Australia Electric Two-Wheeler Market Size, Share, Trends and Forecast by Vehicle Type, Battery Type, Voltage Type, Peak Power, Battery Technology, Motor Placement, and Region, 2025-2033

Australia Electric Two-Wheeler Market Overview:

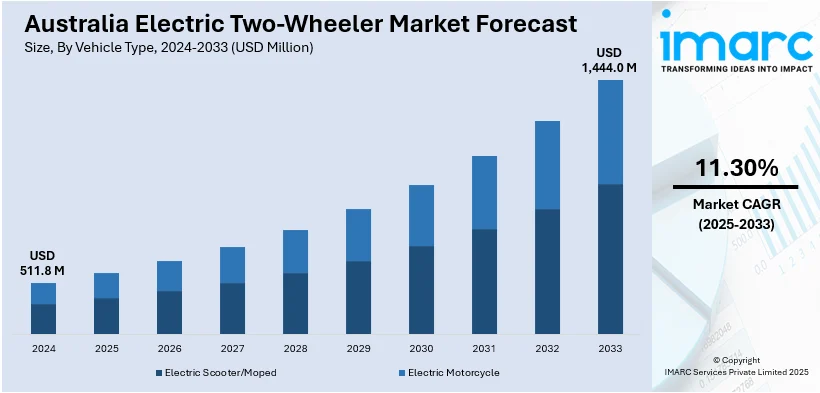

The Australia electric two-wheeler market size reached USD 511.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,444.0 Million by 2033, exhibiting a growth rate (CAGR) of 11.30% during 2025-2033. The market is experiencing significant growth, driven by urban mobility needs, environmental awareness, and supportive policies. Growing adoption of e-scooters and e-bikes, along with improving battery tech and charging infrastructure, is also contributing positively to the market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 511.8 Million |

| Market Forecast in 2033 | USD 1,444.0 Million |

| Market Growth Rate 2025-2033 | 11.30% |

Australia Electric Two-Wheeler Market Trends:

Increased Environmental Awareness

Increased environmental awareness is playing a major role in accelerating the shift toward electric two-wheelers across Australia. The Australia electric two-wheeler market share is growing as more consumers seek alternatives that reduce their carbon footprint and reliance on fossil fuels. Rising fuel prices, frequent climate-related events, and mounting concerns over urban air quality are pushing both individuals and organizations to consider cleaner modes of transport. E-bikes and electric scooters are becoming popular not just for personal use, but also for deliveries and last-mile logistics. For instance, in August 2024, Australia Post announced the launch of a fleet of 175 UBCO electric motorbikes enhancing its commitment to sustainability and safety. Capable of speeds up to 80 km/h these bikes aim to reduce emissions and operational costs while improving delivery efficiency. Younger consumers, in particular, are embracing sustainable mobility as part of their lifestyle choices. Government campaigns, carbon-neutral goals, and the visibility of electric fleets like those used by Australia Post are reinforcing this trend. These factors are expected to create a positive Australia electric two-wheeler market outlook in the coming years.

To get more information on this market, Request Sample

Development of Charging Infrastructure

The expansion of charging infrastructure is becoming a vital enabler for electric two-wheeler adoption in Australia. While public EV charging networks have traditionally focused on cars, there's now a growing emphasis on solutions tailored to scooters and e-bikes. Portable chargers, compact home-based units, and solar-powered charging points are gaining traction among urban users. Local governments and private developers are beginning to incorporate two-wheeler charging stations in residential complexes, commercial buildings, and transport hubs. This growing accessibility is helping to reduce range anxiety and build consumer confidence in electric mobility. For instance, in February 2025, the Australian Renewable Energy Agency (ARENA) allocated A$2.4 million for the installation of 250 public EV chargers across Victoria, New South Wales, and South Australia. This initiative, led by EVX Australia, aims to enhance accessibility for EV owners who lack home charging options, supporting the growing demand for electric vehicles. Moreover, advancements in fast-charging and battery swapping technologies are making electric two-wheelers more practical for daily use. As infrastructure keeps pace with rising demand, it’s expected to significantly boost consumer adoption and fleet operations. This supportive ecosystem is a key factor contributing to Australia electric two-wheeler market growth.

Australia Electric Two-Wheeler Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on vehicle type, battery type, voltage type, peak power, battery technology, and motor placement.

Vehicle Type Insights:

- Electric Scooter/Moped

- Electric Motorcycle

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes electric scooter/moped and electric motorcycle.

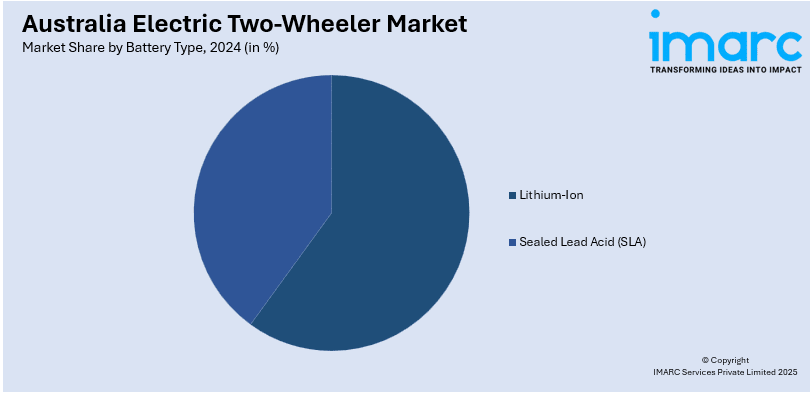

Battery Type Insights:

- Lithium-Ion

- Sealed Lead Acid (SLA)

A detailed breakup and analysis of the market based on the battery type have also been provided in the report. This includes lithium-ion and sealed lead acid (SLA).

Voltage Type Insights:

- <48V

- 48–60V

- 61–72V

- 73–96V

- 96V

A detailed breakup and analysis of the market based on the voltage type have also been provided in the report. This includes <48V, 48–60V, 61–72V, 73–96V, and >96V.

Peak Power Insights:

- <3 kW

- 3–6 kW

- 7–10 kW

- 10 kW

A detailed breakup and analysis of the market based on the peak power have also been provided in the report. This includes <3 kW, 3–6 kW, 7–10 kW, and >10 kW.

Technology Insights:

- Removable

- Non-Removable

A detailed breakup and analysis of the market based on the battery technology have also been provided in the report. This includes removable and non-removable.

Motor Placement Insights:

- Hub Type

- Chassis Mounted

A detailed breakup and analysis of the market based on the motor placement have also been provided in the report. This includes hub type and chassis mounted.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Electric Two-Wheeler Market News:

- In July 2024, Segway-Ninebot announced the launch of its new e-Motorbike series in Australia, featuring three models. The eco-friendly bikes offer high-tech connectivity, impressive range, and advanced safety features, promising a comfortable and efficient commuting experience for urban riders.

- In February 2025, FTN Motion announced the launch of its Streetdog electric motorcycles in Australia. The Streetdog50 and Streetdog80 models offer varying speeds and ranges. Test rides will be available in Melbourne and Sydney, with deliveries expected to start in July 2025.

Australia Electric Two-Wheeler Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Electric Scooter/Moped, Electric Motorcycle |

| Battery Types Covered | Lithium-Ion, Sealed Lead Acid (SLA) |

| Voltage Types Covered | <48V, 48–60V, 61–72V, 73–96V, >96V |

| Peak Powers Covered | <3 kW, 3–6 kW, 7–10 kW, >10 kW |

| Battery Technologies Covered | Removable, Non-Removable |

| Motor Placements Covered | Hub Type, Chassis Mounted |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia electric two-wheeler market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia electric two-wheeler market on the basis of vehicle type?

- What is the breakup of the Australia electric two-wheeler market on the basis of battery type?

- What is the breakup of the Australia electric two-wheeler market on the basis of voltage type?

- What is the breakup of the Australia electric two-wheeler market on the basis of peak power?

- What is the breakup of the Australia electric two-wheeler market on the basis of battery technology?

- What is the breakup of the Australia electric two-wheeler market on the basis of motor placement?

- What is the breakup of the Australia electric two-wheeler market on the basis of region?

- What are the various stages in the value chain of the Australia electric two-wheeler market?

- What are the key driving factors and challenges in the Australia electric two-wheeler market?

- What is the structure of the Australia electric two-wheeler market and who are the key players?

- What is the degree of competition in the Australia electric two-wheeler market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia electric two-wheeler market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia electric two-wheeler market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia electric two-wheeler industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)