Australia Dairy Market Size, Share, Trends and Forecast by Product, Application, Distribution Channel, and Region, 2025-2033

Australia Dairy Market Size and Share:

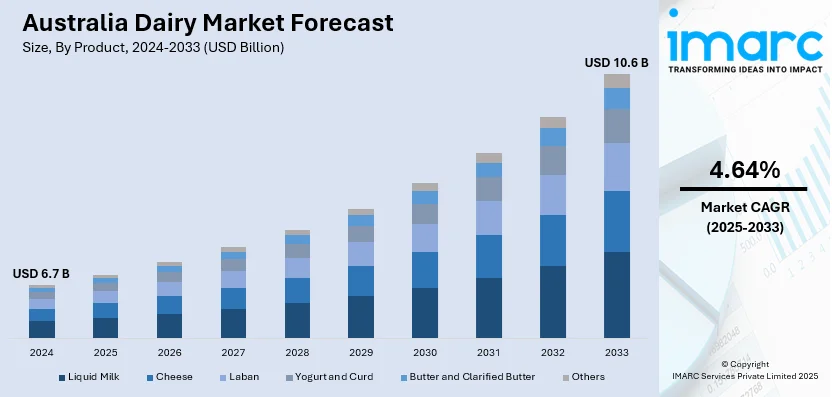

The Australia dairy market size was valued at USD 6.7 Billion in 2024. Looking forward, the market is projected to reach USD 10.6 Billion by 2033, exhibiting a CAGR of 4.64% from 2025-2033. Some of the factors driving the Australia dairy market include the growing demand for plant-based alternatives, advancements in dairy farming and production technologies, increased consumer preference for premium and specialty dairy products, and robust government support and initiatives promoting sustainability and innovation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.7 Billion |

| Market Forecast in 2033 | USD 10.6 Billion |

| Market Growth Rate (2025-2033) | 4.64% |

One of the major drivers of the Australia dairy market is the rising health awareness among consumers. With lifestyle diseases such as obesity, diabetes, and heart conditions gaining prevalence, Australian consumers are finding healthier dietary options that incorporate these dairy products known for their rich nutritional profiles. Milk, yogurt, and cheese are recognized sources of calcium, protein, and essential vitamins such as B12, making them important for a healthy diet. With consumers increasingly seeking healthy alternatives, the demand for functional and fortified dairy products, such as low-fat milk or probiotic yogurts, has increased. This trend is also supported by plant-based dairy alternatives, which are also seen as healthy, and drives innovation in the dairy market. The health trend thus motivates the dairy industry to evolve and come up with products that are healthier yet sustainable and of good quality.

To get more information on of this market, Request Sample

The dairy market in Australia is also driven by its strong export business, mainly to emerging markets in Asia. China, Japan, and many other countries in Southeast Asia require premium-quality Australian dairy products such as milk powders, butter, and cheese. The demand is created on account of Australia’s record for high-quality control and safe production processes and the beneficial climatic conditions that favor the production of high-grade dairy outputs. FTAs between Australia and several Asian economies have further promoted market access through tariff reductions, which enhances the competitive advantage. Growth of urbanization and rising disposable incomes in the importing countries fuel the demand for diversified dairy products. To meet the international standards and changing tastes, Australian dairy producers are heavily investing in innovative processing techniques, sustainable farming practices, and targeted marketing that further reinforces their position as a global dairy leader.

Key Trends of Australia Dairy Market:

Technological Advancements in Dairy Farming and Processing

Technological innovations in dairy farming and processing are widely driving the Australian dairy market. Precision farming techniques include automated milking systems as well as IoT-enabled farm management, which has brought a lot of productivity as well as efficiency to the production of milk. Reduced labor costs, optimized feed use, and better animal welfare mean higher-quality milk output. On the processing front, the development of pasteurization, packaging, and cold-chain logistics has made the shelf life longer, allowing dairy products to remain fresh for longer periods while making their distribution across both local and international markets easier. Advancements in product development include lactose-free milk and non-dairy dairy products that cater to niche markets while further opening up the consumer base. Adopting blockchain technology in supply chains ensures traceability, which is increasingly being important for the ethical and sustainable consumer who seeks transparent sourcing practices.

Shift Toward Premium and Specialty Dairy Products

Australian consumers are increasingly seeking premium and specialty dairy. The demand for organic milk, artisanal cheeses, and probiotic-enriched yogurts is complimented with a desire for indulgence in unique flavors and added health benefits. Environmentally conscious and health-focused consumers are attracted to organically grown dairy products, devoid of synthetic fertilizers and antibiotics. Specialty cheeses and yogurts appeal to culinary enthusiasts and those looking to take their dining experiences to a higher level. Brands tap into this demand by improving product differentiation and storytelling on provenance and craftsmanship. In doing so, they also create space for small-scale, boutique dairies that can add some dynamism to the market.

Government Support and Industry Initiatives

Government policies, especially industry-supported initiatives, are seen as an important driver of the Australian dairy market. Federal and state governments work to support the dairy farming sector by offering subsidies, grants, and research funding for improving productivity and sustainability. For instance, water-efficient and better pasturing programs help farmers counter drought attacks that have been affecting the industry since times immemorial. Whereas industry federation, such as Dairy Australia, that has close consultation with farmers in providing training, availability of technology, and accessing the market. They identify areas where the products could be of superior quality, ensuring compliance with international standards, and reinforcing domestic consumption. Collaboration between the government, private sector, and research institutions builds on innovation, such as drought-resistant feeds or enhanced milk production through genetic advances in cattle.

Growth Drivers of Australia Dairy Market:

Health-Focused Consumption

Australian consumers are increasingly emphasizing health in their dietary choices, resulting in a positive influence on the dairy sector. There is a heightened awareness of the nutritional benefits of dairy, especially its contributions to muscle health, bone density, and gut functionality. Products that are high in protein, such as Greek yogurt and protein-enriched milk, are experiencing greater popularity, particularly among health-conscious consumers. Similarly, items enriched with calcium and probiotics attract families and older individuals. Functional dairy products like kefir and cultured yogurt drinks are gaining traction in grocery stores. As consumers continue to seek convenient but nutritious food options, these trends are anticipated to grow further, bolstering overall demand in the Australia dairy market demand.

Cold Chain Expansion Boosting Regional Dairy Access

Australia’s enhancements in cold chain logistics have played a crucial role in increasing the availability of dairy products beyond urban centers. Retailers and suppliers have made significant investments in temperature-controlled distribution networks, resulting in improved product quality and extended shelf life, even in rural and remote regions. Refrigerated transport and upgraded storage systems enable products like fresh milk, cheese, and yogurt to be distributed over longer distances without spoilage. This advancement has opened new markets across regional Australia, allowing consumers to access a wider selection of fresh and specialty dairy items. The expanded reach also benefits small and mid-sized dairies by broadening their customer base and enhancing their competitive edge.

Ethics and Sustainability Shaping Consumer Choice

Younger consumers in Australia are increasingly favoring dairy brands that reflect their values around sustainability and ethical practices. Transparency in sourcing, low-emission methods, and certifications for animal welfare are now expected rather than optional. Companies are investing in initiatives aimed at carbon reduction, recyclable packaging, and pasture-based farming to meet this consumer demand. Labels that provide information on animal treatment, feed quality, and environmental impact are influential in purchasing decisions, particularly in premium markets. These practices attract ethically conscious shoppers and allow brands to stand out in a crowded marketplace. Ethical branding is becoming a significant factor for customer loyalty and pricing strategies, according to Australia dairy market analysis.

Opportunities of Australia Dairy Market:

Growth in Value-Added and Functional Dairy Products

The Australian dairy market is evolving towards high-margin, value-added segments driven by changing health and lifestyle preferences. Products such as lactose-free milk, protein-enriched yogurt, probiotic drinks, and fortified infant formula are gaining popularity among health-oriented consumers and those with dietary restrictions. These categories enable producers to move away from commodity pricing, offering greater returns per liter. Innovations in flavor, texture, and health benefits are also generating fresh interest in established categories like milk and yogurt. Functional claims such as “gut health,” “immune support,” and “high protein” are resonating with consumers across various age groups. As awareness of food's impact on health increases, value-added dairy presents a clear growth opportunity within the Australian market.

Private Label Expansion with Retail Chains

Australian supermarkets are increasing their investment in private label dairy products, creating significant opportunities for domestic producers. These in-house brands provide stable demand, enabling dairies to secure long-term supply agreements and mitigate exposure to price fluctuations in bulk markets. Retailers are also broadening their private label offerings to incorporate organic, lactose-free, and premium dairy options beyond traditional low-cost products. This paves the way for innovation and product differentiation within the private label sector. For smaller and mid-sized dairies, this strategy allows for greater distribution without necessitating extensive branding investments. As retail players strive for quality and variety, private label collaborations are becoming a key growth strategy.

Opportunity in Plant-Dairy Hybrid Products

Plant-dairy hybrids are emerging as a niche but expanding category in the Australian dairy market, appealing to health-conscious and flexitarian consumers. These products combine traditional dairy with plant-based ingredients like oats, almonds, or coconut to offer new textures, nutritional profiles, and sustainability credentials. Examples include oat-milk yogurts, dairy beverages infused with almond or soy, and blended cream alternatives. This segment permits dairies to engage with plant-based demand while still remaining within the animal dairy framework. It also provides a platform for creative exploration in flavor, packaging, and functional claims. As more Australians embrace flexible eating habits, hybrids are well-situated to connect traditional dairy with contemporary consumer expectations related to health and environmental impact.

Australia Dairy Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Australia dairy market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product, application, and distribution channel.

Analysis by Product:

- Liquid Milk

- Cheese

- Laban

- Yogurt and Curd

- Butter and Clarified Butter

- Others

Liquid milk is one of the largest parts of the Australian dairy market, mainly due to its daily consumption as a staple product. The fresh and long-life milk varieties are predominant, but organic and A2 milk varieties are also gaining traction. The producers aim to make their production more sustainable, with innovations in packaging and carbon emissions reduction measures being welcomed by consumers.

Cheese forms a fast-growing segment, and both reflect the demand in domestic market and export potential. Cheddar, mozzarella, and some specialty artisanal cheeses have gained immense popularity among the Australians. Gourmet food and home cooking have boosted demand for premium and flavored cheese products. There is also increasing focus on developing innovative, lower-fat, and plant-based cheese to cater to health-conscious consumers. The Australia dairy market forecast highlights significant growth driven by innovative, lower-fat, and plant-based cheese options catering to health-conscious consumers.

A popular new ferment in the Australian market among middle eastern and health-conscious groups, probiotic laban is marketed for its refreshing drink or ingredient application for cooking. Manufacturers are continuing their innovation with flavored and fortified lines to target consumers looking for digestive health benefits and unique flavors within the dairy aisle.

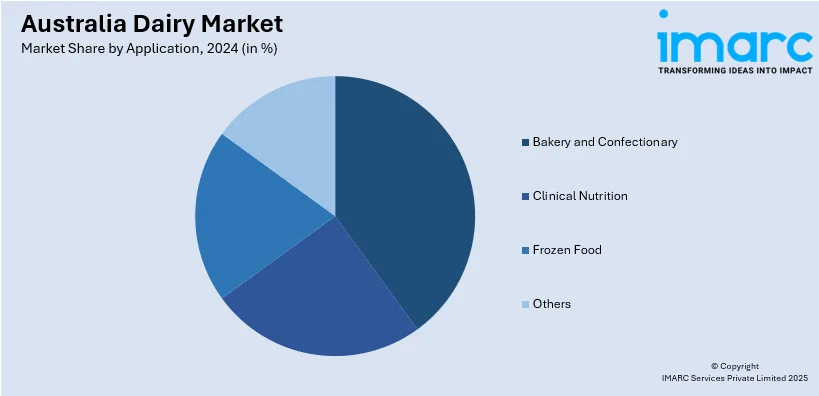

Analysis by Application:

- Bakery and Confectionary

- Clinical Nutrition

- Frozen Food

- Others

Bakery and confectionery are one of the biggest drivers of the Australian dairy market. Butter, cream, and milk powders are used in producing cakes, pastries, and chocolates. All these enhance flavor and texture. The rising demand for premium baked goods and artisanal confectioneries, combined with consumer indulgence, maintains the high usage of dairy in this segment.

Dairy-based clinical nutrition products in this market include protein-enriched milk powders and yogurts, which cater to the demand from health-conscious consumers and older people or patients on nutritional support. It contributes significantly to muscle recovery as well as bone health because it has calcium and other nutritional contents. This creates further pressure on this dairy-based nutritional solution market from rising lifestyle diseases and an increasing older population. The growing Australia dairy market size reflects increased demand driven by rising lifestyle diseases and an aging population.

Frozen food, such as ice cream, ready-to-eat meals, and frozen desserts, remains one of the largest application areas for dairy. The presence of cream, milk solids, and cheese ingredients provides the taste and mouthfeel required. Increased consumer demand for convenience foods and indulgent frozen desserts, coupled with innovation in flavor profiles, are driving dairy's participation in this growing category.

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialist Retailers

- Online Stores

- Others

Supermarkets and hypermarkets hold a significant Australia dairy market share of sales as they are one-stop-shop experience, from milk and cheese to plant-based options, under one roof. The high reach through supermarkets in terms of convenience and competitive price gives Woolworths and Coles much value. Their ability to present promotions and loyalty drives many footfalls and substantial sales volumes.

Convenience stores cater to the on-the-go consumer, and it is easy to see why-they emphasize convenience and immediacy. Their popularity in single-serve dairy products like yogurt cups and flavored milk can fill the quick, last-minute purchase need. They fit nicely in urban and suburban areas, although they are usually priced higher than other retail formats. They have a smaller footprint and rely more on convenience rather than cost efficiency.

Specialist retailers target niche markets and sell premium, organic, and artisanal dairy products. Such outlets focus on quality, provenance, and specialty items such as handcrafted cheeses or dairy from a particular region. They serve health-conscious and discerning consumers who are looking for a more personal experience combining in-store expertise with a curated shopping experience. Although their market share is lower, their impact on premium and specialty segments is greater.

Regional Analysis:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The ACT and NSW regions are important for their consumer base and proximity to urban markets such as Sydney. These areas are the main centers for processed dairy products, such as milk and yogurt. Though production is limited due to smaller farming areas, their developed distribution networks and consumer demand drive high sales of premium and specialty dairy products.

Victoria and Tasmania hold a notable Australia dairy market share, accounting for more than two-thirds of the country's milk production. These regions have good climates, fertile soils, and infrastructure in place. Victoria is particularly strong in milk, cheese, and butter, especially in the Gippsland region, whereas Tasmania's boutique dairies are known for artisanal and organic products that cater to niche markets.

Queensland is significantly smaller in its dairy output but provides a major fresh milk supply source for northern parts of Australia. Challenges faced by the state, therefore, are mainly related to drought, which creates additional investment needs in robust dairy farming. Queensland dairy concentrates on local production and demand, focusing on more sustainable operations so as to respond to changing consumer expectations.

Competitive Landscape:

Key players in the Australian dairy market, such as Fonterra, Saputo Dairy Australia, and Lactalis, are employing diverse strategies to drive growth and sustainability. These companies are heavily investing in product innovation to meet evolving consumer preferences, introducing organic, lactose-free, and plant-based dairy options. Fonterra, for instance, has focused on expanding its premium cheese and yogurt offerings, while Saputo has made strides in reducing its carbon footprint by adopting renewable energy and water-efficient practices. Additionally, Lactalis has enhanced its portfolio with functional and fortified dairy products targeting health-conscious consumers. Collaboration with local farmers is another cornerstone, ensuring consistent milk supply and promoting ethical farming practices. Investments in advanced processing technologies and cold-chain logistics have helped maintain product quality and extend market reach. Moreover, these players are actively involved in global marketing campaigns and partnerships, emphasizing Australia's reputation for high-quality dairy to strengthen their foothold in international markets.

The report provides a comprehensive analysis of the competitive landscape in the Australia dairy market with detailed profiles of all major companies.

Latest News and Developments:

- December 2024: Minecraft has introduced a new range of flavored milks into the Australian food and beverage category for the first time, which is made by Norco Co-operative, Australia’s oldest and largest dairy co-operative.etitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

- October 2024: Pure Dairy’s new 13,000-square-metre facility in Dandenong South, set to launch in April 2025, will revolutionize Australian dairy manufacturing with advanced automated processing systems and sustainable technologies. The project will produce premium dairy and plant-based products for domestic and international markets. The facility reflects Pure Dairy’s commitment to innovation and environmental responsibility.

- September 2024: Fonterra Oceania unveiled a variety of innovative dairy products across Australia and New Zealand, catering to evolving consumer preferences for convenience and bold flavors. New Zealand saw launches like Anchor Ghee, Mainland Chilli and Garlic Brie, and Kapiti yoghurt singles, while Australia introduced Mainland Sweet Cinnamon Spreadable and a Bega cheese snacking range.

- April 2024: Ashgrove Cheese introduced "Ashgrove Eco-Milk," the world's first climate-friendly milk, in Tasmania. Using SeaFeed, a supplement made from native Tasmanian red seaweed, the milk reduces methane emissions by 25%, highlighting Ashgrove's commitment to sustainability. The product features eco-friendly packaging and is available in Woolworths and IGAs, with plans for expansion.

- February 2024: Brownes Dairy in Western Australia launched its Club Cheddar range, featuring flavors like Vintage, Pickled Onion, Green Peppercorn, and Smokey Red. The range builds on their successful cheddar offerings, produced using locally sourced Western Australian milk. Club Cheddar is now available at IGAs across Australia.

Australia Dairy Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Liquid Milk, Cheese, Laban, Yogurt and Curd, Butter and Clarified Butter, Others |

| Applications Covered | Bakery and Confectionary, Clinical Nutrition, Frozen Food, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialist Retailers, Online Stores, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia dairy market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Australia dairy market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia dairy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Dairy refers to foods made from or containing milk, mainly derived from mammals like cows, goats, and sheep. Common dairy products include milk, cheese, butter, yogurt, and cream. The dairy industry deals with the production, processing, and distribution of these products for consumption, offering necessary nutrients such as calcium and protein.

The Australia dairy market was valued at USD 6.7 Billion in 2024.

IMARC estimates the Australia dairy market to exhibit a CAGR of 4.64% during 2025-2033.

The Australia dairy market is driven by rising consumer demand for diverse dairy products, technological advancements in production, and increasing preference for healthy, high-quality foods. Government support for sustainable farming practices and expanding product innovation, including lactose-free and plant-based options, further support the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)