Australia Factoring Market Size, Share, Trends and Forecast by Type, Organization Size, Application, and Region, 2025-2033

Australia Factoring Market Overview:

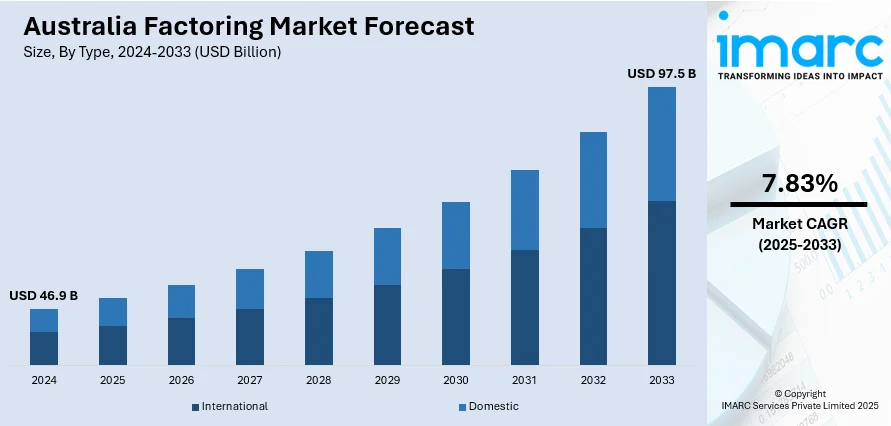

The Australia factoring market size reached USD 46.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 97.5 Billion by 2033, exhibiting a growth rate (CAGR) of 7.83% during 2025-2033. The key drivers include growing SME demand for flexible working capital, fintech innovations speeding up invoice processing, and supply chain financing gaining traction. Regulatory support for digital transactions and open banking is further expanding the Australia factoring market share. Additionally, economic uncertainties and supply chain disruptions push businesses toward factoring for improved cash flow and financial resilience.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 46.9 Billion |

| Market Forecast in 2033 | USD 97.5 Billion |

| Market Growth Rate 2025-2033 | 7.83% |

Australia Factoring Market Trends:

Increasing Adoption of Fintech Solutions in Factoring

The significant shift toward fintech-driven solutions, as businesses seek faster and more efficient access to working capital is majorly driving the Australia factoring market growth. Traditional factoring processes, which often involve lengthy paperwork and manual approvals, are being replaced by digital platforms that leverage automation, AI, and blockchain. These technologies streamline invoice verification, reduce processing times, and enhance risk assessment, making factoring more accessible to SMEs. In Australia, businesses in technology, manufacturing, and financial services are leading the way in the automation movement, with a 35% adoption rate, driving operations. Organizations have invested $3.5 Billion in AI in 2024, backed by $124 Million in government-funded research projects. As industries focus on predictive analytics, fraud detection, and operational efficiency, new opportunities for innovation are emerging. Additionally, fintech companies are offering flexible financing options, such as selective invoice factoring, where businesses can finance individual invoices rather than entire ledgers. This trend is particularly appealing to smaller enterprises that require liquidity without long-term commitments. As competition among fintech providers grows, pricing is becoming more competitive, further driving adoption. Regulatory support for open banking and digital transactions is also accelerating this shift, positioning Australia as a leader in innovative factoring solutions.

To get more information on this market, Request Sample

Growth of Supply Chain Financing in Factoring

Supply chain financing (SCF) is gaining traction in the market, driven by the need for stronger supplier-buyer relationships and improved cash flow management. Therefore, this is creating a positive Australia factoring market outlook. Businesses are increasingly using SCF solutions to extend payment terms while ensuring suppliers receive early payments through factoring arrangements. This trend is particularly prominent in industries with long production cycles, such as manufacturing, agriculture, and retail. Large corporations are partnering with financial institutions to implement SCF programs, benefiting both buyers and suppliers by optimizing working capital. Additionally, the rise of ESG (Environmental, Social, and Governance) considerations is encouraging businesses to adopt ethical financing practices, including fair payment terms for suppliers. As global supply chains face disruptions, Australian companies are turning to SCF to enhance financial resilience. This trend is growing, with more businesses integrating factoring into their broader supply chain strategies to maintain liquidity and operational efficiency.

Australia Factoring Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, organization size, and application.

Type Insights:

- International

- Domestic

The report has provided a detailed breakup and analysis of the market based on the type. This includes international and domestic.

Organization Size Insights:

- Small and Medium Enterprises

- Large Enterprises

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes small and medium enterprises and large enterprises.

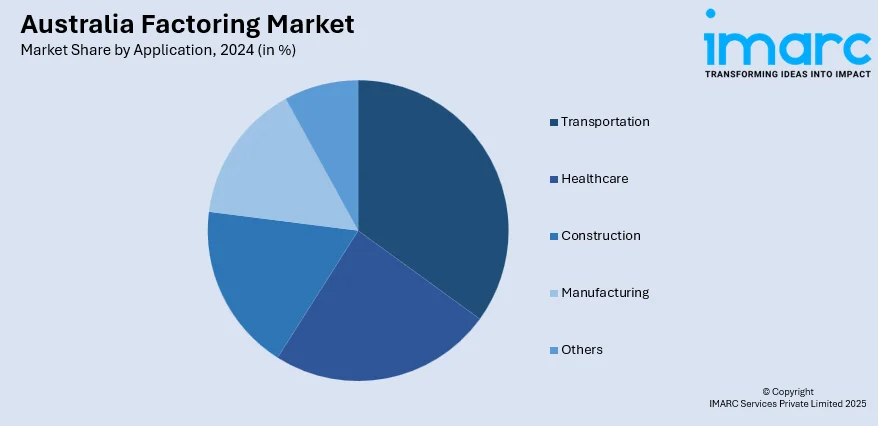

Application Insights:

- Transportation

- Healthcare

- Construction

- Manufacturing

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes transportation, healthcare, construction, manufacturing, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Factoring Market News:

- July 22, 2024: ANZ facilitated the first near real-time cross border payment through the New Payments Platform (NPP) – settling an incoming AUD payment for BNP Paribas. Trained on information available until October 2023, this development enhances cash flow, shortens operational times, and allows financial entities and factoring companies to conduct faster and more seamless transactions. This initiative aligns with global efforts to improve cross-border payment systems, opening new opportunities for Australia’s factoring industry to optimize the management of international receivables.

Australia Factoring Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | International, Domestic |

| Organization Sizes Covered | Small and Medium Enterprises, Large Enterprises |

| Applications Covered | Transportation, Healthcare, Construction, Manufacturing, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia factoring market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia factoring market on the basis of type?

- What is the breakup of the Australia factoring market on the basis of organization size?

- What is the breakup of the Australia factoring market on the basis of application?

- What is the breakup of the Australia factoring market on the basis of region?

- What are the various stages in the value chain of the Australia factoring market?

- What are the key driving factors and challenges in the Australia factoring market?

- What is the structure of the Australia factoring market and who are the key players?

- What is the degree of competition in the Australia factoring market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia factoring market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia factoring market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia factoring industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)