Australia Construction Equipment Market Report by Solution Type (Products, Services), Equipment Type (Heavy Construction Equipment, Compact Construction Equipment), Type (Loader, Cranes, Forklift, Excavator, Dozers, and Others), Application (Excavation and Mining, Lifting and Material Handling, Earth Moving, Transportation, and Others), Industry (Oil and Gas, Construction and Infrastructure, Manufacturing, Mining, and Others), and Region 2025-2033

Australia Construction Equipment Market Overview:

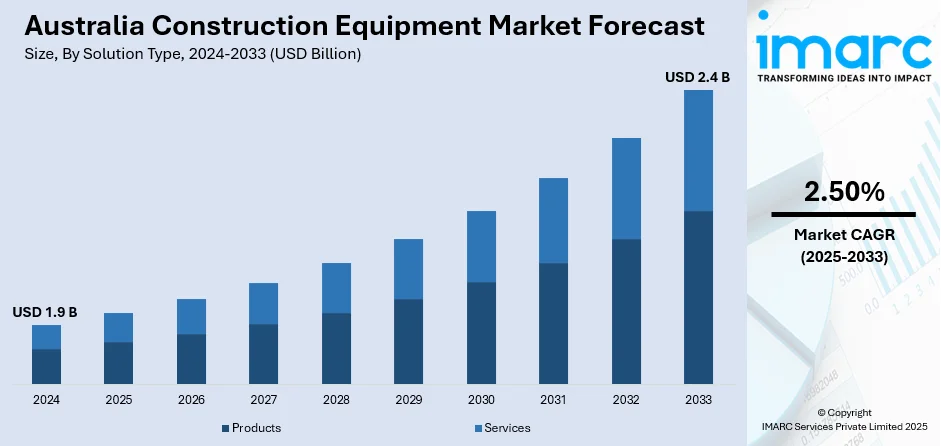

The Australia construction equipment market size reached USD 1.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.4 Billion by 2033, exhibiting a growth rate (CAGR) of 2.50% during 2025-2033. The booming infrastructure projects, rising real estate development, expanding mining activities, increasing government spending, rapid urbanization, technological advancements, surging demand for eco-friendly machinery, and population growth in urban areas are some of the factors favoring the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.9 Billion |

| Market Forecast in 2033 | USD 2.4 Billion |

| Market Growth Rate 2025-2033 | 2.50% |

Australia Construction Equipment Market Trends:

Booming Construction Industry and Infrastructure Projects

The construction industry in Australia is witnessing massive growth, which is one of the key factors fueling the market growth. This can be attributed to the rapid urbanization and government programs, such as National Infrastructure program, which are focused on large infrastructure projects, including highways and bridges, among others. This has further surged the demand for robust construction equipment to life heavy goods and logistics. Moreover, the propulsion of urban development and commercial expansion, especially in Sydney, Melbourne, and Brisbane, have escalated the demand for more reliant machinery, which is creating a positive outlook for the market.

To get more information on this market, Request Sample

Real Estate Developmental

A rapidly growing real estate sector, including both commercial and residential properties, in Australia is significantly upsurging the demand for construction equipment. In line with this, the rapidly urbanizing population and a robust housing market is further creating a greater predominance for apartments, complexes, and high-rise buildings in metropolitan areas, which is facilitating the market growth. Additionally, the large-scale commercial projects like office spaces and shopping centers are propelling the product demand, further providing a considerable thrust to the market growth.

Mining Sector Expansion

The strong mining sector in Australia is fueling the construction equipment market. The country is also one of the world’s largest producers of iron ore, coal, and gold, which delivers a comprehensive mining operation in Australia. This has further surged requirement to equipment such as bulldozers, dump trucks (tipping cars), and front loaders for excavating and carrying raw materials. Moreover, the ongoing demand for new and used construction equipment and the burgeoning mining projects across regions, especially Western Australia and Queensland, are supporting the market growth. Besides, advancements in technology like the automation in mining activities, encourages companies to allocate capital on state-of-the-art machinery capable of performing higher volume and scale operations, which is further facilitating the market growth.

Australia Construction Equipment Market News:

- In 2024, LiuGong Australia introduced its new range of electric construction equipment, marking a significant step towards greener solutions in the industry. The lineup includes electric excavators and wheel loaders, aimed at reducing emissions and noise pollution on construction sites. This development aligns with Australia's growing focus on sustainable infrastructure projects. The launch of this electric range highlights LiuGong's commitment to innovation, addressing the rising demand for eco-friendly machinery across the country.

- In 2024, Takeuchi introduced its first electric compact excavator in Australia, marking a significant step toward sustainable construction equipment in the region. This new model, known as the TB20e, is battery-powered and designed for efficiency in urban construction environments, offering reduced emissions and quieter operation. With a 24.7 kWh lithium-ion battery, it supports long operational hours and rapid recharging, making it a valuable addition to construction sites focused on sustainability and noise reduction.

Australia Construction Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on solution type, equipment type, type, application, and industry.

Solution Type Insights:

- Products

- Services

The report has provided a detailed breakup and analysis of the market based on the solution type. This includes products and services.

Equipment Type Insights:

- Heavy Construction Equipment

- Compact Construction Equipment

A detailed breakup and analysis of the market based on the equipment type have also been provided in the report. This includes heavy construction equipment and compact construction equipment.

Type Insights:

- Loader

- Cranes

- Forklift

- Excavator

- Dozers

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes loader, cranes, forklift, excavator, dozers, and others.

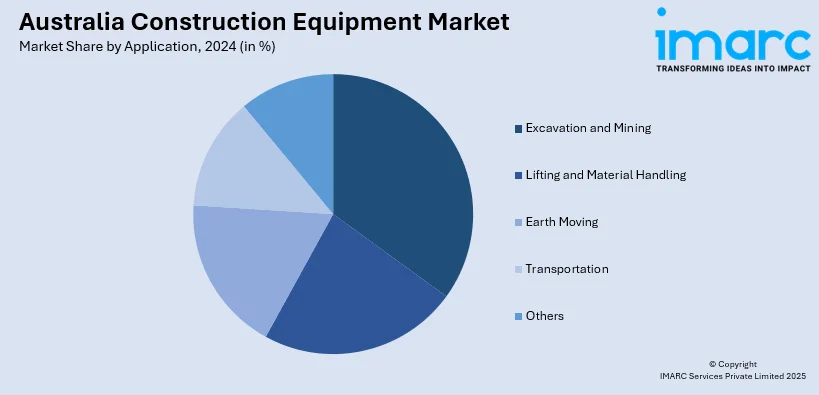

Application Insights:

- Excavation and Mining

- Lifting and Material Handling

- Earth Moving

- Transportation

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes excavation and mining, lifting and material handling, earth moving, transportation, and others.

Industry Insights:

- Oil and Gas

- Construction and Infrastructure

- Manufacturing

- Mining

- Others

The report has provided a detailed breakup and analysis of the market based on the industry. This includes oil and gas, construction and infrastructure, manufacturing, mining, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Construction Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solution Types Covered | Products, Services |

| Equipment Types Covered | Heavy Construction Equipment, Compact Construction Equipment |

| Types Covered | Loader, Cranes, Forklift, Excavator, Dozers, Others |

| Applications Covered | Excavation and Mining, Lifting and Material Handling, Earth Moving, Transportation, Others |

| Industries Covered | Oil and Gas, Construction and Infrastructure, Manufacturing, Mining, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia construction equipment market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Australia construction equipment market?

- What is the breakup of the Australia construction equipment market on the basis of solution type?

- What is the breakup of the Australia construction equipment market on the basis of equipment type?

- What is the breakup of the Australia construction equipment market on the basis of type?

- What is the breakup of the Australia construction equipment market on the basis of application?

- What is the breakup of the Australia construction equipment market on the basis of industry?

- What are the various stages in the value chain of the Australia construction equipment market?

- What are the key driving factors and challenges in the Australia construction equipment?

- What is the structure of the Australia construction equipment market and who are the key players?

- What is the degree of competition in the Australia construction equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia construction equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia construction equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia construction equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)