Australia DevOps Market Size, Share, Trends and Forecast by Type, Deployment Model, Organization Size, Tool, Industry Vertical, and Region, 2025-2033

Australia DevOps Market Overview:

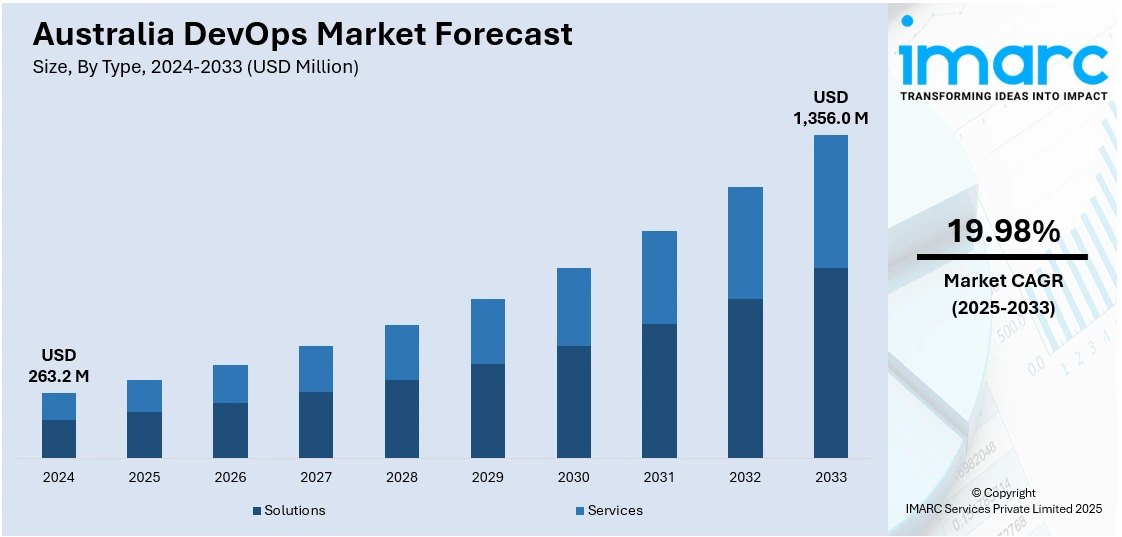

The Australia DevOps market size reached USD 263.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,356.0 Million by 2033, exhibiting a growth rate (CAGR) of 19.98% during 2025-2033. The market in Australia is expanding rapidly because of widespread digital transformation efforts and a growing emphasis on automation, as organizations modernize information technology (IT) systems, integrate emerging technologies, and streamline development processes to boost agility, reduce costs, enhance efficiency, and meet evolving operational and client demands.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 263.2 Million |

| Market Forecast in 2033 | USD 1,356.0 Million |

| Market Growth Rate 2025-2033 | 19.98% |

Australia DevOps Market Trends:

Digital Transformation Initiatives

The continuous rise of digital transformation within Australian organizations is a key factor propelling the growth of the market. As companies strive to update their information technology (IT) infrastructure, they are adopting DevOps as a revolutionary method for developing and overseeing software applications. Digital transformation initiatives focus on utilizing advanced technologies such as artificial intelligence (AI), cloud computing, and internet of things (IoT), necessitating smooth cooperation between development and operations teams. DevOps offers the structure to adopt cloud-native architectures, microservices, and containerization, which are all essential elements that bolster these contemporary technologies. A significant illustration of this change occurred in 2025 when the Commonwealth Bank of Australia (CommBank) revealed a five-year collaboration with Amazon Web Services (AWS) to improve its cloud, AI, and DevOps functions. This partnership is an essential aspect of CommBank’s continuous digital evolution, striving to streamline its technology landscape, enhance AI adoption, and elevate client experiences through efforts like the introduction of a generative AI-driven messaging service. The collaboration illustrates the growing trend of companies implementing DevOps to maintain agility and responsiveness in a progressively competitive digital environment. Through the encouragement of ongoing enhancement, DevOps allows organizations to swiftly adjust to technological progress while maintaining operational resilience and satisfying changing user demands. Such instance highlights the significance of DevOps in the digital transformation process for Australian businesses.

To get more information on this market, Request Sample

Growing Focus on Automation and Efficiency

The quest for operational efficiency and cost reduction is a key factor fueling the adoption of DevOps in Australia, where automation is essential to this change. By automating routine tasks and minimizing human mistakes, DevOps allows organizations to optimize workflows, speed up delivery timelines, and improve overall system dependability. This move toward automation is essential for Australian companies aiming to remove obstacles and enhance their software development lifecycle. A prime example of this is the Modern DevOps Melbourne 2024 conference, held in October 2024 at the Grand Hyatt Melbourne. The event concentrated on enhancing DevOps methodologies with a focus on automation, AI and machine learning (ML) incorporation, and DevSecOps. It aimed to provide cutting-edge solutions to enhance deployment speed and scale in the software development lifecycle. Moreover, the incorporation of advanced technologies like AI and ML into DevOps practices enhances the capacity for quicker, more efficient operations. Organizations participating in these events are progressively embracing DevOps to automate testing, deployment, monitoring, and infrastructure management, resulting in improved resource management, minimized downtime, and faster troubleshooting. As companies in Australia strive to find solutions that enhance both efficiency and quality, the increasing focus on automation within DevOps practices is becoming vital for remaining competitive in the fast-changing digital environment.

Australia DevOps Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, deployment model, organization size, tool, and industry vertical.

Type Insights:

- Solutions

- Services

The report has provided a detailed breakup and analysis of the market based on the type. This includes solutions and services.

Deployment Model Insights:

- Public Cloud

- Private Cloud

- Hybrid Cloud

A detailed breakup and analysis of the market based on the deployment model have also been provided in the report. This includes public cloud, private cloud, and hybrid cloud.

Organization Size Insights:

- Large Enterprises

- Medium-Sized Enterprises

- Small-Sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes large enterprises, medium-sized enterprises, and small-sized enterprises.

Tool Insights:

- Development Tools

- Testing Tools

- Operation Tools

A detailed breakup and analysis of the market based on the tool have also been provided in the report. This includes development tools, testing tools, and operation tools.

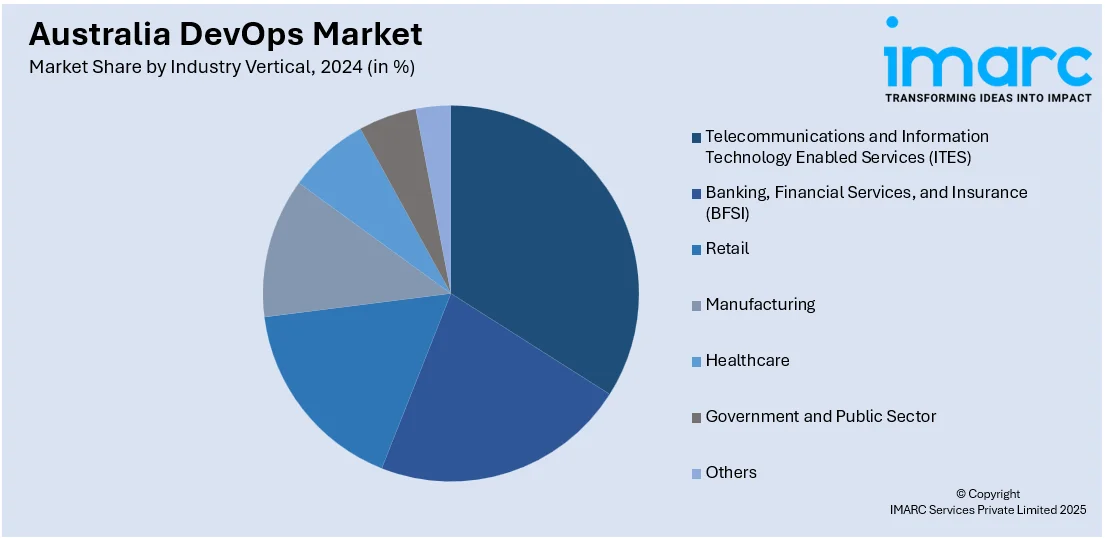

Industry Vertical Insights:

- Telecommunications and Information Technology Enabled Services (ITES)

- Banking, Financial Services, and Insurance (BFSI)

- Retail

- Manufacturing

- Healthcare

- Government and Public Sector

- Others

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes telecommunications and information technology enabled services (ITES), banking, financial services, and insurance (BFSI), retail, manufacturing, healthcare, government and public sector, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia DevOps Market News:

- In March 2025, former Versent executives Robert Frendo and Carl Rigoni launched a new technology consultancy, Nexifi, in Melbourne. Nexifi offers services in digital, data & AI, cloud & DevOps, and CRM, with a focus on outcome-driven solutions. The company aims to deliver optimal customer outcomes by integrating product, user experience, and engineering.

- In May 2024, Synechron announced its acquisition of iGreenData, a Melbourne-based digital engineering company specializing in cloud technology, data engineering, and blockchain. The acquisition strengthened Synechron's expertise in payments and digital transformation, expanding its global presence, especially in the Australian market. The integration enhanced Synechron’s capabilities in cloud and DevOps services.

Australia DevOps Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Solutions, Services |

| Deployment Models Covered | Public Cloud, Private Cloud, Hybrid Cloud |

| Organization Sizes Covered | Large Enterprises, Medium-Sized Enterprises, Small-Sized Enterprises |

| Tools Covered | Development Tools, Testing Tools, Operation Tools |

| Industry Verticals Covered | Telecommunications and Information Technology Enabled Services (ITES), Banking, Financial Services, and Insurance (BFSI), Retail, Manufacturing, Healthcare, Government and Public Sector, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia DevOps market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia DevOps market on the basis of type?

- What is the breakup of the Australia DevOps market on the basis of deployment model?

- What is the breakup of the Australia DevOps market on the basis of organization size?

- What is the breakup of the Australia DevOps market on the basis of tool?

- What is the breakup of the Australia DevOps market on the basis of industry vertical?

- What is the breakup of the Australia DevOps market on the basis of region?

- What are the various stages in the value chain of the Australia DevOps market?

- What are the key driving factors and challenges in the Australia DevOps market?

- What is the structure of the Australia DevOps market and who are the key players?

- What is the degree of competition in the Australia DevOps market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia DevOps market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia DevOps market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia DevOps industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)