Australia Corporate Training Services Market Size, Share, Trends and Forecast by Training Services, Deployment, Mode of Learning, Industry Vertical, and Region, 2025-2033

Australia Corporate Training Services Market Size and Share:

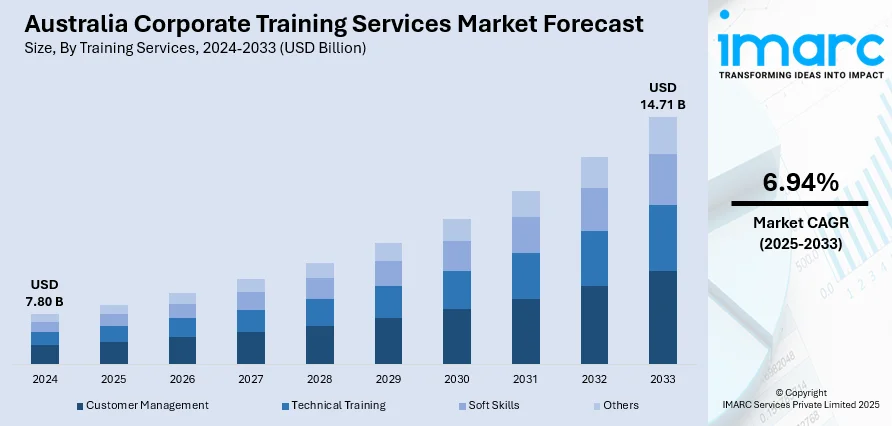

The Australia corporate training services market size was valued at USD 7.80 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 14.71 Billion by 2033, exhibiting a CAGR of 6.94% during 2025-2033. Australia Capital Territory & New South Wales currently dominates the market, holding a significant market share of 35.0% in 2024. The growing need for customized solutions that cater to the specific industry demands, rising preferences for soft skills training to enhance the abilities of the workforce, and increasing adoption of digital learning options that offer flexibility and scalability are some of the factors impelling the Australia corporate training services market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7.80 Billion |

| Market Forecast in 2033 | USD 14.71 Billion |

| Market Growth Rate 2025-2033 | 6.94% |

The Australian corporate training services market is primarily driven by rapid digital transformation. Businesses are scrambling to upskill their workforce in emerging technologies like AI, automation, cloud computing, and cybersecurity to remain competitive and adapt to evolving operational landscapes. This necessitates continuous learning and development programs. The widespread adoption of hybrid and remote work models has fueled demand for flexible, online, and blended learning solutions. Companies require training that can be accessed anywhere, anytime, ensuring employees remain engaged and productive regardless of their physical location. For instance, in May 2024, Argon & Co. opened its academy in Australia and New Zealand. Its curriculum now consists of six programs, with more to come. The Academy is committed to assisting Argon & Co.'s clients in developing the skills necessary to promote performance improvement and cultivate a continuous improvement culture. It specializes in operational excellence and lean methods of working.

To get more information on this market, Request Sample

The Australia corporate training services market growth is also driven by the significant and increasing emphasis on soft skills and leadership development. Beyond technical expertise, organizations recognize the critical role of communication, teamwork, emotional intelligence, problem-solving, and adaptability for enhanced collaboration, innovation, and employee retention. This is particularly crucial for cultivating effective leaders who can navigate dynamic market conditions. For instance, in August 2024, Lumify Group, the biggest provider of corporate ICT, soft skills, and digital skills training in Australasia, announced that it had acquired Wizard Corporate Training, a reputable Australian training provider. This calculated action demonstrates Lumify Group's dedication to growing its service portfolio and establishing itself as the area's leading training provider. Government initiatives supporting workforce development, coupled with the ever-present need for compliance training across various industries, further stimulate market expansion. Australian businesses are increasingly viewing corporate training as a strategic investment crucial for maintaining competitiveness, improving productivity, and fostering a resilient, future-ready workforce.

Australia Corporate Training Services Market Trends:

Rise of Industry-Specific Training

The increasing need for training tailored for specific industries represents one of the key factors impelling the market growth in Australia. According to AHRI research, 37% of organizations planned to increase their training investment, while only 6% reported plans to reduce their training budget. Companies are acknowledging the importance of customized initiatives that cater to the specific demands and obstacles within their industries. Industries like construction, healthcare, and financial services require specialized training that includes technical skills and adherence to industry standards and regulations. This trend is leading to the creation of tailored training materials that target specific job skills and qualifications. Businesses are partnering with specialized training providers to ensure that their employees are equipped with the latest knowledge and practices relevant to their industry. In 2023, Lumify Group introduced Lumify Learn, an officially recognized information and communication technology (ICT) training company that provided vendor-certified material in collaboration with Microsoft, AWS, and CompTIA. The program aimed to address Australia's tech skills shortage by offering basic IT skills and certifications. It also offered specialized bootcamps focused on cybersecurity, artificial intelligence (AI), and data science.

Growing Importance of Soft Skills Development

The rising demand for soft skills training to enhance the abilities of the workforce is propelling the market growth. According to NSSA, technical abilities and knowledge account for only 15% of employment success, whereas well-developed soft and interpersonal skills account for 85%. While technical skills remain essential, businesses are recognizing the importance of soft skills, including communication, teamwork, emotional intelligence, and problem-solving. According to the Australia corporate training services market trends, these abilities are essential for promoting teamwork, improving leadership, and enhancing client interactions. Businesses are putting money into training programs that assist employees in enhancing their interpersonal skills, which are commonly seen as crucial factors in competitive sectors. The emphasis on teaching soft skills is resulting in the creation of extensive training programs that cover more than just technical skills, taking into account various employee development requirements. In 2024, Life Puzzle launched “Ready. Set. Sell,” a 30-day online sales training course designed for beginners and professionals looking to enhance their communication and sales skills. The program focuses on developing confidence, improving creativity, and fostering effective user engagement strategies. It offers daily exercises, weekly training, and personalized coaching to support participants.

Increasing Adoption of E-Learning Platforms

Businesses in Australia are opting for digital learning options that offer flexibility and scalability. E-learning platforms provide content that is interactive and interesting, allowing employees to access training conveniently. According to the Australia corporate training services market forecast, these sites frequently incorporate multimedia components, such as videos, quizzes, and simulations, that improve the educational process. Moreover, companies are utilizing learning management systems (LMS) to monitor employee advancement and personalize training programs based on specific requirements. The capability to combine training with performance measures is motivating companies to adopt digital training solutions. In 2024, the Australian Taxation Office (ATO) introduced a free online education platform called "Essentials to boost your small business" for small-business owners. The platform offers more than 20 courses concentrating on tax, superannuation, and business management, providing flexible learning choices. Created in collaboration with education professionals, its goal is to assist small businesses in efficiently organizing their responsibilities.

Australia Corporate Training Services Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Australia corporate training services market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on training services, deployment, mode of learning, and industry vertical.

Analysis by Training Services:

- Customer Management

- Technical Training

- Soft Skills

- Others

Soft skills stand as the largest training services in 2024, holding 35.6% of the market. They complement rapid digital transformation; as AI and automation grow, uniquely human attributes like critical thinking, creativity, and emotional intelligence become indispensable. Evolving workplace dynamics, particularly hybrid and remote models, demand stronger communication, collaboration, and adaptability for effective team performance. Soft skills directly enhance productivity and employee retention by fostering better teamwork, problem-solving, and leadership, leading to improved engagement and reduced turnover. In a service-oriented economy, superior customer and client relations driven by interpersonal skills are crucial for business success. Moreover, organizations heavily invest in soft skills for leadership development, cultivating resilient and empathetic leaders. These combined factors solidify soft skills' largest market share.

Analysis by Deployment:

- On-Site

- Off-Site

Off-site stands as the largest deployment in 2024, holding 40.7% of the market due to the benefits of focused, distraction-free learning. Removing employees from their daily work environment ensures dedicated attention to the training material, leading to better engagement and retention. Off-site venues often provide specialized facilities and resources not available in-house, creating an optimal learning environment. These locations also foster enhanced networking and team-building opportunities, as participants interact in a neutral setting, promoting stronger collaboration and cross-departmental understanding. Furthermore, the deliberate act of sending employees off-site signals a significant investment in their development, boosting morale and job satisfaction. It also allows for fresh perspectives and innovative thinking, free from the routines and pressures of the regular workplace.

Analysis by Mode of Learning:

- Instructor Led Classroom Only

- Blended Learning

- Online or Computer Based Methods

- Mobile and Social Learning

- Others

Online or computer based methods lead the market with 45.7% of market share in 2024 due to their unparalleled flexibility and accessibility. Training resources are accessible to staff members at any time and from any location, supporting a range of work schedules, remote teams, and unique learning styles. This eliminates the need for travel and reduces time away from work, directly leading to significant cost savings for businesses. Furthermore, online platforms offer scalability, allowing companies to train a large workforce consistently and efficiently without logistical hurdles. They also enable personalized learning experiences through adaptive content and various multimedia formats, catering to different learning styles and enhancing engagement. The ability to easily update content ensures training remains current with rapidly evolving industry demands, making online methods the most practical and cost-effective solution for modern Australian businesses.

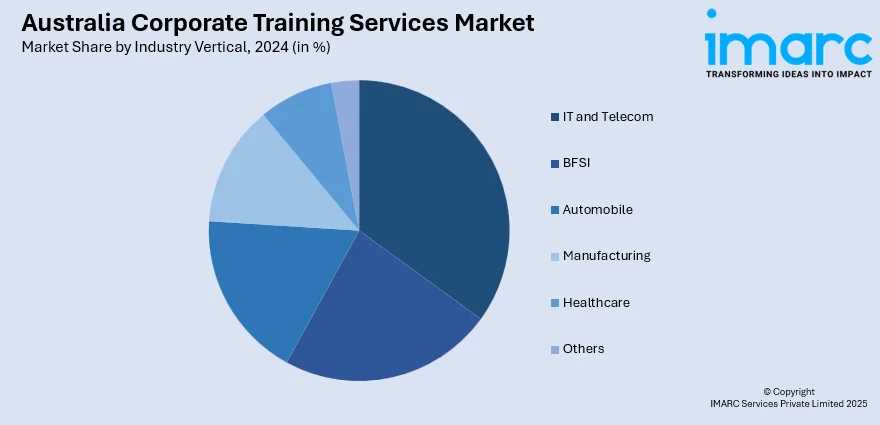

Analysis by Industry Vertical:

- IT and Telecom

- BFSI

- Automobile

- Manufacturing

- Healthcare

- Others

IT and Telecom leads the market with 29.8% of market share in 2024 due to its inherent nature and rapid evolution. Continuous technological advancements, including 5G, IoT, cloud computing, and AI, necessitate constant upskilling for IT and telecom professionals to remain competitive and implement new solutions. Furthermore, the escalating threat of cybersecurity breaches is a major driver. Businesses in this sector handle vast amounts of sensitive data, making robust cybersecurity knowledge and practices critical. This fuels significant investment in specialized training to protect systems and comply with stringent regulations. The digital transformation across all industries relies heavily on IT and telecom infrastructure and expertise, creating a ripple effect where other sectors also demand training in these areas from IT and telecom providers. Finally, the dynamic nature of service delivery requires ongoing training in new platforms, customer support technologies, and network management.

Regional Analysis:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

In 2024, Australia Capital Territory & New South Wales accounted for the largest market share of 35.0%. The New South Wales (NSW) corporate training services market is propelled by its status as Australia's economic powerhouse and a dominant financial and business hub. Key drivers include persistent skills shortages, particularly in vital professional and technical domains, compelling businesses to invest heavily in training to bridge these gaps. Rapid digital transformation across NSW's leading industries demands extensive training in AI, cloud computing, and cybersecurity to maintain competitiveness. The state's highly service-oriented economy fuels strong demand for soft skills, leadership development, and customer service excellence across sectors like finance, healthcare, and professional services. Furthermore, NSW government initiatives, such as the NSW Skills Plan, actively support workforce development, directly stimulating the Australia corporate training services market outlook. The high concentration of corporate headquarters in Sydney also creates a concentrated demand for diverse and specialized corporate training programs.

Competitive Landscape:

The Australia corporate training services market is highly competitive, featuring a mix of global and local players. Key providers include Skillsoft, Dale Carnegie Training, BSI Learning, Australian Institute of Management (AIM), and Franklin Covey. These companies offer diverse solutions, from technical and compliance training to leadership and soft skills development. The market is witnessing a shift toward digital and blended learning models, driven by hybrid work trends and demand for flexible, scalable training. Providers are differentiating through customized content, micro-credentials, and AI-driven learning platforms. Additionally, government-backed upskilling initiatives and rising cybersecurity concerns are prompting firms to expand offerings in tech and data literacy. Strategic partnerships and innovation remain crucial for maintaining market share.

The report provides a comprehensive analysis of the competitive landscape in the Australia corporate training services market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: Scentia acquired the Institute of Executive Coaching and Leadership (IECL), following the closure of GrowthOps. IECL, which specializes in coaching and leadership development, merges with the Australian Institute of Management (AIM). The merger strengthens leadership development services and expands innovation and market reach.

- February 2025: The Indonesia-Australia Skills Exchange (IASE) platform launched to connect Indonesian businesses with Australian TVET providers. Offering over 335 courses from 50+ Australian institutions, it addresses skills gaps in Indonesia’s workforce, supporting economic cooperation under the IA-CEPA agreement and enhancing bilateral partnerships.

- December 2024: Microsoft launched its AI Skills Initiative to upskill one Million people in New Zealand and Australia by 2026. The initiative offers complimentary AI training via multiple platforms and partnerships with government, business, and education sectors to ensure access to AI opportunities across communities.

- November 2024: NIDA Corporate Training announced the launch of its "How to be Human" course, aimed at enhancing communication skills in the AI era. Starting February 2025, the customizable program will focus on soft skills, interpersonal relationships, and leadership, helping businesses foster a people-first culture amidst AI integration.

- August 2024: Planet Ark's Australian Circular Economy Hub partnered with CIRCO NL to launch circular economy training in Australia. The CIRCO methodology, successfully used in Europe and Asia, offers a Circular Business Design Workshop and One-Day Masterclass, helping Victorian organizations embrace circular business models to reduce waste and enhance product value.

Australia Corporate Training Services Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Training Services Covered | Customer Management, Technical Training, Soft Skills, Others |

| Deployments Covered | On-Site, Off-Site |

| Modes of Learning Covered | Instructor Led Classroom Only, Blended Learning, Online or Computer Based Methods, Mobile and Social Learning, Others |

| Industry Verticals Covered | IT and Telecom, BFSI, Automobile, Manufacturing, Healthcare, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia corporate training services market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia corporate training services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia corporate training services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The corporate training services market in Australia was valued at USD 7.80 Billion in 2024.

The Australia corporate training services market is projected to exhibit a CAGR of 6.94% during 2025-2033, reaching a value of USD 14.71 Billion by 2033.

The market is driven by digital transformation, demand for workforce upskilling, hybrid work models, and government-supported learning initiatives. Organizations seek flexible, tech-enabled training solutions to boost productivity, retain talent, and meet evolving industry needs. Customized, scalable programs and e-learning platforms are increasingly preferred across diverse sectors and regions.

Australia Capital Territory & New South Wales holds the largest share of the Australia corporate training services market due to digital innovation, diverse industry presence, government upskilling programs, hybrid work models, and Sydney’s corporate concentration, which are fueling demand for flexible, tech-driven, and customized corporate training solutions across sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)