Australia Data Center Physical Security Market Report by Component (Solution, Services), Data Center Size (Small Data Centers, Medium Data Centers, Large Data Centers), End-Use (BFSI, Government and Defense, IT and Telecom, Healthcare and Life Sciences, Retail and Ecommerce, Manufacturing, and Others), and Region 2025-2033

Australia Data Center Physical Security Market Overview:

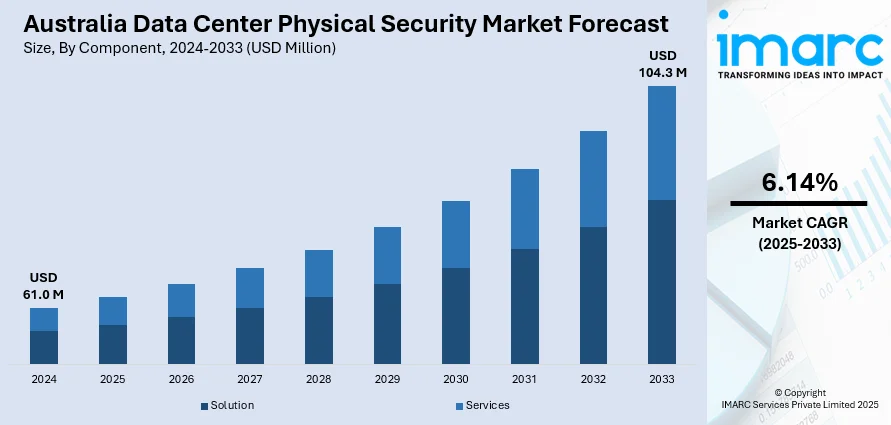

The Australia data center physical security market size reached USD 61.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 104.3 Million by 2033, exhibiting a growth rate (CAGR) of 6.14% during 2025-2033. The rising cybersecurity threats, stringent regulatory requirements, growing data privacy concerns, continuous advancements in security technologies, and the expanding data center infrastructure, driven by digital transformation and cloud adoption, are key factors fueling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 61.0 Million |

| Market Forecast in 2033 | USD 104.3 Million |

| Market Growth Rate 2025-2033 | 6.14% |

Australia Data Center Physical Security Market Trends:

Rise in cybersecurity threats

The growing need for enhanced physical security in data centers is being driven by the rise in cyberattacks and data breaches. As cyber threats become more sophisticated, attackers often target the physical infrastructure of data centers to gain unauthorized access or cause disruption. High-profile incidents, such as ransomware attacks and data theft have exposed vulnerabilities, underscoring the critical need for robust physical security measures. This has led to a heightened focus on safeguarding the physical premises through measures like surveillance systems, access controls, and intrusion detection systems. Consequently, data centers are investing heavily in security personnel, perimeter fencing, and monitoring technologies to protect against unauthorized access and ensure the integrity of their operations, which is aiding in market expansion.

To get more information of this market, Request Sample

Regulatory compliance requirements

Strict legal requirements and industry norms are pressuring data centers to improve their physical security protocols. Regulations such as the Australian Privacy Act, the Notifiable Data Breaches (NDB) scheme, and sector-specific guidelines mandate rigorous measures for data protection and security. To ensure compliance, prevent breaches, and guarantee data integrity, data centers are implementing extensive physical security controls, including maintaining secure access points, conducting regular security audits, and implementing disaster recovery plans. The need to adhere to these regulations drives investments in physical security and ensures that data centers are prepared to handle potential security incidents effectively, thereby bolstering the market demand.

Increasing adoption of advanced security technologies

The ongoing advancements in security technologies are revolutionizing physical security in data centers. Innovations, such as biometric access controls, video analytics, and Internet of Things (IoT)-enabled surveillance systems are becoming integral components of modern security strategies. These technologies provide enhanced monitoring capabilities, real-time threat detection, and automated responses to security incidents. For example, biometric systems offer a higher level of authentication than traditional key cards, while video analytics can identify suspicious behavior and alert security personnel before a breach occurs. The adoption of these technologies is enhancing security measures and addressing the evolving complexity of threats faced by data centers, contributing to the market growth.

Australia Data Center Physical Security Market News:

- In May 2024, OVHcloud launched its third data center in Sydney, Australia, featuring advanced water-cooling technology and optimized for mission-critical workloads. The facility supports OVHcloud's Scale dedicated servers powered by AMD and Intel processors.

- In July 2024, Lucid Software launched its global data residency in Australia, hosted by Amazon Web Services (AWS). This expansion enhances collaboration, performance, and security for APAC customers. James Harkin, APAC Senior Director, emphasized the program’s alignment with local compliance standards and the ability of Australian enterprises to control their data storage.

Australia Data Center Physical Security Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component, data center size, and end-use.

Component Insights:

- Solution

- Access Control

- Video Surveillance

- Monitoring and Detection

- Others

- Services

- Consulting

- System Integration

- Maintenance and Support

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution (access control, video surveillance, monitoring and detection, and others) and services (consulting, system integration, and maintenance and support).

Data Center Size Insights:

- Small Data Centers

- Medium Data Centers

- Large Data Centers

A detailed breakup and analysis of the market based on the data center size have also been provided in the report. This includes small data centers, medium data centers, and large data centers.

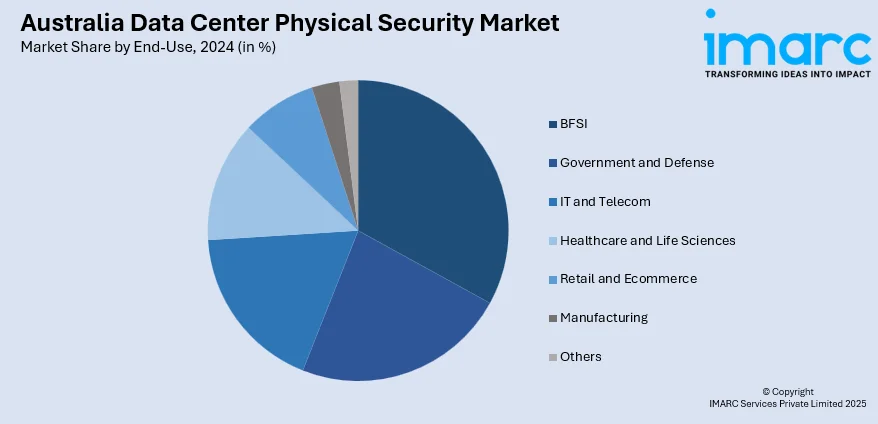

End-Use Insights:

- BFSI

- Government and Defense

- IT and Telecom

- Healthcare and Life Sciences

- Retail and Ecommerce

- Manufacturing

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use. This includes BFSI, government and defense, IT and telecom, healthcare and life sciences, retail and ecommerce, manufacturing, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Data Center Physical Security Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Data Center Sizes Covered | Small Data Centers, Medium Data Centers, Large Data Centers |

| End-Uses Covered | BFSI, Government and Defense, IT and Telecom, Healthcare and Life Sciences, Retail and Ecommerce, Manufacturing, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia data center physical security market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia data center physical security market on the basis of component?

- What is the breakup of the Australia data center physical security market on the basis of data center size?

- What is the breakup of the Australia data center physical security market on the basis of end-use?

- What are the various stages in the value chain of the Australia data center physical security market?

- What are the key driving factors and challenges in the Australia data center physical security?

- What is the structure of the Australia data center physical security market and who are the key players?

- What is the degree of competition in the Australia data center physical security market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia data center physical security market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia data center physical security market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia data center physical security industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)