Australia E-Learning Market Size, Share, Trends and Forecast by Technology, Provider, Application, and Region, 2026-2034

Australia E-Learning Market Size and Share:

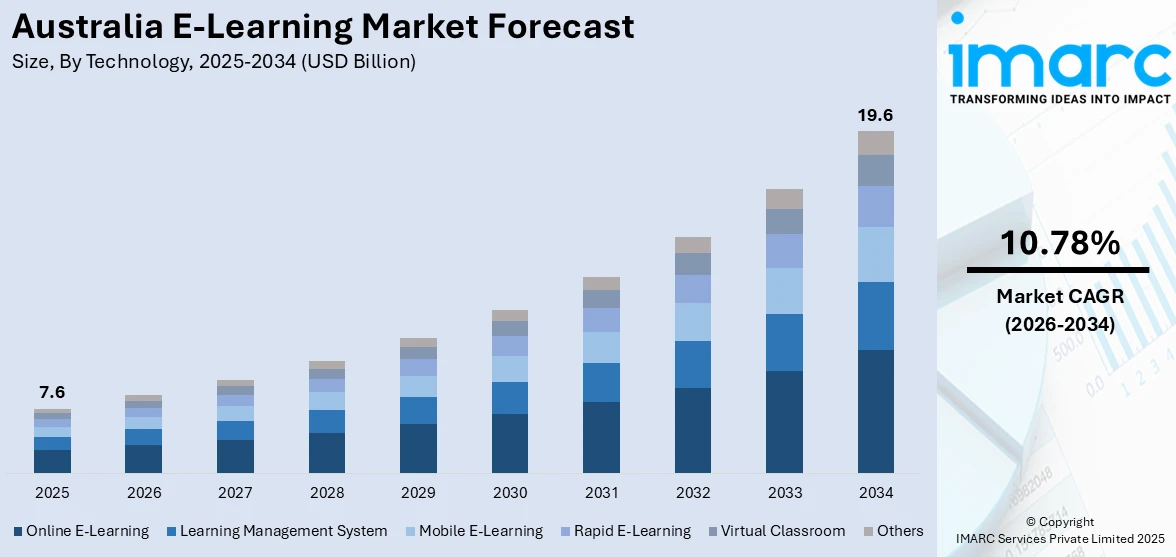

The Australia e-learning market size was valued at USD 7.6 Billion in 2025. Looking forward, the market is projected to reach USD 19.6 Billion by 2034, exhibiting a CAGR of 10.78% from 2026-2034. The market is driven by the growing adoption of vocational training that requires e-learning solutions for scalable and efficient upskilling opportunities, along with the increasing usage of mobile apps that make learning more engaging and adaptable to busy schedules.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 7.6 Billion |

| Market Forecast in 2034 | USD 19.6 Billion |

| Market Growth Rate (2026-2034) | 10.78% |

Technological advancements are enhancing the quality, accessibility, and effectiveness of online education in Australia. Virtual reality (VR) and augmented reality (AR) are making learning methods more interactive and engaging. Advanced e-learning platforms can personalize learning experiences by adjusting content based on individual progress. This ensures better learning outcomes. Virtual classrooms, equipped with advanced video conferencing tools, allow for real-time interaction, which makes remote learning more dynamic and collaborative. Cloud technology enables scalable and flexible e-learning solutions and allows learners to access content anytime and anywhere. It lets institutions and organizations offer flexible and cooperative learning environments. Moreover, improvements in game design and analytics make learning more engaging through interactive elements like points, badges, and rewards.

To get more information on this market Request Sample

Government agencies in Australia are facilitating the adoption and expansion of digital education initiatives. They are investing to promote digital literacy and integrate e-learning with the national education system. They are offering grants and funds to educational institutions so that they can develop e-learning infrastructure and adopt e-learning platforms. Moreover, educational institutions, both at the K-12 and tertiary levels, receive financial support to incorporate digital technologies into their teaching methods. Besides this, government policies prioritize skill development and workforce training, especially in industries like healthcare, technology, and manufacturing, where e-learning provides flexible and cost-effective solutions. By supporting the integration of e-learning in vocational education and training (VET), government agencies ensure that individuals, especially in regional and remote areas, have access to the necessary skills for employment.

Key Trends of Australia E-Learning Market:

Rising Integration of Artificial Intelligence (AI)

The increasing integration of AI is enhancing the personalization, efficiency, and effectiveness of online learning experiences, which is impelling the market growth. AI allows adaptive learning, where platforms can tailor content and assessments based on individual learner needs to ensure more effective skill development. It also provides features like chatbots and virtual tutors that offer real-time support and guidance to students and improve engagement and learning outcomes. Furthermore, educators and trainers can track learner progress through AI-driven analytics so that they can identify scope of improvement and alter teaching methods as per the requirement. In the corporate sector, AI is being used to create customized training modules that are more relevant to individual employees. With AI, e-learning platforms can deliver more interactive and immersive learning experiences like gamification that cater to diverse learning styles. According to the IMARC Group’s report, the Australia artificial intelligence market is projected to exhibit a growth rate (CAGR) of 15.80% during 2024-2032.

Increasing Demand for Vocational Training

The rising demand for vocational training is creating the need for e-learning platforms, as more individuals and businesses are seeking accessible, flexible, and cost-effective solutions for skill development. E-learning platforms enable learners to gain practical and industry-relevant skills in sectors like healthcare, information technology (IT), and construction, which require specialized training. As the workforce needs to adapt to changing job requirements and technological advancements, vocational training delivered through e-learning allows for scalable and efficient upskilling opportunities. Digital learning platforms offer interactive tools and real-world case studies to enhance hands-on learning experiences. Moreover, they minimize geographic restraints and make vocational training accessible to individuals in remote or underserved areas. The data published on the website of the IMARC Group shows that the Australia vocational training market is expected to reach USD 29.41 Billion by 2032.

Rising Penetration of Smartphones

The growing penetration of smartphones is making learning more accessible and convenient. With smartphones becoming an essential part of daily life, learners can now access educational content from their comfort zones. Users can complete courses, watch instructional videos, and participate in interactive lessons through mobiles. In addition, mobile apps designed for e-learning provide personalized and short-form content, which makes learning more engaging and adaptable to busy schedules. This rising trend can help students in schools and universities as well as professionals who are seeking personal development and upskilling opportunities. Moreover, younger demographics who are often early adopters of technology are more inclined to use smartphones for educational purposes. IMARC Group’s report predicted that the Australia smartphone market will exhibit a growth rate (CAGR) of 1.60% during 2024-2032.

Growth Drivers of Australia E-Learning Market:

Flexible and Personalized Learning Options

Flexible and personalized learning solutions are becoming essential components of the e-learning market in Australia. Self-paced courses, adaptive learning platforms, and customizable modules enable learners to study based on their own schedules, preferences, and proficiency levels. This method serves a wide range of audiences including students, working professionals, and lifelong learners thereby enhancing engagement and retaining knowledge effectively. Adaptive assessments and progress tracking further facilitate individualized learning experiences ensuring the relevance and effectiveness of content. The increasing focus on convenience and tailored education is promoting broader acceptance of digital learning solutions across schools, universities, and corporate training initiatives. By catering to distinct learning needs and improving accessibility these platforms are attracting considerable market interest and shaping investment trends. This trend is bolstering the Australia e-learning market share in both academic and professional domains.

Cost-Effectiveness

Cost-effectiveness is a significant factor driving the adoption of e-learning in Australia. Online education removes costs related to physical infrastructure, travel, printed materials, and classroom logistics, making it more budget-friendly for both learners and institutions. Educational bodies, training providers, and businesses gain from scalable solutions that can address larger audiences at minimal additional costs. Moreover, learners save time on commuting and accommodation costs, making e-learning a viable alternative to conventional methods. Subscription-based models, free resources, and low-cost certifications further enhance affordability. These financial benefits broaden access to education and professional development across various demographics. The capability to provide quality learning experiences at lower costs is a crucial factor contributing to the expansion of the Australia e-learning market demand.

Government and Institutional Support

Government initiatives and institutional support are driving the market growth in Australia. Policies encouraging digital literacy, online education, and skill enhancement stimulate the adoption of e-learning solutions in both public and private sectors. Investments in digital infrastructure, grants for educational technology, and backing for online curriculum development offer essential resources to institutions and startups. Schools, universities, and vocational training centers are integrating digital platforms into their educational processes, while corporations are utilizing e-learning for workforce skill enhancement. Collaborations between public and private sectors and incentives for embracing innovative educational technologies strengthen market penetration. By nurturing a supportive environment for digital education, government and institutional involvement speeds up adoption, enhances infrastructure, and ensures quality delivery, thus promoting the Australia e-learning market growth across various sectors.

Opportunities of Australia E-Learning Market:

Corporate Training Expansion

The corporate training sector remains a significant opportunity within the Australian e-learning landscape. Companies are increasingly investing in digital learning solutions to enhance employee skills, ensure compliance with industry standards, and improve professional development programs. E-learning platforms enable organizations to provide uniform training across various locations, monitor employee progress, and cut down on logistical expenses compared to conventional classroom settings. The adaptability of online courses allows employees to learn at their own pace without disrupting their work responsibilities, which boosts engagement and retention. Furthermore, there is a rising interest in specialized courses centered on leadership, technical skills, and workplace safety. The demand for adaptable, measurable, and engaging training solutions positions corporate e-learning as a rapidly growing segment within the larger Australian education technology market.

International and Cross-Border Learning

The global reach of online education creates substantial opportunities for Australian e-learning providers. By offering courses on an international scale, providers can tap into a broader audience, diversify their revenue sources, and enhance their brand visibility beyond Australia. Platforms that accommodate multiple languages, cultural nuances, and globally recognized certifications can attract learners from various regions. According to Australia e-learning market analysis, the rise in internet accessibility and the acceptance of digital learning enhance cross-border engagement, allowing Australian providers to compete worldwide. Universities, vocational institutions, and corporate training organizations can take advantage of this trend by offering specialized programs and short-term certifications aimed at international students and professionals. Expanding into international markets enhances growth prospects while showcasing Australian educational expertise globally.

Collaborations with Educational Institutions

Partnerships between e-learning providers and educational institutions present significant growth opportunities. Schools, colleges, and universities are increasingly looking for digital solutions to complement traditional teaching methods and broaden access to online curricula. Collaborations enable these institutions to integrate interactive platforms, adaptive learning tools, and digital assessments into their offerings, leading to improved student engagement and learning results. Additionally, providers can assist with faculty training, content creation, and infrastructure enhancements, fostering long-lasting business relationships. These partnerships also facilitate co-branded courses, certification programs, and blended learning approaches that attract a more diverse array of learners. By connecting technology with formal education, these collaborations enhance the adoption of e-learning while ensuring quality delivery, marking it as a strategic opportunity within the Australian market.

Australia E-Learning Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Australia e-learning market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on technology, provider, and application.

Analysis by Technology:

- Online E-Learning

- Learning Management System

- Mobile E-Learning

- Rapid E-Learning

- Virtual Classroom

- Others

Online e-learning platforms offer flexible and cost-effective learning opportunities for students and professionals. Users can access courses anytime through these platforms, which fosters remote learning. Moreover, Australia has a well-developed internet infrastructure with high digital literacy to support the accessibility of a wide range of subjects, certifications, and self-paced modules.

The learning management system (LMS) is widely adopted by educational institutions and businesses in Australia to manage, deliver, and track training programs. Course creation, assessments, and learner progress tracking are streamlined via LMS platforms. Government and corporate initiatives utilize LMS technology to upskill employees and integrate e-learning with curricula.

Mobile e-learning enables learners to access educational content on-the-go, which enhances convenience and engagement. Platforms optimized for mobile use, such as apps for language learning or professional certifications, cater to diverse audiences. Mobile e-learning is particularly effective for microlearning and short courses.

Rapid e-learning addresses the need for quick content development and deployment, which makes it a popular choice in Australia’s corporate sector. Organizations employ rapid e-learning tools to create engaging and interactive training modules within tight timelines. This technology is ideal for onboarding, compliance training, and skill development.

Virtual classrooms enable real-time interaction between educators and learners without geographical restraints. They can support live lectures, discussions, and collaborative activities. They are used in academic and professional training contexts to ensure continuity in education and skill-building.

Analysis by Provider:

- Services

- Content

The services segment includes platform development, system integration, and support services. Service providers ensure seamless implementation and maintenance of e-learning platforms for schools, universities, and businesses. They cater to custom requirements, such as corporate training or academic curricula, thus enabling scalability and optimization.

The content segment focuses on the creation and delivery of educational materials, including courses, modules, videos, and interactive tools. Content providers and local developers create tailored content for academic, professional, and personal development needs. They assist in providing engaging, relevant, and up-to-date learning resources.

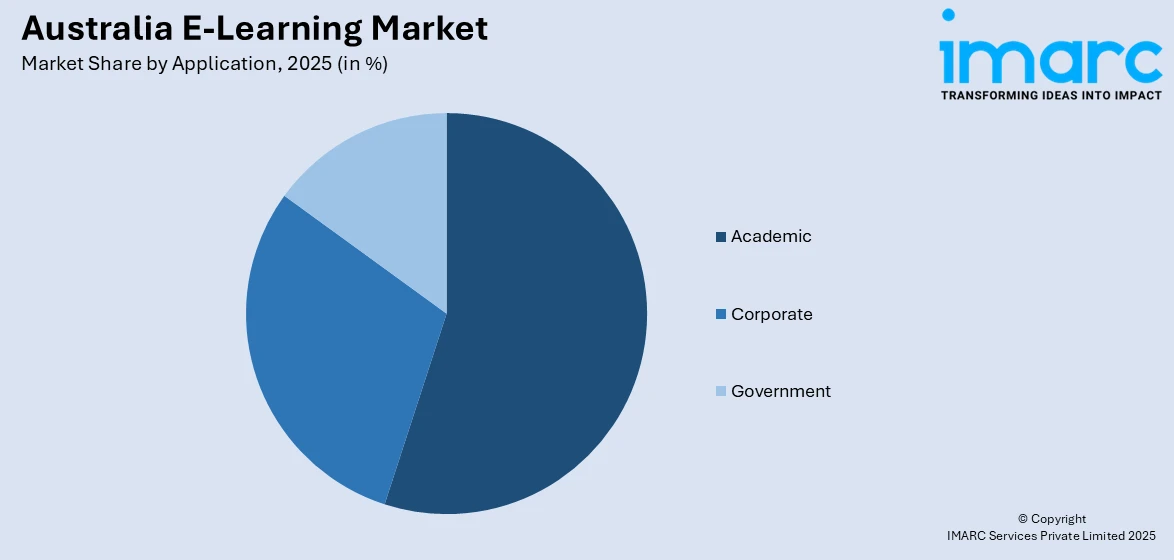

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Academic

- K-12

- Higher Education

- Vocational Training

- Corporate

- Small and Medium Enterprises

- Large Enterprises

- Government

The academic segment (K-12, higher education, and vocational training) inculcates schools, universities, and vocational training institutions. E-learning platforms support remote and hybrid learning. They also offer flexibility and accessibility to students across urban and remote areas, which enhance interactive learning experiences.

The corporate segment (small and medium enterprises and large enterprises) employs e-learning platforms to train employees and upskill them. Leadership programs and technical courses are offered through digital learning platforms by organizations. Rapid e-learning and mobile learning technologies are particularly popular in this segment.

The government segment utilizes e-learning for public sector employee training, citizen education initiatives, and community skill development programs. Digital platforms enable the efficient delivery of compliance and regulatory workforce training. They support government-led projects like digital literacy and professional certification programs, to make them more reachable.

Regional Analysis:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The Australia Capital Territory & New South Wales region has well-established educational institutions, corporate headquarters, and government agencies. Extensive adoption of e-learning in schools, universities, and businesses is enabled through the well-setup internet infrastructure of the region. Furthermore, the region is investing in technological advancements and upskilling in industries like finance and IT to make it a central hub for e-learning solutions.

In the Victoria & Tasmania region, there is a rise in e-learning adoption due to regular emphasis on education and innovation. Being a leading education hub, Melbourne is noted for its high adoption of e-learning in schools, universities, and vocational training institutions. The region focuses on flexible and hybrid learning models that cater to a diverse demographic.

In Queensland, VET courses are employed to encourage the use of digital platforms for skill development. Remote areas of the region rely heavily on e-learning for schooling and professional training. In addition, Queensland has a high student population that requires tailored e-learning solutions.

In the Northern Territory & South Australia, e-learning assists in bridging educational gaps in remote and underserved regions. Digital platforms make sure that pupils and experts in these parts get access to quality education and training. Industries like mining and agriculture use e-learning for employee training and compliance.

In the Western Australia region, the burgeoning industries like mining, energy, and healthcare are investing in employee training and development, which require e-learning platforms. Remote education solutions cater to the state’s vast and sparsely populated areas. Schools and universities also adopt e-learning to enhance accessibility and curriculum delivery.

Competitive Landscape:

Key players are focusing on addressing local demands, such as remote access for regional areas and professional upskilling. They are placing bets on innovative platforms that can provide content tailored to diverse user needs. They are offering customizations in LMS that are widely adopted by schools, universities, and businesses. Moreover, they are investing in advanced technologies like AI-driven personalization, interactive modules, and gamification features. They are also leveraging cloud technology and mobile accessibility to ensure scalable and seamless learning experiences. In addition, they are collaborating with educational institutions and corporations to create targeted training and skill development programs. They are supporting government initiatives to boost the adoption of e-learning platforms. For instance, in July 2024, BSI Digital Learning, a prominent training provider for management systems, announced its collaboration with Silicon Valley's 'Section School' to launch an AI Academy in Australia. The institute promises to offer AI Crash Course and other upskilling courses and enhance AI literacy and capabilities.

The report provides a comprehensive analysis of the competitive landscape in the Australia e-learning market with detailed profiles of all major companies.

Latest News and Developments:

- June 2024: Lumify Learn, the leading digital courses provider, unveiled its Academic Accelerator Program that can assist Australian students in skill development and getting employment. It seeks to provide students with access to field experts and enhance learning experiences.

- October 2024: The Media Federation of Australia (MFA) launched a free e-learning course, titled ‘VOZ as a currency’ to give knowledge about the Virtual Australia (VOZ) trading currency. The course aims to provide comprehensive practical skills required to understand audience measurement.

Australia E-Learning Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Online E-Learning, Learning Management System, Mobile E-Learning, Rapid E-Learning, Virtual Classroom, Others |

| Providers Covered | Services, Content |

| Applications Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia e-learning market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Australia e-learning market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia e-learning industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

E-learning refers to education and training delivered through digital platforms, which enables remote access to courses and resources via the internet. It offers flexibility, interactive content, and personalized learning experiences for students and professionals. It finds applications in academic education in schools and universities, corporate training programs, government skill-building initiatives, and personal development courses.

The Australia e-learning market was valued at USD 7.6 Billion in 2025.

IMARC estimates the Australia e-learning market to exhibit a CAGR of 10.78% during 2026-2034.

The increasing demand for remote and hybrid learning models is encouraging the adoption of e-learning platforms in educational institutions and businesses. Besides this, the rising demand for efficient and customizable training and education is fueling the market growth. The increasing numbers of local EdTech startups are investing in innovative learning solutions, which is further propelling the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)