Australia CBD Products Market Size, Share, Trends and Forecast by Source, Distribution Channel, Application, and Region, 2025-2033

Australia CBD Products Market Size and Share:

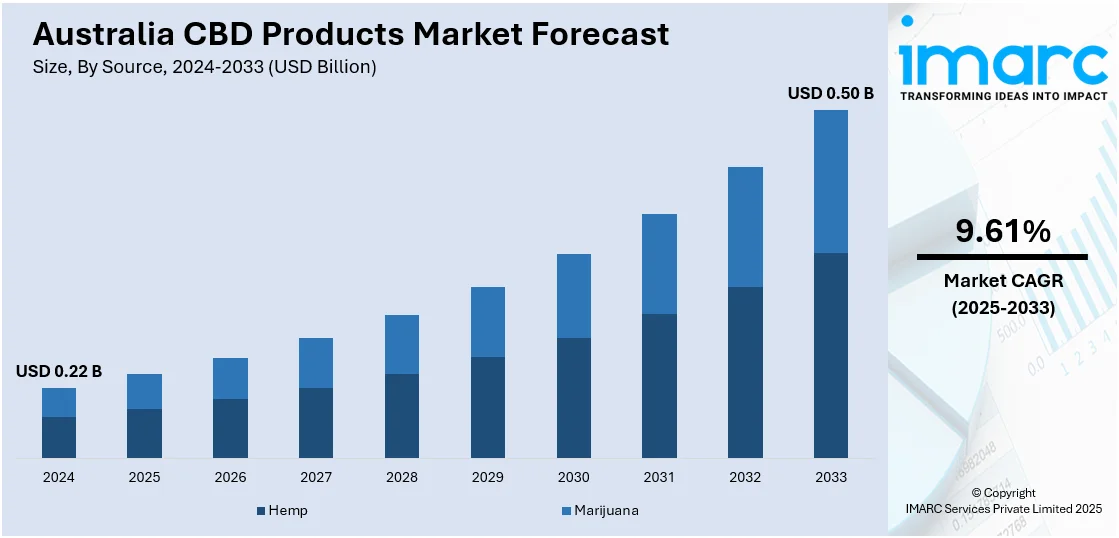

The Australia CBD products market size reached USD 0.22 Billion in 2024. Looking forward, the market is expected to reach USD 0.50 Billion by 2033, exhibiting a growth rate (CAGR) of 9.61% during 2025-2033. The rising demand for CBD products in Australia is driven by increasing interest in alternative medicine, greater product innovation, and a wider variety of offerings, as users seek natural remedies for physical and mental health concerns, favoring personalized, high-quality solutions for wellness.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.22 Billion |

| Market Forecast in 2033 | USD 0.50 Billion |

| Market Growth Rate 2025-2033 | 9.61% |

Key Trends of Australia CBD Products Market:

Enhanced Product Innovation and Variety

The growing innovation in CBD products with businesses providing a more varied selection of offerings is positively influencing the market in Australia. From oils and tinctures to edibles, topicals, and skincare products, the range of CBD choices is increasing to meet a wider array of user preferences and requirements. This advancement is seen in the variety of products offered and also in the strength, purity, and bioavailability of CBD, providing more efficient options for individuals. As user preferences move towards tailored products to tackle particular health issues, companies are persistently enhancing formulations and launching novel uses for CBD. A definitive illustration of this trend is the introduction of Tilray Medical’s EU-GMP accredited Redecan cannabis offerings in Australia in 2024. This encompassed premium cannabis products like Redecan PC THC28 Purple Churro and Redecan SA THC28 Space Age Cake, broadening the selection of high-quality, certified CBD items accessible to users in Australia. Tilray Medical is enhancing the expanding range of CBD products and driving market innovation by providing an assorted assortment of high-quality, regulated items. This constant evolution ensures that the Australian CBD market remains dynamic and responsive to individual needs, attracting a wider user base and driving market growth as more people seek tailored solutions for their health and wellness.

To get more information on this market, Request Sample

Rising Popularity of Alternative Medicine

As traditional medicine faces increasing skepticism, many people are turning to alternative and complementary therapies, which is driving the demand for CBD products. A noticeable shift toward natural remedies is emerging, with more people preferring herbal treatments and plant-based solutions for managing both physical and mental health concerns. Individuals are becoming more educated about the potential benefits of CBD, especially in treating conditions, such as anxiety, insomnia, and chronic pain. This growing awareness is fostering a more open-minded approach, where individuals are willing to explore non-pharmaceutical options. A prime example of this shift is the launch of Charlotte's Web CBD formulation in Australia in 2024. Initially created by the Stanley Brothers to treat Charlotte Figi’s Dravet syndrome, this product garnered widespread media attention due to its success in managing Figi’s epilepsy. The product was locally manufactured and distributed with FoliuMed, marking a significant step in the acceptance of CBD as a legitimate, effective alternative treatment. This kind of high-profile success is contributing to the growing popularity of CBD as an alternative medicine, encouraging more people to seek out these natural solutions for their health needs. As the trend continues, CBD products are being incorporated into everyday wellness routines, supporting the market growth and cementing CBD’s place in the broader movement of natural and holistic health practices.

Growth Drivers of Australia CBD Products Market:

Rising Legal Acceptance and Regulatory Development

One of the most powerful forces behind growth in the Australia CBD products market share is the changing legal environment around cannabis and hemp-derived products. In recent years, Australia has experienced substantive regulatory development that has created a more permissive environment for CBD-based products, particularly for therapeutic use. The Therapeutic Goods Administration (TGA) has progressively eased limitations on low dose cannabidiol so that it is available over the counter under certain circumstances. The progressive development in this direction has led to both local and international companies investigating and developing their products in the Australian market. What is unique about Australia in this respect is its strict, evidence-based regulatory approach. These guarantees products have high quality and efficacy standards, which consequently establish trust with consumers. Moreover, the increased public debate on the medicinal uses of cannabis, especially in New South Wales and Victoria states, has also contributed to normalizing the use of CBD, leading more individuals to go out in search of it for anxiety, sleep, and relieving chronic pain.

Unique Agricultural Capacity and Domestic Production

According to the Australia CBD products market analysis, the region’s climatic and geographical conditions render it strategically placed for cultivating industrial hemp, the main provider of CBD. The nation has vast acres of cultivated land with varying environmental regions, which permit continuous and high-quality production of hemp. Specifically in areas such as Tasmania and parts of Western Australia, the domestic agricultural industry has increased cultivation to supply both locally and overseas. What is particularly unique about this growth is the nation's capacity to cultivate a vertically integrated supply chain, reducing dependence on imports. With robust agricultural research organizations and government-backed programs pursuing sustainable crop innovation, Australia is set to become a significant provider of hemp-sourced CBD. Not only does this local supply diminish production expenses, but it also facilitates improved product traceability and quality control, which is a priority for Australian consumers. This agricultural prowess underpins the growing CBD product range in applications like skincare, edibles, and wellness supplements.

Increased Health Consciousness and Changing Consumer Attitudes

The rising health awareness among customers is a critical driver of the Australia CBD products market growth. Consumers are increasingly looking for natural solutions to pharmaceutical drugs based on a quest for overall wellness and reduced side effects. This trend is especially visible in cities such as Melbourne, Sydney, and Brisbane, where the culture of wellness has taken root. Australians are also at the forefront of adopting wellness trends, and CBD has easily blended into mental health-oriented lifestyles, fitness recovery, and proactive care. Local manufacturers have capitalized on this cultural transformation with new CBD-infused products developed to suit Australian ways of life, like topical balms for surf-related joint soreness or tinctures sold for outback stamina. Stigma against the use of cannabis is also in decline, following nationwide education drives and increasing support for medical cannabis. Collectively, these changes in perception and choice are driving demand, while stimulating long-term innovation and investment in the CBD market throughout Australia.

Opportunities of Australia CBD Products Market:

Growth in Therapeutic Uses and Over-the-Counter Availability

Australia offers a substantial opportunity in CBD product development for therapeutic application, especially with the relaxing of access via pharmacy outlets. With low-dose CBD being over-the-counter available under certain guidelines, firms have the opportunity to address a large section of the population requiring relief from anxiety, insomnia, inflammation, and chronic pain. The model of regulation used here is specific to the region and puts Australia at the forefront of legitimizing CBD use for common conditions in an open yet controlled system. The Australian health infrastructure, supported by robust general practitioner-subsidiary pharmacy relationships, provides a natural vehicle for dispensing CBD products in an evidence-led environment. There is also an increasing volume of local research, mainly from Australian medical institutes and universities, which endorses the effectiveness of CBD in treating several ailments. This increases confidence among patients and healthcare professionals alike, clearing the way for increased acceptance and adoption.

Export Potential Through Quality Standards and Regional Proximity

Australia's image for robust quality control and ecologically friendly approaches gives it a significant advantage in reaching international CBD markets, particularly in Asia-Pacific markets where the Australia CBD products market demand is growing. Nations like Japan, South Korea, and Thailand are in the process of testing or slowly opening up their markets to CBD, and Australia's geographical proximity and high standard of manufacturing place it well as a supplier. The nation's clean and green reputation, coupled with government regulation of production processes, contributes to the added value of "Made in Australia" CBD products. Local producers also enjoy preferential trade agreements and an existing export infrastructure, especially through Sydney, Brisbane, and Fremantle ports. Australian businesses have a unique chance to establish reputable brands in nascent CBD markets overseas while tapping into regional consumer demand for traceable and responsibly produced health products. This export opportunity is unusual geographically and in being able to drive market education and influence consumer trust within newer markets.

Innovation in Niche Lifestyle and Wellness Segments

Australia's multicultural consumer base and robust cultural predisposition toward wellness and natural living create opportunities for innovation in niche CBD product segments. From lifestyle supplement products geared to surfers, hikers, and athletes, to sun and dry climate skin products, the local market permits authentically Australian product innovation. CBD laden sunscreens and after-sun balms, for instance, are specifically designed to meet Australia's high UV environment- an aspect not generally available in other international markets. There is also a shift to organic and sustainable living, particularly among coastal and rural communities, where there is high demand for plant-based, chemical-free products. This can be capitalized on by Australian CBD brands through the production of purpose-driven, locally customized products that adhere to the local lifestyle and values. Moreover, pet wellness trends offer further scope, as it is common knowledge that Australians engage in high spend on pet wellness. These lifestyle-congruent niches make the market ready for varied, creative CBD uses with far-reaching appeal.

Challenges of Australia CBD Products Market:

Sophisticated Regulatory Environment and Restricted Product Classification

One of the biggest issues confronting the market for CBD products in Australia is the sophistication and inflexibility of its regulatory environment. Although the Therapeutic Goods Administration (TGA) has authorized low-dose CBD products to be made available over-the-counter, classification itself remains extremely restrictive. Only CBD products registered or listed on the TGA are allowed to sell legally, and this involves the submission of a lot of clinical evidence and compliance with rigorous quality standards. The process is both time-consuming and expensive, and it acts as a great barrier for small and medium-sized businesses seeking to enter the market. In contrast to other nations in which CBD is more akin to a supplement or wellness product, Australia positions it in quasi-pharmaceutical status. This restricts the marketing and sale of CBD products. The requirement for pharmaceutical-grade manufacturing and labeling rules creates yet another level of complexity, usually hindering innovation and time-to-market for new products.

Public Perception and Education Gaps

Although interest continues to increase, public knowledge about CBD in Australia remains uneven, continuing to impact consumer confidence and market growth. Most Australians are still uncertain about the distinction between CBD and THC and connect all cannabis-derived items to illicit drug consumption. This is even more evident in conservative areas and within older age groups. Urban cities such as Sydney and Melbourne tend to exhibit a growing acceptance, but CBD products might take longer to be embraced by rural populations due to residual cultural hesitations and misinformation. The Australian legal medical cannabis regime is only recent, and although it has opened doors, it has opened them to confusion regarding what is legal and what is not, particularly since states interpret guidelines differently. This lack of consistent public education and knowledge complicates it for businesses to market their products. Brands will hence need to spend a lot of money on educating consumers in order to fill the gap, which can be both time-consuming and expensive.

Constraints in Supply Chain and Production Cost

Australia's geographical isolation gives rise to specific logistical challenges in production and distribution of CBD products. Although the nation has robust agricultural functions for growing hemp, most of the infrastructure required for CBD extraction, purification, and mass manufacturing is still on the go. Having to import specialized gear or locally unavailable raw materials also contributes to costs of operation. Furthermore, rigorous biosecurity regulations and customs procedures complicate importing or exporting CBD materials. These limitations can contribute to the cost of production being greater than in countries with more developed cannabis industries, like the US or regions of Europe. There is also the issue of product quality consistency from batch to batch, which is absolutely paramount considering the pharmaceutical-grade levels demanded of the TGA. The smaller producers might find it difficult to remain profitable because of these barriers to entry, particularly when up against imported lines or the multinational brands with larger economies of scale. All combined, these cost and supply chain issues can dampen the growth rate of the industry in Australia.

Australia CBD Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on source, distribution channel, and application.

Source Insights:

- Hemp

- Marijuana

A detailed breakup and analysis of the market based on the source have also been provided in the report. This includes hemp and marijuana.

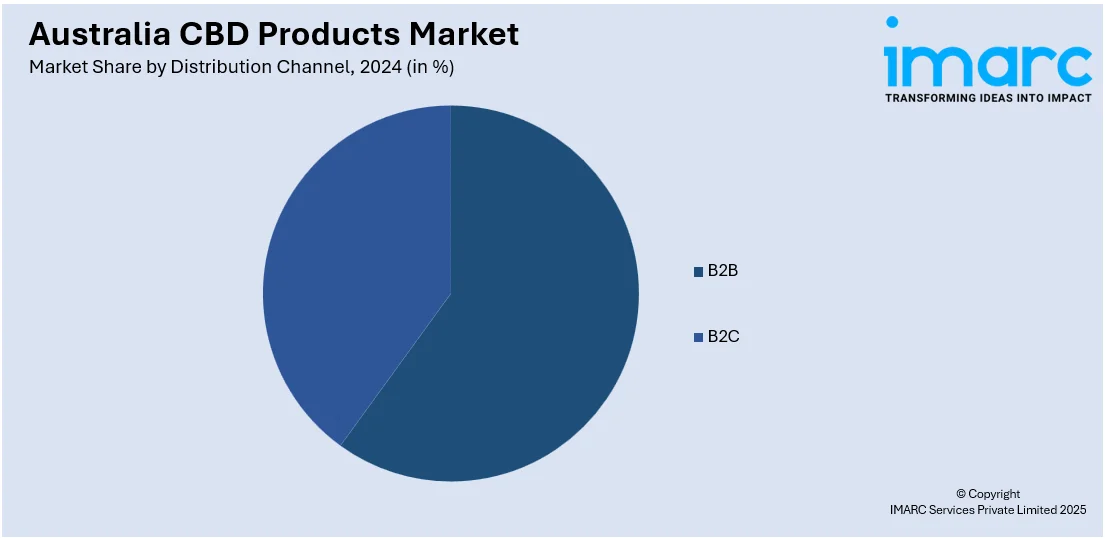

Distribution Channel Insights:

- B2B

- B2C

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes B2B and B2C.

Application Insights:

- Pharmaceutical

- Wellness

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes pharmaceutical and wellness.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia CBD Products Market News:

- In April 2025, Tilray launched its first range of cannabis-infused medical edibles in Australia under the Good Supply brand. The sugar-free, vegan-friendly pastilles come in three variants, including THC10, THC10 CBD10, and CBD20. This marks a significant milestone in Tilray's international expansion, offering new treatment options for Australian medical cannabis patients.

- In March 2025, Avecho Biotechnology and Sandoz signed a 10-year exclusive license and development agreement to commercialize Avecho's CBD capsule for insomnia in Australia. Avecho will retain rights in other markets, with Sandoz handling commercialization and distribution in Australia. The agreement includes potential milestone payments and royalties for Avecho, as well as the aim for TGA approval of the product.

Australia CBD Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Hemp, Marijuana |

| Distribution Channels Covered | B2B, B2C |

| Applications Covered | Pharmaceutical, Wellness |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia CBD products market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia CBD products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia CBD products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia CBD products market was valued at USD 0.22 Billion in 2024.

The Australia CBD products market is projected to exhibit a CAGR of 9.61% during 2025-2033.

The Australia CBD products market is expected to reach a value of USD 0.50 Billion by 2033.

The key trend of the Australia CBD products market is shifting toward premium, lab-tested wellness goods with clear traceability. Interest is rising in niche formats like skincare, pet care, and functional beverages tailored to Australian lifestyle. Brands emphasize sustainable, local industrial hemp sourcing. Digital marketing, telehealth integration, and pharmacy-based distribution are also expanding.

Key drivers of Australia CBD products market include evolving regulations, growing consumer interest in natural health alternatives, and increased over-the-counter access. Local hemp cultivation supports product traceability and quality. Rising public awareness, healthcare professional endorsements, and demand for wellness products tailored to Australian lifestyles are also fueling sustained market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)