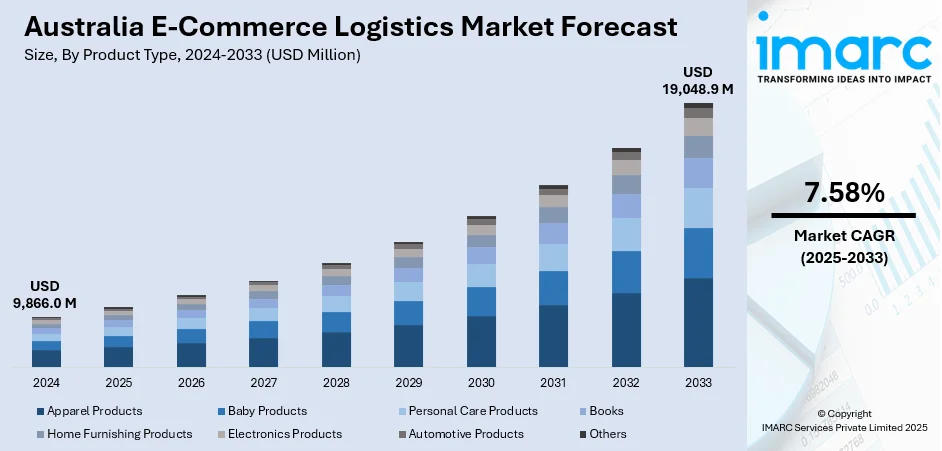

Australia E-Commerce Logistics Market Report by Product Type (Apparel Products, Baby Products, Personal Care Products, Books, Home Furnishing Products, Electronics Products, Automotive Products, and Others), Service Type (Transportation, Warehousing, and Others), Operational Area (International, Domestic), and Region 2025-2033

Australia E-Commerce Logistics Market Overview:

Australia e-commerce logistics market size reached USD 9,866.0 Million in 2024. Looking forward, the market is expected to reach USD 19,048.9 Million by 2033, exhibiting a growth rate (CAGR) of 7.58% during 2025-2033. The market is expanding rapidly, driven by rising online shopping, advanced digital technologies, and growing demand for efficient delivery solutions. Trends, such as sustainable logistics, automation, and last-mile innovations, are also reshaping the sector. Strong infrastructure and evolving consumer expectations continue to strengthen growth, boosting the Australia e-commerce logistics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 9,866.0 Million |

|

Market Forecast in 2033

|

USD 19,048.9 Million |

| Market Growth Rate 2025-2033 | 7.58% |

E-commerce logistics encompasses a complex framework of methods, plans, and technologies designed to streamline the effective transportation of goods from online merchants to customers. This intricate process involves various stages, such as order placement, processing, warehousing, inventory management, packaging, shipping, delivery, post-sale services, including handling returns and providing customer support, etc. Success in e-commerce logistics relies on a comprehensive understanding of road conditions and transportation regulations. The system also incorporates real-time tracking features, allowing customers to monitor the progress of their orders. This logistical approach empowers businesses to expand their reach into international markets, attracting a broader customer base and enhancing revenue potential. Additionally, it proficiently handles the intricacies of cross-border shipping, managing aspects like customs clearance and compliance.

To get more information on this market, Request Sample

Key Trends of Australia E-Commerce Logistics Market:

Expansion of Last-Mile Delivery Innovations

The Australian last-mile delivery sector is changing at a lightning pace as online shopping platforms grapple with changing consumer demands. Firms are testing various solutions like parcel lockers, drones, and electric vans to enhance delivery speed, convenience, and eco-friendliness. Cities are seeing more micro-fulfillment centers that keep products closer to consumers, thus cutting lead times. Further, integration with third-party logistics providers is becoming the norm to manage peak season spikes competently. Such innovations not only improve customer satisfaction but also enable businesses to differentiate themselves in a competitive marketplace. The growing emphasis on convenience and eco-friendly practices ensures that last-mile logistics will remain a central trend shaping the future of the Australia e-commerce logistics market growth.

Integration of Automation and Advanced Analytics

Automation and data-related technologies are increasingly being incorporated in e-commerce logistics processes in Australia. Distribution centers and warehouses are incorporating robotics, automated guided vehicles, and AI-driven inventory management systems to make processes smoother and minimize human errors. Predictive analytics also allows logistics companies to predict demand, optimize routes, and make processes more efficient overall. This technological transformation not only saves them money but also enables businesses to manage the increasing number of web orders with accuracy. Businesses are also using real-time monitoring and IoT-based devices to enhance supply chain visibility, providing more transparency to customers. As the industry expands, automation and analytics integration are standout trends transforming operational efficiency, allowing e-commerce logistics providers to stay flexible and customer-centric.

Growing Emphasis on Sustainable Logistics

Sustainability has become a defining trend in the market, with businesses and consumers increasingly prioritizing eco-friendly practices. According to the Australia e-commerce logistics market analysis, companies are adopting electric vehicles, alternative fuels, and carbon-neutral delivery methods to reduce emissions in logistics operations. Packaging innovation, such as recyclable materials and reduced plastic usage, also reflects this shift toward environmental responsibility. Many e-commerce platforms are introducing “green delivery” options, allowing consumers to choose slower but more sustainable shipping methods. Regulatory pressure and rising environmental awareness further drive companies to embed sustainability into logistics strategies. This trend not only enhances corporate reputation but also aligns with Australia’s broader goals of reducing carbon footprints. Sustainable logistics is now a competitive differentiator, positioning businesses as socially responsible while maintaining operational efficiency.

Growth Drivers of Australia E-Commerce Logistics Market:

Surge in Online Consumer Spending

The continuous rise in online consumer spending is one of the strongest drivers fueling Australia’s e-commerce logistics market. Increasing internet penetration, digital payment adoption, and improved shopping experiences are encouraging more consumers to buy online. This growing consumer base is generating higher demand for efficient logistics services that can handle diverse product categories, from fashion to electronics and groceries. Seasonal sales, promotional campaigns, and global shopping festivals further intensify order volumes, pushing logistics providers to expand capacity and enhance service quality. The convenience of home delivery and growing trust in online platforms continue to accelerate e-commerce adoption. As a result, the logistics sector is evolving rapidly to keep pace with these consumption trends, creating sustained growth opportunities.

Investment in Infrastructure Development

Australia’s ongoing investment in logistics and transportation infrastructure is another key driver of e-commerce logistics growth. Upgrades in road networks, port facilities, and airport cargo handling capacities are enabling faster, more reliable, and cost-efficient goods movement across the country. The development of advanced warehousing facilities, including automated fulfillment centers, is also enhancing operational capabilities for handling increasing order volumes. Government-backed infrastructure projects further strengthen connectivity between urban and regional areas, expanding the reach of e-commerce platforms. These improvements not only support local market growth but also facilitate cross-border trade, allowing businesses to serve international customers more efficiently. Strong infrastructure investments thus provide a robust foundation for the logistics ecosystem, directly fueling the expansion of Australia’s e-commerce logistics market.

Adoption of Technology-Driven Logistics Solutions

The increasing adoption of technology-driven logistics solutions is driving significant growth in Australia e-commerce logistics market demand. Companies are deploying advanced systems for route optimization, real-time tracking, and predictive analytics to enhance operational efficiency. Cloud-based logistics platforms are enabling seamless coordination among stakeholders, while IoT devices provide continuous visibility into shipments. These innovations not only reduce delivery times but also enhance accuracy and customer experience. Mobile applications that offer live updates and flexible delivery options further strengthen consumer trust in online shopping. Additionally, AI-powered demand forecasting allows logistics providers to optimize resource allocation during peak periods. By embracing digital technologies, businesses can meet rising consumer expectations, streamline supply chains, and remain competitive in Australia’s rapidly expanding e-commerce logistics market.

Opportunities of Australia E-commerce Logistics Market:

Cross-Border Trade Expansion

Cross-border trade expansion presents a significant opportunity for Australia’s e-commerce logistics sector. As consumers increasingly buy products from Asia, Europe, and North America, the need for effective global logistics services remains on the increase. Australian consumers tend to demand various product segments like fashion, electronics, and lifestyle items not available locally. To satisfy this need, logistics providers need to provide efficient customs clearance, affordable shipping, and reputable delivery networks that deliver services promptly. Companies embracing sophisticated tracking systems, transparent pricing, and flexible delivery options will capture consumer trust and market share. Global carrier partnerships and digital trade platforms add further efficiencies to the services. As foreign shopping habits increase, cross-border logistics solutions will become the epicenter for long-term opportunities for Australian providers.

Growth of Niche E-commerce Segments

The growth of niche e-commerce segments such as online groceries, healthcare products, and fashion is unlocking specialized opportunities in the Australian logistics market. Each category requires distinct handling, from temperature-controlled cold storage for perishables to secure packaging for pharmaceuticals and fast turnaround for fast fashion. Providers capable of designing tailored, industry-specific logistics solutions can capture strong demand from these rapidly expanding verticals. For example, grocery deliveries emphasize speed and freshness, while healthcare logistics prioritize compliance and safety standards. As consumers increasingly shop online for these categories, the need for specialized warehousing, distribution, and delivery grows. Companies investing in segment-specific expertise and infrastructure can differentiate themselves, building stronger partnerships with e-commerce retailers and securing long-term competitive advantages.

Rise of Third-Party Logistics (3PL) Partnerships

The rise of third-party logistics (3PL) partnerships is creating considerable opportunities in the Australia e-commerce logistics market. Many online businesses, particularly SMEs, are outsourcing logistics functions to focus on their core operations such as sales, marketing, and customer engagement. 3PL providers offering scalable, flexible, and cost-efficient services—ranging from warehousing and inventory management to packaging and last-mile delivery—are increasingly in demand. These partnerships also enable businesses to quickly adapt to seasonal peaks and fluctuating demand without heavy investment in infrastructure. By integrating digital platforms, real-time tracking, and advanced analytics, 3PL companies can deliver value-added services that enhance efficiency and customer experience. As competition intensifies in e-commerce, 3PL partnerships will remain a vital growth avenue for both retailers and logistics providers.

Challenges of Australia E-commerce Logistics Market:

High Operational Costs

High operational costs remain one of the most pressing challenges for Australia’s e-commerce logistics market. The country’s vast geography increases transportation distances, making it difficult to balance cost efficiency with consumer expectations for fast delivery. Rising fuel prices, higher labor costs, and the expense of sustainable packaging materials further strain profitability. Small and medium-sized logistics providers face the greatest impact as they compete against global players with larger economies of scale. The need for efficient last-mile delivery solutions in remote and regional areas adds additional complexity and expense. Companies often struggle to absorb these costs or pass them onto consumers without risking competitiveness. Developing optimized networks and strategic partnerships has become essential to mitigating operational cost pressures.

Regulatory and Customs Complexities

Regulatory and customs complexities create significant hurdles for logistics providers operating in the Australia e-commerce market, particularly in cross-border trade. Shipments often face strict compliance checks, duties, and documentation requirements that can slow down delivery timelines. Delays in customs clearance not only affect efficiency but also negatively impact customer satisfaction, a crucial factor in e-commerce. Companies expanding internationally must navigate diverse trade agreements, tax regulations, and product standards, requiring continuous investment in compliance expertise and digital tracking systems. Smaller logistics providers often lack the resources to manage these intricacies effectively, making them less competitive in global shipping. Streamlining regulatory processes and enhancing collaboration with customs authorities remain vital for reducing delays and improving efficiency in international e-commerce logistics.

Intense Market Competition

Intense competition is a defining challenge in the Australia e-commerce logistics market, with global giants, regional players, and local providers vying for dominance. Large multinational logistics companies leverage advanced technology, extensive networks, and economies of scale to capture market share, while smaller firms focus on personalized service and niche markets. This competitive environment fuels constant pressure to innovate, maintain high service levels, and offer competitive pricing. Price wars are common, but they often reduce profit margins and strain operational sustainability. Additionally, consumer expectations for rapid, low-cost delivery force providers to continuously invest in infrastructure, technology, and workforce capabilities. Balancing differentiation, cost management, and innovation is essential for survival in this highly fragmented and competitive logistics landscape.

Australia E-Commerce Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, service type, and operational area.

Product Type Insights:

- Apparel Products

- Baby Products

- Personal Care Products

- Books

- Home Furnishing Products

- Electronics Products

- Automotive Products

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes apparel products, baby products, personal care products, books, home furnishing products, electronics products, automotive products, and others.

Service Type Insights:

- Transportation

- Warehousing

- Others

A detailed breakup and analysis of the market based on the service type have also been provided in the report. This includes transportation, warehousing, and others.

Operational Area Insights:

- International

- Domestic

The report has provided a detailed breakup and analysis of the market based on the operational area. This includes international and domestic.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Aramex Australia

- Australia Post

- Couriers and Freight

- CouriersPlease

- DHL

- eStore Logistics

- FedEx

- NPFulfilment

- Sendle

- StarTrack Express Pty Limited

- TMS Logistics

- Zoom2u Pty Ltd

Australia E-Commerce Logistics Market News:

- In August 2024, CIRRO E-Commerce, a prominent provider of logistics solutions for the online retail sector, introduced its new cross-border shipping services originating from Australia to multiple global destinations. Through this expansion, customers gain the ability to ship parcels to regions including New Zealand, North America, and Europe, supported by CIRRO E-Commerce’s dependable and streamlined delivery network.

- In November 2024, DHL Supply Chain Australia (DHL) expanded its services by providing small and medium-sized enterprises (SMEs) with access to its advanced e-commerce fulfillment network across the country. Branded as the DHL Fulfilment Network, this offering delivers flexible warehousing solutions and tailored last-mile delivery designed specifically for growing e-commerce businesses. Beyond domestic advantages, the platform also connects SMEs to international markets, leveraging DHL’s extensive global presence to create new avenues for business expansion and cross-border growth.

Australia E-Commerce Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Apparel Products, Baby Products, Personal Care Products, Books, Home Furnishing Products, Electronics Products, Automotive Products, Others |

| Service Types Covered | Transportation, Warehousing, Others |

| Operational Areas Covered | International, Domestic |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Aramex Australia, Australia Post, Couriers and Freight, CouriersPlease, DHL, eStore Logistics, FedEx, NPFulfilment, Sendle, StarTrack Express Pty Limited, TMS Logistics, Zoom2u Pty Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia e-commerce logistics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia e-commerce logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia e-commerce logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The e-commerce logistics market in Australia was valued at USD 9,866.0 Million in 2024.

The Australia e-commerce logistics market is projected to exhibit a CAGR of 7.58% during 2025-2033.

The Australia e-commerce logistics market is projected to reach a value of USD 19,048.9 Million by 2033.

The Australia e-commerce logistics market is driven by rising demand for faster delivery options, growth of last-mile solutions, and adoption of advanced technologies like automation and AI. Expanding cross-border trade, sustainability initiatives in packaging and transportation, and increasing reliance on third-party logistics providers are also shaping market evolution.

The growth in the Australia e-commerce logistics market is fueled by expanding online shopping adoption, increasing consumer expectations for same-day and next-day delivery, and rising demand for efficient last-mile solutions. Advancements in digital platforms, warehouse automation, and strong investment in logistics infrastructure further accelerate market expansion across diverse sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)