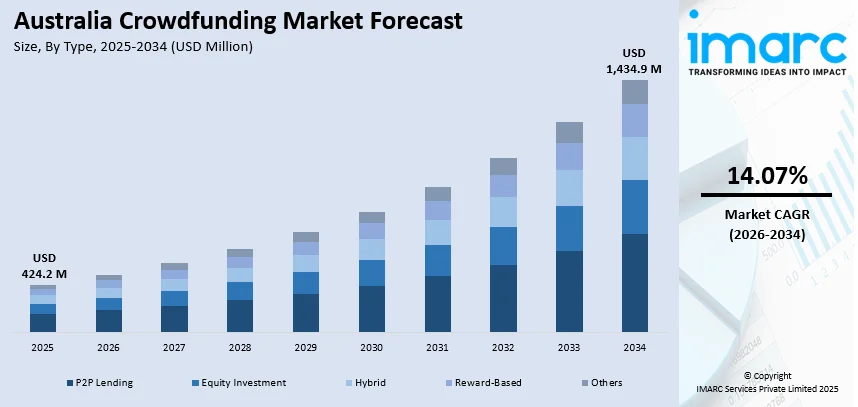

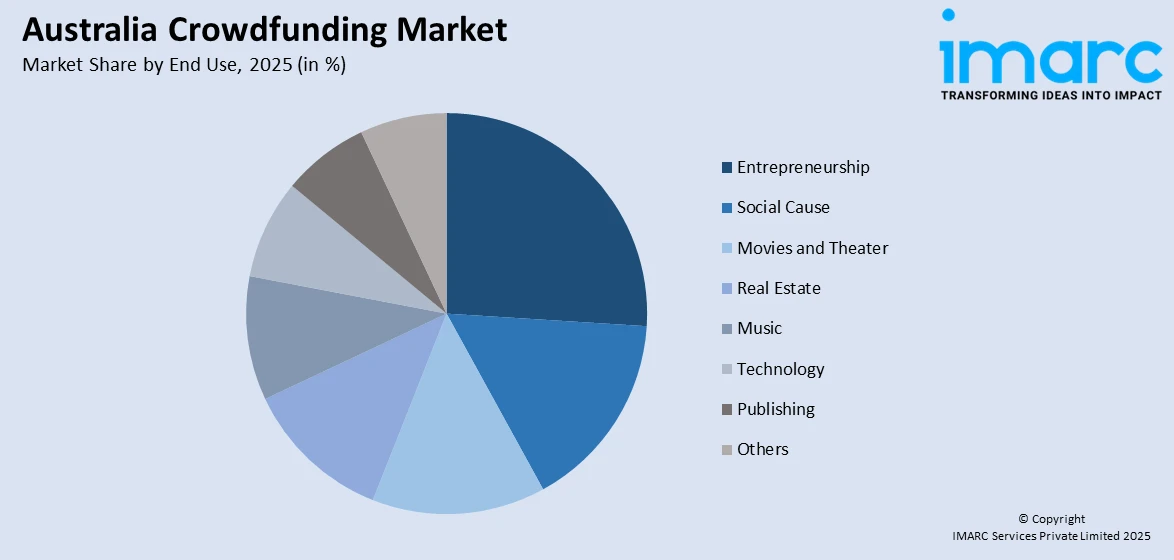

Australia Crowdfunding Market Report by Type (P2P Lending, Equity Investment, Hybrid, Reward-Based, and Others), End Use (Entrepreneurship, Social Cause, Movies and Theater, Real Estate, Music, Technology, Publishing, and Others), and Region 2026-2034

Market Overview:

Australia crowdfunding market size reached USD 424.2 Million in 2025. Looking forward, the market is expected to reach USD 1,434.9 Million by 2034, exhibiting a growth rate (CAGR) of 14.07% during 2026-2034. The increasing proliferation of internet access and the rise of digital platforms, which have facilitated the ease of crowdfunding, is primarily driving the market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 424.2 Million |

| Market Forecast in 2034 | USD 1,434.9 Million |

| Market Growth Rate (2026-2034) | 14.07% |

Crowdfunding is a fundraising method that leverages the collective support of a large number of individuals, typically through online platforms. Entrepreneurs, artists, or charitable causes seeking financial backing present their projects or ideas to the public, who can then contribute small or large amounts of money to help bring the initiative to fruition. This democratized approach to funding enables creators to access capital without relying solely on traditional sources like banks or investors. Crowdfunding platforms, such as Kickstarter or Indiegogo, host campaigns where supporters receive rewards or benefits based on their contribution level. This model fosters community engagement, empowers grassroots initiatives, and transforms the way projects across various industries secure financial support.

To get more information on this market Request Sample

Key Trends of Australia Crowdfunding Market:

Emergence of Equity Crowdfunding and Startup Ecosystem Development

Australia's crowdfunding industry has witnessed a significant move toward equity crowdfunding, spurred by the nation's thriving startup ecosystem and innovative regulatory conditions. Contrary to the standard reward-based form of crowdfunding, equity crowdfunding permits investors to acquire shares in early-stage firms, thus facilitating increased public access to financing for innovation. This is especially the case in Australia, where more startups are looking for alternative funding beyond traditional venture capital and bank financing. The Australian Securities and Investments Commission (ASIC) has put in place streamlined rules specifically targeted at promoting equity crowdfunding platforms such that smaller investors can participate more easily while still having their protections in place. This regulatory transparency has contributed to driving growth in the industry, with more capital and investors made accessible to startups. The trend also demonstrates an overall change in culture of investment, where Australians are willing to invest in entrepreneurial ventures, promoting innovation and employment opportunities in the domestic economy.

Integration of Technology and Digital Payment Innovations

The Australia crowdfunding market share is greatly influenced by technological and online payment system advances, transforming the way campaigns are initiated, controlled, and financed. Sites are integrating mobile friendliness, social media connectivity, and safe payment gateways to improve user experience and reach. With such a high level of internet penetration and adoption of digital banking in Australia, crowdfunding campaigns are able to cost-effectively access large, tech-aware audiences. In addition, budding blockchain technology is starting to gain traction, with promising advantages such as enhanced transparency, smart contracts, and lower costs. Such innovations in technology improve fundraising campaign success rates while enhancing mutual trust between donors and fundraisers. With digital literacy and fintech adoption increasing in Australia, the market for crowdfunding is set to become more vibrant and accessible, enabling projects from various sectors like creative industries, social enterprises, and environmentally friendly technology, to reach supporters nationwide and overseas.

Social Impact and Community-Focused Campaigns

One of the most notable trends influencing the Australia crowdfunding market growth is the increasing popularity of social impact and community-focused campaigns. Most of the Australian fundraisers are using crowdfunding to tackle local social causes, fund environmental causes, and support indigenous businesses, a testament to the high level of community orientation and environmental concern in the country. Causes that are typical in campaigns include mental health services, clean energy projects, educational programs, and cultural conservation initiatives. This is backed by social enterprise and nonprofit-focused platforms that offer targeted tools for measurement of impact and donor outreach. Social awareness about corporate social responsibility and ethical investing has also increased the call for campaigns that produce measurable social gains. This social orientation distinguishes the Australian crowdfunding market and inspires greater involvement and commitment from donors who wish to genuinely impact with their contribution, reinforcing the overall system's resilience and potential for growth.

Growth Drivers of Australia Crowdfunding Market:

Supportive Regulatory Environment and Government Initiatives

One of the primary growth drivers of Australia's crowd financing market is the nation's facilitative regulatory environment, which has been judiciously crafted to ensure investor protection while making the market accessible. The Australian Securities and Investments Commission (ASIC) has a leading role in enacting rules that enable crowdfunding operations, specifically in equity crowdfunding, for small and medium-sized enterprises (SMEs) to raise funds from a wider pool of investors. In contrast to other nations where regulatory restrictions confine crowdfunding to reward-based models, Australia's forward-thinking strategy supports public engagement in startup business funding with obvious disclosure standards and investor limits to hedge risks. Also, government initiatives that promote innovation and entrepreneurship complement these regulations by motivating startups to try crowdfunding as a suitable source of funding. The regulatory clarity and promotion by authorities instill confidence among investors and entrepreneurs alike and play a role in expanding the overall ecosystem of crowdfunding within Australia.

Increasing Entrepreneurial Culture and Startup Ecosystem

According to the Australia crowdfunding market analysis, thriving entrepreneurial spirit and fast-growing startup economy are key drivers of the growth in the industry. Sydney, Melbourne, and Brisbane have emerged as innovation hotspots and are magnets for talent, incubators, and accelerators that support new businesses. Most startups discover that crowdfunding is a favorable option compared to conventional funding sources such as banks or venture capitalists, given the former's ability to provide access to a broader capital pool and the opportunity to test products with initial backers. The variety of industries that enjoy the benefit of crowdfunding, from technology and artistic endeavors to social enterprises and local businesses, indicates the expanding reach of this type of financing. This cultural transformation toward adopting innovation and risk-taking is inspiring more entrepreneurs to create crowdfunding campaigns, while at the same time building a community of investors willing to invest in new Australian companies and further stimulate economic growth.

Growing Digital Connectivity and Fintech Usage

Australia's superior level of digital connectivity and its quick uptake of fintech solutions are the key drivers of growth for the crowdfunding industry. With ubiquitous internet use and a population familiar with financial transactions online, crowdfunding sites are able to access a large and active base. The use of secure digital payment infrastructure, mobile applications, and social media campaign tools increases the visibility of campaigns and streamlines the funding process, which means more individuals are willing to become backers or investors. In addition, fintech technologies like smart contracts and blockchain are slowly impacting the market by providing enhanced transparency, lowered costs of transactions, and quicker settlement. This digital infrastructure aids conventional reward-based crowdfunding along with intricate designs like equity crowdfunding, where security and trust are the top priorities. As digital finance remains on the rise in Australia, the crowdfunding market can expect to be boosted by greater accessibility, efficiency, and investor confidence, further cementing its growth trend.

Opportunity of Australia Crowdfunding Market:

Increasing Access for Regional and Remote Entrepreneurs

Australia's distinctive geography offers a huge chance for the crowdfunding industry to cater to regional and remote entrepreneurs. Beyond large urban centers such as Sydney and Melbourne, small ventures and startups are often at a disadvantage in terms of accessing conventional financing owing to remoteness from financial centers and limited local investor networks. Crowdfunding websites, easily accessed over the internet, eliminate these spatial constraints by bridging regional innovators directly with a large aggregate of prospective supporters or investors nationwide and even globally. This democratization of capital is especially significant in a nation where rural industries like agriculture, mining, and tourism are crucial to the economy and increasingly seeking to innovate with new technologies or green practices. By facilitating inclusive funding prospects for regional entrepreneurs, crowdfunding can contribute to diversifying Australia's economic base and support growth in communities that are often underserved by traditional finance systems.

Social Impact and Indigenous Business Opportunities

One of the greater opportunities within Australia's crowdfunding industry is investing in social enterprises and indigenous ventures. There is an increasing need for Australian investors and philanthropists to fund projects that have a beneficial social, environmental, or cultural impact. Crowdfunding is poised to make it easy to finance community-based projects such as renewable energy, mental health initiatives, education schemes, and cultural preservation programs, especially those by Aboriginal and Torres Strait Islander business owners. Such projects are normally unable to get traditional funding yet deeply appeal to a willing public who want to be part of something meaningful. Crowdfunding campaigns can also mobilize attention and community support for these causes, developing groups of people who are invested in the success of the ventures. The synergies between crowdfunding and the region’s increasing social impact orientation are a compelling way to further the growth of the Australia crowdfunding market demand, while achieving the goals of inclusivity and reconciliation.

Harnessing Technological Innovation and Fintech Development

The accelerated development of technology and fintech innovation in Australia offers a rich soil for developing opportunities for crowdfunding. Australia's high digital literacy and high penetration of mobile devices provide a setting where crowdfunding platforms can leverage advanced technologies such as artificial intelligence, data analytics, and blockchain in order to enhance success rates for campaigns and investor protection. For instance, blockchain technology can enhance transparency and trust by securely keeping track of transactions and ownership in equity crowdfunding. Moreover, the use of crowdfunding alongside innovative fintech products like digital wallets and peer-to-peer lending platforms facilitates greater ease and quickness of funding transactions. This technological convergence appeal to a youth generation of investors who are tech savvy, and it also compels conventional investors to look into other investment models. As the Australian fintech ecosystem develops further, crowdfunding can leverage these technologies to extend its reach, simplify processes, and create new products according to local market demands.

Challenges of Australia Crowdfunding Market:

Regulatory Sophistication and Investor Protection Issues

One of the most significant challenges to the Australian market for crowdfunding is the sophistication and diversity of regulatory standards among states and sectors. Although the Australian Securities and Investments Commission (ASIC) has made frameworks available to enable crowdfunding, understanding these frameworks can be challenging for startups and platforms. The regulatory framework involves strict disclosure requirements, investment limits, and compliance mechanisms aimed at safeguarding retail investors from fraud or loss of money. On occasion, these safeguards translate into additional administrative costs and burdens that discourage small businesses from accessing crowdfunding. In addition, educating prospective investors on the risks of equity crowdfunding is still a major challenge. Most Australian investors are still not aware of this relatively new investment vehicle, and hence, they exhibit hesitant participation. Achieving the right balance between ensuring strong investor protection and keeping the market open and appealing to entrepreneurs remains a sensitive matter for regulators and market players.

Limited Market Awareness and Cultural Hesitation

Australia's crowdfunding industry also suffers from a lack of public knowledge and cultural reluctance toward non-traditional financing. Bank loans or private equity have traditionally ruled the Australian funding landscape, and numerous entrepreneurs and investors remain unaware or ill-informed about crowdfunding. This absence of general knowledge can restrict the pool of project creators and investors willing to explore crowdfunding platforms. Apart from this, Australian investors tend to favor safer, conventional investment channels, as a conservative risk strategy can slow the development of new funding approaches. Cultural preference for working face-to-face and building long-term business relationships can also hinder the adoption of entirely electronic crowdfunding campaigns. To overcome this, there is a need for continuous education, openness, and success stories that lead to trust in the crowdfunding platform and show its potential as a source of capital in the Australian marketplace.

Scaling Challenges and Competition from Platforms

Another of Australia's crowdfunding market challenges is the challenge of scaling platforms and attaining sustainable business models in the presence of increasing competition. The market has a variety of players, ranging from niche platforms that specialize in one area such as creative projects or social enterprises to larger ones providing equity crowdfunding services. Nevertheless, the comparatively limited population and splintered investor base mean the size and number of campaigns remain smaller and less frequent compared to bigger global markets. This can make it hard for platforms to come up with steady revenue and top-rated startups that will seek deeper pockets abroad. Additionally, the necessity to constantly innovate technologically as well as adhere to changing regulation increases operating complexity and expense. Smaller platforms particularly struggle with marketing, customer acquisition, as well as establishing trust, which can hinder expansion and consolidation. This competitive landscape, coupled with these scaling challenges, results in only strongly differentiated and well-operated platforms standing a good chance in Australia's crowdfunding scene.

Australia Crowdfunding Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type and end use.

Type Insights:

- P2P Lending

- Equity Investment

- Hybrid

- Reward-Based

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes P2P lending, equity investment, hybrid, reward-based, and others.

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Entrepreneurship

- Social Cause

- Movies and Theater

- Real Estate

- Music

- Technology

- Publishing

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes entrepreneurship, social cause, movies and theater, real estate, music, technology, publishing, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Crowdfunding Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | P2P Lending, Equity Investment, Hybrid, Reward-Based, Others |

| End Uses Covered | Entrepreneurship, Social Cause, Movies and Theater, Real Estate, Music, Technology, Publishing, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia crowdfunding market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia crowdfunding market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia crowdfunding industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia crowdfunding market was valued at USD 424.2 Million in 2025.

The Australia crowdfunding market is projected to exhibit a CAGR of 14.07% during 2026-2034.

The Australia crowdfunding market is expected to reach a value of USD 1,434.9 Million by 2034.

The Australia crowdfunding market trends include rising equity crowdfunding, growing interest in social impact projects, and increased use of digital platforms integrated with fintech innovations. The market is also seeing enhanced regulatory support and expanding participation from regional entrepreneurs, reflecting a broader shift toward accessible, technology-driven funding models across diverse sectors.

The Australia crowdfunding market is driven by supportive regulations, a growing startup culture, and increased digital connectivity. Government initiatives promoting innovation, rising interest in alternative financing, and advancements in fintech also boost market growth. These factors together create a favorable environment for both entrepreneurs and investors in the crowdfunding space.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)