Australia Biscuits Market Size, Share, Trends and Forecast by Product Type, Ingredient, Packaging Type, Distribution Channel, and Region, 2025-2033

Australia Biscuits Market Overview:

The Australia biscuits market size reached USD 1.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.6 Billion by 2033, exhibiting a growth rate (CAGR) of 6.08% during 2025-2033. Rising demand for convenient snacks, increasing health-consciousness, boosting interest in healthier varieties, innovation in flavors and packaging, growing e-commerce channels, and premiumization trends are some of the factors propelling the growth of the market. Seasonal promotions and expanding product ranges also support sustained consumer engagement and brand competition.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.6 Billion |

| Market Growth Rate 2025-2033 | 6.08% |

Australia Biscuits Market Trends:

Rising Preference for Heritage Biscuits

In Australia, there has been a noticeable shift toward traditional biscuit varieties with deep-rooted familiarity among consumers. Products that have stood the test of time are seeing renewed interest, especially those associated with nostalgia and everyday indulgence. Classic recipes known for their rich, buttery texture and consistent taste are gaining more shelf space and household preference. This movement reflects a growing desire for comfort snacks that evoke tradition, reliability, and emotional connection. Retailers are responding by highlighting these longstanding favorites in promotions and product displays. The appeal lies not only in flavor but also in the product’s established identity, which resonates across generations. This return to familiar biscuit choices suggests a broader lean toward authenticity and simplicity in snacking habits. For example, in November 2024, Arnott's revealed that its 120-year-old Scotch Finger biscuit continued to grow in popularity, with 11 million packets sold in the past year, marking a 19.4% sales increase from October 2023 to October 2024.

To get more information on this market, Request Sample

Growth in Filled Biscuit Offerings

Australia’s biscuit segment is expanding with the introduction of filled biscuit formats that combine texture with indulgent flavors. New launches featuring smooth, rich centers paired with crisp outer layers are capturing attention in the sweet snack aisle. These offerings cater to evolving preferences for convenient, shareable treats that balance taste with practicality. Packaging formats designed for freshness and portability add to their appeal, particularly among on-the-go consumers and families. With premium positioning and eye-catching shelf presence, these biscuits align with the demand for innovative, flavor-forward snacks. Their entry reflects a shift toward more experiential biscuit varieties, where multi-sensory appeal, crunch, creaminess, and aroma enhance everyday snacking occasions and drive repeat purchases across age groups. For instance, in January 2023, Nutella introduced Nutella Biscuits to Australian grocery stores. These biscuits feature a crunchy golden base filled with Nutella's signature hazelnut spread and come in a resealable pouch, making them ideal for sharing. Nutella Biscuits are available in the biscuit aisle of major supermarkets at a recommended retail price of USD 6 per pack.

Australia Biscuits Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, ingredient, packaging type, and distribution channel.

Product Type Insights:

- Crackers and Savory Biscuits

- Plain Crackers

- Flavored Crackers

- Sweet Biscuits

- Plain Biscuits

- Cookies

- Sandwich Biscuits

- Chocolate-coated Biscuits

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes crackers and savory biscuits (plain crackers and flavored crackers) and sweet biscuits (plain biscuits, cookies, sandwich biscuits, chocolate-coated biscuits, and others).

Ingredient Insights:

- Wheat

- Oats

- Millets

- Others

A detailed breakup and analysis of the market based on the ingredient have also been provided in the report. This includes wheat, oats, millets, and others.

Packaging Type Insights:

- Pouches/Packets

- Jars

- Boxes

- Others

The report has provided a detailed breakup and analysis of the market based on the packaging type. This includes pouches/packets, jars, boxes, and others.

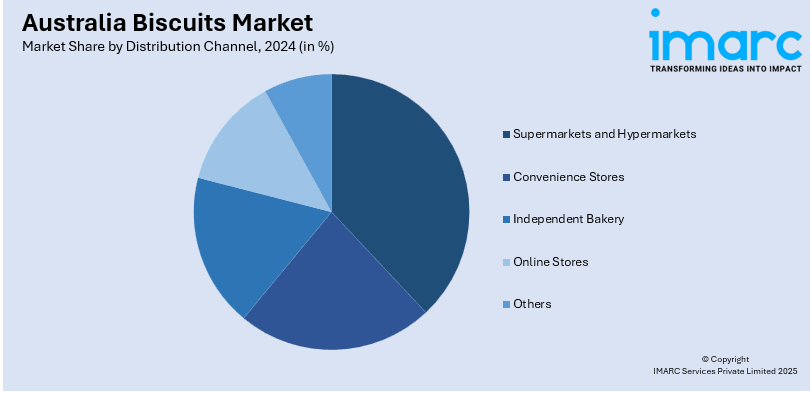

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Independent Bakery

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, independent bakery, online stores, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Biscuits Market News:

- In December 2024, Arnott's reported that Tim Tam Original was Australia's top-selling biscuit, despite a price increase to USD 6 per packet due to rising input costs, notably cocoa. Other popular biscuits included Barbecue Shapes, Chicken Crimpy Shapes, Pizza Shapes, and Jatz.

Australia Biscuits Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Ingredients Covered | Wheat, Oats, Millets, Others |

| Packaging Types Covered | Pouches/Packets, Jars, Boxes, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Independent Bakery, Online Stores, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia biscuits market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia biscuits market on the basis of product type?

- What is the breakup of the Australia biscuits market on the basis of ingredient?

- What is the breakup of the Australia biscuits market on the basis of packaging type?

- What is the breakup of the Australia biscuits market on the basis of distribution channel?

- What are the various stages in the value chain of the Australia biscuits market?

- What are the key driving factors and challenges in the Australia biscuits market?

- What is the structure of the Australia biscuits market and who are the key players?

- What is the degree of competition in the Australia biscuits market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia biscuits market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia biscuits market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia biscuits industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)