Australia Digital Payment Market Size, Share, Trends and Forecast by Component, Payment Mode, Deployment Type, End Use Industry, and Region, 2026-2034

Australia Digital Payment Market Size and Share:

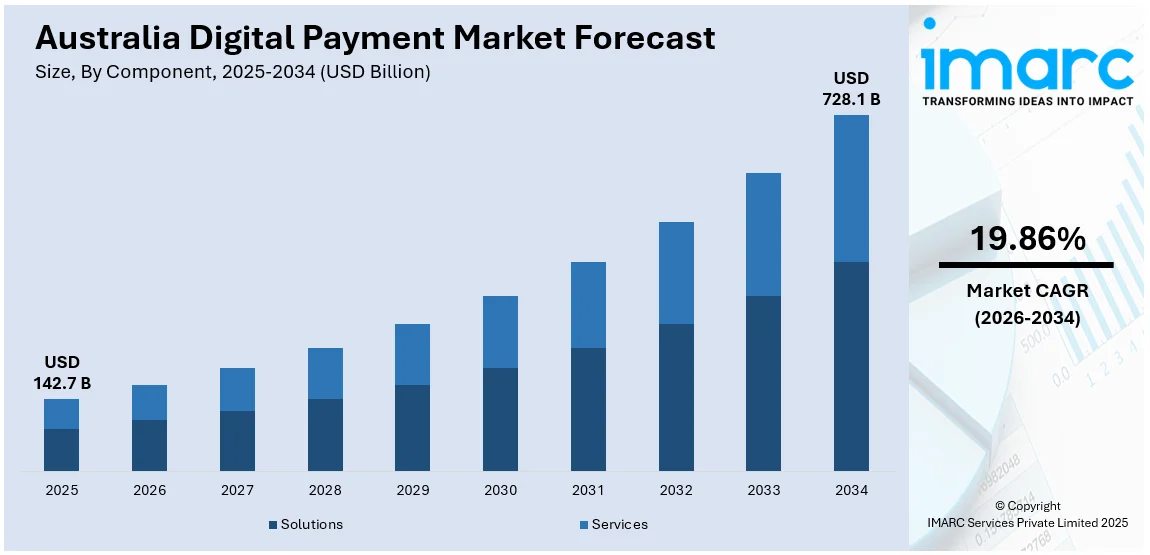

The Australia digital payment market size was valued at USD 142.7 Billion in 2025. Looking forward, the market is expected to reach USD 728.1 Billion by 2034, exhibiting a CAGR of 19.86% during 2026-2034. Victoria & Tasmania currently dominates the market, holding a significant market share of 38.3% in 2025. The growing reliance on smartphones, as mobile wallets are the most preferred method of payment, rising trend of online shopping, and increasing demand for peer-to-peer (P2P) payment apps and buy now, pay later (BNPL) services are some of the major factors fueling the Australia digital payment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 142.7 Billion |

| Market Forecast in 2034 | USD 728.1 Billion |

| Market Growth Rate (2026-2034) | 19.86% |

High smartphone penetration and the widespread adoption of contactless payments have fueled the use of mobile wallets like Apple Pay and Google Pay. Nearly all in-person card transactions now support tap-and-go functionality. The surge in e-commerce has driven demand for seamless and secure online transactions, encouraging the integration of digital wallets and payment gateways. For instance, in April 2024, Volt, a leading global platform for real-time payments, introduced a new one-click digital payment solution in Australia, designed specifically for retail users and built on the secure PayTo framework. This innovative service not only enables merchants to receive funds instantly but also enhances the overall payment experience for customers by streamlining the process and removing credit card surcharge fees. The popularity of Buy-Now-Pay-Later (BNPL) services, such as Afterpay and Zip, has created more flexible consumer spending options, particularly among younger users. Additionally, real-time payment infrastructure like the New Payments Platform (NPP) and tools such as PayID and Osko have enhanced transaction speed and convenience.

To get more information on this market Request Sample

The Australia digital payment market growth is also driven by government-backed initiatives, including open banking under the Consumer Data Right (CDR) and updated digital payment regulations, which are fostering innovation and improving market transparency. For instance, in October 2023, the Australian government revealed its intention to implement new laws that would enable the Reserve Bank of Australia to oversee digital payment services, which encompass digital wallet providers. Enhanced cybersecurity measures, fraud protection, and biometric authentication have further boosted consumer confidence. Collectively, these elements are transforming Australia into a nearly cashless economy, with consumers and businesses alike embracing faster, more secure, and more versatile digital payment solutions.

Key Trends of Australia Digital Payment Market:

Increasing demand for fintech solutions

Advanced technology, such as peer-to-peer (P2P) payment applications or buy now, pay later (BNPL) solutions offered by FinTech firms can be quite enticing to the digitally influenced clientele. Such advancements enhance digital payments’ efficiency, business, and scope. Fintech companies are known for their streamlined and hassle-free payment solutions that allow for quick and easy transactions. With the enhancement in technology, a wider acceptance of digital payment methods is apparent because of one or more of their features, like one-click payment, in-app wallets, and auto-payment options. BNPL platforms are rising where customers complete purchases and start paying interest-free installments over a certain period, especially among youth. The growth of e-commerce platforms is increasing BNPL usage tremendously, which, in turn, is offering a favorable market outlook. As per the IMARC Group’s report, the Australia fintech market is expected to reach USD 20.0 Billion by 2032.

Social media integration

The data published on the website of the International Trade Administration (ITA) in 2024 shows that Australia has 13 million active Facebook users, thereby revealing that social media is also a big driver in the promotion of B2C transactions. Online payment options are rolling out on social network sites, such as Facebook. Such interconnections save time and resources as they allow customers to avail services, buy items, or send money without leaving the application. According to the Australia digital payment market forecast, there is a necessity for unified digital payment monetary systems, considering the rise of social commerce that involves people buying products through social networks. Digital payments are required to ensure smooth purchases in marketplaces like Facebook Marketplace, which promotes sales for businesses and buying for people. Social media programs ease P2P payments, allowing users to remit funds to friends or relatives in real time. These features are most loved by younger age groups, who deem speed and efficiency in any financial transaction to be very critical.

E-learning growth

E-learning sites need easy ways to pay for memberships and course purchases, which is acting as major Australia digital payment market trend. Students and professionals can easily pay for instructional content using digital payment methods like e-wallets, credit or debit cards, and buy now, pay later (BNPL) options. Short-term certificates, workshops, and modular courses are attractive as they frequently require modest, ongoing fees. Learners have access to flexible and reasonably priced payment choices owing to digital payment platforms, particularly those that facilitate microtransactions. Since e-learning platforms serve students from various nations, cross-border payments are a necessity. These payments are made possible in large part by digital payment gateways that facilitate low-cost international transfers and multi-currency transactions. The data published on the official website of the IMARC Group says that Australia e-learning market size is projected to exhibit a growth rate (CAGR) of 12.20% during 2025-2033.

Growth Drivers of Australia Digital Payment Market:

Technological Infrastructure and Consumer Adoption

Australia's digital payments market has grown strongly with high adoption by consumers and well-developed technological infrastructure. Most Australians enjoy access to high-speed internet and smartphones, which has opened the door for fast growth of digital wallets and contactless payments. Cities like Sydney, Melbourne, and Brisbane have adopted smart payment technologies, utilizing them in public transport, retail, and daily transactions. Contactless "tap-and-go" payments are now cultural, fueled by consumer demands for speed, convenience, and cleanliness. Banks and fintechs have also made their services mobile-friendly, providing frictionless app-based interfaces for banking, bill payments, and peer-to-peer transfers. Furthermore, increased confidence in electronic systems and decreased cash handling, particularly in the post-pandemic context, have spurred this behavioral change. Consumers increasingly see digital payments not as a choice but as the norm, resulting in sustained market growth across various sectors such as retail, services, and healthcare.

Regulatory Support and Fintech Innovation

One of the principal drivers of Australia's digital payment growth is its liberal regulatory framework, which encourages innovation and competition. Through government programs like Open Banking and the Consumer Data Right, customers can safely provide third-party providers access to their financial information, increasing openness and facilitating the development of customized financial services. The New Payments Platform (NPP), supported by the country’s major banks, enables instant, round-the-clock bank transfers using simple identifiers like mobile numbers or email addresses. These changes have allowed fintech startups and international payments providers to enter the marketplace, providing subscription billing, digital invoicing, and consolidated business payment solutions. Both established companies and local startups gain from this regulatory certainty, which facilitates the creation of secure, efficient, and customer-centric financial products. Such collaboration between innovation and regulation enhances accessibility and affordability while also encouraging increased trust in digital platforms, driving sustained growth in consumer as well as enterprise segments.

Cybersecurity, Trust, and Shifting Payment Patterns

Sophisticated security solutions and increasing digital literacy are also driving Australia's digital payments market growth. Payment companies are also pouring funds into artificial intelligence-based, biometric, and real-time monitoring fraud detection systems to facilitate safe transactions. These steps solve mounting worries over online fraud and instill consumer confidence, particularly among elderly groups that were earlier reluctant to become cashless. Mobile wallets like Google Pay, Apple Pay, and Samsung Pay are also being accepted at large scale across the nation, owing to the high density of NFC payment terminals. In addition, embedding digital payments in day-to-day applications—food delivery, ride-sharing, and utility services—supports habitual usage. This is complemented by the growth of reward programs and cash-back reward structures associated with digital payments, providing additional value to users. With enhanced security improving and convenience growing, Australians are evermore satisfied with a cashless way of life, driving the nation closer to complete digital payment adoption.

Opportunities of Australia Digital Payment Market:

Expansion to Remote and Regional Areas

The most important opportunity within Australia's digital payment industry exists in offering services to remote and regional communities. As much as Sydney and Melbourne are already fully integrated digitally, much of the rural community still operates under traditional banking and cash. With the shutdown of many bank branches and ATMs in less populated areas, there arises a greater demand for convenient digital financial services. This need is a clear opportunity for fintech firms and digital payment providers to adapt low-bandwidth, simple-to-use platforms to suit consumers with limited internet connectivity in deprived areas. Mobile-based solutions that support offline transactions, as well as tools that work with intermittent connectivity, can help bridge the digital divide. Additionally, collaboration with local retailers, post offices, and community hubs can act as distribution and education points for digital payment adoption. By meeting the needs of underserved populations, providers can tap into a relatively untouched market while contributing to broader financial inclusion efforts across the country.

Development in Cross-Border and Multicurrency Payments

Australia's robust trade and tourism connections, especially with Asian-Pacific countries, offer a huge potential in cross-border digital payments. Business and consumers alike are progressively taking part in international business, e-commerce, travel reservations, and digital services, all of which need to be supported by effortless, secure multicurrency payment capabilities. There is an increasing need for services that can enable real-time currency conversion, transparency of fees, and international regulatory compliance. Digital wallets and fintech services that are capable of cross-currency bridging and enabling quick, low-cost cross-border transfers are also on the rise, particularly among small-to-medium businesses and freelancing experts. Additionally, the geographic and economic closeness of Australia to Asia gives it a strategic location to establish international payment corridors. There are also opportunities for expansion in student remittances, foreign education payments, and foreign property transactions by foreign investors. Leveraging these international connections can give Australian digital payment service providers a competitive advantage and extend the market horizon beyond home borders.

Embracing New Sectors and Lifestyle Services

The incorporation of digital payments into new sectors and lifestyle services presents huge growth opportunities in Australia. As industries such as telehealth, online education, digital entertainment, and gig economy marketplaces grow, so too does the demand for unified payment solutions that provide instant, secure, and flexible transactions. Subscription-based models for streaming, fitness, wellness, and e-learning platforms are growing, with opportunities for recurring billing solutions that meet local consumer tastes. Likewise, ride-sharing, food delivery, and home services apps will be able to gain from in-app payment facilities and added-value features such as loyalty rewards and digital tipping. Furthermore, Australia's increasing emphasis on sustainability and ethical consumption provides scope for digital payment products to include carbon offset tracking, rounding up to a donation, and eco-rewards. Linking payments to the user's day-to-day digital life maximizes convenience and builds sustained customer interest. Payment providers that resonate with the developing lifestyle patterns and local culture will be in good stead to succeed in Australia's changing digital economy.

Government Initiatives of Australia Digital Payment Market:

Consumer Data Right and Open Banking Framework

A most revolutionary government initiative transforming the digital payment ecosystem in Australia is the establishment of the Consumer Data Right (CDR) that forms the basis for the nation's Open Banking system. The law enables consumers to share their financial information securely with approved third parties, creating more competition and innovation within the payments and financial services industries. In contrast to most global equivalents, Australia's CDR is specifically tailored to go beyond banking, with a view to extending to industries like energy and telecommunications in the future. This makes for a more integrated digital economy in which payment systems can be integrated with other elements of a consumer's financial life. In providing control over data to the individual, the government is facilitating custom-made financial services, made-to-measure digital payment solutions, and clear comparisons between products. This structure empowers consumers, motivates fintech start-ups to be innovative, and pushes legacy banks to step up the digital value proposition. As such, CDR is driving the development of the digital payment ecosystem forward while ensuring data security and consumer consent.

Modernizing Payments Infrastructure through the NPP

Another significant government-initiated initiative is support and facilitation of the New Payments Platform (NPP), which provides real-time, 24/7 transfer of funds between NPP-enabled financial institutions. This infrastructure is a building block of Australia's shift to quicker, smarter digital payments. The NPP enables innovations such as PayID and PayTo, enabling users to pay with simple-to-remember identifiers such as phone numbers or email addresses instead of banking details. It also allows businesses to make instant payments of salaries, bills, and services—greatly enhancing cash flow and operational efficiency. The NPP was created through cooperation between the Reserve Bank of Australia, banks, and payment service institutions, so it is a specially coordinated public-private undertaking. It has a flexible overlay architecture that allows it to accommodate future innovations without the need for fundamental adjustments to the underlying system. Through ongoing investment in this infrastructure, the government is keeping Australia's digital payment capability strong, scalable, and internationally competitive.

Regulatory Sandboxes and Support for Innovation

The Australian government has also set up innovation hubs and regulatory sandboxes to support responsible innovation in digital payments. These allow fintech companies to test new payment services and products in a sandbox setting without needing to get approval right away and be fully regulated. This reduces the entry threshold for startups and allows them to develop innovative, consumer-focused solutions for market in a shorter time. The Australian Securities and Investments Commission (ASIC) is at the forefront of supporting these sandboxes, providing advice and maintaining consumer protection during tests. The government also actively works together with industry players to determine regulatory requirements and reduce the burden of licensure, especially under its wider digital economy plan. Australia’s support for innovation is unique, as it balances regulatory oversight with flexibility, creating an environment where compliance and creativity can coexist. These proactive measures have positioned Australia as a regional leader in fintech development and are crucial in sustaining the long-term growth of digital payments.

Challenges of Australia Digital Payment Market:

Digital Exclusion and Uneven Access

One of the most urgent concerns for the Australian digital payments market is that of digital exclusion, specifically among older Australians, Indigenous Australians, and those who live in regional and remote areas. Whereas Australia's capital cities enjoy ubiquitous high-speed internet and digital literacy services, many regional communities continue to experience patchy connectivity and limited provision of digital infrastructure. The transition away from cash and branch bank closure have put financial pressure on those who are not tech-savvy or do not have the tools, including smartphones or stable internet. Older Australians, especially, prefer face-to-face banking and cash transactions and might find app-based services overwhelming or intimidating. Furthermore, language limitations and illiteracy among certain Indigenous groups impede access to digital platforms. These access and confidence gaps present a significant hurdle to the inclusive development of the digital payments ecosystem and need to be addressed with specific interventions.

Cybersecurity Risks and Consumer Confidence Concerns

With increasing adoption of digital payments across Australia, so does the potential for cybercrime, fraud, and data breach. Despite the increasing complexity of security systems, Australians are more and more targeted by phishing attacks, identity theft, and internet-based fraud schemes. While these events lead to monetary losses, they also weaken consumer confidence in electronic payment systems. Most users worry about the way their personal and financial information is stored, exchanged, or possibly mishandled by third-party service providers. Even the best-intentioned innovations like Open Banking evoke concerns regarding exposure of data, particularly when users must provide their banking credentials to receive customized financial services. Furthermore, as digital platforms continue to diversify and blend with social media and commerce, the level of complexity involved in securing end-to-end transactions is amplified. Having strong security controls yet still easy to use is a fine balance, and its failure will make users reluctant and decelerate the pace of digital payment acceptance.

Regulatory Complexity and Market Fragmentation

Digital payments in Australia also encounter regulatory complexity and market fragmentation issues. Although the government has taken some considerable strides with reforms such as the Consumer Data Right and the New Payments Platform, the broader regulatory environment can be challenging for newcomers to navigate. Fintech entrepreneurs and small payment institutions typically find it hard to meet duplicative financial, consumer protection, anti-money laundering, and data privacy laws. Such complexity can hinder innovation, raise costs, and discourage investment in the industry. Besides, the market is still fragmented with a multitude of payment methods, platforms, and standards utilized, creating interoperability problems. For instance, there are point-of-sale terminals that do not have support for all digital wallets, and not all banks are fully integrated into the real-time payment system. These inconsistencies cause confusion to both merchants and consumers, making the digital transactions less efficient and attractive. Harmonizing standards and simplifying regulatory frameworks will be key to overcoming these long-term challenges.

Australia Digital Payment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Australia digital payment market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on component, payment mode, deployment type, and end use industry.

Analysis by Component:

- Solutions

- Application Program Interface

- Payment Gateway

- Payment Processing

- Payment Security and Fraud Management

- Transaction Risk Management

- Others

- Services

- Professional Services

- Managed Services

Solutions are expected to dominate the market due to the rising demand for integrated, real-time, and secure transaction platforms. Businesses and financial institutions are increasingly adopting end-to-end payment solutions that combine processing, fraud prevention, and compliance features. These platforms support diverse payment methods, such as PayTo, BNPL, and mobile wallets, enabling seamless customer experiences across channels. Moreover, the rise of e-commerce and digital banking requires scalable infrastructure, making advanced payment solutions essential. As digital ecosystems grow more complex, providers offering modular and API-based solutions gain traction, supporting innovation and adaptability while helping businesses remain competitive in a fast-evolving financial landscape.

Services account for a significant share of Australia’s digital payment market due to the increasing need for operational support, maintenance, and customer engagement. As digital payments become more sophisticated, businesses rely on service providers for transaction monitoring, fraud detection, technical support, and analytics. These services ensure smooth functioning, security, and compliance with evolving regulations. Additionally, managed services and consulting help organizations optimize payment strategies, integrate APIs, and personalize customer experiences. The high frequency of digital transactions across sectors, from retail to utilities, creates continuous demand for value-added services, reinforcing their vital role in sustaining the reliability and efficiency of the payment ecosystem.

Analysis by Payment Mode:

- Bank Cards

- Digital Currencies

- Digital Wallets

- Net Banking

- Others

Bank cards lead the market with around 63.3% of market share in 2025 due to their widespread acceptance, user familiarity, and integration with contactless technology. Both debit and credit cards are extensively used for in-store and online purchases, supported by strong banking infrastructure and secure networks. The popularity of tap-and-go payments, especially through Visa and Mastercard, aligns with consumer demand for convenience and speed. Additionally, bank cards are often linked with digital wallets, enabling seamless mobile transactions. With strong fraud protection measures and reward programs, bank cards remain the preferred choice for a majority of Australians, maintaining their dominance in the payment landscape.

Analysis by Deployment Type:

- Cloud-based

- On-premises

Cloud-based solutions hold the largest share in the market due to their scalability, flexibility, and cost-effectiveness. These platforms enable seamless integration with various payment channels, allowing businesses to offer fast, secure, and real-time transactions. Cloud infrastructure supports advanced features like analytics, fraud detection, and automated updates, ensuring continuous service improvement. With growing e-commerce and mobile payment adoption, cloud-based systems provide the agility needed to meet evolving consumer demands. Additionally, they reduce the need for heavy on-premise infrastructure, making them ideal for businesses of all sizes. Their role in enhancing efficiency and innovation cements their leading position in the Australia digital payment market outlook, highlighting the growing preference for scalable, cloud-based payment solutions across the country.

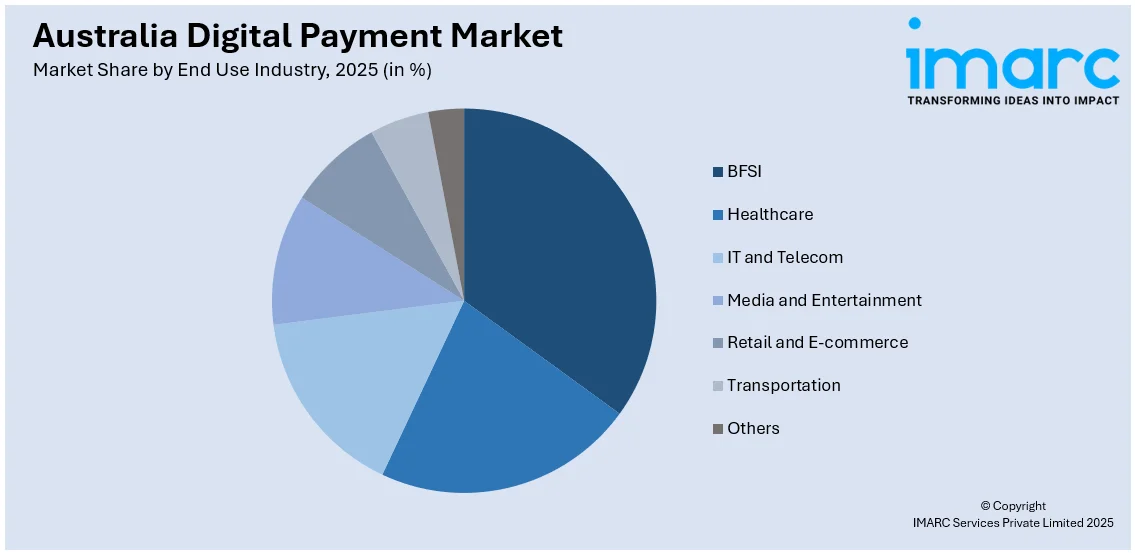

Analysis by End Use Industry:

Access the comprehensive market breakdown Request Sample

- BFSI

- Healthcare

- IT and Telecom

- Media and Entertainment

- Retail and E-commerce

- Transportation

- Others

Retail and e-commerce hold the largest share in the Australia digital payment market due to the rapid shift in consumer shopping habits toward online and contactless transactions. The widespread availability of digital wallets, BNPL options, and card-based payments supports seamless and secure checkouts, both in-store and online. Retailers are increasingly adopting integrated payment gateways to enhance customer experience and reduce friction at checkout. The growth of mobile commerce and promotional incentives further drives digital payment adoption. As consumer expectations for speed, convenience, and flexibility rise, the retail and e-commerce sectors remain at the forefront of digital payment innovation and transaction volume. Digital payment systems are used by the telecom and IT industries for mobile payments, software licensing, and subscription-based services. Digital payments help these sectors by enabling smooth billing, recurring payments, and the capacity to cater to a wide customer base with diverse payment preferences.

Regional Analysis:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

In 2025, Victoria & Tasmania accounted for the largest market share of over 38.3%. Both states benefit from technological infrastructure investments, such as expanded NFC-enabled terminals and enhanced mobile connectivity, enabling widespread contactless and mobile wallet use, driven by rising e‑commerce and retail adoption. The push for financial inclusion and fintech innovation, supported by local schemes and startups in Melbourne and Hobart, fuels demand for modern digital payment solutions. Additionally, regulatory support, including NPP adoption and open banking under federal and state policies, enhances security, interoperability, and consumer trust, which is further driving the Australia digital payment market demand. COVID‑19 further accelerated digital payment usage, as consumers and businesses embraced safer, more hygienic, and efficient online and in-store transactions.

Competitive Landscape:

In order to meet the increasing need for creative, safe, and seamless payment solutions, major participants in the Australian digital payment market are aggressively improving their products. By incorporating cutting-edge technology such as mobile wallets, contactless payments, and biometric verification, major financial institutions are extending their digital payment services and guaranteeing safer and more seamless transactions. By making BNPL options more publicly known, businesses are making a big difference in the retail and e-commerce industries. The mobile payment market provides ease for both customers and businesses. Key players are also promoting bitcoin payment solutions in response to the increasing demand for digital currencies. Moreover, key players are introducing digital banks to promote the environment of digital payments in the country. For instance, in November 2023, AMP introduced a digital banking arm designed specifically to cater to the transactional requirements of sole proprietors and small enterprises. This new division focuses on addressing the unique financial needs of these business segments through tailored solutions.

The report provides a comprehensive analysis of the competitive landscape in the Australia digital payment market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: Banked acquired UK-based VibePay to boost global Pay by Bank usage, following its late-2024 purchase of Australian firm Waave and Amazon Australia's checkout integration. The move strengthened Australia's digital payment footprint as Banked, co-founded by Australian Brad Goodall, aimed to merge infrastructure with VibePay’s AI-driven consumer tools.

- April 2025: Fiserv acquired Australian digital payment facilitator Pinch Payments to expand its footprint in Australia and New Zealand. The company integrated Pinch’s technology and team to enhance service speed and flexibility for PayFacs, ISVs, BPSPs, ISOs, and enterprise clients.

- March 2025: Visa partnered with four major Australian banks, ANZ, NAB, HSBC, and Westpac to launch Visa B2B Integrated Payments in Australia, aiming to streamline digital B2B transactions. The embedded solution automated business payments via SAP’s platform, enhancing efficiency and supporting Australian firms with simplified digital payment processes.

- February 2025: AMP in Australia has unveiled a new digital banking service tailored for micro and small enterprises, leveraging Starling Bank’s Engine platform to enhance digital payment capabilities. This initiative introduces the country’s first debit cards without printed numbers and incorporates cashflow management tools, aiming to improve financial operations for previously underserved business owners.

- February 2025: Backbase and MeaWallet formed a strategic partnership to enhance digital payment security in Australia and New Zealand through advanced tokenisation technology. They introduced Mea Push Provisioning and Mea Card Data to help banks and fintechs offer faster, secure digital wallet experiences across platforms like Apple Pay and Google Pay.

Australia Digital Payment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Payment Modes Covered | Bank Cards, Digital Currencies, Digital Wallets, Net Banking, Others |

| Deployment Types Covered | Cloud-based, On-premises |

| End Use Industries Covered | BFSI, Healthcare, IT and Telecom, Media and Entertainment, Retail and E-commerce, Transportation, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia digital payment market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Australia digital payment market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia digital payment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The digital payment market in Australia was valued at USD 142.7 Billion in 2025.

The Australia digital payment market is projected to exhibit a CAGR of 19.86% during 2026-2034, reaching a value of USD 728.1 Billion by 2034.

High smartphone and contactless-pay adoption, e-commerce growth, widespread BNPL usage, real-time infrastructure like NPP and PayID, robust open banking frameworks, strong regulatory support, enhanced cybersecurity, and consumer preference for fast, secure, frictionless transactions. These factors collectively fuel digital payment expansion.

Victoria & Tasmania holds the largest share of the Australia digital payment market due to strong mobile wallet usage, fintech innovation, real-time payment systems like NPP, widespread contactless adoption, and increased e-commerce activity post-COVID.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)