Australia Event Management Software Market Size, Share, Trends and Forecast by Component, Deployment Type, Organization Size, End User, and Region, 2025-2033

Australia Event Management Software Market Overview:

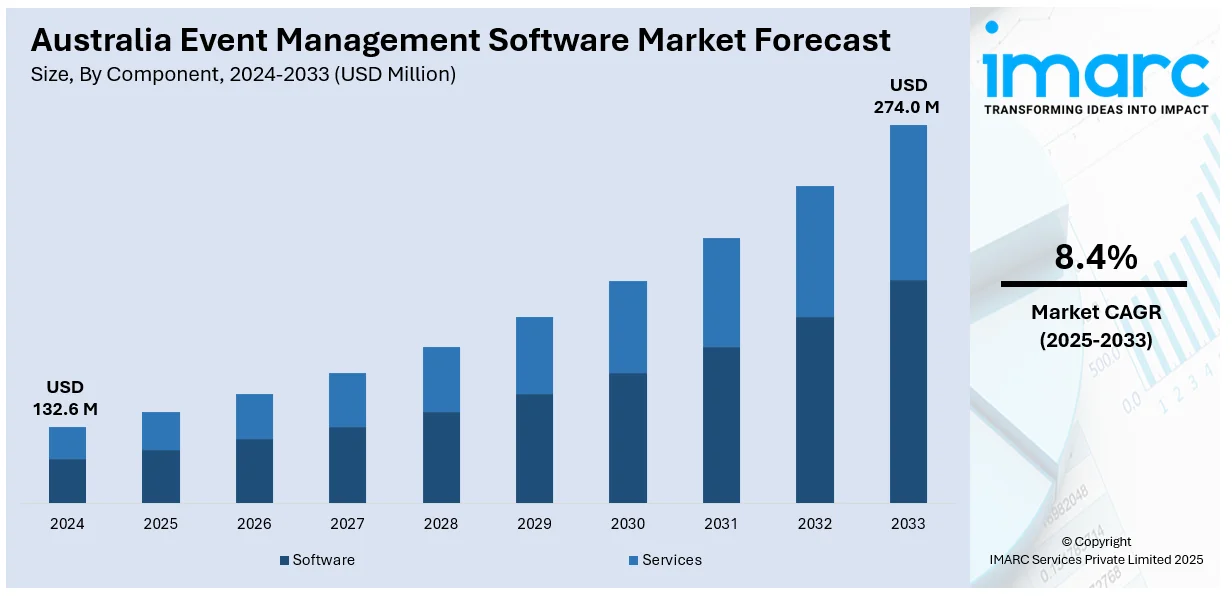

The Australia event management software market size reached USD 132.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 274.0 Million by 2033, exhibiting a growth rate (CAGR) of 8.4% during 2025-2033. The increasing digital transformation, growing demand for real-time data analytics, rising adoption of AI and cloud computing, expanding regulatory compliance requirements, heightened focus on cybersecurity, and the need for operational efficiency across various industries to enhance decision-making and business resilience are expanding the Australia event management market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 132.6 Million |

| Market Forecast in 2033 | USD 274.0 Million |

| Market Growth Rate 2025-2033 | 8.4% |

Australia Event Management Software Market Trends:

Growing Adoption of AI and Automation in Event Management Software

The Australia event management software market growth is driven by an increase in the adoption of artificial intelligence (AI) and automation to improve event planning, execution, and attendee engagement. For instance, according to a survey published on September 26, 2024, 94% of event coordinators are thinking about implementing artificial intelligence (AI) to provide real-time translation services at their events. This study polled 1,000 decision-makers in marketing, project management, and events positions in multinational corporations worldwide. As evidenced by the fact that 67% of multilingual event planners have implemented AI-powered voice translation services and 70% of them use in-person professional simultaneous interpretation, there has been a notable shift in the use of AI in event translation. Chatbots, predictive analytics, and automated scheduling are demonstrations of AI-driven technologies that are assisting event planners in streamlining processes and providing individualized experiences. Automated workflows cut down on manual labor, increasing productivity and cutting expenses for companies. Additionally, real-time decision-making is made possible by AI-powered data insights, which improve audience targeting and event logistics. Software developers are integrating AI features due to the growing demand for smart event solutions and the requirement for seamless hybrid and virtual event experiences. Automation in event management software is becoming a critical component in enhancing attendee engagement, optimizing event return on investment, and guaranteeing seamless operations with the rise of virtual and hybrid events. As a result, it is a major growth driver in the Australian industry.

To get more information on this market, Request Sample

Rising Demand for Cloud-Based and Mobile Event Solutions

Cloud-based event management software is gaining significant traction in Australia due to its scalability, flexibility, and cost-effectiveness. Businesses and event planners are increasingly adopting cloud-based platforms that offer real-time collaboration, remote accessibility, and enhanced security features. The rise of mobile event apps further complements this trend, providing attendees with seamless registration, ticketing, networking, and live updates. These mobile solutions improve engagement through interactive features such as live polling, push notifications, and AI-driven matchmaking, which in turn is positively impacting Australia event management software market outlook. Additionally, the growing preference for contactless solutions post-pandemic has fueled the demand for digital ticketing and cashless transactions. Cloud-based event software also supports integration with CRM systems, social media platforms, and analytics tools, enhancing overall event management efficiency. As businesses continue to focus on digital transformation, the demand for cloud and mobile event management solutions is expected to grow, shaping the future of the Australian event management software market. For instance, LexisNexis Risk Solutions announced the opening of its first cloud hosting facility in Australia on July 4, 2024, offering localized risk orchestration services. The objective of this effort is to improve data security, lower latency, and streamline compliance processes for Australian companies using the RiskNarrativeTM platform.

Australia Event Management Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component, deployment type, organization size, and end user.

Component Insights:

- Software

- Venue Management Software

- Ticketing Software

- Event Registration Software

- Event Marketing Software

- Event Planning Software

- Others

- Services

- Professional Services

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes software (venue management software, ticketing software, event registration software, event marketing software, event planning software, and others) and services (professional services and managed services).

Deployment Type Insights:

- On-premises

- Cloud

A detailed breakup and analysis of the market based on the deployment type have also been provided in the report. This includes on-premises and cloud.

Organization Size Insights:

- Large Enterprises

- Small and Medium Enterprises (SMEs)

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes large enterprises and small and medium enterprises (SMEs).

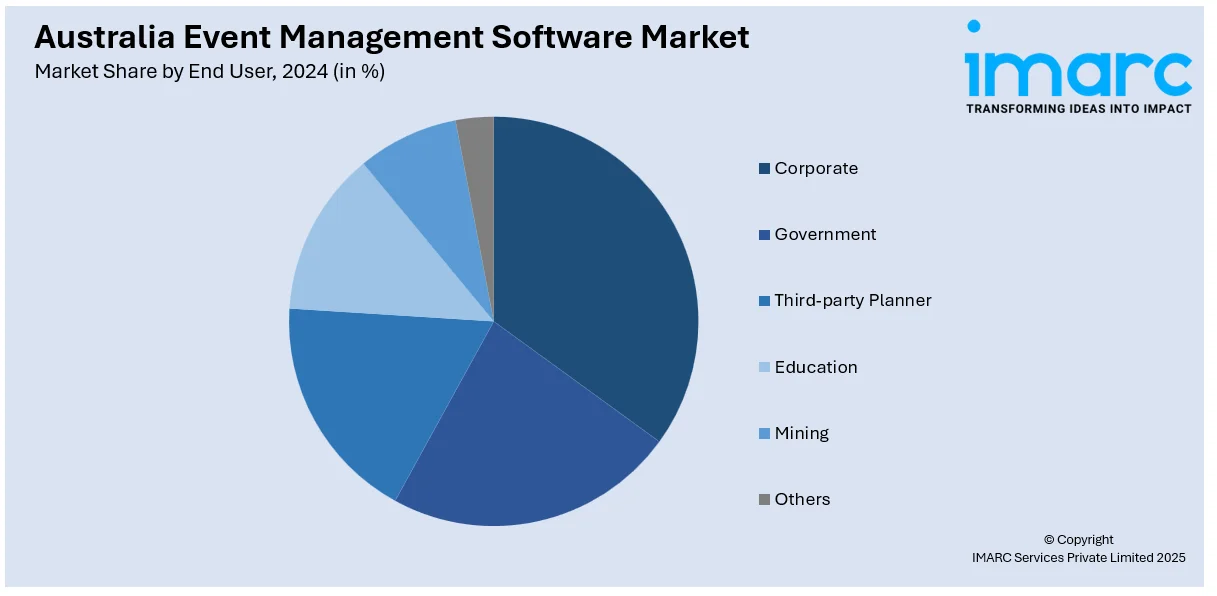

End User Insights:

- Corporate

- Government

- Third-party Planner

- Education

- Mining

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes corporate, government, third-party planner, education, mining, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Event Management Software Market News:

- On July 1, 2024, Motorola Solutions announced that it has acquired Noggin, a global provider of cloud-based business continuity planning and critical event management software with headquarters in Sydney. To improve corporate resilience and expedite incident management, Noggin's integrated platform provides situational awareness dashboards, integrated maps, and customizable workflows. By acquiring capabilities that support proactive safety and security measures for businesses and public safety organizations, Motorola Solutions hopes to expand its portfolio.

Australia Event Management Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployment Types Covered | On- premises, Cloud |

| Organization Sizes Covered | Large Enterprises, Small and Medium Enterprises (SMEs) |

| End Users Covered | Corporate, Government, Third-party Planner, Education, Mining, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia event management software market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia event management software market on the basis of component?

- What is the breakup of the Australia event management software market on the basis of deployment type?

- What is the breakup of the Australia event management software market on the basis of organization size?

- What is the breakup of the Australia event management software market on the basis of end user?

- What is the breakup of the Australia event management software market on the basis of region?

- What are the various stages in the value chain of the Australia event management software market?

- What are the key driving factors and challenges in the Australia event management software market?

- What is the structure of the Australia event management software market and who are the key players?

- What is the degree of competition in the Australia event management software market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia event management software market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia event management software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia event management software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)