Australia Data Center Networking Market Size, Share, Trends and Forecast by Component, End-User, and Region, 2025-2033

Australia Data Center Networking Market Size and Share:

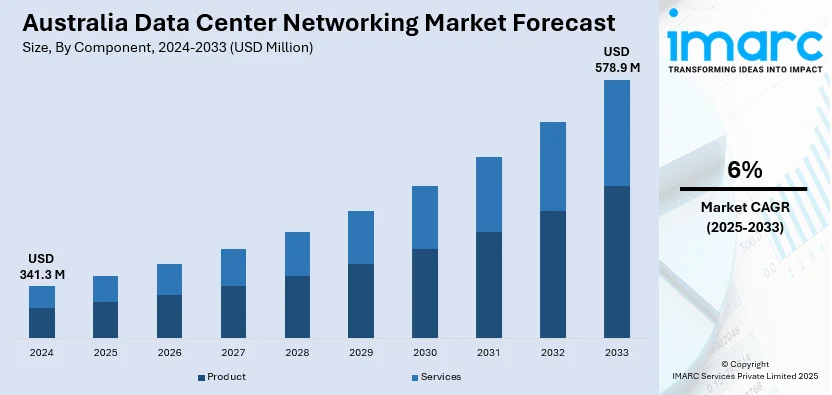

The Australia data center networking market size was valued at USD 341.3 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 578.9 Million by 2033, exhibiting a CAGR of 6% from 2025-2033. The market is experiencing significant growth driven by the increased investment in data center real estate, growing demand for digital transformation in enterprises, increase in e-commerce and online services, proliferation of Internet of Things (IoT) devices, escalating demand for energy-efficient and sustainable data centers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 341.3 Million |

| Market Forecast in 2033 | USD 578.9 Million |

| Market Growth Rate (2025-2033) | 6% |

The market in Australia is primarily driven by the increasing commitment to renewable energy and sustainability among the masses. With Australia focusing more on green technologies and is looking to minimize its carbon footprint, renewable sources, including solar and wind power, are increasingly becoming prominent means of powering data centers. Moreover, growing investment by large as well as small and medium-sized organizations in local data centers to ensure compliance with data protection regulations, reduce latency, and improve the resilience of their networks is fueling the market. On 11th September 2024, Zscaler, a cloud security leader, launched a new data center in Perth, expanding its Australian network in Sydney, Melbourne, and Canberra through Equinix to address over 29 million phishing attempts and a 479% rise in phishing content. This supports Australia’s goal to be the most cyber-secure nation by 2030. With more than 150 renewable energy-powered data centers, Zscaler aims for carbon neutrality by 2025.

To get more information on this market, Request Sample

Rising cybersecurity concerns along with the growing need for strong data protection are also affecting the growth of the data center networking market positively. With cyberattacks becoming increasingly sophisticated, Australian organizations are increasingly emphasizing the protection of sensitive data through secure data storage solutions. The proliferation of cloud computing infrastructure in Australia is also contributing to the growth of the market in Australia. Considerable rise in the development of new facilities in key cities across the country is propelling job creation, economic growth, enhanced regional capacity for delivering cloud-based services, and supporting digital transformation efforts, thereby driving the market. On 20th June 2024, Equinix, a leading digital infrastructure company, announced that it has invested AU$240 million to add 4,175 cabinets to its network of data centers in Sydney and Melbourne. This expansion aims to support the increasing demand for high-density power, advanced cooling, and interconnection, driven by the growing need for digital infrastructure, including artificial intelligence (AI).

Australia Data Center Networking Market Trends:

Expansion of Data Center Infrastructure

The establishment of new data center facilities in key regions is driving growth in the tech and cybersecurity industries, which in turn is impacting the Australian data center networking market positively. For instance, On 15th October 2024, Vanta announced its expansion in Australia by establishing a new data center networking facility. The strategic move enhances the company's regional presence and supports additional compliance frameworks, demonstrating Vanta's commitment to strengthening its technological infrastructure and market positioning in the Asia-Pacific region. Companies are enhancing regional infrastructure, offering stronger solutions, meeting local regulations, and enhanced service growing needs for secure cloud services. Moreover, as businesses in the Asia-Pacific region increasingly look to data security and compliance, the ability to support a broader range of compliance frameworks strengthens competitive positioning and market share, driving further innovation and growth.

Growth of AI and Cloud Solutions

The increasing demand for advanced data centers and AI-driven solutions in Australia is another key driver for the market. The partnership aims to enhance data center performance and capabilities, accelerate AI adoption, and support digital transformation for enterprises. With the growing adoption of cloud computing and artificial intelligence (AI) technologies, enterprises are seeking high-performance infrastructure to support their digital transformation. Next-generation data centers with GPU cloud capabilities are critical for accelerating AI development and enhancing computing power. With businesses trying to stay competitive, the demand for scalable, efficient, and innovative data storage and processing solutions continues to rise, thereby fostering significant market growth in the region.

Increase in E-Commerce and Online Services

The rapid expansion of e-commerce and digital platforms has significantly driven the Australian data center market. As more businesses pivot to online operations, including retail, entertainment, and finance, there is an increased need for cloud infrastructure and data storage solutions. With consumers expecting seamless digital experiences, businesses require high-performance data centers that can manage increased traffic, transactions, and secure payment processing. The exponential growth of digital content, from media streaming to cloud gaming, is pushing companies to enhance their server and data storage capacity. This trend leads to the construction of modern, energy-efficient data centers capable of scaling up to meet the growing demand for secure, uninterrupted online services.

Australia Data Center Networking Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Australia data center networking market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on component and end-user.

Analysis by Component:

- Product

- Ethernet Switches

- Routers

- Storage Area Network (SAN)

- Application Delivery Controller (ADC)

- Others

- Services

- Installation and Integration

- Training and Consulting

- Support and Maintenance

The product segment encompasses various hardware and software solutions supporting efficient data center operations. Network switches and routers serve essential functions in handling increasing traffic volumes and improving data transfer. High-speed interconnect solutions focus on reducing latency and optimizing performance. Network security tools aim to protect against cyberthreats, and load balancers and traffic management products help maintain consistent service delivery. Wireless technologies and software-defined networking elements simplify management, enabling flexible resource allocation.

Services in the Australian market are essential in providing ongoing support, maintenance, and optimization for the infrastructure. Managed services, including monitoring networks, disaster recovery, and cloud integration make it possible for data centers to operate at maximum efficiency but minimize risks. These services enhance business network performance, minimize periods of downtime, and take control of complex IT environments.

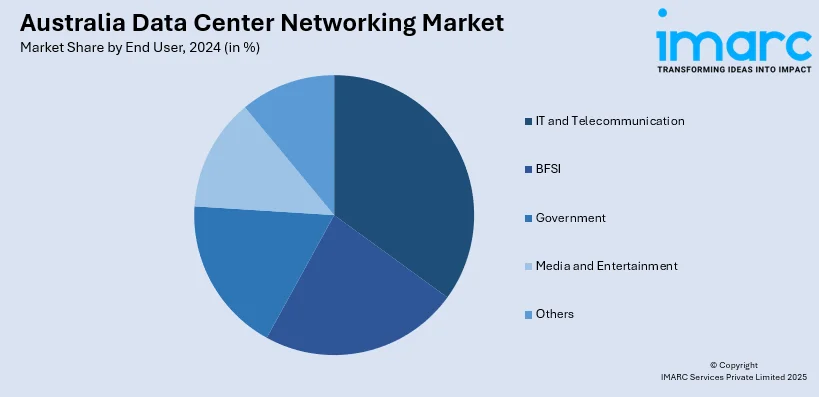

Analysis by End User:

- IT and Telecommunication

- BFSI

- Government

- Media and Entertainment

- Others

The IT and telecommunications sector plays a significant role in the Australian data center networking market, as this is driving the demand for high-speed, reliable infrastructure. The demand for cloud services, data storage, and real-time communication has increased the dependency on advanced networking solutions. Therefore, data centers need to provide scalable, low-latency connectivity for telecommunications providers and IT companies to offer competitive services and enhance digital transformation across industries.

Data center networking is essential in the banking, financial services, and insurance (BFSI) sector as a whole due to huge volumes of financial transactions, besides sensitive customer data. Such a sector demands high-performance networking solutions that ensure the security of data, speed, and uptime. With such a stringent regulatory framework on Australia's financial services, data centers should meet high standards of security and compliance.

The government relies on networking in data centers to govern and secure a large portion of public sector data. With a digitalization service, the agencies need an infrastructure that can support robust and secure services for online services, communication system, and the management of public records. As governments are pushing more towards efficient and citizen-friendly solutions, the demand becomes critical for resilient and scalable data center networks, while delivering smooth services with their high standards of privacy and security.

Regional Analysis:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The Australia Capital Territory and New South Wales are central to Australia's market, which accommodates crucial business centers such as the city of Sydney. Being Australia's largest city, Sydney attracts data centers with its more advanced infrastructure, connectivity, and closeness to undersea cables. Strong regional emphasis on digital transformation and technology start-ups and the government's services makes the area very crucial for the data center network.

Victoria and Tasmania hold significance for the market, with Melbourne as an important technology and business hub. Victoria benefits from a strong focus on industries, such as healthcare, finance, and education, all of which heavily rely on data centers for secure, high-speed communication and data storage. Tasmania is smaller but growing in its role to host edge data centers and regional infrastructure for emerging technologies such as IoT.

Queensland represents a significant player in the market, with Brisbane acting as a key gateway for the state’s growing digital economy. Queensland’s strong presence in industries, such as agriculture, mining, and tourism requires efficient, high-capacity data networks to manage operations and ensure connectivity. The state's emphasis on digital infrastructure and data security drives demand for scalable, secure networking solutions, especially as more businesses move to the cloud and adopt smart technologies.

The Northern Territory and South Australia are new emerging regions for the data center networking market, with increasing demand for localized data processing and storage. Adelaide is also becoming a key location for data centers, offering strategic advantages in terms of energy availability and cost-effective operations. In these regions, companies are shifting their focus towards renewable energy, which makes them an attractive option for companies seeking sustainable solutions to meet the need for data center networking, especially in industries like energy and government.

Western Australia is of strategic importance in the data center networking context due to its location on the international connectivity route, more so in the Asia-Pacific region. Perth, being next to the major subsea cables, provides low latency networking solutions and is a critical gateway for data exchange between the Australian market and the global marketplace. With the growth in mining and resources industries, it is becoming increasingly important that the data center infrastructure within Western Australia supports large-scale data processing, storage, and analytics.

Competitive Landscape:

Key players in Australia are focusing on enhancing the ability of their infrastructure with data storage, high-speed connectivity, and cloud service-based demand. These next-generation networking technologies include investment in 5G, software-defined networking (SDN), and network automation towards improving operational efficiency as well as scalability. In addition, security features are given importance, such as advanced firewalls, encryption, and intrusion detection systems that can be part of networking solutions to abide by data protection regulations. Players are also looking at green energy solutions, such as renewable energy and energy-efficient data center designs, in order to meet sustainability goals. Furthermore, partnerships are being strengthened with telecommunications providers as well as cloud service providers, allowing for more seamless networking services acaross the region, creating the opportunity for businesses to scale their operations efficiently.

The report provides a comprehensive analysis of the competitive landscape in the Australia data center networking market with detailed profiles of all major companies.

Latest News and Developments:

- On February 14, 2024, Amazon announced that they are planning to invest USD 13.2 Billion in Australian cloud computing with plans to build new data centers in Melbourne and Sydney. The Sydney facility will have an IT capacity of 40MW, while the Melbourne center will be part of the AWS region and contribute significantly to job creation and GDP.

- On August 14, 2024, Australian data center firm NextDC launched a new facility, D1, in Darwin in partnership with the Northern Territory Government and Vocus. The facility supplies 7 megawatts of power within a 3,000-square-meter technical area, accommodating up to 1,500 racks. NextDC CEO Craig Scroggie highlighted the facility's role in accelerating computing and achieving national digital equity for the Northern Territory.

Australia Data Center Networking Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| End-Users Covered | IT and Telecommunication, BFSI, Government, Media and Entertainment, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia data center networking market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Australia data center networking market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia data center networking industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Data center networking refers to the infrastructure and solutions used to connect and manage data centers. It involves networking products such as ethernet switches, routers, and storage systems that enable fast data processing, communication, and cloud computing, supporting businesses' digital transformation and cloud service demands.

The Australia data center networking market was valued at USD 341.3 Million in 2024.

IMARC estimates the Australia data center networking market to exhibit a CAGR of 6% during 2025-2033.

Key drivers include increased investment in data center real estate, growing demand for digital transformation, the rise of e-commerce and online services, the proliferation of IoT devices, and the focus on energy-efficient and sustainable data centers powered by renewable energy sources.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)