Australia E-Commerce Market Size, Share, Trends and Forecast by Type, Transaction, and Region, 2026-2034

Australia E-Commerce Market Size and Share:

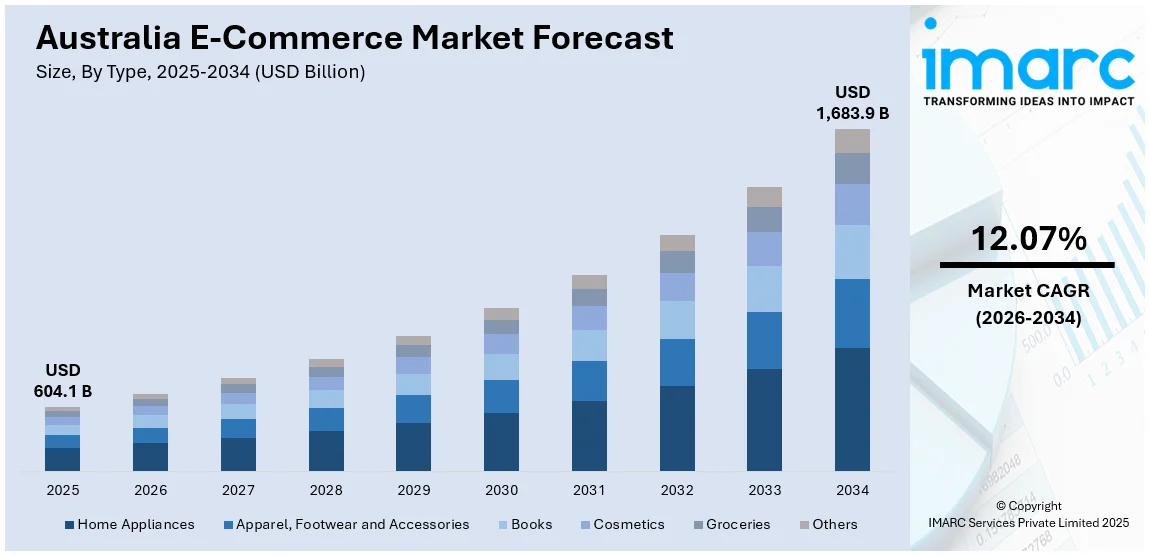

The Australia e-commerce market size was valued at USD 604.1 Billion in 2025. Looking forward, the market is expected to reach USD 1,683.9 Billion by 2034, exhibiting a CAGR of 12.07% from 2026-2034. The market is driven by the growing reliance on smartphones for purchasing goods, as it allows users to purchase goods anytime and from anywhere, and the integration of artificial intelligence (AI) due to the capability of AI to recommend products as per the browsing history results in a customized shopping experience.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 604.1 Billion |

| Market Forecast in 2034 | USD 1,683.9 Billion |

| Market Growth Rate (2026-2034) | 12.07% |

As per the data published on the website of the IMARC Group, the Australia digital payment market size reached USD 118.0 Billion in 2024. Digital payment adoption is a prominent factor driving the industry as it offers individuals a secure, convenient, and smooth means of shopping. New forms of digital wallets are allowing Australians to use contactless and instant payments for all online purchases. This reduces the hindrance associated with traditional payment methods like credit cards and bank transfers, making transactions easier and convenient for people.

To get more information on this market Request Sample

AI and machine learning (ML) are transforming the shopping concept, with algorithms recommending individual products based on browsing behavior. AI chatbots serve instant support to customers, enhance customer services with reduced waiting time that increase conversion rates. Another technological advancement that revolutionizes e-commerce in Australia is augmented reality (AR). AR offers the opportunity to "try" a product like clothes, accessories, and furniture before purchase. All these new options are enabling improved customer relations, minimized returns, and maximized sales. IMARC Group’s report predicts that the Australia artificial intelligence market size will exhibit a growth rate (CAGR) of 15.80% during 2024-2032.

Key Trends of Australia E-Commerce Market:

Growing mobile commerce

Australia is witnessing an increment in the adoption of e-commerce with the widespread use of smartphones for online shopping. The proliferation of mobile apps and mobile-optimized websites are simplifying the process of online shopping. With the high dependence on smartphones, mobile shopping is becoming an easy means for consumers to access products and services anytime, anywhere in Australia. Among many reasons, one is the development of mobile payment solutions that streamline the payment process. Due to such fast and secure payment options, users can quickly complete a transaction without sensitive credit card details. The IMARC Group’s report predicts that the Australia smartphone market will exhibit a growth rate (CAGR) of 1.60% during 2024-2032. This growing reliance on mobile shopping significantly impacts the Australia e-commerce market share, driving expansion across diverse sectors.

Influence of social media

The rise of social media is contributing significantly to the growth of e-commerce in Australia, with most businesses using Instagram, Facebook, and TikTok as their primary marketing tools. Social media allows brands to directly contact customers, create awareness, and build a community. By posting images, streaming videos, and communicating with their audiences live, businesses are demonstrating their products in real time, drawing attention to, and driving traffic to their virtual stores. The rise of social commerce is another key development, with platforms incorporating direct shopping features. Instagram shopping tools allow individuals to buy products using posts and stories, cutting down the time between spotting a product and purchasing it. According to the IMARC Group’s report the Australia social media market is expected to reach USD 5.71 Billion by 2032. Besides this, the Australia e-commerce market forecast predicts sustained growth, driven by the integration of social media shopping tools and evolving user habits.

Global marketplace participation

Global marketplace participation is driving the market because it is expanding both B2C and B2B outreach. E-commerce platforms offer a wide collection of international products at competitive prices, encouraging customers to engage in cross-boarder shopping. International selling opportunities are now leveraging global marketplaces for Australian businesses. With such platforms, sellers can engage with international customers without the hassle of setting up operations beyond domestic territory. Sellers can upload products to such platforms with built-in audience, and use the logistics, payment systems, and marketing-related tools that come with the platform. The growing prevalence of business to customer e-commerce trade in Australia, is offering a favorable outlook. The data published on the IMARC Group’s website predicts that the Australia B2C e-commerce market size will exhibit a growth rate (CAGR) of 8.20% during 2024-2032. This increasing activity significantly enhances the e-commerce market share Australia achieves, bolstering its global presence in digital trade.

Growth Drivers of Australia E-Commerce Market:

Logistics and Delivery Speed

Consumers in Australia now anticipate quick, dependable, and transparent delivery options for their online purchases. Same-day and next-day delivery services are becoming increasingly prevalent, especially in urban areas, as Australia Post and private couriers enhance their last-mile logistics. Companies like StarTrack, CouriersPlease, and Sendle are competing on delivery speed and tracking precision. The establishment of metro fulfilment hubs and micro-warehousing has enabled retailers to meet these heightened service expectations. Retailers that provide real-time tracking and allow customers to choose delivery timeframes enjoy a competitive advantage. Additionally, click-and-collect services have gained popularity, merging online and offline shopping experiences, particularly for major retailers like Woolworths, Big W, and Bunnings. This approach offers cost benefits for retailers and convenience for customers who prefer to pick up their orders locally, avoiding delays associated with home delivery.

Cross-Border E-commerce

Cross-border transactions represent a significant portion of Australia’s online retail sector. Australian consumers often shop from international websites such as Amazon US, AliExpress, ASOS, and Shein, motivated by a wider selection of products, competitive pricing, and access to global brands that may not be available locally. Despite a weaker Australian dollar, the demand for international goods remains strong, although shipping fees and delivery times continue to be key challenges. Popular categories for cross-border purchases include apparel, beauty products, and electronics. Some international sellers, particularly from China, offer all-inclusive pricing with pre-paid duties and taxes, simplifying the purchasing process. Platforms that effectively manage delivery logistics to Australia and provide straightforward return policies tend to outperform others. Local retailers are feeling the pressure on pricing and competition, prompting many to implement similar delivery strategies and product offerings.

Subscription Models

Subscription-based shopping is increasingly favored by many Australian consumers, particularly in sectors such as groceries, personal care, health supplements, and pet supplies. These models provide the ease of automated, recurring deliveries that help customers prevent stockouts and save time. Brands like Who Gives A Crap (toilet paper), HelloFresh (meal kits), and PetCircle (pet supplies) have cultivated strong customer loyalty with flexible subscription options and additional benefits like discounts, priority shipping, and personalized recommendations. Retailers analyze data from recurring orders to enhance customer experiences and minimize churn. The ability to pause, skip, or adjust deliveries is essential for keeping users engaged. The rise of these services indicates a trend towards predictable, seamless shopping within the Australia e-commerce market demand.

Opportunities of Australia E-Commerce Market:

Expansion into Regional Areas

There is a growing trend among Australia's rural and regional populations to embrace e-commerce due to limited physical retail options. Many smaller towns lack specialty shops and major supermarkets, leading to a significant demand for a wider range of products online. Consumers in these regions often encounter higher prices and a restricted selection, making online shopping a viable alternative. Retailers who enhance their delivery networks through collaborations with local courier services or extensions of Australia Post can cultivate enduring customer loyalty. Establishing dependable shipping schedules, local pickup options, and customer support geared towards regional requirements can further help bridge the divide between urban and rural areas. This sector is still in its infancy, presenting considerable growth potential in areas such as hardware, healthcare, educational supplies, and fashion, making it a critical opportunity within Australia’s e-commerce environment.

Niche and Specialty Products

Australians are increasingly on the lookout for products that cater to their unique tastes, principles, or specific requirements, especially in instances where mainstream retailers do not meet their needs. Online platforms enable niche brands to connect with specific audiences without the costs associated with physical retail spaces. Whether it’s gluten-free food items, handmade jewelry, regional crafts, or exclusive fashion pieces, specialty goods typically enjoy higher profit margins and foster strong customer loyalty. Social media channels like Instagram and TikTok have made it easier for these brands to create a sense of community and trust. Consumers are attracted to the narratives surrounding the products—their origins, production methods, and unique qualities. This trend has provided opportunities for new brands to grow quickly by emphasizing authenticity and distinct offerings within the Australian e-commerce market.

Eco-Friendly and Ethical Retail

Australian consumers are becoming increasingly aware of their environmental impact and expect retailers to align with their values. Products that feature sustainable packaging, reusable elements, or reduced carbon footprints are gaining popularity, particularly among younger shoppers. Brands that transparently communicate their ethical sourcing practices, local production capabilities, or carbon offset initiatives tend to foster deeper connections with their customers. This commitment extends to operational practices as well, with warehouses utilizing solar energy, recyclable materials in their logistics, and clear waste management policies. Eco-friendly alternatives in sectors such as home cleaning, fashion, beauty, and personal care are especially sought after. The demand for these products isn’t merely idealistic; consumers are frequently willing to pay a premium for sustainable choices. Retailers that integrate environmental and social responsibility into their core offerings can engage with a rapidly expanding, values-focused segment in Australia’s e-commerce landscape.

Challenges of Australia E-Commerce Market:

High Delivery Costs

Australia's extensive geography and sparse population outside of major urban centers create considerable challenges for e-commerce logistics. Transporting goods across states or to remote locations results in longer shipping times, increased fuel costs, and a limited number of courier services, all of which elevate fulfillment expenses. Unlike more densely populated nations, Australian retailers are unable to mitigate these costs through volume or proximity. Many delivery companies impose extra fees for rural shipments, and maintaining warehouses near all customer areas is not feasible. These elevated costs often hinder small and mid-sized retailers from providing free or expedited shipping, making it challenging to compete with larger global entities or domestic companies with more resources. This situation can lead to consumers abandoning their shopping carts or hesitating to purchase from lesser-known or regional vendors. According to the Australia e-commerce market analysis, effectively managing delivery expenses remains one of the most crucial factors influencing profitability and customer satisfaction.

Returns and Reverse Logistics

Handling product returns poses a significant operational and financial challenge in Australia’s e-commerce sector. The vast size of the country and the distribution of its population result in longer and more expensive reverse shipping, particularly for customers in regional or rural areas. Many delivery services lack affordable and efficient reverse logistics, compelling retailers to create their own expensive systems or absorb the high costs associated with returns. Additionally, there is no widely accepted standard for packaging, labeling, or tracking returns, leading to varying experiences for customers and inefficiencies for businesses. Elevated return rates, especially in the apparel and electronics sectors, exert pressure on profit margins. Retailers must find a way to balance flexible return policies with the necessity of operational viability in a geographically challenging environment.

Customer Acquisition Costs

The cost of online advertising in Australia has risen significantly, as platforms like Google and Meta face increasing competition in nearly all retail sectors. As more brands vie for attention in paid search and social media feeds, the costs associated with clicks and conversions have surged, particularly during peak shopping periods. This escalation poses challenges for smaller or newer brands trying to grow without depleting their marketing budgets. Additionally, the organic reach on social media has diminished, further compelling businesses to depend on paid advertising strategies. Customer expectations for engaging content, fast-loading websites, and seamless shopping experiences contribute to the rising acquisition costs. With a limited pool of local digital inventory and a concentrated online audience, e-commerce businesses must seek alternative customer acquisition methods or enhance their retention strategies to remain profitable.

Australia E-Commerce Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Australia e-commerce market, along with forecast at the country and regional levels from 2026-2034. The market has been categorized based on type and transaction.

Analysis by Type:

- Home Appliances

- Apparel, Footwear and Accessories

- Books

- Cosmetics

- Groceries

- Others

The increasing demand for home appliances in e-commerce can be attributed to the prevailing trend of convenience, low prices, and door deliveries. Online portals furnish extensive product comparisons, along with their extensive descriptions and reviews that make customer's purchase more informed. Seasonal sales and discount offer act as a catalyst for online home appliances sales. The Australia e-commerce market overview highlights the growing preference for online platforms as a key driver of home appliance sales.

Online shopping is becoming more appealing to people since it offers a wide range of options, easy returns coupled with special deals. With the advent of virtual try-on technology and size guides for size specification, the demand for e-commerce platforms for purchasing fashion and clothing items is on the rise. Social media influencers are also promoting these fashion accessories, which is impelling the growth of the market.

Online book shopping sites offer many advantages, such as diverse collections, recommendations, and better availability than the physical book outlets. E-commerce platforms provide discounts and convenient delivery services, which makes these platforms popular among avid readers and students.

Customized recommendations, tutorials, and descriptive product information propel the cosmetics segment in the e-commerce market. Catering to diverse preferences, these online platforms are mitigating the demand for premium and organic products, along with offering exclusive deals.

E-commerce platforms address grocery needs with instant deliveries, subscription models, and variety. Targeting lifestyle of busy individuals these e-commerce platforms offer convenience, which is catalyzing the growth of the market.

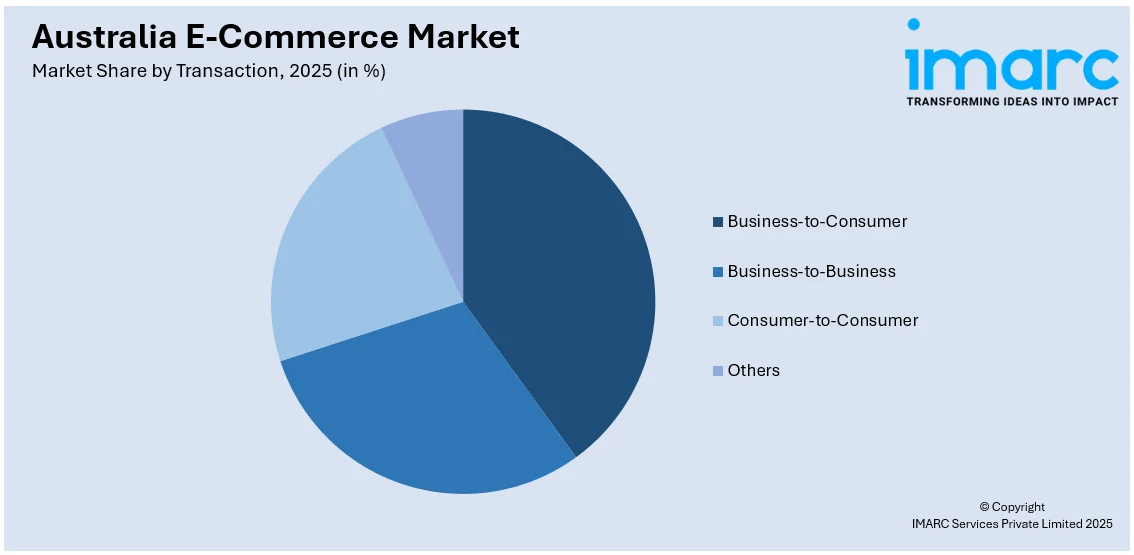

Analysis by Transaction:

Access the comprehensive market breakdown Request Sample

- Business-to-Consumer

- Business-to-Business

- Consumer-to-Consumer

- Others

Business-to-consumer is a major segment as it is more convenient for individuals to access products on online platforms. Businesses offer a massive range of products and services through web-based commerce platforms. Discounts and loyalty programs coupled with fast delivery options further attract buyers to this segment.

A significant increment is observed in business-to-business platform usage as numerous businesses are opting for digital procurement processes to facilitate bulk purchases. Web-based channels allow companies to compare suppliers, negotiating better trading terms and track orders. This segment is further influenced by the rise of software as a service (SaaS) solutions for smooth transaction.

Customer-to-customer platforms enable users to buy and sell directly from each other. All this aids the segment due to the encouraged use of secondhand goods, sustainable shopping trend and local trading. Mobile applications and secure payment systems are a way to promote online participation.

Regional Analysis:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales holds a notable Australia e-commerce market share characterized by the high levels of e-commerce shopping because of the presence of a tech-savvy population and strong penetration of internet. Sydney is a commercial hub driving the demand for e-commerce platforms among affluent individuals. With its extensive costal area, it offers established logistics networks that drive the online shopping scenario.

Victoria is leading the e-commerce market because of its massive consumer base and tech friendly culture. With increasing interest in online shopping for niche products like organic ones, Tasmania plays a major role in the market’s expansion. Moreover, the region's investment in innovation and sustainability is supporting the growth of e-commerce market.

High need in e-commerce in Queensland is created due to the rising population and the expansion of urban landscape in areas like Brisbane. As a result, there is an increased demand for groceries and home ware along with lifestyle products that are supported by improved delivery and marketing campaigns.

The growing reach of e-commerce in the Northen Territory & Southern Australia due to increased internet access and digitization. People living in remote areas are benefiting from online shopping platforms to purchase daily essentials while urban centers like Adelaide are driving the demand for diverse categories.

Perth's economic activities and isolated location make e-commerce platforms a convenient option for people. Industry growth is well supported by logistics development and targeted marketing activities in essential categories like groceries, fashion items, and electronics in the state.

Competitive Landscape:

Key players in Australia are focusing on innovative strategies, developed infrastructure and customer-centric approaches. Prominent companies are offering extensive product ranges at competitive prices along with efficient delivery systems. They are also spending money in technological advancement through research and development (R&D) by integrating AI for personalized appeals and improving experience over mobile apps and websites. Retail giants are offering same day grocery delivery service, which is bolstering the growth of the market. In addition, these key contributors are implementing eco-friendly practices like green packaging and carbon neutrality in shipments, which is supporting the growth of the market across the globe. Key market players are also partnering or focusing on mergers and acquisitions (M&A) to improve their online presence. For instance, in 2024, EssilorLuxottica established a partnership with ecommerce brand Pattern to improve their presence on online market places in Australia for its Ray-Ban and Oakley companies.

The report provides a comprehensive analysis of the competitive landscape in the Australia e-commerce market with detailed profiles of all major companies.

Latest News and Developments:

- January 2025: It was reported that Flipkart co-founder Binny Bansal launched "OppDoor," an e-commerce startup targeting markets like the US, Canada, UK, Germany, Japan, and Australia. The Singapore-registered company provides end-to-end services for e-commerce businesses, including fully-managed operations and Amazon brand expansion.

- September 2024: Coles opened its first automated customer fulfillment center (CFC) in Truganina, Victoria, featuring advanced Ocado AI and robotics technology. The 87,000m² facility can process 10,000 online orders daily, improving product availability, freshness, and delivery flexibility.

- September 2024: Alibaba’s grocery chain Freshippo entered the Australian market in partnership with Ebest, an online Asian supermarket. Freshippo products, including Chinese snacks, juices, and sauces, will be available through Ebest’s app and website, catering to growing demand for ethnic groceries.

- August 2024: CIRRO E-Commerce launched cross-border shipping services from Australia to international destinations, including New Zealand, North America, and Europe, with delivery times ranging from 3–10 working days. The service features end-to-end management, customs clearance, IT integration, and full shipment traceability. CIRRO aims to support Australian e-merchants with reliable, efficient logistics solutions.

- December 2023: Australia Post partnered with Myer to enhance e-commerce, improving delivery speed, and offering over 4,700 collection points across major cities.

Australia E-Commerce Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Home Appliances, Apparel, Footwear and Accessories, Books, Cosmetics, Groceries, Others |

| Transactions Covered | Business-to-Consumer, Business-to-Business, Consumer-to-Consumer, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia e-commerce market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Australia e-commerce market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia e-commerce industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia e-commerce market was valued at USD 604.1 Billion in 2025.

IMARC estimates the e-commerce market to exhibit a CAGR of 12.07% during 2026-2034.

The Australia e-commerce market is expected to reach a value of USD 1,683.9 Billion by 2034.

The Australia e-commerce market is driven by increased internet penetration, mobile shopping trends, and the growing user preference for convenience. Enhanced logistics infrastructure, widespread adoption of digital payment systems, and the rising demand for diverse product categories also support the market growth.

Australia e-commerce market is witnessing growth in mobile shopping, fast delivery options, and subscription services. Social commerce and influencer-driven sales are rising, along with demand for sustainable products. Brands are focusing on personalization, while many shift to direct-to-consumer models to reduce reliance on third-party marketplaces.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)