Australia Esports Market Report by Revenue Model (Media Rights, Advertising and Sponsorships, Merchandise and Tickets, and Others), Platform (PC-based Esports, Consoles-based Esports, Mobile and Tablets), Games (Multiplayer Online Battle Arena (MOBA), Player vs Player (PvP), First Person Shooters (FPS), Real Time Strategy (RTS)), and Region 2025-2033

Australia Esports Market Size and Share:

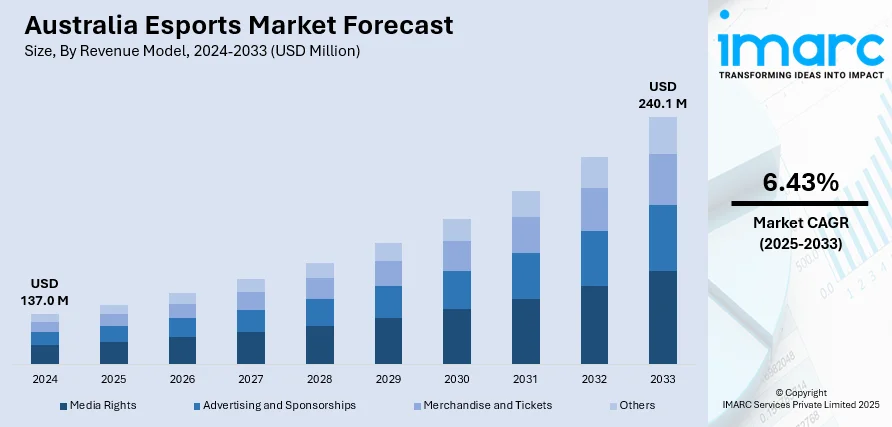

The Australia esports market size reached USD 137.0 Million in 2024. Looking forward, the market is projected to reach USD 240.1 Million by 2033, exhibiting a growth rate (CAGR) of 6.43% during 2025-2033. The market is primarily driven by the growing number of corporate sponsorships and brand integrations, increasing appeal among a younger demographic using digital platforms, higher expenditures on infrastructure in esports, and the growing commercialization of esports in the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 137.0 Million |

|

Market Forecast in 2033

|

USD 240.1 Million |

| Market Growth Rate 2025-2033 | 6.43% |

Key Trends of Australia Esports Market:

Increasing Investments in Infrastructure

The Australian esports market has seen a significant rise in investments directed toward the development of dedicated esports infrastructure. Various organizations, including private companies and governmental bodies, have recognized the potential of esports as a growing entertainment and sporting sector. As a result, investments are being funneled into creating state-of-the-art gaming arenas, training facilities, and production studios to host major esports tournaments and events. This rapid development not only augments the local esports scene but also positions Australia as an attractive destination for international esports events. The establishment of these facilities also supports the professional growth of local esports athletes, providing them with access to world-class resources. As the infrastructure expands, the visibility and professionalism of esports in Australia are expected to continue rising, further driving market growth, and fostering long-term sustainability in the industry.

To get more information of this market, Request Sample

Rising Popularity of Among Younger Audiences

The esports industry in Australia is experiencing significant growth, particularly among younger audiences such as millennials and Gen Z, who are increasingly engaged with digital platforms. These demographics are not only consuming esports content for entertainment but are also exploring it as a potential career path. Platforms such as Twitch and YouTube have been essential in providing access to esports, allowing fans to support their beloved teams and players, ultimately cultivating a strong online community. Australian educational institutions are starting to include esports programs in their curricula to give students the chance to pursue careers in game design, broadcasting, and professional gaming due to increasing interest in the field. Moreover, the increase in amateur involvement in online tournaments showcases the growing interest of younger demographics in competitive gaming.

Corporate Sponsorship and Brand Integration

As more companies realize the marketing possibilities of the esports business, corporate sponsorship is growing in prominence within the Australian esports market. Companies, both domestic and international, are working in increasing numbers with esports teams, competitions, and content producers to reach a tech-savvy, highly involved audience. Brands from industries including technology, clothing, and energy drinks are becoming more noticeable through product placements, sponsorships, and advertising. The increase in corporate interest is contributing to the commercialization of esports, giving teams and events the necessary financial support while making esports a more widely used form of entertainment. Esports in Australia are predicted to develop as a potent medium for brand promotion and additional market expansion as more brands become involved. As a result, this is creating a positive outlook for the market.

Growth Drivers of Australia Esports Market:

Expansion of Gaming Infrastructure

The growth of gaming infrastructure is a vital factor propelling the Australian esports market forward. With the implementation of high-speed internet in both urban and rural areas, connectivity is improving, leading to enhanced gameplay and streaming experiences. The establishment of dedicated gaming arenas and esports hubs is providing physical venues for competitive events and community interaction. Additionally, streaming platforms are granting players and fans immediate access to matches, tutorials, and various content, thereby strengthening the esports ecosystem. These advancements enhance accessibility and attract investments from both public and private entities. As the infrastructure continues to develop, it is anticipated to play a significant role in increasing the Australia esports market share.

Growing Popularity of Local Tournaments

Local esports tournaments and leagues are becoming increasingly popular in Australia, cultivating a dynamic competitive gaming culture. Community-centric competitions are offering amateur and semi-professional gamers the chance to display their talents while attracting audiences both online and within physical venues. These events nurture loyalty among fans and players, establishing regional esports communities that promote ongoing engagement. The rise in sponsorship and media coverage also provides local tournaments with the visibility necessary for growth. Furthermore, these competitions often act as a gateway for players looking to compete on international stages. This surge in organized local events is directly boosting the Australia esports market demand.

Streaming and Content Creation Boom

The emergence of content creation and live streaming has revolutionized the way esports is experienced and monetized in Australia. Platforms like Twitch, YouTube Gaming, and TikTok allow players, teams, and influencers to cultivate robust online followings, transforming casual gaming into sustainable careers. This expanding network of streamers and content creators is fostering consistent viewer engagement and attracting brand collaborations. Fans now engage with their favorite players during tournaments and through ongoing live content, tutorials, and interactive sessions. The potential for monetization through subscriptions, advertisements, and sponsorships is motivating more gamers to join this space. This trend stands as a significant driver, according to Australia esports market analysis.

Opportunities of Australia Esports Market:

Development of Esports Education Programs

The increasing acknowledgment of esports as a legitimate career option has created significant opportunities for educational institutions in Australia to implement specialized programs. Universities and training centers are starting to investigate courses in areas like esports management, event production, game design, broadcasting, and digital marketing specifically for the gaming sector. These initiatives can help professionalize the industry and cultivate a skilled workforce that supports the broader esports environment. Educational prospects also include high school clubs and workshops designed to introduce students to gaming careers earlier on. By formalizing esports education, Australia can develop industry-ready professionals and maintain sustainable growth, transforming passion into legitimate careers and strengthening the future workforce for esports in the country.

Expansion into Regional Markets

Regional Australia offers considerable unexploited opportunities for the expansion of the esports market. While urban areas currently lead in esports activity, there is a growing interest in gaming culture in smaller towns and regional centers. Establishing grassroots tournaments, local esports leagues, and dedicated gaming spaces in these regions can engage new audiences and identify emerging talent beyond metropolitan settings. This approach encourages wider national participation, helping to make esports opportunities accessible to all. Improvements in internet infrastructure and a governmental emphasis on regional development enhance the potential for growth in these areas, significantly expanding the player base and audience reach. Supporting regional esports ecosystems fosters inclusive industry growth and creates long-term market sustainability throughout the country.

Cross-Industry Collaborations

Esports in Australia has immense potential for partnerships across various sectors that can boost fan engagement and commercial viability. Collaborations with industries such as entertainment, fashion, and music can create immersive experiences that attract broader audiences. For instance, in-game concerts, branded merchandise lines, and influencer-driven campaigns can merge pop culture with gaming. These partnerships can transform esports events into lifestyle activities instead of mere competitions, widening their appeal to non-traditional fans. Moreover, brands outside the gaming industry can leverage esports as an effective way to engage with younger, tech-savvy consumers. As esports continues to gain cultural significance, these collaborations will serve as important pathways for innovation and market growth in Australia.

Challenges of Australia Esports Market:

Lack of Formal Industry Regulation

A significant challenge in the Australian esports market is the lack of standardized industry regulation. Without an established governing body or a consistent set of rules, issues can emerge regarding player rights, contracts, prize distribution, and tournament integrity. This absence of a structured system frequently results in varying treatment of players and teams and creates legal ambiguities in sponsorship and event agreements. It can also pose obstacles for investors and partners looking to enter the industry with confidence. Implementing regulatory frameworks is essential for protecting players, ensuring fair competition, and enhancing the industry's credibility. Formal governance is crucial for developing a more sustainable and professional esports ecosystem in Australia capable of competing on a global stage.

Funding and Sponsorship Constraints

Gaining reliable funding and sponsorship remains a notable challenge for the advancement of esports in Australia. While high-profile sponsors may be drawn to major tournaments and professional teams, grassroots organizations, local leagues, and smaller content creators often face difficulties securing financial backing. This can hinder their ability to grow operations, invest in quality equipment, and provide competitive opportunities for emerging talent. The comparatively small size of the Australian esports audience, in relation to global markets, can also dissuade potential investors. Additionally, the general unfamiliarity among non-endemic brands regarding esports' marketing potential contributes to limited sponsorship involvement. Addressing these financial challenges is vital for fostering a vibrant and inclusive esports ecosystem that nurtures growth from the grassroots level.

Limited Career Pathways

The perception of restricted long-term career pathways continues to be a significant obstacle for aspiring esports professionals in Australia. While there are success stories, many players and content creators experience uncertainty concerning income stability, career longevity, and advancement opportunities. Unlike traditional sports, the esports sector lacks organized development programs, athlete support services, and clear career transition plans for those moving on from competition. This uncertainty can deter talented individuals from seriously pursuing a career in esports or encourage them to exit the industry prematurely. Furthermore, parents and educators may hesitate to endorse a pathway that lacks well-defined prospects. Addressing this challenge requires building structured talent pipelines, educational initiatives, and career development programs that promote esports as a viable and respected profession in Australia.

Australia Esports Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on revenue model, platform and games.

Revenue Model Insights:

- Media Rights

- Advertising and Sponsorships

- Merchandise and Tickets

- Others

The report has provided a detailed breakup and analysis of the market based on the revenue model. This includes media rights, advertising and sponsorships, merchandise and tickets, and others.

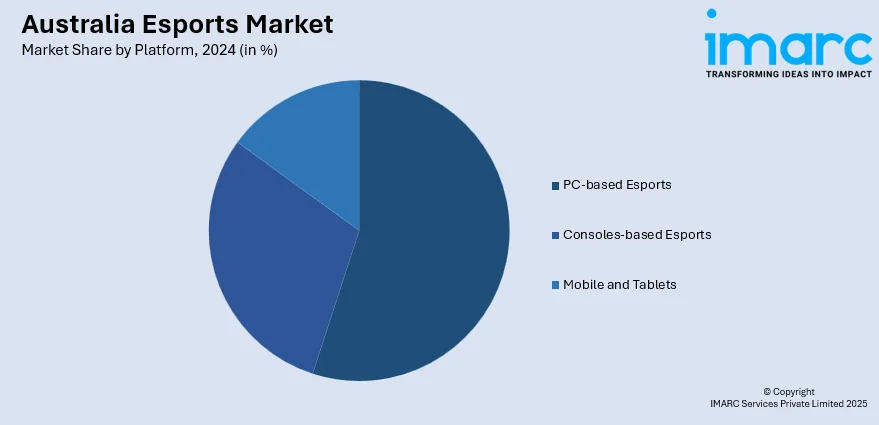

Platform Insights:

- PC-based Esports

- Consoles-based Esports

- Mobile and Tablets

A detailed breakup and analysis of the market based on the platform have also been provided in the report. This includes PC-based esports, consoles-based esports, and mobile and tablets.

Games Insights:

- Multiplayer Online Battle Arena (MOBA)

- Player vs Player (PvP)

- First Person Shooters (FPS)

- Real Time Strategy (RTS)

A detailed breakup and analysis of the market based on the games have also been provided in the report. This includes multiplayer online battle arena (MOBA), player vs player (PvP), first person shooters (FPS), and real time strategy (RTS).

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Esports Market News:

- In July 2025, ZOWIE, a professional esports brand, launched its first ZOWIE Zone in Australia at WY Gaming in Sydney. This immersive venue offers gamers a tournament-grade experience with top-tier monitors optimized for FPS titles.

- In April 2025, Philips Evnia partnered with Ground Zero Gaming for the 2025 esports season, aiming to enhance competitive gaming through innovation and inclusivity. Ground Zero, a leader in Australia's esports, will utilize Evnia's advanced monitors to improve player performance and fan engagement, expanding their global presence in the esports arena.

- In November 2024, Tabcorp partnered with PandaScore to enhance esports betting services in Australia, focusing initially on Counter-Strike, League of Legends, and Dota 2. The collaboration will utilize PandaScore’s AI-driven data and odds services, aiming to meet the rising demand for esports betting across various platforms and markets.

- In September 2023, the Chiefs Esports Club, a well-known Australian esports organization, was acquired by Team Bliss. Both brands will continue to function separately under their own names even after they unite. Founded in 2019, Team Bliss has achieved success in local League of Legends Circuit Oceania (LCO) events as well as in PUBG and Rainbow Six: Siege contests.

Australia Esports Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Revenue Models Covered | Media Rights, Advertising and Sponsorships, Merchandise and Tickets, Others |

| Platforms Covered | PC-based Esports, Consoles-based Esports, Mobile and Tablets |

| Games Covered | Multiplayer Online Battle Arena (MOBA), Player vs Player (PvP), First Person Shooters (FPS), Real Time Strategy (RTS) |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia esports market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia esports market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia esports industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The esports market in Australia was valued at USD 137.0 Million in 2024.

The Australia esports market is projected to exhibit a compound annual growth rate (CAGR) of 6.43% during 2025-2033.

The Australia esports market is expected to reach a value of USD 240.1 Million by 2033.

Growth drivers include rising digital adoption, increasing popularity of multiplayer games, and improved internet infrastructure. Supportive community initiatives, youth-driven interest in competitive gaming, and the emergence of local content creators are also contributing to broader awareness, higher participation, and commercial investment in the esports ecosystem across the country.

Australia is witnessing a rise in professional league formations, growing female participation, and integration of esports in education, which are the key trends of the Australia esports market. There is also increased use of streaming platforms for fan engagement and stronger collaborations between gaming and entertainment industries to deliver immersive, cross-platform content experiences which are further accelerating the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)