5.2% during 2025-2033.

The Australia financial services market is projected to reach a value of USD 317.7 Billion by 2033.

The key trends of the Australia financial services market include rising digital adoption, increased fintech collaboration, and a shift toward personalized, data-driven services. ESG-focused investing is also gaining popularity, while regulatory reforms emphasize transparency and consumer protection. Embedded finance and open banking are reshaping competition, enhancing customer experiences, and expanding financial product accessibility.

The key drivers include strong digital infrastructure, a high mobile banking penetration rate, and supportive regulatory frameworks like the Consumer Data Right. Increased demand for wealth management, superannuation services, and insurance, alongside fintech innovation and rising financial literacy, continues to propel market growth across both urban and regional populations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)