Australia EdTech Market Size, Share, Trends and Forecast by Sector, Type, Deployment Mode, End User, and Region, 2025-2033

Australia EdTech Market Size and Share:

The Australia edtech market size was valued at USD 3.9 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 7.4 Billion by 2033, exhibiting a CAGR of 7.3% from 2025-2033. The growing digital adoption at all levels of education, government funding, a growing need for personalized learning, advancements in cloud technology, and the requirement to increase accessibility in education to remote areas are the main factors facilitating the Australia edtech market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.9 Billion |

| Market Forecast in 2033 | USD 7.4 Billion |

| Market Growth Rate (2025-2033) | 7.3% |

The growth in Australia's EdTech market is fuelled by growing digital adoption in education due to the government's $1.2 billion Digital Economy Strategy. This investment supports the development of digital infrastructure and technological innovations in schools and universities, fostering the integration of online learning platforms and smart classroom technologies. The surge in demand for flexible, personalized, and remote learning solutions, accelerated by the pandemic, has further propelled this growth. For example, the number of cloud-based platforms, such as learning management systems (LMS), has grown exponentially, allowing students living in cities and rural areas alike to easily access educational content.

.webp)

To get more information on this market, Request Sample

In addition to this, the demand for Australia's focus on education in STEM and vocational training encourages the uptake of specialized EdTech tools for skill building. Regional initiatives aimed at reducing the educational gap in remote areas have also triggered the acceptance of modern digital solutions. The country hosts around 7,000 schools with more than 24% of the regional population going to university. In this regard, the demand is massive, and various enterprises are also participating in growth by including EdTech for corporate training for up-skilling the employees and thus fulfilling the requirements of a particular industry. As per the Australia edtech market forecast, ongoing technological advancements are impelling the market growth, with the Australian EdTech sector expected to reach unprecedented levels of accessibility and quality.

Australia EdTech Market Trends:

Personalization and adaptive learning technologies

Tailored learning experiences are now major drivers in the Australian EdTech landscape. With the power of artificial intelligence (AI), adaptive learning platforms analyze learner behaviors and provide customized content in line with specific needs. This trend is closely linked to the growing trend toward student-centered education, which results in greater engagement and higher levels of learning. In recent times, for example, schools have adopted the platforms Mathletics and LiteracyPlanet due to their offerings of adaptive tools for K-12 education. Over 60% of Australian educators now reportedly prioritize personalized learning solutions catering to diverse student abilities.

Emergence of hybrid models of education

The hybrid model combines both online and offline learning in the Australian education. Schools and universities incorporate Learning Management Systems, which are now digital classrooms that complement the traditional means of teaching. This hybrid approach ensures that there will always be a continuity of education for a student during any event such as natural disasters and health crises. The University of Sydney increased its digital infrastructure to cater to more than 70,000 students. By 2025, according to experts, 40% of the total Australian higher education will incorporate hybrid models because of its ability to offer flexibility with quality.

Improvements in immersive learning through Augmented Reality (AR)/ Virtual Reality (VR)

Immersive technologies such as AR/ VR are transforming Australian education to create engaging, hands-on learning environments, thereby offering a favorable Australia edtech market outlook. They have a significant impact on the practical skills fields, like healthcare and engineering. Institutions like TAFE Queensland are using AR/VR in their training programs, allowing students to practice real-world scenarios in an efficient and safe manner. The adoption of these tools is projected to grow by 25% annually, driven by the decreasing cost of AR/VR hardware and the increasing availability of content, which is providing an impetus to the market growth.

Australia EdTech Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Australia edtech market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on sector, type, deployment mode, and end user.

Analysis by Sector:

- Preschool

- K-12

- Higher Education

- Others

The preschool segment benefits from growing awareness about early childhood education's importance and the adoption of digital tools like gamified learning apps to improve engagement and skill-building. Australia saw a sharp increase in e-learning tools designed for children aged 2–5, with 45 minutes of daily educational screen time being recommended for this age group.

K-12 adoption is driven by investments such as the AU$328 million NSW fiber rollout, enhancing digital infrastructure in schools. Platforms like Edrolo, used in over 1,100 schools, aim to support 1 million high school students by 2025. Additionally, cloud-based solutions like Google Workspace are becoming vital as schools upgrade aging devices.

Corporate upskilling is a major driver, with companies like Go1 aiming to reach 1 billion learners globally. This segment also includes professional development programs and platforms tailored to specific needs, reflecting a growing demand for lifelong learning solutions.

Analysis by Type:

- Hardware

- Software

- Content

The demand for advanced EdTech hardware in Australia is fueled by the increasing use of interactive displays, smartboards, and VR-enabled devices to create engaging and immersive learning environments. This segment is also supported by government initiatives promoting digital infrastructure in schools and universities.

Software demand is driven by the proliferation of learning management systems, student collaboration tools, and gamified educational solutions tailored to personalized learning experiences. Cloud-based deployments are becoming pivotal in enabling flexible and accessible education for both institutions and individual learners.

Content growth stems from the expansion of diverse, high-quality digital resources such as online courses, AI-driven interactive modules, and multimedia-rich textbooks. Partnerships with educators and institutions help curriculum-aligned content, meeting the evolving needs of K-12 and higher education segments.

Analysis by Deployment Mode:

- Cloud-based

- On-premises

The demand for cloud-based EdTech solutions in Australia is based on their scalability and flexibility, allowing institutions to increase resources with minimal infrastructure costs. They support remote access, thus making education inclusive for students in geographically dispersed areas. Furthermore, these solutions simplify collaboration and integrate advanced tools like Learning Management Systems (LMS), thus enhancing engagement and academic outcomes.

On the other hand, institutions that emphasize the security and control of data tend to be attracted to on-premise EdTech solutions. They can be fully customized to meet specific educational needs and to ensure strict compliance with data protection regulations. Although the initial investments in these systems are higher, they offer stability and are preferred for uninterrupted offline functionalities in regions with poor internet connectivity.

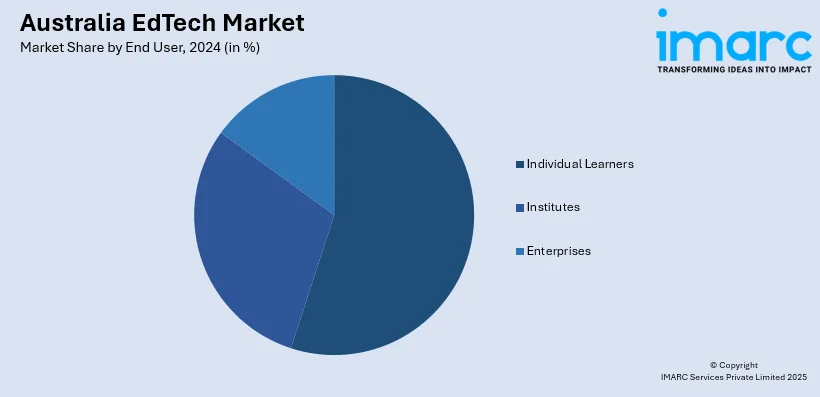

Analysis by End User:

- Individual Learners

- Institutes

- Enterprises

The rising availability of affordable, on-demand courses caters to individuals aiming for flexible, self-paced learning. The integration of gamification and personalized learning paths further enhances engagement, meeting diverse learner needs.

Moreover, institutions are embracing EdTech to improve operational efficiency through digital management systems, automate administrative tasks, and foster collaborative learning environments. Moreover, technology adoption helps institutions remain competitive by offering innovative teaching solutions.

Besides this, corporate training programs also benefit from EdTech platforms that deliver tailored skill development and compliance training modules. These solutions enable businesses to adapt quickly to industry changes and maintain a competitive workforce.

Regional Analysis:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The concentration of establishments and government offices in the Australian Capital Territory & New South Wales region creates a need for EdTech solutions related to administrative efficiency and policy-directed learning programs. There's also an increasing trend with digital innovation initiatives that help improve adoption.

Victoria & Tasmania’s high focus on STEM education and increasing accessibility to remote and disadvantaged populations increase the demand for high-end EdTech. The government's support for equitable learning also increases demand.

Furthermore, rapid urbanization and regional investments in education infrastructure across Queensland are driving a strong market for interactive EdTech tools, catering to diverse learner needs from rural to metropolitan areas.

In the Northern Territory & South Australia, the need to fill the digital divide in remote communities, as well as industry-specific training programs, increases the adoption of EdTech. There is an emphasis on platforms offering vocational training.

Additionally, the thrust for training in mining and resource sector-related skills in Western Australia increases the demand for EdTech solutions that offer industry-specific certifications. Also, education access to dispersed geographies.

Competitive Landscape:

The competitive landscape of Australia's EdTech market is characterized by a dynamic mix of local startups, established companies, and global players. Over 700 EdTech firms operate in the region, primarily concentrated in urban hubs like Sydney and Melbourne. These firms cater to diverse segments, including K-12, higher education, corporate training, and lifelong learning. Local companies have gained prominence, leveraging personalized learning technologies and adaptive platforms. Global giants are expanding their footprint by offering scalable cloud-based educational solutions. The market is also witnessing increased collaboration between technology providers and educational institutions, fostering innovation in areas like AI-driven learning, gamification, and virtual classrooms. Government initiatives and funding support further stimulate competition by encouraging new entrants.

The report provides a comprehensive analysis of the competitive landscape in the Australia edtech market with detailed profiles of all major companies.

Latest News and Developments:

- February 2024: The University of Sydney and EdTech startup HEX announced a School of Record partnership, marking the country's first agreement. Through this five-year partnership, it will support efforts to narrow the digital skills gap and create more opportunities for students to achieve university-level credit as they skill up in innovation and entrepreneurship. The company is pleased that the University of Sydney acknowledges that experiential learning has academic credibility.

- April 2024: Spark Education inaugurated its first off-line learning center in Melbourne. It marked further expansion around the world and consolidation in a leading position in the global education market.

- July 2024: ANZ’s biggest edtech provider revealed new brand positioning as it plans to double down on the spontaneous pace of advancements and innovation and agenda of helping teachers to teach students.

- October 2024: The Association of Australian Education Representatives in India (AAERI) has joined forces with OpenLearning to introduce an online training program for the industry.

- October 2024: the Koala launched Australian-first AI platform for students to look for their perfect UniMatch. The platform makes the otherwise cumbersome process of selecting the right discipline and finding the ideal university a little easier by providing personalized recommendations based on the strengths, interests, and preferences of each student.

Australia EdTech Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Preschool, K-12, Higher Education, Others |

| Types Covered | Hardware, Software, Content |

| Deployment Modes Covered | Cloud-based, On-premises |

| End Users Covered | Individual Learners, Institutes, Enterprises |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia edtech market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Australia edtech market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia edtech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

EdTech refers to the use of digital technologies to enhance and support education. It encompasses a wide range of applications such as online learning platforms, smart classrooms, adaptive learning tools, and immersive technologies like AR/VR, aimed at improving accessibility, engagement, and learning outcomes across various education sectors.

The Australia edtech market was valued at USD 3.9 Billion in 2024.

IMARC estimates the Australia edtech market to exhibit a CAGR of 7.3% during 2025-2033.

Key drivers of the Australia EdTech market include government investments in digital infrastructure, increasing digital adoption in education, the demand for personalized and flexible learning solutions, advancements in cloud technologies, and the need to bridge educational gaps, particularly in remote areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)