Australia Buy Now Pay Later Services Market Size, Share, Trends and Forecast by Channel, Enterprise Size, End Use, and Region, 2025-2033

Australia Buy Now Pay Later Services Market Size and Share:

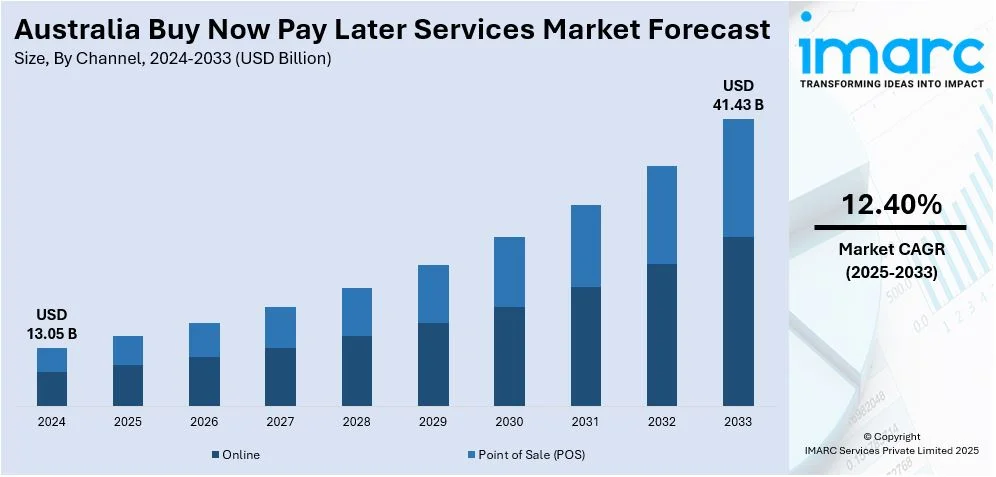

The Australia buy now pay later services market size was valued at USD 13.05 Billion in 2024. Looking forward, the market is projected to reach USD 41.43 Billion by 2033, exhibiting a CAGR of 12.40% from 2025-2033. The market share is expanding, driven by the escalating demand for flexible payment options, the rapid adoption of e-commerce platforms for purchasing products and services, continual technological advancements, integration with major retailers and platforms, and supportive regulatory frameworks.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 13.05 Billion |

| Market Forecast in 2033 | USD 41.43 Billion |

| Market Growth Rate (2025-2033) | 12.40% |

The Australian buy now, pay later (BNPL) services market has shown robust growth. A combination of evolving preferences and technological advancements, along with a shift in economic conditions, is responsible for driving the market. The market provides people with a viable alternative, allowing one to pay for items purchased in regular installments over time, often without accruing interest or other charges as long as repayments are duly met. BNPL is popular for convenience, flexibility, and helping individuals better manage their cash flow. Traditional credit products such as credit cards and personal loans have come under scrutiny due to high interest rates, complex terms, and the potential for debt accumulation. They come forth as an alternative that enjoys better transparency and ease of understanding with simple repayment terms and almost non-existent barriers to entry.

To get more information on this market, Request Sample

A significant trend influencing the market is the increasing digitalization of retail and e-commerce across Australia. As more shoppers turn to online purchases, BNPL services are becoming more integrated into e-commerce platforms, facilitating a smooth checkout process. Retailers, seeing the advantages of providing BNPL options, are collaborating with BNPL providers to boost conversion rates and enhance average order values. By allowing individuals to distribute the cost of purchases over time, BNPL services can motivate consumers to buy more expensive items or shop more often, ultimately benefiting both buyers and retailers. The economic landscape in Australia also significantly influences the growth of BNPL services.

Key Trends of Australia Buy Now Pay Later Services Market:

Changing Consumer Preferences and Demand for Flexible Payment Solutions

A significant factor propelling the BNPL market growth in Australia is the changing inclination for flexible payment choices. Individuals, especially within younger demographics like Millennials and Gen Z in Australia, are progressively looking for options beyond conventional credit offerings like credit cards. BNPL services offer a simple and clear method for handling finances, typically providing interest-free instalments when payments are timely. In contrast to credit cards, BNPL options are generally simpler to comprehend, featuring fixed repayment plans and no concealed charges. Consequently, people are turning to BNPL options for facilitating bigger or more regular purchases without the financial strain often associated with conventional credit methods. By 2033, the IMARC Group forecasts that the digital payment market in Australia will reach USD 667.0 Billion.

Growth of E-commerce and Digital Shopping Platforms

The rapid expansion of e-commerce and digital shopping platforms is offering a favorable Australia buy now pay later services market outlook. With online shopping emerging as the favored way to buy goods and services, BNPL providers have tailored their services to match digital retail trends. The capability to incorporate BNPL choices effortlessly into the checkout experience enables retailers to provide instant financing options without requiring customers to exit the platform or seek conventional credit products. This integration has shown to enhance conversion rates, elevate sales, and promote larger transaction amounts, benefiting both consumers and retailers. BNPL services specifically appeal to online shoppers, as they offer an easy, fast, and convenient method for handling payments, which has become a vital element in influencing online buying choices. As per the Australian Bureau of Statistics, online retail sales amounted to USD 4,411.2 Million in December 2024.

Economic Pressures and Rising Cost of Living

The economic environment in Australia, marked by rising living costs and financial pressures, is propelling the Australia buy now pay later services market growth. As individuals encounter rising costs for products and services, especially in housing, food, and utilities, they are more frequently searching for adaptable payment options to handle their expenditures. For example, in 2024, Clio launched Clio Payments in Australia, a versatile payment solution for legal practices. Additionally, BNPL services enable individuals to distribute payments over a period, providing an option to avoid paying significant amounts at once. The capacity to handle cash flow more effectively is attractive, particularly for individuals who might lack access to conventional credit options or prefer to steer clear of burdensome high-interest loans. For numerous individuals, the attraction is found in the clarity and straightforwardness of BNPL conditions, which can offer a feeling of financial safety without the intricacies of conventional borrowing. As long as economic pressure persists, the demand for flexible payment options such as BNPL is anticipated to stay robust.

Growth Drivers of Australia Buy Now Pay Later Services Market:

Young Demographic

The younger population especially millennials and Gen Z plays a crucial role in the growth of the Buy Now, Pay Later (BNPL) services market. These demographics are deeply connected through digital platforms and prefer financial solutions that stray from traditional credit systems. They are drawn to BNPL options because of their flexibility, user-friendliness, and the chance to sidestep conventional credit card debt. Young consumers are more inclined to utilize services that provide a smooth app-based experience enabling them to manage their finances in a more controlled and transparent manner. As digital natives, they are open to innovative payment methods and BNPL offers them the chance to make purchases without worrying about high-interest rates or long-lasting commitments positioning it as their choice for financial management.

Low-Interest Financing

A major appeal of Buy Now, Pay Later (BNPL) services is the low-interest, frequently interest-free, financing alternatives they provide. In contrast to traditional credit products which often come with high-interest rates and concealed fees BNPL services present a straightforward and flexible choice for consumers to distribute their payments over time without incurring added financial strain. This is especially attractive to those who may lack access to conventional credit or are hesitant about piling up high-interest credit card debt. By offering short-term, interest-free payment plans BNPL services promote responsible spending making them an increasingly favored option for consumers seeking straightforward and predictable payment methods without the concern of excessive interest costs.

Retailer Integration

Retailer integration significantly contributes to the expansion of the Buy Now, Pay Later (BNPL) services market. A growing number of both online and physical retailers are beginning to include BNPL options at checkout, acknowledging the advantages of providing flexible payment solutions to their clientele. This integration enables consumers to tap into BNPL services instantly during their shopping experience, improving convenience and minimizing friction in the buying process. By offering BNPL as a payment choice, retailers can appeal to a broader audience, particularly those who may not be able to make full payments immediately. Furthermore, it has been demonstrated that the presence of BNPL can enhance conversion rates and increase the average transaction values, benefiting retailers while broadening the service's accessibility.

Opportunities of Australia Buy Now Pay Later Services Market:

Expansion into New Demographics

The Buy Now, Pay Later (BNPL) sector in Australia has predominantly focused on younger, tech-savvy audiences. However, there exists a substantial opportunity to reach older demographics who may not have typically engaged with BNPL services. This could involve creating more flexible and customized payment options that align with the financial behaviors of older individuals. For instance, offering extended repayment periods or interest-free choices for significant, necessary purchases such as home renovations or medical expenses might resonate with this age group. Given that older consumers tend to be more cautious regarding credit, they may find BNPL services appealing if designed to reduce financial risk. By extending their focus to include older customers, BNPL providers can access a new, valuable market segment that prioritizes flexibility in financial services.

Partnerships with More Retailers

A significant opportunity for the Buy Now, Pay Later (BNPL) market is to develop partnerships with a wider array of retailers, both large and small. At present, BNPL services are mainly concentrated in sectors like fashion, electronics, and entertainment. However, expanding into areas such as healthcare, travel, and education would allow BNPL services to address a broader spectrum of consumer requirements. For example, integrating BNPL with healthcare services could help consumers manage medical expenses through instalments. Similarly, providing BNPL options for travel or education costs would unlock new growth possibilities, as these areas are associated with considerable consumer spending. By widening the sectors that adopt BNPL services, providers can boost adoption rates and attract a more diverse customer base, thus driving market expansion.

International Expansion

Australia's Buy Now, Pay Later (BNPL) market has seen rapid growth, presenting vast opportunities for international expansion of the model. Various global markets, especially in North America, Europe, and certain regions of Asia, display similar consumer trends—specifically e-commerce-driven purchases and a demand for flexible payment options. By tailoring the BNPL service to accommodate the regulatory and cultural specificities of these international markets, Australian providers can engage with a larger and more varied customer demographic. The worldwide trend of moving away from traditional credit systems further bolsters this expansion. Through strategic alliances with global retailers and localized marketing initiatives, BNPL providers can enhance their operations, replicate their Australian success, and position themselves as leaders in international markets.

Challenges of Australia Buy Now Pay Later Services Market:

Regulatory Uncertainty

As the Buy Now, Pay Later (BNPL) services market expands, there is increasing regulatory oversight. Regulatory bodies and governments are paying closer attention to ensure that BNPL services are not leading to excessive consumer debt or promoting irresponsible spending. This growing focus may result in the introduction of stricter regulations, such as clearer lending standards, caps on credit amounts, or more rigorous consumer protection measures. Although these regulations aim to safeguard consumers, they also present operational challenges for BNPL providers. Adapting to new compliance obligations may increase operational costs and necessitate changes in business models, which could impact profit margins and market dynamics. Providers will need to swiftly adapt in order to continue growing while aligning with changing financial regulations.

Market Saturation

The Australian BNPL sector is quickly reaching saturation as a growing number of companies enter the arena, competing for a piece of the rising consumer appetite for flexible payment solutions. Although BNPL services have seen considerable growth, the competition is becoming fiercer, making it challenging for newcomers to establish a foothold. Established players like Afterpay, Zip, and Klarna have already built strong brand identities and expansive customer bases. As competition escalates, the need for differentiation becomes crucial, and companies must seek innovative offerings, enhanced user experiences, or exclusive partnerships to set themselves apart. Furthermore, with numerous providers targeting the same retailers and consumers, profit margins may decline, and customer acquisition expenses could rise, constraining growth opportunities.

Credit Risk and Defaults

A major challenge in the BNPL market is the escalating risk of credit defaults, particularly as more consumers engage with BNPL services without undergoing traditional credit assessments. Unlike banks or credit card issuers, BNPL providers typically do not evaluate a customer’s credit score in the same way, leading to heightened financial risk. Consumers might overextend themselves by entering multiple BNPL agreements without fully grasping the repercussions of missed payments. A significant number of defaults could adversely impact the financial stability of BNPL providers. This risk poses profitability challenges, as companies may incur greater expenses related to debt recovery, late fees, and loss provisions, jeopardizing their long-term viability in the market.

Australia Buy Now Pay Later Services Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Australia buy now pay later services market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on channel, enterprise size, and end use.

Analysis by Channel:

- Online

- Point of Sale (POS)

The online segment of the market is driven by the increasing penetration of e-commerce platforms, growing internet accessibility, and rising preferences for digital transactions. People are increasingly opting for online channels due to the convenience of browsing, comparing, and purchasing products or services from the comfort of their homes. Additionally, the availability of multiple payment options, attractive discounts, and doorstep delivery services further enhance the appeal of online platforms.

The point of sale (POS) segment remains a significant distribution channel, particularly for businesses that rely on direct consumer interactions. POS transactions occur at physical locations, including retail stores, supermarkets, restaurants, and service centers, where customers can make payments using cash, credit/debit cards, or mobile payment systems. This channel benefits from immediate transactions, personalized customer service, and the ability to physically inspect products before purchase.

Analysis by Enterprise Size:

- Large Enterprises

- Small and Medium Enterprises

Large enterprises play a crucial role in the market, leveraging their extensive resources, established brand presence, and advanced technological infrastructure to drive growth. These organizations often have significant capital to invest in cutting-edge solutions, automation, and data-driven decision-making tools, allowing them to optimize operations and enhance customer engagement.

Small and medium enterprises contribute significantly to market dynamism by fostering innovation, agility, and localized customer engagement. Unlike large corporations, SMEs operate with lean structures, allowing them to adapt quickly to market changes and requirements, thereby driving the Australia buy now pay later services market demand.

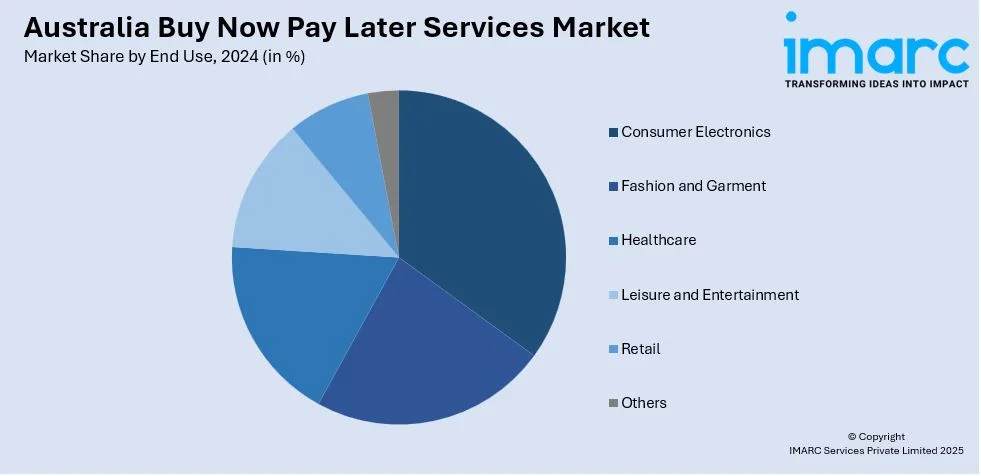

Analysis by End Use:

- Consumer Electronics

- Fashion and Garment

- Healthcare

- Leisure and Entertainment

- Retail

- Others

The consumer electronics segment is driven by the increasing reliance on smartphones, laptops, wearables, and other digital devices that have become essential in daily life. Rapid technological advancements, coupled with the growing preference for smart and connected devices, have fueled the market growth. Consumers seek convenience, efficiency, and innovation, leading to higher adoption rates of online shopping for electronics.

The fashion and garment industry continues to evolve with changing consumer preferences, seasonal trends, and increasing awareness about sustainable fashion. This segment includes apparel, footwear, and accessories, with both luxury and fast-fashion brands competing for market share. E-commerce has significantly influenced purchasing behavior, offering consumers a wide variety of styles, price points, and customization options.

The healthcare segment encompasses pharmaceuticals, medical devices, wellness products, and personal care essentials, catering to an increasing demand for health and hygiene solutions. The rise in chronic diseases, aging populations, and heightened health awareness have contributed to the expansion of this segment.

The leisure and entertainment segment includes products and services related to gaming, sports, travel, and recreational activities. Digital transformation has reshaped this sector, with online streaming platforms, mobile gaming, and virtual experiences gaining immense popularity. Consumers increasingly seek flexible entertainment options that cater to their on-the-go lifestyles, leading to the rapid adoption of digital subscriptions and e-tickets.

The retail segment encompasses a broad range of products, from groceries and household goods to luxury items and specialty products. With evolving consumer habits, retailers have embraced both online and offline channels to maximize reach and sales. The rise of e-commerce has introduced personalized shopping experiences, AI-driven recommendations, and doorstep delivery, transforming retail dynamics.

Regional Analysis:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

This region is a major economic hub, driven by Sydney’s strong financial sector, government institutions, and a thriving retail and consumer market. The high population density and urbanization contribute to a robust demand for various products and services, making it a key area for market expansion. With a well-developed infrastructure and digital connectivity, e-commerce has gained significant traction, while traditional retail continues to thrive in metropolitan centers.

Victoria, home to Melbourne, serves as a commercial and cultural center with a diverse consumer base and a dynamic retail landscape. The state is known for its strong fashion, entertainment, and hospitality industries, driving demand across multiple market segments. Tasmania, while smaller in scale, benefits from a growing tourism sector and an increasing preference for locally produced goods.

Queensland’s market is shaped by its strong tourism industry, booming construction sector, and expanding urban centers such as Brisbane and the Gold Coast. The state’s warm climate and outdoor lifestyle contribute to high demand for leisure, fashion, and entertainment-related products. Additionally, its growing population and infrastructure developments are fueling retail expansion, both online and offline.

These regions have a unique market dynamic due to their lower population densities and reliance on industries such as mining, agriculture, and defense. In South Australia, Adelaide serves as a commercial hub, supporting retail, healthcare, and technology growth. Meanwhile, the Northern Territory’s economy is driven by tourism and natural resource exports, influencing consumer demand and spending patterns.

Western Australia, led by Perth, is an economic powerhouse due to its strong mining and resources sector, which significantly impacts regional purchasing power. The high-income population in mining hubs supports demand for premium and luxury goods, while Perth’s urban development fosters growth in retail, healthcare, and entertainment markets. The region’s geographical vastness presents logistical challenges for distribution, making e-commerce and digital platforms critical in reaching consumers efficiently.

Competitive Landscape:

Market players are launching a self-regulated spending limit function in their app, enabling users to establish personal budget restrictions beneath their authorized levels. This effort seeks to encourage prudent spending, especially among younger people dealing with financial difficulties. The feature is scheduled to debut in Australia before expanding to additional markets. BNPL providers are utilizing artificial intelligence (AI) to improve their operational efficiency. The business is introducing AI-powered chatbots in customer service positions, carrying out responsibilities like those of human workers. The embrace of AI has resulted in considerable job cuts, with intentions for additional layoffs as part of a strategy to get ready for a possible stock market offering. Moreover, BNPL firms are broadening their services to cover areas like leisure and entertainment. By offering adaptable payment choices for events such as concerts, festivals, and travel reservations, these companies are expanding their reach and accessing new customer demographics.

The report provides a comprehensive analysis of the competitive landscape in the Australia buy now pay later services market with detailed profiles of all major companies.

Latest News and Developments:

- February 2025: ASIC unveiled a consultation on new regulatory guidance for the buy now pay later industry. The company published the draft Regulatory Guide 000, low cost credit contracts (Draft RG 000), alongside Consultation Paper 382, Low cost credit contracts (CP 382), inviting feedback from the industry and relevant stakeholders.

- June 2024: The Australian government unveiled a bill mandating buy-now-pay-later (BNPL) companies to conduct credit assessments on borrowers, seeking to regulate the swiftly expanding industry favored by young consumers similar to other credit offerings.

- November 2023: AtPay, a buy now, pay later (BNPL) service utilizing decentralized finance (DeFi), has partnered with core banking platform Pismo ahead of a soft launch in Australia.

Australia Buy Now Pay Later Services Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Channels Covered | Online, Point of Sale (POS) |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium Enterprises |

| End Uses Covered | Consumer Electronics, Fashion and Garment, Healthcare, Leisure and Entertainment, Retail, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, Australia buy now pay later services market forecasts, and dynamics of the market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Australia buy now pay later services market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia buy now pay later services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Buy Now Pay Later (BNPL) services market in Australia was valued at USD 13.05 Billion in 2024.

The BNPL services market in Australia is projected to grow at a CAGR of 12.40% from 2025-2033, reaching a value of USD 41.43 Billion by 2033.

Key trends in Australia's buy now pay later (BNPL) market include the increasing adoption of BNPL services across diverse sectors like healthcare, travel, and education. Additionally, there is a rise in regulatory scrutiny, a focus on consumer protection, and growing competition, pushing providers to innovate with flexible and personalized payment plans.

The growth of the BNPL services market in Australia is driven by rising demand for flexible payment options, rapid e-commerce expansion, integration with major retailers, technological advancements, and increasing economic pressures due to the high cost of living. Additionally, consumer preference for alternatives to traditional credit products is fueling adoption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)