Australia Contact Lenses Market Size, Share, Trends and Forecast by Material, Design, Usage, Application, Distribution Channel, and Region, 2025-2033

Australia Contact Lenses Market Overview:

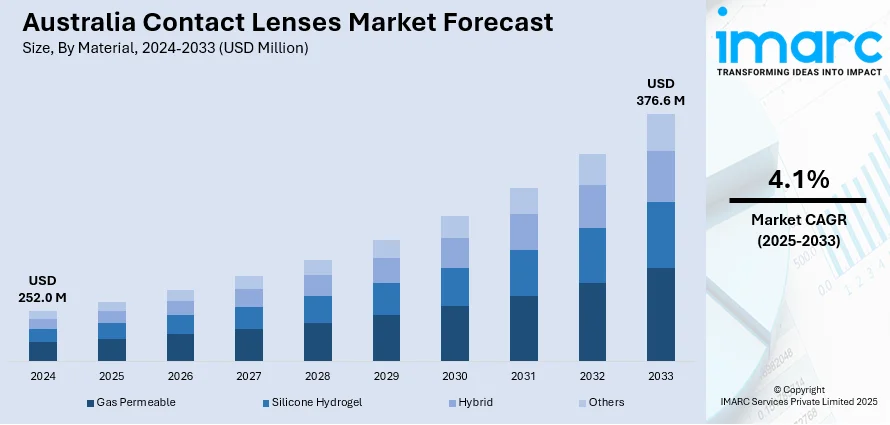

The Australia contact lenses market size reached USD 252.0 Million in 2024. Looking forward, the market is expected to reach USD 376.6 Million by 2033, exhibiting a growth rate (CAGR) of 4.1% during 2025-2033. The market is fueled by enhanced demand for daily disposable lenses, heightened adoption for cosmetic purposes, and greater acceptance among mature users looking for advanced vision correction, comfort, and lifestyle-friendly options over conventional glasses.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 252.0 Million |

| Market Forecast in 2033 | USD 376.6 Million |

| Market Growth Rate 2025-2033 | 4.1% |

Key Trends of Australia Contact Lenses Market:

Rising Demand for Daily Disposable Lenses

Australian consumer tastes are gradually gravitating towards daily disposable lenses because of the improved hygiene advantage, convenience, and lower risk of infection. The lenses require no cleaning agents or storage cases, which is particularly enticing for working professionals and young adults. Further, there has been increased awareness about eye care and preventive measures, and users are opting for methods that reduce the risk of complications. Retailers are reacting with wider assortments and promotion bundles, especially in metropolitan areas. Furthermore, the penetration of e-commerce has hastened access to subscription-based delivery platforms, stimulating repeat purchases. The Australia contact lenses market growth pattern demonstrates this shift toward high-frequency, short-duration products, particularly among first-time users and those in search of an alternative to eyeglasses. This trend is also assisted by the development of hydrogel and silicone hydrogel materials that enhance oxygen permeability and wearer comfort, thus making daily disposables the preferred choice in the premium segment, which further contributes to the Australia contact lenses market demand.

To get more information on this market, Request Sample

Expanding Use of Lenses for Aesthetic and Lifestyle Needs

Apart from vision correction, Australia contact lenses market outlook is observing growing use for cosmetic and lifestyle applications. Patterned and colored lenses, once specialized, have become mainstream among young adults and social media influencers. The wish to change or enhance eye appearance for special occasions, photography, or everyday wear is driving steady demand. Regulatory transparency over non-prescription aesthetic lenses has also enabled their presence in optical outlets and beauty retailing spaces. The convergence of healthcare and personal fashion is attracting more consumers to the category. Innovation around moisture retention and longer wear has bridged the gap between comfort and style. The increasing role of digital marketing, online tutorials, and virtual try-on capabilities is also driving user interaction. This category is making a valuable contribution to the Australia contact lenses share, a reflection of larger shifts in consumer behavior where beauty and functionality walk hand-in-hand. For instance, in August 2024, Visioneering Technologies Inc. has appointed Gelflex as the distributor in Australia and New Zealand of its NaturalVue Multifocal contact lenses. The lenses feature an extended depth of focus design, which helps in myopia progression as well as presbyopia management.

Increased Adoption Among the Geriatric Population

Australia's geriatric population is highly embracing contact lenses, underpinned by advances in multifocal lens design and materials ideal for presbyopia treatment. According to the reports, in September 2024, Johnson & Johnson's TECNIS Odyssey intraocular lens was approved in Australia, pointing to growing demand for advanced vision correction options beyond contact lenses, particularly among presbyopic and cataract patients. Moreover, elderly persons who used to depend on spectacles are now switching to lenses that provide wider fields of view and minimize reliance on reading glasses. Advances in tear film stabilization and oxygen-permeable materials enhance wearability among older patients, with eye care professionals actively supporting trial programs to facilitate initial use. Educational outreach from clinics and community health programs has successfully removed misconceptions about the safety of lenses for older eyes. Additionally, the convenience of extended wear lenses is also winning over retirees in need of flexibility during travel or outdoor excursions. As this population continues to grow and become intensely health-focused, Australia contact lenses market share potential will increase steadily in coming years, indicating a more diversified customer base and demand profile.

Growth Drivers of Australia Contact Lenses Market:

Rising Prevalence of Digital Eye Strain

One of the key drivers of the Australia contact lenses market growth is the increasing prevalence of digital eye strain, fueled by prolonged use of screens for both work and leisure. In the wake of growing remote working and online learning opportunities in cities such as Sydney, Melbourne, and Brisbane, numerous Australians are suffering from side effects like dry eyes, blurred vision, and eye fatigue. This transition has increased demand for daily disposable lenses promoted for enhanced moisture retention and breathability, assisting users in finding comfort balanced with extended screen use. Educators and professionals alike are looking for disposable structures to minimize upkeep and infection potential, while compensating for vision requirements associated with contemporary digital living. The increase in the use of wearables in city lifestyles further supports demand for contact lenses that provide convenience and harmony with augmented and virtual reality platforms. With greater Australians focusing on eye health as part of busy digital lifestyles, contact lenses provide an efficient, hassle-free solution that complements modern lifestyle needs.

Increased Retail Availability and Consumer Awareness

According to the Australia contact lenses market analysis, the widespread distribution of products across different channels has tremendously accelerated growth in the region. Alongside conventional optometry clinics, chains, department stores, and online websites now commonly provide lens fittings, subscription services, and doorstep delivery. This multichannel presence offers customers—particularly in suburban and rural areas—even more convenient and accessible ways to acquire lenses. Educational campaigns by professional groups and eye care practitioners have enhanced public knowledge of the advantages, dangers, and proper use of contact lenses. Urban metropolises in states such as Victoria and Western Australia organize lens-care seminars and mobile clinics at university precincts and shopping malls to assist initial wearers. The campaigns minimize myths regarding lenses and encourage professional fittings and give consumers confidence regarding hygiene and safety. The combination of retail availability and formal education creates consumer trust, which induces greater numbers of Australians to accept contact lenses as a safe, convenient substitute for eyeglasses and, therefore, fuels market growth across markets and geographies.

Technological Innovation and Specialized Solutions

Advances in contact lens materials and designs are acting as significant drivers of growth in the Australian market. Companies are launching silicone hydrogel, multifocal, toric, and color lenses, providing solutions for astigmatism, presbyopia, and cosmetics. Such advances are especially popular with Australia's outdoor lifestyle, with water-resistance and UV-blocking lenses fitting swimmers, surfers, and beachgoers in coastal areas such as Queensland and South Australia. Specialty lenses like orthokeratology lenses for nocturnal myopia control in kids are increasingly popular among parents and optometrists, who value long-term eye health and independence from daytime lenses. Urban lifestyles also appreciate prestige options like smart lenses that interact with wearable devices or offer improved hydration features. The capacity to provide medical-grade options and lifestyle-oriented options makes contact lenses a vibrant category in Australia, where convenience intersects with innovative needs across active and aging populations and active lifestyles.

Opportunities of Australia Contact Lenses Market:

Expansion to Regional and Remote Regions

One prominent opportunity among Australia contact lenses market is widening access to regional and remote towns and communities, where conventional optometry service is usually limited. Residing in places such as the Northern Territory, regional Queensland, and country Western Australia are many who encounter issues with accessing routine eye care and buying prescription lenses. The increasing availability of tele-optometry and home-delivery ordering platforms offers a pragmatic answer, with patients able to obtain virtual consultations and home-delivered contact lenses. Health campaigns and mobile eye clinics have already started filling in the gap, but potential for wider growth remains huge. Those businesses that establish custom outreach programs and cost-effective delivery logistics can access a largely untapped market. Additionally, regional Australians live an active outdoors life, which boosts the demand for UV-protective and sports-oriented contact lenses. By integrating outreach, education, and convenient services, brands can establish trust and sustainable loyalty in such regions, substantially expanding their customer base beyond metropolitan hubs.

Increasing Demand for Custom and Specialty Lenses

One of the growing opportunities in Australia's market for contact lenses is the demand for custom and specialty lenses that are suitable for vision disorders. As more Australians face advanced vision problems like keratoconus, astigmatism, and presbyopia, interest in contact lenses that extend beyond routine prescriptions is increasing. Specialty lenses, such as scleral and multifocal lenses, are increasingly becoming popular among aging populations as well as irregular cornea sufferers. Australia's elderly population, especially in states of New South Wales and Victoria, is driving this trend as elderly people look for wearability substitutes for reading glasses or normal bifocals. Additionally, busy Australians such as sports people and outdoor laborers are using specialty lenses for enhanced stability and performance under changing conditions. Domestic eye care practitioners and lens makers can take advantage of the factor to work together on tailor-made solutions that meet the distinct lifestyle and environmental requirements of the Australian population, and leverage more profitable product segments.

Innovation in Sustainability and Eco-Conscious Lenses

Environmental consciousness is increasing around Australia, which having an impact on the contact lenses industry. As consumers become more environmentally aware, there is increasing demand for environmentally friendly packaging, biodegradable lens composition, and recycling schemes specifically designed to minimize plastic usage. Australia's eco-conscious population—particularly in such urban centers as Hobart, Canberra, and Byron Bay—is looking positively for brands that share its values. Contact lens businesses that launch environmentally friendly products and highlight carbon-neutral practices can stand out in a competitive market. Also, optometry offices that provide lens recycling drop-offs or partner with green organizations can capture loyal, values-oriented consumers. There is also potential in informing consumers about the environmental consequences of lenses and encouraging responsible disposal practices. By connecting product innovation and environmental stewardship, contact lens brands can win over Australia's expanding population of conscious consumers, driving both customer loyalty and a greener health and wellness industry.

Australia Contact Lenses Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on material, design, usage, application, and distribution channel.

Material Insights:

- Gas Permeable

- Silicone Hydrogel

- Hybrid

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes gas permeable, silicone hydrogel, hybrid, and others.

Design Insights:

- Spherical

- Toric

- Multifocal

- Others

A detailed breakup and analysis of the market based on the design have also been provided in the report. This includes spherical, toric, multifocal, and others.

Usage Insights:

- Daily Disposable

- Disposable

- Frequently Replacement

- Traditional

The report has provided a detailed breakup and analysis of the market based on the usage. This includes daily disposable, disposable, frequently replacement, and traditional.

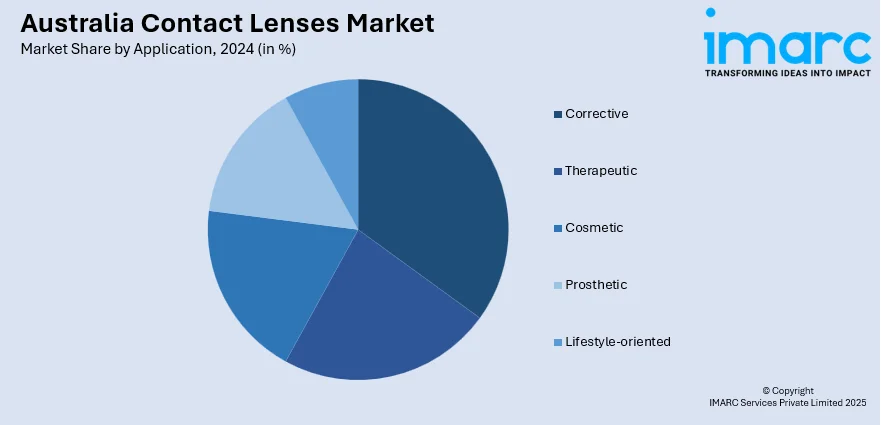

Application Insights:

- Corrective

- Therapeutic

- Cosmetic

- Prosthetic

- Lifestyle-oriented

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes corrective, therapeutic, cosmetic, prosthetic, and lifestyle-oriented.

Distribution Channel Insights:

- E-commerce

- Eye Care Practitioners

- Retail Stores

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes e-commerce, eye care practitioners, and retail stores.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Contact Lenses Market News:

- In May 2024, Johnson & Johnson revealed the introduction of its ACUVUE OASYS MAX 1-Day Sphere and Multifocal contact lenses in Australia. Designed for today's digital lives, the lenses feature TearStable Technology, OptiBlue light filtering, and Pupil Optimised Design to provide consistent comfort, visual acuity, and performance at all distances.

- In June 2023, Alcon Vision Care introduced TOTAL30 monthly replaceable contact lenses in Australia and New Zealand available in sphere, toric, and multifocal forms with full ranges of power. The product is first to bring water gradient lens technology to the reusable category.

Australia Contact Lenses Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Gas Permeable, Silicone Hydrogel, Hybrid, Others |

| Designs Covered | Spherical, Toric, Multifocal, Others |

| Usages Covered | Daily Disposable, Disposable, Frequently Replacement, Traditional |

| Applications Covered | Corrective, Therapeutic, Cosmetic, Prosthetic, Lifestyle-Oriented |

| Distribution Channels Covered | E-Commerce, Eye Care Practitioners, Retail Stores |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia contact lenses market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia contact lenses market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia contact lenses industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia contact lenses market was valued at USD 252.0 Million in 2024.

The Australia contact lenses market is projected to exhibit a CAGR of 4.1% during 2025-2033.

The Australia contact lenses market is expected to reach a value of USD 376.6 Million by 2033.

The key trends of the Australia contact lenses market include rising emphasis on daily disposable lenses for hygiene and convenience, and sophisticated specialty lenses such as Toric, multifocal, and myopia-control lenses. Tele-optometry and online prescription options are gaining momentum, while lens materials now emphasize breathability, UV protection, and environmentally friendly packaging to meet outdoor, active lifestyles.

The major growth drivers of the contact lenses market in Australia include growing digital screen use, awareness about eye health, and demand for easy, lifestyle-compatible alternatives to glasses. Advances in technology, growing online shopping availability, and preferences for daily disposable and specialty lenses also contribute to market expansion in urban and regional consumer markets.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)