Australia Data Center Construction Market Size, Share, Trends and Forecast by Construction Type, Data Center Type, Tier Standards, Vertical, and Region, 2025-2033

Australia Data Center Construction Market Size and Share:

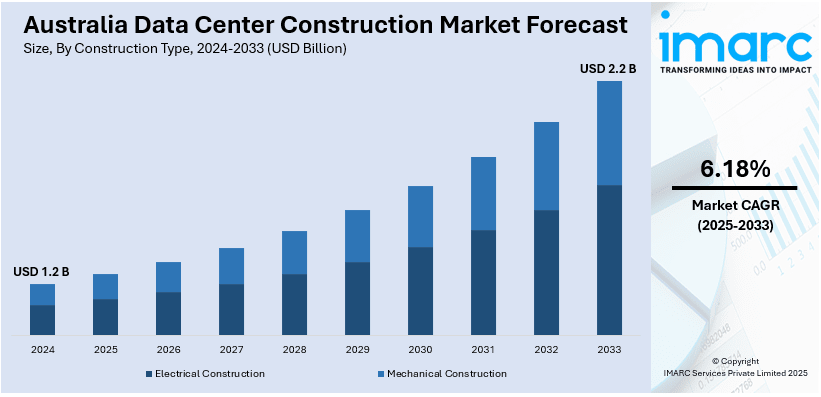

The Australia data center construction market size was valued at USD 1.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.2 Billion by 2033, exhibiting a CAGR of 6.18% from 2025-2033. The market is primarily driven by the continual advancements in digital technologies, rising integration of artificial intelligence, adoption of modular solutions, deployment of 5G infrastructure, enhanced focus on renewable power sources, growth in industry-specific IT needs, investments in secure facilities, and initiatives promoting sustainable development and operational scalability.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.2 Billion |

| Market Growth Rate 2025-2033 | 6.18% |

The market in Australia is majorly influenced by the growing emphasis on digital transformation in industries such as health care, retail, as well as finance. This is raising the demand for scalable and efficient data center infrastructure as businesses grapple with the increasing requirements for data storage and processing capability. The market is further bolstered by Australia's strategic focus on enhancing its digital infrastructure to attract investments. For example, on August 14, 2024, NEXTDC Limited opened its D1 Darwin data center in a strategic collaborative event with Vocus and the Northern Territory Government. The 7MW capacity facility will be able to support leading-edge technologies like artificial intelligence and will provide secure, low-latency access to cloud platforms worldwide. The establishment of facilities like NEXTDC development strengthens the Northern Territory's digital economy, which enables local businesses to embrace innovative solutions and compete in dynamic Asia-Pacific markets.

To get more information on this market, Request Sample

Government support through favorable policies and investments further accelerates market expansion. Strategic connectivity and Australia's geographical location also attract significant foreign investments, positioning the country as a hub for global data center operations. For instance, HMC Capital acquired Global Switch Australia Holdings Pty Limited on October 24, 2024, for about AUD 2.12 billion. The goal of this acquisition is the development of HMC's Global DigiCo Platform in two adjacent Sydney data center sites, which currently hold 26MW capacity and will grow up to 88MW capacity. The region is becoming increasingly crucial for the global data center scene. Increasing Investments and acquisitions in data security frameworks are creating an ecosystem that supports market growth.

Australia Data Center Construction Market Trends:

Increasing Demand for Environment-Friendly Data Center Design

Sustainability is becoming the focus in data center construction with environmental concerns and targets of energy efficiency. Operators are adding green building standards like LEED certifications to their projects. Renewable energy sources, including solar and wind power, are lessening dependency on traditional energy grids. Advanced cooling technologies, such as liquid cooling and free cooling systems, are being deployed to reduce energy consumption. For example, in October 2023, GreenSquareDC™ announced plans to develop an AUD 1 billion green AI data center in Perth, Western Australia. The project will feature a 300 MW wind and solar farm over 3,100 hectares, providing a renewable energy supply while reducing reliance on traditional grids. Initiatives like this enhance Australia's position as a leader in the sustainable development of data centers and go in line with global trends concerning renewable energy and reduction in carbon footprint.

Expansion of Hyperscale Data Center

The hyperscale data center expansion is significantly changing the market due to the investment of large-scale technology companies in these data centers to support high-density computing and big data analytics. Hyperscale data center is equipped with high-level power and cooling systems, making its operations efficient and reliable. For instance, on January 9, 2024, Delta Electronics installed 12 prefabricated Power Train Units (PTUs) for a hyperscale data center in Australia. These units, with high-efficiency, uninterruptible power supplies, and water-cooled direct expansion systems, significantly reduced the time taken for deployment, thus illustrating innovations that are driving the market forward. Complementing efforts like this not only addresses the pressing need for quick deployment but also supports the growing requirements of the market.

Adoption of Edge Computing Infrastructure

The adoption of edge computing infrastructure is the other major trend that enables the processing of real-time applications with low latency for devices and internet of things (IoT) applications. Modular data centers are gaining popularity, especially because of advances in 5G technologies. For example, OVHcloud recently launched its third data center in Sydney, which opened on May 14, 2024, with cutting-edge water-cooling systems to optimize sustainability and efficiency. This facility is part of OVHcloud's broader regional strategy to meet the growing demand for high-performance cloud solutions driven by emerging technologies like edge computing, 5G, and artificial intelligence (AI). OVHcloud's Sydney facility exemplifies this trend, as it leverages advanced cooling and energy-efficient designs to address the environmental challenges of edge computing.

Australia Data Center Construction Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Australia data center construction market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on construction type, data center type, tier standards, and vertical.

Analysis by Construction Type:

- Electrical Construction

- Mechanical Construction

Electrical construction is one of the main essentials for data center projects in Australia as it provides a smooth and stable power supply and enhances system reliability. Installation of advanced electrical systems with backup generators, uninterruptible power supplies (UPS), and high-efficiency power distribution are provided to make continuous operations 24/7. Increasing demand in cloud computing and digital storage demands robust electrical frameworks with the least downtime, improved energy efficiency, and compliance with tough standards and regulations.

Mechanical construction is an important aspect of maintaining optimal environmental conditions within data centers. This includes the installation of HVAC systems, cooling towers, and precision air handling units, which are critical for managing heat generated by servers. The increasing demand for data processing in Australia fuels innovation in energy-efficient mechanical solutions. Focusing on sustainability and cost-effectiveness, mechanical construction ensures that data centers remain operational and environmentally friendly, meeting the sustainability goals of the industry and the government.

Analysis by Data Center Type:

- Mid-Size Data Centers

- Enterprise Data Centers

- Large Data Centers

Mid-size data centers address businesses that have a need for scalability and cost-effectiveness for their data processing requirements. They are gaining relevance in Australia as they can support SMEs and are more flexible in the context of large enterprise operations and smaller-scale setups. This facility acts as a balance between performance and affordability between large enterprise operations and small-scale operations. It further enhances regional connectivity and catalyzes digital growth in underprivileged regions.

Enterprise data centers are crucial for large organizations requiring dedicated infrastructure to manage sensitive and high-volume data. These facilities in Australia emphasize customized solutions, enhanced security, and operational autonomy. They are key drivers in sectors like finance, healthcare, and government. Enterprise data centers also adopt advanced technologies such as artificial intelligence (AI) and machine learning (ML), ensuring efficient data handling and maintaining Australia's competitiveness in the global digital economy.

Large data center accommodates tens of thousands of computing servers within cutting-edge energy-efficient power systems managing high-density workloads for demanding applications. These data centers drive strong demand for cloud services, cloud storage, and the internet. The robust interconnectivity, as well as scalability, increases the digital infrastructure and economy of Australia.

Analysis by Tier Standards:

- Tier I and II

- Tier III

- Tier IV

Tier I and Tier II data centers are introductory facilities, which are typically designed for businesses that have very simple requirements and low uptime demands. In the Australian data center construction market, these tiers are necessary for start-ups and small businesses looking for low-cost solutions. Although they provide little redundancy, they become entry-level options that aid regional digital inclusion and allow for industries to transition over time to better infrastructure.

Tier III data centers form a considerable part of the fast-growing Australian data center construction market and offer high reliability and redundancy. They are built always to be available and running during maintenance operations, which is very useful for businesses that do not always need their systems up. Their cost-effective yet high-performance nature makes them useful for various types of businesses in Australia, and their adoption supports the country's expanding digital economy.

Tier IV data centers represent the utmost operational excellence, offering almost no downtime due to a system entirely fault tolerant. In Australia, these premium sites will serve as a prerequisite for organizations that require the highest availability, such as finance and the government. Given their resilience in handling high loads of critical work, Tier IV data centers further affirm Australia as the world's premier location for secure and reliable digital infrastructure.

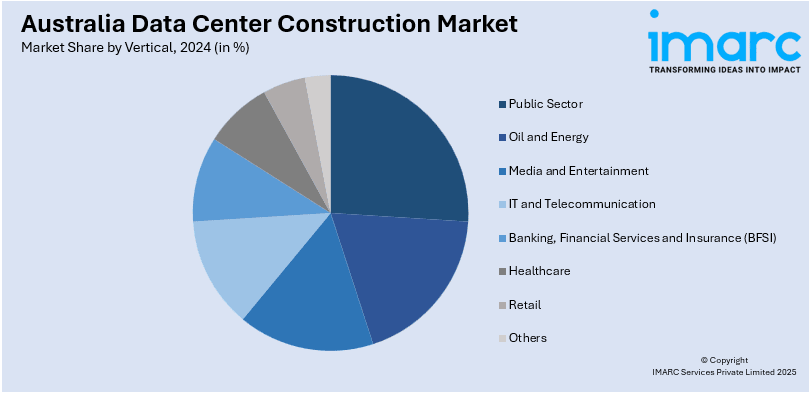

Analysis by Vertical:

- Public Sector

- Oil and Energy

- Media and Entertainment

- IT and Telecommunication

- Banking, Financial Services and Insurance (BFSI)

- Healthcare

- Retail

- Others

The focus on digital transformation and safe data storage leads to public sector demand in Australia for the data center construction market. E-governance and smart city projects undertaken by the government call for reliable infrastructure to handle sensitive data in massive volumes. Data centers serving the public sector focus on security, compliance, and energy efficiency as they support critical services aligned with national data sovereignty and sustainability objectives.

Oil and energy form the main pillar of the market, as they guarantee real-time analytics, monitoring, and operational efficiency in this sector. High-level technologies, such as the internet of things (IoT) and artificial intelligence (AI), are used for the energy grid, exploration, and production. With more emphasis placed on sustainability in oil and energy, it results in increasing the usage of energy-efficient data centers, forming a complementary cycle driving both digitalization and shifting to renewable energies.

The media and entertainment industries require highly performing data centers to be able to sustain large amounts of content production, storage, and delivery. Rapid growth in Australian digital media consumption has promoted the development of data centers supporting high-bandwidth and low-latency services. Data centers ensure uninterrupted content delivery and inspire gaming, video streaming, and broadcasting innovation.

Regional Analysis:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

This region is a prime hub for government and financial services, thus creating the need for robust data center infrastructure. New South Wales has Sydney as one of its prime tech hubs, which attracts hyperscalers and cloud providers around the world. Proximity to major financial institutions and regulatory bodies further adds to the importance of data centers in this region, fostering economic growth and supporting national digital transformation initiatives.

Victoria, in general, Melbourne, is emerging as the largest data center construction market within the region because of the area's favorable location and robust ecosystem with leading ICT industries. The industry involves health care, education, and finance sectors which involve reliability for storing data. Tasmania finds favor due to access to renewable energy and finds a way for green energy solutions set by Australia, which is also encouraging environment-friendly investments.

Queensland is showing increased data center activity mainly due to the growing business landscape and the need for regional connectivity. Diversifying the economy of the state and advancing digital infrastructure supports mid-size and enterprise data center growth. Disaster resilience planning in Queensland also makes it a good location for data centers demanding high operational reliability and redundancy.

The Northern Territory and South Australia play a major part in the market as the region focuses on supporting industries such as mining, energy, and public services through data centers. These regions emphasize edge computing to increase connectivity in remote areas, driving regional economic development. With the availability of renewable energy resources, South Australia is also surfacing as a sustainable data center location, in line with general environmental goals.

The western region plays a significant part in the market as the market supports the resource-driven economy of the region, such as mining and energy industries, that heavily depend on advanced analytics and Internet of Things (IoT) technologies. The strategic location to connect the Asia-Pacific markets further strengthens the region's position in the market. The region also benefits from renewable energy investments, making it an ideal place for an eco-friendly data center facility.

Competitive Landscape:

The competitive landscape of the Australia data center construction market is characterized by significant collaborations among developers, technology providers, and infrastructure specialists. For instance, on September 4, 2024, Blackstone Inc. announced that, in collaboration with the Canada Pension Plan Investment Board, it would be acquiring AirTrunk, the prominent Asia-Pacific data center platform, from Macquarie Asset Management and the Public Sector Pension Investment Board. The transaction, valued at over AUD 24 Billion, marks Blackstone's greatest investment in Asia-Pacific, as digital infrastructure investment increases with the advance of artificial intelligence (AI) and widespread digitization. Many companies are turning towards energy-efficient design and integration of renewable energy in line with sustainability goals. Additionally, strategic partnerships with local governments and utility providers have eased the process of executing projects while ensuring compliance with the rules. Investments in modules of construction and systems using artificial intelligence (AI) are further improving operational efficiency and scalability in a market that is constantly evolving.

The report provides a comprehensive analysis of the competitive landscape in the Australia data center construction market with detailed profiles of all major companies.

Latest News and Developments:

- June 13, 2024: Macquarie Data Centers started construction of IC3 Super West in Sydney with FDC Construction as the main contractor. Designed to support the highest-density cloud and artificial intelligence (AI) workloads, the data center will include hybrid air and liquid cooling systems to service the most advanced computing loads. The development is expected to create over 1,200 jobs and marks a major expansion of Macquarie's Park Data Centre Campus, with a total IT load capacity to be increased to 63 megawatts.

- November 29, 2024: DCI Data Centers unveiled a new AUD70 million high-security data centers, ADL02, in Kidman Park, Adelaide. This facility increases the campus's total IT load capacity to 5.4MW and offers 24/7 on-site security with access to 100% renewable power. The investment highlights DCI's dedication to strengthening South Australia's digital infrastructure, driving the state's economic development and progress in technology.

Australia Data Center Construction Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Construction Types Covered | Electrical Construction, Mechanical Construction |

| Data Center Types Covered | Mid-Size Data Centers, Enterprise Data Centers, Large Data Centers |

| Tier Standards Covered | Tier I and II, Tier III, Tier IV |

| Verticals Covered | Public Sector, Oil and Energy, Media and Entertainment, IT and Telecommunication, Banking, Financial Services and Insurance (BFSI), Healthcare, Retail, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia data center construction market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Australia data center construction market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia data center construction industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Data center construction involves designing, building, and equipping facilities that house IT infrastructure, including servers, storage, and networking equipment. Applications include cloud computing, data storage, content delivery, and supporting industries such as finance, healthcare, and telecommunications with secure and scalable digital solutions.

The Australia data center construction market was valued at USD 1.2 Billion in 2024.

IMARC estimates the Australia data center construction market to exhibit a CAGR of 6.18% during 2025-2033.

The key factors driving the Australia data center construction market include rising demand for cloud computing, rapid digitization, the expansion of artificial intelligence (AI) driven applications, and government investments in digital infrastructure. Additionally, the focus on energy efficiency and sustainable construction further supports market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)