Australia Data Center Cooling Market Size, Share, Trends and Forecast by Component, Type of Cooling, Cooling Technology, Data Center Size, Vertical, and Region, 2025-2033

Australia Data Center Cooling Market Size and Share:

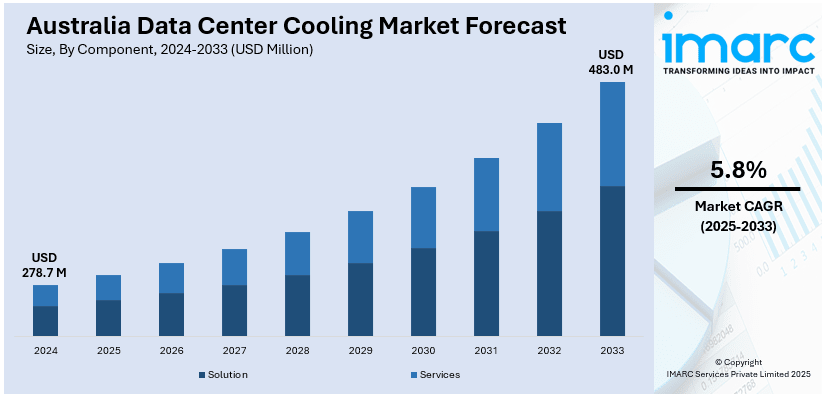

The Australia data center cooling market size was valued at USD 278.7 Million in 2024. Looking forward, the market is expected to reach USD 483.0 Million by 2033, exhibiting a CAGR of 5.8% from 2025-2033. The market is majorly driven by the rising demand for advanced data centers, growth in digital services, adoption of edge computing, escalating energy costs fuelling the shift to sustainable cooling solutions, the expansion of 5G networks, AI advancements, and the need for efficient cooling in high-density settings.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 278.7 Million |

| Market Forecast in 2033 | USD 483.0 Million |

| Market Growth Rate 2025-2033 | 5.8% |

The market in Australia is majorly driven due to the increased demand for advanced data centers that support the rapid expansion of digital services, mainly from industries such as cloud computing and e-commerce. Moreover, the accelerating adoption of edge computing is also increasing the demand for efficient data cooling systems that ensure operational reliability and avoid as much downtime as possible. Additionally, the escalating energy costs are also encouraging a shift towards sustainable cooling solutions, including liquid cooling and renewable-powered systems, with the objective of optimizing power usage effectiveness (PUE) and achieving high levels of environmental compliance. According to the article in ABC News, the Australian data centers currently draw about 5% (1,050 MW) of Australia's electricity, which is likely to grow to 8% (2,500 MW) by 2030.

To get more information of this market, Request Sample

Furthermore, the expansion of 5G networks is increasing the demand for sophisticated cooling systems in data centers to handle increased data traffic efficiently. According to a Computer Weekly article, Vodafone is planning on more than doubling its mobile network coverage in Australia by 2025, covering 98.4% of the population through a network-sharing agreement with Optus. The expansion will benefit regional areas and holiday destinations, bringing 4G and 5G connectivity to places like Cloncurry, Thursday Island, and Coober Pedy, among others. Apart from this, the rise in heat loads due to the demand for AI and machine learning applications is forcing innovation and development of higher capacity cooling, thereby propelling the market. The combined effort between global technology providers and Australian business houses is shaping innovation toward the diverse requirements of a growing digital infrastructure of Australia, is supporting the market further.

Key Trends of Australia Data Center Cooling Market:

Rising Adoption of Liquid Cooling Technologies

The Australian market is experiencing significant growth due to the shift toward liquid cooling technologies, driven by their superior efficiency and scalability. Liquid cooling is becoming essential to handle high-density data centers, as it reduces energy consumption and operational costs while providing precise temperature control. For instance, a study conducted by Tao Lu et al examines innovative methods of waste heat recovery in data centers using liquid cooling technology to provide waste heat for building space heating, subsequently reducing the consumption of district heating and lowering CO2 emissions. Two heat exchanger schemes were proposed—one connecting to the secondary side (Scheme 1) and the other to the primary side (Scheme 2) of the cooling distribution unit—achieving significant energy savings, with Scheme 1 reusing 155.2 MWh of waste heat annually in comparison with 138 MWh for Scheme 2, and saving 2290.5 kWh and 905.2 kWh of electricity, respectively. Both schemes achieved profitability within a year, with Scheme 1 reducing CO2 emissions by 291,996 kg and Scheme 2 by 258,192 kg, making substantial contributions to carbon neutrality in data center operations. This integration of liquid cooling solutions with renewable energy sources is aligning with Australia’s sustainability goals, strengthening their adoption further.

Growth in Sustainable Cooling Solutions

The market is experiencing a notable rise in demand for eco-friendly cooling technologies to meet Australia’s carbon-neutral objectives. Data centers are increasingly integrating sustainable solutions, such as free cooling systems that leverage natural air and water sources, significantly reducing reliance on energy-intensive refrigeration. Furthermore, the adoption of modular cooling designs is allowing facilities to optimize power usage effectiveness (PUE). As per a Stulz Oceania article, the Polaris data center in Queensland, Australia, engaged with STULZ Oceania to improve the efficiency and sustainability of its cooling by employing the EMOS system along with optimization techniques. This collaboration brought the reduction of energy consumption in the cooling systems by 29%, while maintaining high standards in SLAs and the industry. Moreover, it increased the reliability of temperature and humidity control in the cooling infrastructure. These innovations align with government initiatives promoting green technologies and sustainable practices, enhancing the Australia data center cooling market growth potential in environmentally responsible cooling infrastructure.

Increasing Deployment of Artificial Intelligence in Cooling Systems

Artificial Intelligence (AI) is transforming data center cooling in Australia by enabling predictive maintenance and real-time optimization. AI-powered systems are improving energy efficiency by continuously monitoring temperature, humidity, and power usage to adjust cooling dynamically. For instance, as per a W.media article, the rise of AI and high-performance computing is reshaping data center investment and design, with increasing demand for high-density infrastructure. Average rack densities are projected to rise from 12 kW to 50 kW by 2027, with some AI clusters requiring up to 100 kW per rack, driving innovations like liquid cooling and AI-driven energy monitoring, highlighting the potential of AI to reduce the physical footprint and equipment needs of data centers. This trend is supported by rising investments in hyperscale data centers, which require intelligent cooling systems to manage heat effectively. Additionally, AI-driven solutions are helping operators reduce operational costs by minimizing equipment wear and ensuring uninterrupted operations, thereby making cooling systems more reliable and sustainable.

Growth Drivers of Australia Data Center Cooling Market:

Increased Data Center Investment and Hyperscale Growth

A major growth driver for Australia's data center cooling market is the increased investment in infrastructure by local operators as well as international hyperscale providers. Top tech companies are setting up or growing their footprint in Australia because of the country's politically stable climate, secure energy source, and geopolitical position in the Asia-Pacific region. This growing construction of data centers, especially in Sydney, Melbourne, and Canberra, requires extremely efficient and scalable cooling solutions. These huge facilities need sophisticated thermal management to accommodate high-density computing while meeting energy efficiency standards. Operators are hence making investments in purpose-designed cooling infrastructure, such as hybrid systems that integrate conventional air conditioning and liquid cooling technologies. The imperative to future-proof facilities from increasing computational loads and volatile energy costs also promotes flexible, energy-efficient cooling solutions. This investment momentum is a key driver of the Australia data center cooling market demand.

Regulatory Pressure and Sustainability Focus Driving Efficient Cooling Adoption

Australia's strict environmental regulations and energy performance rating systems like NABERS and Green Star ratings are key drivers of demand for more environmentally friendly cooling solutions in data centers. Regional incentives in Queensland and New South Wales encourage the use of low-global warming potential refrigerants and free-cooling systems that utilize ambient air or evaporative methods prevalent in Australia's coastal and inland environments. These regulatory systems compel providers to deploy high-efficiency precision air conditioning, VRF systems, and chilled beam solutions that maintain low energy intensity. Since Australian cities typically have to contend with mixed climate profiles ranging from humid subtropical climates in the eastern part of the country to hot and dry inland areas, operators design cooling infrastructures to achieve both performance and compliance requirements. This coordination of regulation, environmental stewardship, and market demand spur investment in eco‑friendly cooling technologies, supporting expansion throughout the national data center cooling industry.

Edge Facility Expansion and Localized Interconnectivity Needs

According to the Australia data center cooling market analysis, edge computing expansion and needs for fast, local digital services, like low‑latency 5G connectivity and AI inference at the edge of the network, are redefining the form of infrastructure in the region. Hubs in Queensland, Victoria, and South Australia are seeing increased demand for micro‑data centers with flexible, compact cooling systems. Smaller sites generally use modular, scalable cooling modules tend to be prefabricated to track the ambient environmental conditions and footprint limitations of Australia's varied regional topography. Moreover, local content deployment mandates and data sovereignty regulations push operators to site these facilities nearer the urban and suburban end users. Consequently, vendors of cooling equipment for Australia's market provide plug‑and‑play precision cooling cabinets, contained aisle solutions, and passive cooling designs optimized for tropical, temperate, or desert environments. With edge facilities increasing in number, their collective need for effective, region‑optimized cooling solutions drives the larger data center cooling market expansion across the country.

Australia Data Center Cooling Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Australia data center cooling market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on component, type of cooling, cooling technology, data center size, and vertical.

Analysis by Component:

- Solution

- Air Conditioning

- Chilling Units

- Cooling Towers

- Economizer Systems

- Liquid Cooling Systems

- Control Systems

- Others

- Services

- Consulting

- Installation and Deployment

- Maintenance and Support

Solution plays an important role in the Australia data cooling center market as the technological and infrastructural elements are crucial for efficient operations and sustainability. Solutions target energy-efficient systems, such as liquid cooling, advanced HVAC technologies, and modular designs tailored to climate conditions. These innovations help decrease carbon footprints while supporting the increasing demand for data, placing strategic emphasis on the importance of technology providers in optimizing energy use and ensuring system reliability.

Services play a crucial role in the market due to the maintenance, monitoring, and consultancy in achieving efficiency in data centers. Managed services, including remote monitoring and predictive analytics, ensure system uptime and cost control. In addition, consulting services guide data center operators toward sustainable cooling practices, regulatory compliance, and scalability, which reflect the growing emphasis on a robust service ecosystem to complement technological advancements.

Analysis by Type of Cooling:

- Room-Based Cooling

- Row-Based Cooling

- Rack-Based Cooling

Room-based cooling plays an important role for the market as it is a traditional method where the entire room is cooled uniformly, usually using raised floors or overhead ducts to distribute air. This system is cost-effective for facilities with low-to-medium heat densities and ensures reliability for legacy setups. It remains significant in Australia's data cooling market due to its compatibility with older data centers and its scalability for large, non-compartmentalized spaces.

Row-based cooling plays a significant role in the market as it places the cooling units between server rows for targeted cooling towards specific areas. This setup improves efficiency in terms of energy and reduces total cooling costs since one directly attacks the heat sources. Due to adaptability to newer high-density environments and integration with a modular infrastructure, it is preferred more by Australian enterprises looking to get the maximum out of their processes while at the same time diminishing carbon footprint.

Rack-based cooling plays a crucial role for the market as it targets individual racks, making it suitable for high-performance computing. The technology delivers unmatched precision, especially valuable for data centers requiring high power density. Rack-based cooling is very important in the Australian market as it incorporates more edge computing and advanced technologies to minimize energy consumption and ensure thermal management in compact configurations.

Analysis by Cooling Technology:

- Liquid-Based Cooling

- Air-Based Cooling

Liquid cooling plays a significant role in Australia's data center market due to superior efficiency in dissipation, particularly in high-performance computing systems. This method requires less energy consumption compared to other cooling methods and is ideal for sustainability and cost control during operations. This type of cooling technology is ideal for dense server data centers since the management of heat in these environments will determine their performance and reliability.

Air-based cooling plays a crucial role in the Australian data cooling centers as it is simple and cost-effective. It relies on air circulation for heat removal and is appropriate for facilities with moderate cooling needs. Economizers have helped improve the energy efficiency of air cooling, and this allows data centers to use their power more efficiently while ensuring that performance is maintained in various climatic conditions.

Analysis by Data Center Size:

- Mid-Sized Data Centers

- Enterprise Data Centers

- Large Data Centers

Mid-sized data centers play a crucial role in the Australia data cooling center market as it is designed to meet medium-scale businesses' needs for reliable, cost-effective cooling solutions. These centers are balanced between affordability and performance, serving industries such as healthcare, retail, and small IT firms. Modular designs often allow for scalability, which enables businesses to adapt to increasing demands while maintaining operational efficiency. They form a considerable part of the market, providing tailored solutions to bridge the gap between enterprise and large-scale data center operations.

Enterprise data centers play a significant role in the Australian data cooling center as it caters to large enterprises that have high IT needs and require dedicated cooling. It focuses on energy efficiency with high cooling capacity and critical infrastructure, such as financial services, government projects, and large-scale IT operations. Also, they need to offer highly secure, customized environments that can manage extreme workloads to ensure business continuity and comply with high regulatory standards.

Large data centers play an important role in the data cooling center in Australis as they are catering to hyperscale operations such as cloud computing giants and global IT service providers. These facilities require advanced cooling technologies to manage immense heat loads, ensuring uninterrupted performance and sustainability. Representing the pinnacle of data center infrastructure, they focus on innovation, leveraging technologies such as liquid cooling and AI-driven systems. Their role is pivotal in supporting Australia's digital transformation and global competitiveness.

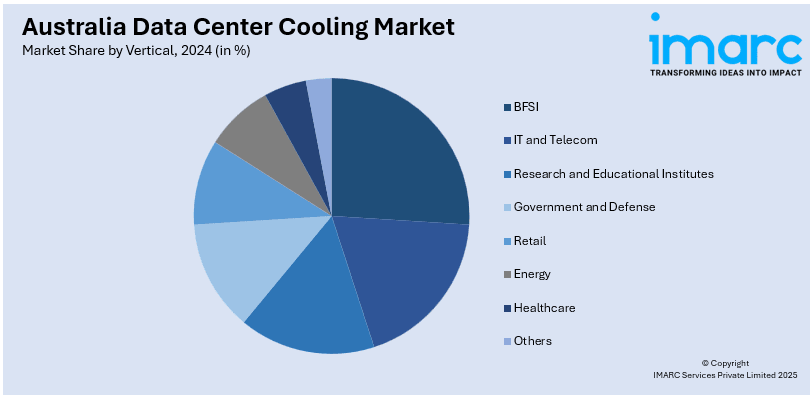

Analysis by Vertical:

- BFSI

- IT and Telecom

- Research and Educational Institutes

- Government and Defense

- Retail

- Energy

- Healthcare

- Others

Banking, Financial Services and Insurance (BFSI) plays a significant role in the market as it depends on a strong IT infrastructure to manage huge volumes of sensitive financial data. Increasing digitalization and data-intensive processes such as real-time transactions and fraud detection make efficient cooling systems crucial to maintaining server performance and reliability. Energy efficiency is the sector's priority for reducing operational costs and ensuring uninterrupted service to its clients.

The IT and telecom sector plays a vital role in the Australian data cooling center market as these sectors expand exponentially in data processing and cloud computing, optimal server conditions become essential to sustain operations. High-performance cooling technologies are critical in large-scale operations, ensuring uptime for the system, and responding to the increasing demand for connectivity and data-driven services by the consumers.

Research and educational institutions are significant contributors to the data cooling center market as they require high-performance computing systems for simulations, data analysis, and academic research. These institutions have limited budgets, so cost-effective and energy-efficient cooling solutions are emphasized. Through cutting-edge cooling technologies, they ensure smooth operation of their data centers, supporting innovation and advanced research initiatives that are critical to their missions.

Regional Analysis:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory (ACT) and New South Wales (NSW) are significant for the data cooling center market as both these regions are economically and technologically strong. Additionally, Sydney is an economic hub, accommodates thousands of organizations that generate significant data and need sophisticated cooling solutions. The region's infrastructural investments and pro-government policies enhance the development and uptake of efficient cooling technologies.

Victoria and Melbourne are significant contributors to the market of data center cooling, with its lively tech industry and the increasing need for data storage. Tasmania's cooler climate provides cost-effective opportunities for data center cooling, hence reduced dependence on energy-intensive systems. Apart from this, these regions drive innovation and sustainability in cooling technologies.

Queensland plays a crucial role in the Australian data cooling center market as the hot and humid climate of Queensland requires efficient cooling systems for data center operations. The state's growing industrial base and digital transformation initiatives are driving demand for advanced cooling solutions. Also, strategic investments in renewable energy also support sustainable data center practices in the region.

Northern Territory and Southern Australia play a crucial role in the market as these regions offer unique opportunities in the data cooling center market through emerging industrial hubs and strategic data infrastructure projects. Harsh climatic conditions of Northern Territory demand specific cooling solutions, while South Australia's renewable energy leadership aligns with sustainable cooling advancement.

Western Australia is playing a crucial role in the Australian data cooling center market as the mining sector and geographical isolation in the region create a strong need for localized data cooling infrastructure. The state's investments in high-capacity data centers and adoption of energy-efficient cooling technologies underpin its significance in the national market. In addition, Western Australia also supports innovation in remote and hybrid cooling systems due to its unique needs.

Competitive Landscape:

The Australia data cooling center market is marked by intense competition, driven by growing data storage demands and a strong emphasis on sustainability. Playes in the market focus on energy-efficient cooling technologies, including liquid and hybrid systems, to meet the environmental standards and reduce operational costs. The market is also shaped by innovation, with an increasing reliance on renewable energy sources to power data centers. Regional development and collaboration with the broader tech sector further intensify competition, with companies striving to offer advanced, reliable, and cost-effective cooling solutions to stay ahead in the dynamic landscape.

The report provides a comprehensive analysis of the competitive landscape in the Australia data cooling center market with detailed profiles of all major companies.

Latest News and Developments:

- On December 3, 2024, Australian IT firm Atturra acquired New Zealand-based data center company Plan B for NZD 20 million (USD 11.7 Million), with potential additional payments tied to performance targets. This acquisition aims to expand Atturra's managed services and presence in New Zealand, leveraging Plan B's network of five data centers. Both companies emphasized their shared commitment to customer success and geographical growth.

- On May 14, 2024, OVH cloud announced the launch of its third data center in Sydney, featuring advanced water-cooling technology to meet growing demands for high-compute cloud solutions. The new facility, designed for sustainability, eliminates air conditioning in server rooms, achieving significant reductions in environmental impact with a PUE of 1.29 and a WUE of 0.30l/kWh. This expansion aligns with OVH cloud's commitment to providing energy-efficient, high-performance cloud solutions, particularly for emerging technologies like 5G and generative AI.

Australia Data Center Cooling Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Types of Cooling Covered | Room-Based Cooling, Row-Based Cooling, Rack-Based Cooling |

| Cooling Technologies Covered | Liquid-Based Cooling, Air-Based Cooling |

| Data Center Sizes Covered | Mid-Sized Data Centers. Enterprise Data Centers, Large Data Centers |

| Verticals Covered | BFSI, IT and Telecom, Research and Educational Institutes, Government and Defense, Retail, Energy, Healthcare, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia data center cooling market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Australia data center cooling market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia data center cooling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Data center cooling refers to the systems and technologies used to regulate temperature and prevent overheating in data centers, ensuring optimal performance and reliability of servers and equipment. It includes various solutions like air-based, liquid-based, and hybrid cooling methods, aimed at managing heat generation in high-density computing environments.

The Australia data center cooling market was valued at USD 278.7 Million in 2024.

IMARC estimates the Australia data center cooling market to exhibit a CAGR of 5.8% during 2025-2033.

The Australia data center cooling market is expected to reach a value of USD 483.0 Million by 2033.

The Australia data center cooling market is evolving rapidly, with major trends pointing toward sustainable, high-efficiency solutions. Liquid cooling, such as direct-to-chip and immersion systems, is gaining traction to manage increasing heat from AI, cloud, and 5G-driven workloads. Precision air conditioning, free-cooling, and low-GWP refrigerants are also seeing wider adoption.

The market in Australia is majorly driven by the growing demand for advanced data centers due to the expansion of digital services, the increasing adoption of edge computing, rising energy costs prompting sustainable cooling solutions, and the expansion of 5G networks and AI technologies requiring efficient cooling systems.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)