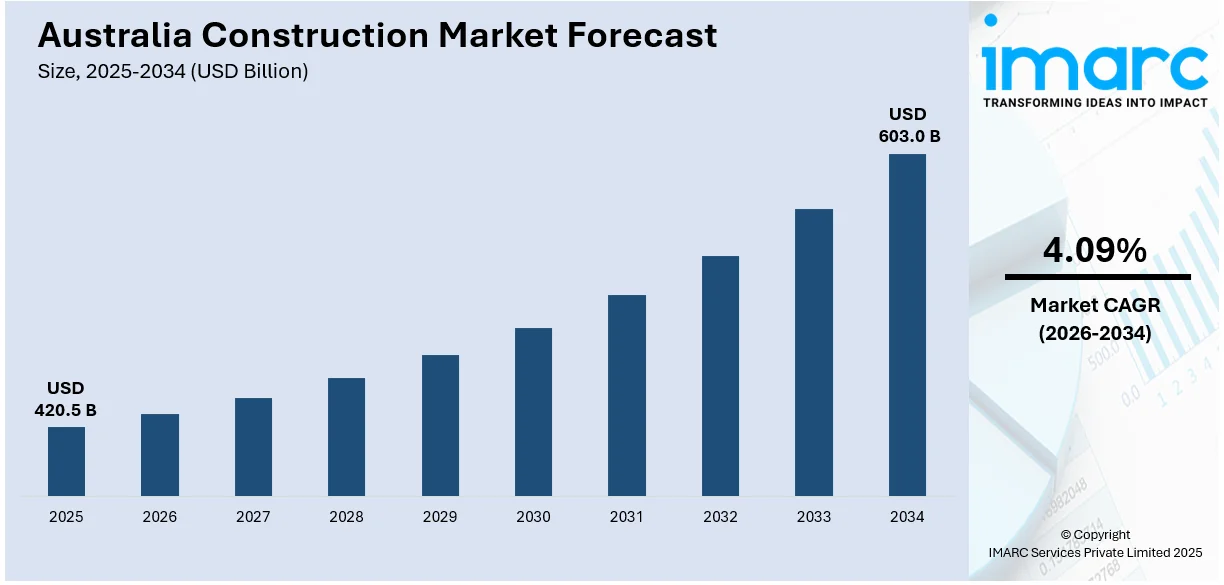

Australia Construction Market Size, Share, Trends and Forecast by Sector, and Region, 2026-2034

Australia Construction Market Size and Share:

The Australia construction market size was valued at USD 420.5 Billion in 2025. Looking forward, the market is expected to reach USD 603.0 Billion by 2034, exhibiting a CAGR of 4.09% from 2026-2034. The market is driven by the growing government infrastructure spending, economic expansion, which is leading to the construction of commercial, residential, and mixed complexes, and advanced technologies and sustainability trends..

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 420.5 Billion |

|

Market Forecast in 2034

|

USD 603.0 Billion |

| Market Growth Rate (2026-2034) | 4.09% |

Government infrastructure spending is a key driver stimulating the market growth. Large-scale infrastructure projects, including roads, rail, airports, and public transport systems, require substantial construction investments. These projects are designed to improve connectivity, reduce congestion, and support economic growth in both urban and rural areas. Increased government funding for transportation infrastructure is facilitating the expansion of cities and enhancing regional connectivity. Investments in utilities like water, electricity, and telecommunications infrastructure are vital for urbanization. Governing agencies are prioritizing the development of smart grids and renewable energy systems to meet the expanding demand. This increased spending on utilities is promoting sustainable development and supporting Australia’s transition to cleaner energy sources.

To get more information on this market Request Sample

As the economy is growing and businesses are expanding, there is an increase in the demand for commercial properties and office spaces. The rise in business activity is also stimulating the need for industrial facilities like warehouses and manufacturing plants. Increased economic activity fosters customer confidence, which contributes to greater demand for residential properties. This drives construction activity in both urban and regional areas, where new commercial developments are needed to accommodate growing populations. Economic growth encourages private investments in large-scale infrastructure projects, such as airports, hospitals, and schools, further stimulating the market growth. This sustained investment in infrastructure, housing, and commercial development continues to drive the construction market in Australia, providing long-term opportunities for growth.

Key Trends of Australia Construction Market:

Integration of advanced technologies

The Incorporation of innovative technologies is improving efficiency and productivity. Technologies including drones, 3D printing and Building Information Modeling (BIM) are revolutionizing project planning as well as execution. BIM enables real-time collaboration between teams, optimizing designs and reducing errors in construction processes. Drones are enhancing site surveys, providing accurate data while improving safety and reducing labor costs. Robotics is currently being deployed for tasks such as bricklaying, welding, and material handling, enhancing speed and precision. For instance, in September 2024, Laing O’Rourke and John Holland partnered with Robotics Australia Group to drive construction innovation. The collaboration aimed to enhance safety, productivity, and sustainability through automation and robotics. Both companies worked with developers to integrate advanced technological solutions, building a robotics supply chain. Additionally, automation in construction helps address labor shortages and lower reliability on manual labor. The use of smart sensors and Internet of Things (IoT) devices enable predictive maintenance and real-time monitoring of equipment and buildings.

Rising sustainability trends

The demand for energy-efficient buildings and eco-friendly materials is increasing across both residential and commercial sectors. Builders and developers are adopting green building practices, such as using sustainable materials like recycled steel, timber, and eco-concrete. These practices help reduce construction’s carbon footprint and enhance energy performance in buildings, aligning with environmental goals. Government policies and incentives supporting sustainable construction, including energy saving regulations, are also chief drivers. Projects incorporating renewable energy systems, such as wind turbines or solar panels, are becoming more prevalent in the market. Additionally, private entities are constantly innovating to produce sustainable material made from waste. For example, in April 2024, Australia's first RESIN8 facility was officially opened in Melbourne, transforming hard-to-recycle plastics into building materials. Located in Tottenham, the plant addressed recycling challenges by processing 1 metric tons of plastic per hour. Moreover, the rising use of water conservation technologies, such as rainwater harvesting and efficient plumbing systems, in the construction projects, is strengthening the market growth. Sustainability trends are also reshaping urban planning, with an increased focus on green spaces, sustainable transport, and low-carbon communities.

Growing demand for residential spaces

Population growth is a major driver of the market, fueling demand for housing. This expansion fuels both new residential developments and urban growth, especially in cities like Sydney, Melbourne, and Brisbane. The growing population requires additional infrastructure including roads, schools, healthcare centers, and public transit systems. As more population shift to urban areas, there is a rising demand for commercial properties. Retail spaces, office infrastructure, and mixed-use properties are required to support enterprises and services that serve urban communities. High population density in major regions also drives the need for apartment complexes and multi-family housing projects. To address this need, Believe Housing Australia initiated a 14 million AUD affordable rental housing project in Mansfield Park in March 2024. The initiative sought to tackle housing affordability in the region, offering necessary residences for low-income tenants. The launch event signified an important advancement in broadening affordable housing choices across Australia.

Growth Drivers of Australia Construction Market:

Strong Government Infrastructure Pipeline

Australia’s federal and state governments continue to drive construction growth through long-term infrastructure investment programs. Large-scale transport projects, including road, rail, and airport upgrades, are being prioritized to improve connectivity and economic productivity. Initiatives like the National Infrastructure Plan and state-specific investments are allocating substantial budgets to both urban and regional infrastructure development. These projects create a ripple effect, stimulating demand in supporting sectors such as engineering, logistics, and real estate. The government's focus on creating resilient, future-ready infrastructure ensures a steady flow of construction contracts. Moreover, stimulus measures post-pandemic have reinforced the sector’s importance in economic recovery, positioning it as a key driver of national employment and GDP growth over the coming years.

Commercial and Industrial Expansion

The expansion of Australia’s commercial and industrial real estate sectors is significantly contributing to Australia construction market share. The growth of e-commerce, logistics, and data center construction is propelling demand for distribution and warehouse facilities, particularly in urban areas and ports. Office and retail spaces are also being reconfigured to accommodate changing post-pandemic needs, such as flexible floor plans, health-focused designs, and collaborative workspaces. The manufacturing and mining industries are also investing in infrastructure upgrades and facilities operations, which increases construction activity as well. These trends not only reconfigure the built environment of Australian cities but also spark long-term investments in design, project management, and supply of materials, creating strong growth for the wider construction ecosystem.

Population Growth and Urbanization

Australia’s ongoing population growth, driven by high immigration levels and internal migration patterns, is creating sustained demand for infrastructure and public amenities. With the growth of urban centers, more transport networks, utilities, schools, healthcare facilities, and community infrastructure become necessary. This population pressure is particularly acute in rapidly growing areas like Greater Melbourne, Western Sydney, and Southeast Queensland. Urban sprawl and densification are also driving large-scale urban development of new precincts and satellite cities, providing new prospects for commercial and civic buildings. Consequently, the construction sector continues to be linked closely to population trends, with urbanization continuing to drive both public and private sector investment in infrastructure to enable livability, mobility, and economic activity.

Opportunities of Australia Construction Market:

Regional Infrastructure Development

Australia’s focus on decentralizing growth from major cities presents vast opportunities in regional construction. Government initiatives like the “Building Better Regions Fund” are accelerating investments in regional infrastructure, ranging from transport to utilities and social infrastructure. These projects aim to enhance connectivity, support local industries, and improve the quality of life in non-metropolitan areas. Construction firms that expand their presence beyond urban centers can capitalize on less-saturated markets with growing demands for schools, hospitals, housing, and business infrastructure. Furthermore, natural resource hubs and agricultural regions often require robust logistics and energy support, creating a continuous pipeline for civil, industrial, and public infrastructure construction. This shift supports long-term industry resilience and fosters regional economic development through job creation and improved accessibility.

Public-Private Partnerships (PPPs)

The increasing adoption of public-private partnership (PPP) models in Australia opens collaborative avenues for construction firms. Governments are leveraging private capital and expertise to finance, build, and manage large infrastructure projects, especially in transport, healthcare, and education, which is further boosting the Australia construction market demand. These models reduce public fiscal burden while ensuring efficient delivery of complex projects. For construction companies, PPPs present access to long-term, high-value contracts with shared project risks and returns. Additionally, private sector participation fosters innovation in project design, finance structuring, and lifecycle asset management. As Australia's infrastructure needs grow, particularly in major cities and growth corridors, PPPs will remain a preferred strategy, creating scalable opportunities for developers, investors, and construction service providers to jointly shape urban and regional infrastructure.

Indigenous and Social Infrastructure Projects

Australia’s commitment to inclusive development is translating into increased investment in Indigenous and social infrastructure projects. Programs aimed at improving housing, education, health, and community facilities for Aboriginal and Torres Strait Islander communities are expanding, especially in remote and underserved regions. These projects offer significant opportunities for construction firms experienced in culturally responsive design, community engagement, and remote logistics. Additionally, government and NGO collaboration is fostering initiatives that address homelessness, affordable housing, and aged-care facility shortages. Construction firms aligned with social impact goals and ESG standards stand to benefit from this growing segment. These projects not only offer steady work pipelines but also enhance corporate reputation and contribute positively to broader societal outcomes, promoting equity and inclusion in national development.

Australia Construction Market Outlook:

Continued Demand for Education Infrastructure

Australia’s growing student population, driven by both domestic growth and international enrolments, will continue to boost demand for new schools, universities, and training facilities. The education sector is seeing increased government investment in classroom expansions, campus modernization, and technology-integrated learning spaces. Construction companies are expected to benefit from long-term projects focusing on both public and private education infrastructure, particularly in high-growth regions. Moreover, education facilities are evolving to include multipurpose community hubs and green design elements. The sector’s emphasis on accessibility and inclusive design also offers additional value-added opportunities for specialized contractors. With Australia's aim to remain a leading global education hub, construction activity in this sector will remain steady, contributing to the overall resilience and diversification of the national construction market.

Rise in Build-to-Rent (BTR) Developments

Australia’s Build-to-Rent (BTR) model is gaining momentum as a viable long-term investment class and an emerging growth area within the construction market. Unlike traditional housing, BTR projects are owned by institutional investors and designed for long-term rental, offering professionally managed housing with modern amenities. Increasing urban population density, housing affordability challenges, and changing lifestyle preferences are fueling BTR demand. Major developers and superannuation funds are allocating resources to this segment, particularly in Sydney, Melbourne, and Brisbane. For construction firms, BTR represents a pipeline of large-scale, design-forward residential projects. The BTR sector also tends to focus on quality finishes, energy efficiency, and integrated technology, pushing contractors to meet high standards, making it a strategic growth area in the medium to long term.

Growing Role of Construction Financing Innovation

Innovative financing mechanisms are set to reshape the future of Australia’s construction market. Traditional funding avenues are now being supplemented by real estate investment trusts (REITs), green bonds, infrastructure funds, and global institutional capital. These instruments are enabling faster project rollouts and diversifying risk, particularly for large infrastructure and urban renewal projects. With interest in ESG-aligned investments growing, financiers are increasingly backing projects that incorporate environmental and social value. This financial innovation is enhancing liquidity in the construction ecosystem, encouraging developers to initiate more complex and capital-intensive projects. In the coming years, firms with strong financial structuring capabilities and partnerships with investment groups will be better positioned to lead in project delivery, driving momentum and innovation across the construction value chain.

Challenges of Australia Construction Market:

Escalating Project Costs and Budget Overruns

Rising construction costs are a persistent challenge across Australia, with price volatility in raw materials, labor, and fuel significantly affecting project budgets. Unpredictable global supply chains, energy market instability, and inflation have pushed prices higher, impacting both private developments and public infrastructure. Budget overruns have become more frequent, leading to delays, project scope reductions, or cancellations. Smaller contractors, in particular, are struggling to maintain profitability in this environment. Additionally, insurance premiums and compliance costs have risen, adding further financial strain. Inaccurate initial cost estimations and insufficient contingency planning are compounding these issues. As a result, maintaining cost efficiency and transparent financial planning has become critical for sustaining long-term construction activity and investor confidence in the Australian market.

Regulatory and Planning Delays

Complex regulatory frameworks and slow planning approval processes are significantly hindering construction progress in Australia. Navigating federal, state, and local requirements can be time-consuming, particularly for large-scale and mixed-use projects. Environmental impact assessments, zoning changes, heritage preservation rules, and stakeholder consultations often extend timelines and inflate project costs. Variability in regulations across jurisdictions creates additional legal and administrative burdens, especially for developers working across state lines. According to the Australia construction market analysis, these delays postpone construction activity and also discourage investment, particularly from smaller firms with limited resources. Efforts to streamline and modernize the regulatory landscape have been slow, leaving many projects stuck in bureaucratic bottlenecks. Accelerating planning processes and harmonizing regulations remain essential for improving overall market efficiency and responsiveness.

Aging Workforce and Talent Pipeline Issues

Australia’s construction sector is facing a demographic challenge, with a significant portion of its workforce nearing retirement age and insufficient new talent entering the industry. Apprenticeship and vocational training enrollment have declined, and the sector struggles to attract younger workers due to perceptions of physically demanding labor, limited career progression, and safety concerns. Furthermore, the pandemic disrupted international labor mobility, reducing access to skilled migrant workers, an important component of Australia’s construction workforce. This talent gap is particularly acute in specialized roles such as project management, structural engineering, and advanced equipment operation. The lack of skilled workers leads to project delays, decreased productivity, and increased wage competition. Addressing this challenge requires a stronger focus on training, industry promotion, and labor mobility policies.

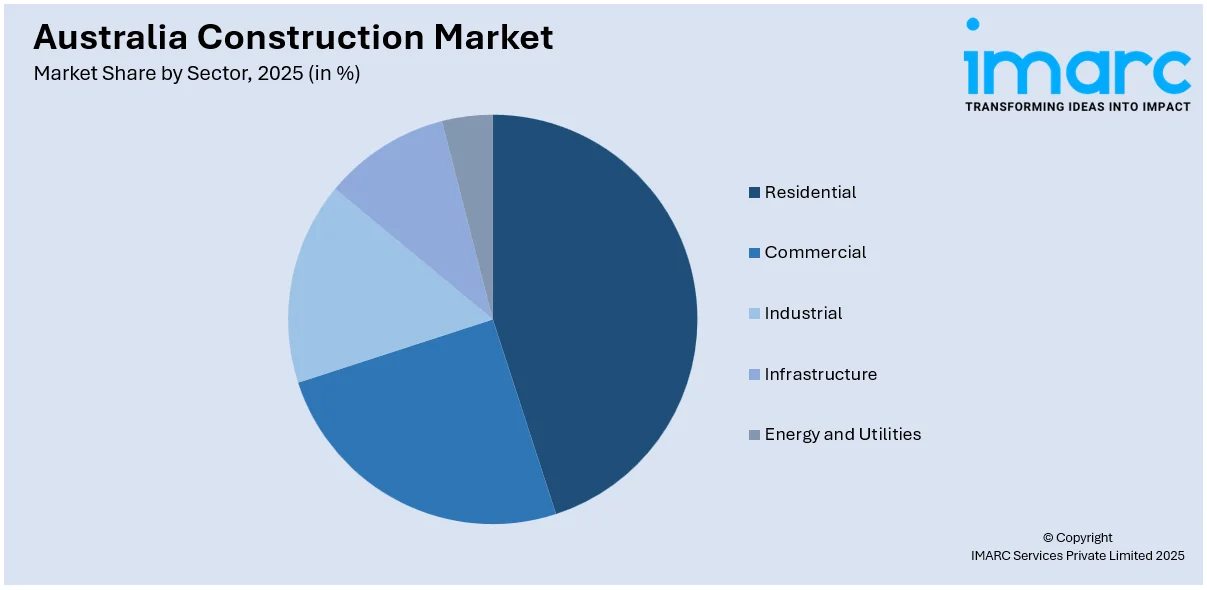

Australia Construction Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Australia construction market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on sector.

Analysis by Sector:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Industrial

- Infrastructure

- Energy and Utilities

The residential sector is driven by the growing need for residential spaces like apartments, townhouses, and single-family homes. Increased demand for housing, fueled by growing income levels and government incentives for first-home buyers, significantly contributes to the market growth. Additionally, the focus on affordable housing and luxury developments further propels the growth of the market.

The commercial sector is expanding due to rising business activity, particularly in cities. As companies continue to invest in new locations and upgrade existing infrastructure, there is an increasing demand for commercial construction projects. Factors like shifting workplace trends like remote work policies and flexible office spaces, influence commercial building designs. Urban regeneration and the development of mixed-use buildings are becoming significant in this sector, contributing to the growth of commercial construction.

The industrial construction sector is increasing the demand for manufacturing facilities, warehouses, and distribution centers, especially with the expansion of e-commerce. The need for high-tech and automated manufacturing plants, along with improved supply chain infrastructure, drives the demand for industrial construction. Sectors like pharmaceuticals, chemicals, and food processing require specialized facilities, catalyzing the demand for customized industrial buildings.

The infrastructure sector observes substantial growth due to government investments in public projects aimed at improving connectivity. Infrastructure development includes airports, roads, bridges, rail networks, and utilities encompassing sewage systems and water supply. The sector is critical for supporting economic growth, improving quality of life, and fostering regional development. Private-public partnerships (PPP) are increasingly funding mega-scale infrastructure ventures, especially in emerging markets.

Energy and utilities construction are driven by the global shift to renewable energy and the need for modernized power grids. The demand for sustainable energy solutions including solar, wind, and hydroelectric power are prompting the development of renewable energy infrastructure. The demand for electricity, gas, and water distribution systems in fast-growing areas is driving the market for utility infrastructure. Government regulations, incentives for clean energy, and corporate sustainability targets are strengthening the market growth.

Regional Analysis:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The market in the Australia Capital Territory & New South Wales is driven by rapid population growth, particularly in Sydney. The demand for residential housing, commercial developments, and infrastructure projects is high due to urban expansion. The government is heavily investing in public transportation and road networks, which further stimulate the market growth. New South Wales is becoming a major hub for commercial and industrial construction, with numerous business and manufacturing facilities being developed in the region. The region's political and economic stability also makes it an attractive area for construction projects.

Victoria, with Melbourne are a central hub, driving construction growth due to high demand for housing projects, particularly in suburban areas. Road and rail projects play a crucial role in improving the connectivity within state. Tasmania’s construction sector is experiencing steady growth fueled by rising tourism activities and regional economic progress. Sustainable building projects thrive in both regions due to the growing focus on energy-efficient construction practices. Government policies and incentives further encourage green building in residential and commercial developments.

The market in Queensland is driven by increasing population, especially in urban areas, such as Brisbane and the Gold Coast. The need for homes and business venues is rising, particularly for retail and office properties. Region’s construction sector also benefits from the investments made in infrastructure like transport systems, roads, and public services. The tourism industry in the state promotes the need for hospitality and entertainment facilities. Moreover, Queensland's emphasis on renewable energy initiatives including solar farms is propelling the growth of construction market in the area.

The Northern Territory & South Australia’s construction market is characterized by increasing demand for infrastructure and housing projects. Infrastructure development, including roads, ports, and water systems, are essential to support the resource-rich industries in this region. South Australia is observing growth in industrial and energy-related construction. Northern Territory benefits from areas like gas extraction and resource processing, which require specialized industrial construction.

Western Australia has a robust construction market, which is driven by the mining and resource extraction sectors. The demand for industrial infrastructure like mining facilities, pipelines, and storage facilities is driving the region’s market. Perth, the state capital, also sees considerable growth in residential and commercial construction due to urban expansion. Infrastructure projects related to transportation and utilities are key drivers, especially those supporting the growing resources sector. The state’s focus on developing sustainable infrastructure and renewable energy solutions is further strengthening growth in its construction market.

Competitive Landscape:

Key construction firms, developers, and governmental bodies significantly influence the market in Australia. Major construction companies play a crucial role in executing extensive residential, commercial, and infrastructure developments. In July 2024, Saint-Gobain finalized its acquisition of CSR in Australia, enhancing its foothold in the construction industry. CSR, a prominent provider of building materials, contributed notable brands and substantial sales to Saint-Gobain. The purchase supports Saint-Gobain's strategy of growing in fast-expanding Asia-Pacific markets. These companies provide skills in project management, engineering, and sustainable construction practices, aiding in the advancement of urban areas and essential infrastructure. Developers in the private and public sectors are funding in residential projects, commercial structures, and mixed-use developments. They are also influencing sustainability trends by incorporating green technologies and energy-efficient designs into their initiatives. Government bodies are financing and launching infrastructure initiatives, enveloping community improvements, transportation systems, and public services.

The report provides a comprehensive analysis of the competitive landscape in the Australia construction market with detailed profiles of all major companies.

Latest News and Developments:

- December 2024: European construction giant STRABAG has expanded across the Australian market with the acquisition of Georgiou Group. This strategic move aimed to strengthen STRABAG’s presence and abilities in offering mega-scale infrastructure projects. The move allowed STRABAG to enhance its competitiveness and operational scale in the region.

- November 2024: The Perth Children’s Hospital Foundation (PCHF) appointed West to West Group for building West Australia’s first children’s hospice. Sandcastles was planned in Swanbourne to support terminally ill children and their families. Construction started in 2024, with the hospice expected to open and operate by 2026. Multiple organizations funded the project, and clinical operations received support from the state government. The hospice’s design included family suites, creating a comforting as well as supportive environment for those in need.

- October 2024: Sumitomo Forestry acquired a 51% controlling stake in Metricon, Australia's largest housebuilder, for $79 million. The acquisition allowed Sumitomo to take over the company, with an option to procure the remaining shares. Metricon became a fully consolidated subsidiary and planned to list on the Tokyo Stock Exchange. The partnership aimed to strengthen Metricon's ability to address opportunities in the Australian housing market. Founded in 1976, Metricon operates across Australia, especially in Victoria, New South Wales, and southeast Queensland.

Australia Construction Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Residential, Commercial, Industrial, Infrastructure, Energy and Utilities |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Laing O’Rourke, Lendlease Corporation, CIMIC Group, CPB Contractors, Hutchinson Builders, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, forecasts, and dynamics of the Australia construction market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Australia construction market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia construction industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Construction involves the processes of designing, planning, and creating structures, infrastructure, and facilities. It encompasses different phases, such as site preparation, engineering, and project oversight. Construction projects include everything from homes and businesses to highways, overpasses, and infrastructure services. The aim is to develop practical, secure, and long-lasting areas that fulfill the requirements of people, companies, and communities.

The Australia construction market was valued at USD 420.5 Billion in 2025.

IMARC estimates the Australia construction market to exhibit a CAGR of 4.09% during 2026-2034.

Key factors driving the market in Australia include strong population growth and expanding demand for housing. Government investments in infrastructure projects like roads, rail, and public transport, stimulates the market growth. The notable emergence of energy-effective and sustainable building practices encourages green construction. Additionally, technological advancements in construction methods and materials improve project efficiency, while its thriving resources sector drives the demand for industrial and energy infrastructure across the region.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)