Australia Ceramic Tiles Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Australia Ceramic Tiles Market Size and Share:

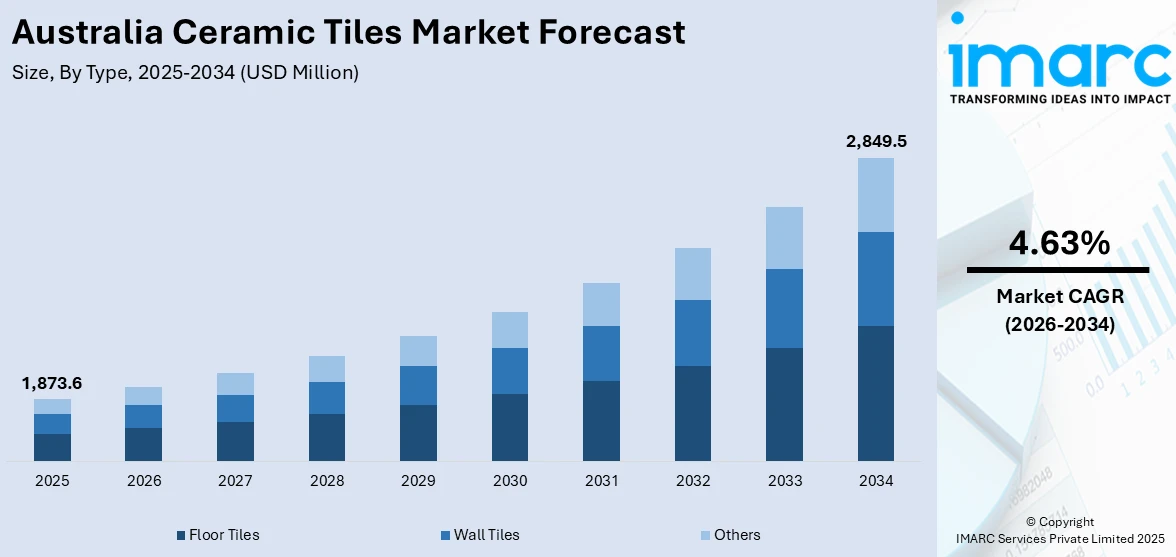

The Australia ceramic tiles market size reached USD 1,873.6 Million in 2025. Looking forward, the market is expected to reach USD 2,849.5 Million by 2034, exhibiting a growth rate (CAGR) of 4.63% during 2026-2034. The market is driven by rising residential and commercial construction, increasing renovation activities, and consumer preference for durable, low-maintenance flooring. Enhanced import availability, innovative tile designs, and growing demand for eco-friendly building materials also support growth. Government infrastructure spending further boosts tile consumption across diverse applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,873.6 Million |

| Market Forecast in 2034 | USD 2,849.5 Million |

| Market Growth Rate 2026-2034 | 4.63% |

Key Trends of Australia Ceramic Tiles Market:

Emphasis on Sustainable and Locally Sourced Materials

Australia’s construction and interior design industries are witnessing growing interest in sustainability, with ceramic tile manufacturers and importers responding by promoting eco-certified and low-VOC products. Recycled content in tiles and water-saving production technologies are gaining traction, aligning with national environmental building standards such as Green Star. Local production of ceramic tiles, though limited, is seeing renewed interest as firms explore low-emission clay sourcing and cleaner firing methods. Consumers are also increasingly prioritizing supply chain transparency, pushing brands to disclose environmental credentials. This focus on sustainability is not only a differentiator in competitive bids but also influences procurement decisions for public infrastructure and green-certified buildings. For instance, in 2023, researchers at the University of Technology Sydney (UTS) have developed a novel ceramic material made from recycled glass fines, aiming to reduce the environmental impact of traditional construction materials like tiles. By combining glass waste with a bio-based binder and water, the material can be molded or extruded, then fired at just 760°C—significantly lower than conventional tiles—resulting in a waterproof, fully recyclable product. This innovation lowers energy use, diverts waste from landfills, and supports sustainable tile applications for kitchens and bathrooms.

To get more information on this market Request Sample

Expansion of Outdoor and Hybrid Tile Applications

The Australia ceramic tile market demand is diversifying into outdoor and transitional spaces, driven by rising investments in patios, alfresco areas, and open-air commercial venues. Non-slip and weather-resistant ceramic tiles are increasingly used in landscaping and poolside settings due to their durability and design versatility. Moreover, hybrid indoor-outdoor tile collections are gaining popularity among homeowners seeking design continuity between living areas and external zones. Retailers are expanding outdoor tile ranges with textures resembling stone, timber, and concrete to meet varied consumer preferences. This trend aligns with Australia’s lifestyle emphasis on outdoor living and is fueling innovation in tile performance, adhesives, and surface coatings. For instance, Beaumont Tiles promotes SPC Core hybrid flooring as a durable choice, offering strong resistance to scratches and moisture, plus a built-in underlay for added comfort and sound reduction. Its easy-care nature makes it ideal for high-traffic zones like living rooms and hallways, providing both practicality and style.

Increasing Demand for Large-Format and Exterior Tiles

According to the Australia ceramic tiles market analysis, one of the notable trends influencing the market, is the increased popularity of large-format tiles, particularly in interior and exterior uses. The trend is fueled by current design fashion that emphasizes seamless, open-plan designs. Large-format tiles minimize grout lines, providing a smoother, more integrated appearance that matches modern Australian architecture, especially in upscale residential projects. Furthermore, the Australian outdoor living culture has led to increased demand for ceramic tiles to be installed in patios, verandas, and alfresco areas. House owners are looking for tiles that may easily shift from indoor to outdoor spaces, better creating a sense of space and design cohesion. The nation's varied climate regions, ranging from seashore dampness to desert interiors, also call for tiles that are not only fashionable but very resistant and weather tolerant. Consequently, manufacturers are now aiming at producing ceramic tiles with higher slip resistance, UV stability, and thermal performance for these purposes.

Growth Drivers of Australia Ceramic Tiles Market:

Strong Construction and Renovation Activities

Australia's highly active construction and renovation industry are central in fueling demand for ceramic tiles. The country's high affinity for home improvement, together with a desire for strength and a pleasing appearance, has resulted in greater consumption of ceramic tiles. These tiles are preferred for their flexibility, durability, and low maintenance, which is why they are suitable for a wide range of uses, such as flooring, walls, and countertops in residential and commercial establishments. The trend towards home remaking, especially in cities, increases the demand for ceramic tiles even more, as homeowners want to increase the practicality and aesthetic appeal of their homes. Further, the increase in public infrastructure projects, i.e., transport terminals and public facilities, supports the increasing demand for ceramic tiles throughout the nation. The vibrant construction environment highlights the central place of ceramic tiles in Australia's building material sector.

Digital Printing and Customization Progress

Technological advancements, especially digital printing, have had a major impact on the Australian market for ceramic tiles. Digital printing technology allows manufacturers to create high-definition, bespoke tile designs that replicate the look of natural materials like stone, wood, and marble at a much lower cost. This has opened design options, and consumers are able to customize their surroundings with specialty tile patterns and textures. The capability to design customized designs has appealed to Australian consumers, who appreciate uniqueness and flair in their residential and commercial environments. Additionally, these technological innovations have resulted in the production of tiles with improved features, including anti-slip surfaces and antibacterial coatings, fulfilling the changing needs and desires of consumers. Consequently, digital printing combined with customization has been a major growth driver for the Australian ceramic tile industry.

Focus on Sustainability and Green Initiatives

There has been a focus in the Australian ceramic tiles industry on sustainability, led by growing environmental concerns among consumers and regulatory authorities. Producers are embracing green initiatives, including recycling materials for use in making tiles and energy-efficient production processes. These efforts are consistent with Australia's pursuit of less carbon emissions and green building. Moreover, there has been an increase in demand for certified environmentally friendly building products, with consumers and companies in search of goods that promote energy efficiency and environmental preservation. Ceramic tiles, being durable and needing low maintenance, are poised to satisfy these sustainability standards. The increasing focus on sustainability affects not only the buying habits of consumers but also acts as a driving force for innovation in the industry, which results in the establishment of more eco-friendly tile forms. This push toward sustainability is one of the main growth drivers fueling the Australia ceramic tiles market share.

Australia Ceramic Tiles Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on type and application.

Type Insights:

- Floor Tiles

- Wall Tiles

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes floor tiles, wall tiles, and others.

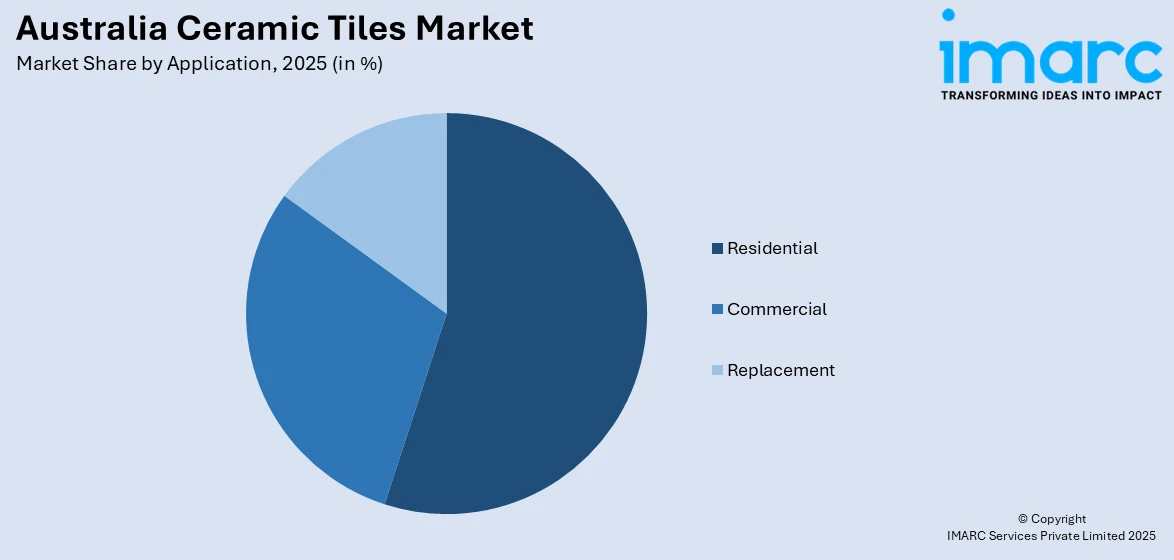

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Replacement

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential, commercial, and replacement.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Ace Stone + Tiles

- Beaumont Tiles

- Ceramic Solutions (Australia) Pty Ltd

- Classic Ceramics

- Ijaro International

- Italia Ceramics

- Johnson Tiles

- Metz Group

- National Ceramic Industries Pty Ltd

- Stone and Tile Projects

- TileCloud

Australia Ceramic Tiles Market News:

- In 2025, Spanish ceramic tile manufacturer Baldocer, which is operational in Australia, reported that it has reduced its direct CO₂ emissions per square meter of tile by 16% over the past five years, along with a 14% cut in emissions per ton of processed earth. This progress was driven by initiatives such as the installation of nearly 20,000 solar panels generating 900 MWh of electricity and the expansion of heat recovery systems that lowered energy consumption by 15%.

- In December 2024, Volt Solar Tiles, a subsidiary of Australia’s Leeson Group, raised over AUD 1.1 Million via equity crowdfunding to support its entry into the US market, positioning itself as a cost-effective competitor to Tesla’s Solar Roof. Volt offers innovative solar tiles that interlock with standard ceramic roofing tiles, making them quicker and easier to install using traditional roofing techniques. With strong partnerships, including Bristile Roofing and Spanish ceramic tile manufacturer La Escandella, Volt is expanding into global markets. The company highlights its tile's affordability—up to five times cheaper than Tesla’s offering—and high energy efficiency. Volt plans to launch in the US by mid-2025, focusing on markets with growing demand for integrated solar-ceramic tile solutions.

Australia Ceramic Tiles Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Floor Tiles, Wall Tiles, Others |

| Applications Covered | Residential, Commercial, Replacement |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Ace Stone + Tiles, Beaumont Tiles, Ceramic Solutions (Australia) Pty Ltd, Classic Ceramics, Ijaro International, Italia Ceramics, Johnson Tiles, Metz Group, National Ceramic Industries Pty Ltd, Stone and Tile Projects, TileCloud, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia ceramic tiles market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia ceramic tiles market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia ceramic tiles industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia ceramic tiles market was valued at USD 1,873.6 Million in 2025.

The Australia ceramic tiles market is projected to exhibit a CAGR of 4.63% during 2026-2034.

The Australia ceramic tiles market is expected to reach a value of USD 2,849.5 Million by 2034.

Australia's ceramic tiles market is fueled by high construction activity, a thriving renovation market, and increasing demand for resistant, fashionable floor coverings. Advances in technology, such as digital printing, and increased emphasis on sustainability also drive expansion. Customer desire for easy-to-maintain, bespoke surfaces also continue to drive expansion across the country.

Australia's ceramic tile market is witnessing increasing demand for large format tiles, and seamless flow of inside to outside. Sustainability is a trend that is gaining momentum, and eco-friendly materials and energy-efficient production are witnessing popularity. Other trends influencing consumer choices in residential and commercial building sectors include modern looks, low maintenance surfaces, and technology innovations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)