Australia Enterprise Governance, Risk and Compliance (eGRC) Market Report by Component (Software, Services), Deployment Mode (Cloud, On-premises), Business Function (Finance, Information Technology, Legal, Operations, and Others), Organization Size (Small and Medium Enterprises, Large Enterprises), Vertical (BFSI, Construction and Engineering, Energy and Utilities, Government, Healthcare, Manufacturing, Retail and Consumer Goods, Telecom and IT, Transportation and Logistics, and Others), and Region 2025-2033

Australia Enterprise Governance, Risk and Compliance (eGRC) Market Overview:

The Australia enterprise governance, risk and compliance (eGRC) market size reached USD 996.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,915.2 Million by 2033, exhibiting a growth rate (CAGR) of 12.7% during 2025-2033. The increasing regulatory complexities, heightened focus on data privacy, the growing need for risk management across industries, the widespread adoption of eGRC solutions to ensure compliance, mitigate risks, and enhance operational transparency, and the rise in cyber threats and stringent government regulations are some of the major factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 996.2 Million |

| Market Forecast in 2033 | USD 2,915.2 Million |

| Market Growth Rate 2025-2033 | 12.7% |

Australia Enterprise Governance, Risk and Compliance (eGRC) Market Trends:

Growing Regulatory Compliance

Increasingly stringent regulations and standards require organizations to implement robust eGRC solutions to ensure adherence and avoid legal penalties. For instance, in January 2023, Melbourne-headquartered governance, risk, and compliance (GRC) software firm 6clicks launched a GRC tools marketplace. The 6clicks Marketplace lists more than 100 organizations’ risk and compliance software, content, and services aimed at businesses and their advisors, including MSPs. The marketplace categories range from GRC software for cybersecurity, risk assessment and management, corporate governance, auditing and assessment, and data privacy and protection, to GRC-related consulting, training, and other services. The marketplace also provides standards, laws, regulations, frameworks, policies, control sets, audit and assessment templates, risk and issue libraries, project methodologies, and playbooks. This includes industry-specific content – for example, businesses can access control libraries and obligations provided by law firm King Wood Mallesons to ensure compliance with Australian Credit License and Australian Financial Services licenses. Such endeavors are reflective of the increasing compliance with existing regulations, thereby creating a positive outlook for the market.

Rising Risk Management

As businesses face increasing threats from cyberattacks, operational disruptions, and financial uncertainties, effective risk management becomes crucial. For instance, in January 2024, as per an article published by Centre for Strategic and International Studies, Russian hackers attacked 65 Australian government departments and agencies and stole 2.5 million documents in Australia’s largest government cyberattack. Hackers infiltrated an Australian law firm that worked with the government to gain access to government files. In September 2023, a Russian ransomware group leaked Australian federal police officers’ details on the dark web. The leak is the latest phase of a Russian attack that started in April 2023 against an Australian law firm that services several Australian government agencies. The need for integrated risk management frameworks to safeguard against emerging risks such as these and ensure strategic alignment. eGRC solutions provide comprehensive tools for identifying, assessing, and mitigating risks, and enhancing organizational resilience, thereby fueling the market's growth.

Australia Enterprise Governance, Risk and Compliance (eGRC) Market News:

- In February 2024, ReadiNow, a global leader in Governance, Risk Management, and Compliance (GRC) solutions, announced the launch of ReadiNow Nova, a groundbreaking enhancement to its digital transformation platform. Nova represents not just an evolution, but a revolution in user interface and user experience (UI/UX) design, meticulously crafted to meet the dynamic needs of modern businesses.

- In May 2024, Sydney-based HyperGRC announced a new composable architecture for its governance, risk, and compliance (GRC) platform. The company has opened all application programming interfaces (APIs) within the platform and is now offering a free tier for the core risk management module.

Australia Enterprise Governance, Risk And Compliance (eGRC) Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on component, deployment mode, business function, organization size, and vertical.

Component Insights:

-market.webp)

To get more information on this market, Request Sample

- Software

- Audit Management

- Compliance Management

- Risk Management

- Policy Management

- Incident Management

- Others

- Services

- Integration

- Consulting

- Support

The report has provided a detailed breakup and analysis of the market based on the component. This includes software (audit management, compliance management, risk management, policy management, incident management, and others) and services (integration, consulting, and support).

Deployment Mode Insights:

- Cloud

- On-premises

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes cloud and on-premises.

Business Function Insights:

- Finance

- Information Technology

- Legal

- Operations

- Others

The report has provided a detailed breakup and analysis of the market based on the business function. This includes finance, information technology, legal, operations, and others.

Organization Size Insights:

- Small and Medium Enterprises

- Large Enterprises

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes small and medium enterprises and large enterprises.

Vertical Insights:

- BFSI

- Construction and Engineering

- Energy and Utilities

- Government

- Healthcare

- Manufacturing

- Retail and Consumer Goods

- Telecom and IT

- Transportation and Logistics

- Others

The report has provided a detailed breakup and analysis of the market based on the vertical. This includes BFSI, construction and engineering, energy and utilities, government, healthcare, manufacturing, retail and consumer goods, telecom and IT, transportation and logistics, and others.

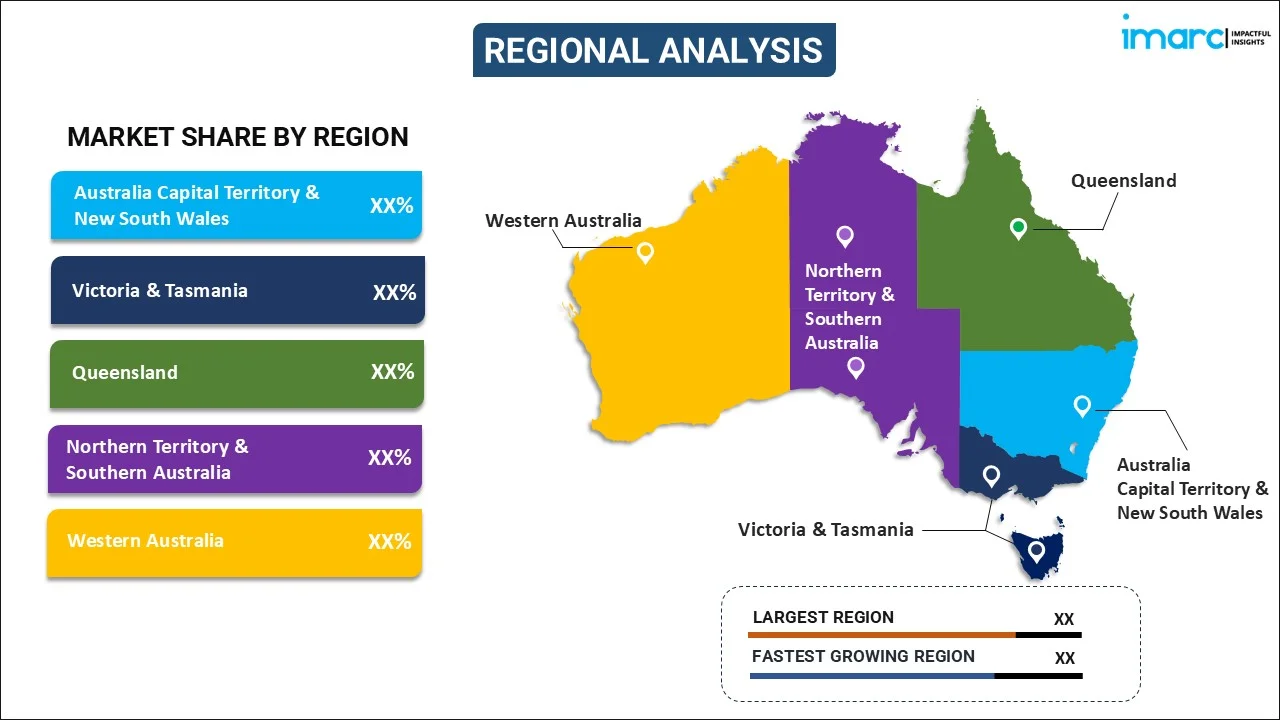

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Enterprise Governance, Risk And Compliance (eGRC) Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployment Modes Covered | Cloud, On-premises |

| Business Functions Covered | Finance, Information Technology, Legal, Operations, Others |

| Organization Sizes Covered | Small and Medium Enterprises, Large Enterprises |

| Verticals Covered | BFSI, Construction and Engineering, Energy and Utilities, Government, Healthcare, Manufacturing, Retail and Consumer Goods, Telecom and IT, Transportation and Logistics, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia enterprise governance, risk and compliance (eGRC) market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Australia enterprise governance, risk and compliance (eGRC) market?

- What is the breakup of the Australia enterprise governance, risk and compliance (eGRC) market on the basis of component?

- What is the breakup of the Australia enterprise governance, risk and compliance (eGRC) market on the basis of deployment mode?

- What is the breakup of the Australia enterprise governance, risk and compliance (eGRC) market on the basis of business function?

- What is the breakup of the Australia enterprise governance, risk and compliance (eGRC) market on the basis of organization size?

- What is the breakup of the Australia enterprise governance, risk and compliance (eGRC) market on the basis of vertical?

- What are the various stages in the value chain of the Australia enterprise governance, risk and compliance (eGRC) market?

- What are the key driving factors and challenges in the Australia enterprise governance, risk and compliance (eGRC)?

- What is the structure of the Australia enterprise governance, risk and compliance (eGRC) market and who are the key players?

- What is the degree of competition in the Australia enterprise governance, risk and compliance (eGRC) market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia enterprise governance, risk and compliance (eGRC) market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia enterprise governance, risk and compliance (eGRC) market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia enterprise governance, risk and compliance (eGRC) industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)