Australia Automotive Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Australia Automotive Market Size and Share:

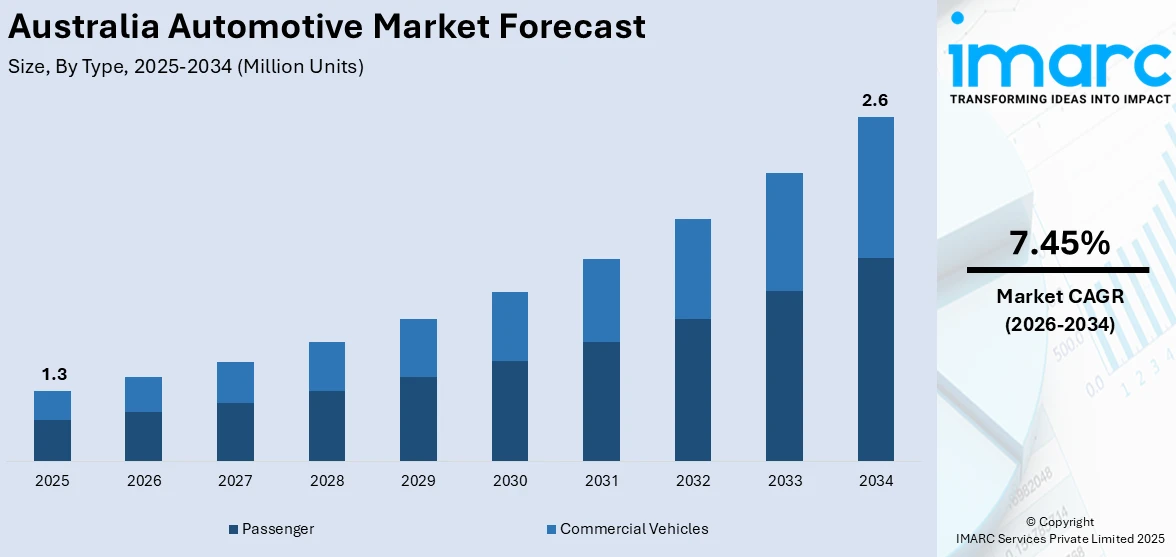

The Australia automotive market size was valued at 1.3 Million Units in 2025. Looking forward, the market is expected to reach 2.6 Million Units by 2034, exhibiting a CAGR of 7.45% from 2026-2034. The market is driven by the rising electric vehicle (EV) adoption, rising government incentives, increasing fuel prices, surging demand for sport utility vehicles (SUVs), autonomous technology advancements, and expanding charging infrastructure.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

1.3 Million Units |

|

Market Forecast in 2034

|

2.6 Million Units |

| Market Growth Rate 2026-2034 | 7.45% |

The Australia automotive market growth is driven by the evolving consumer preferences and continuous technological advancements. In addition, the rising demand for fuel-efficient and eco-friendly vehicles, particularly electric vehicles (EVs) and hybrids, is fueling the market demand as government policies promote sustainability through tax incentives, rebates, and stricter emissions regulations. For instance, in 2025, the Australian government allocated $50 million to subsidize EV loans for farmers and truckers, encouraging the adoption of electric utes and contributing to the market growth. Moreover, the growing urban population and infrastructure development support vehicle sales, with an increasing emphasis on smart mobility solutions, providing an impetus to the market. Moreover, the rise of ride-sharing services and subscription-based vehicle ownership models is prompting manufacturers and dealerships to adjust their sales strategies to evolving consumer preferences, thereby driving market growth.

To get more information of this market Request Sample

At the same time, in the commercial world, the need for light commercial vehicles (LCVs) and heavy trucks is increasing, driven by expansion in e-commerce, construction, and mining sectors. For instance, in September 2024, the Toyota RAV4 dominated monthly sales with 5,182 units, followed by the Toyota HiLux with 4,313 units, reflecting ongoing demand for SUVs and utes. According to this, ongoing development in vehicle safety, autonomous driving technology, and connectivity features in cars is boosting the confidence of the consumers, and enhancing the market demand. Apart from this, the growth in charging points, especially in urban areas, is promoting the adoption of EVs, leading to the growth of the market. Furthermore, financial incentives for fleet electrification make companies want to adopt sustainable transport options, pushing the demand for the market. Also, continuous supply chain interruptions and semiconductor shortages continue to challenge the company, impacting availability and pricing for vehicles in the near term and driving the business forward.

Key Trends of Australia Automotive Market:

Surging Electric Vehicle (EV) Adoption

The surging EV adoption is significantly influencing the Australia automotive market trends. For example, in 2024, EV sales in Australia reached a record high of approximately 114,000 units, accounting for nearly 10% of all new light vehicle sales. This surge reflects substantial growth from previous years, fueled by an expanded model lineup and enhanced charging infrastructure. The market in the region is experiencing swift growth because of state support programs and rising environmental visibility together with expanding charging facilities. Major car manufacturers continue to release new EV models featuring enhanced energy efficiency and longer operating ranges to enhance customer interest. Apart from this, state-level policies that offer rebates and registration discounts and increasing fuel prices are speeding up the EV market adoption in the region. Furthermore, corporate fleets as well as ride-sharing services invest in EVs for their sustainability objectives and operational expense reduction, which is boosting the Australia automotive market demand.

Growth in SUV and Ute Demand

The growth of SUVs and utility vehicles (utes) is enhancing the Australia automotive market outlook, as they are the top-selling vehicle type in the region. For instance, the Ford Ranger was the best-selling vehicle in Australia in 2024, with 62,593 units sold, followed by the Toyota RAV4 SUV and Toyota HiLux ute. This highlights the leading position of utes and SUVs in the market. Driveway users prefer these utility models because they adapt well to various settings and deliver high offroad performance and roomy interior space. Moreover, automakers deliver sustainable luxury versions of their products with high environmental performance to address customer demands. Also, dual-cab utes continue to gain increasing popularity with personal and commercial customers because of their appeal. Besides this, the future of light commercial vehicle electrification receives support from government incentives, which drive manufacturers to develop electric and hybrid utes, fostering the market growth.

Advancements in Autonomous and Connected Vehicle Technology

The adoption of advanced driver-assistance systems (ADAS) and connected car technology is boosting the automotive market share in Australia. Features like adaptive cruise control, lane-keeping assistance, and collision avoidance systems are increasingly becoming standard in new vehicles, improving both safety and driving convenience. The rollout of 5G networks is further improving vehicle connectivity, enabling real-time traffic data, remote diagnostics, and over-the-air software updates. According to a survey, Australian car buyers consider 360° cameras with assisted parking as crucial features in new vehicles and blind spot monitoring as equally important. The high consumer interest in ADAS technologies shows the level of need for these features. Additionally, the increasing interest in semi-autonomous and autonomous vehicle testing works toward creating conditions for future self-driving technology to be adopted. This technological progress enhances automobile operation and shapes the direction of governmental traffic rules along with municipal development schemes, transforming the Australian automotive market forecast.

Growth Drivers of Australia Automotive Market:

Expanding EV Infrastructure and Policy Support

Australia’s accelerating transition to electric vehicles is underpinned by a broadening national charging network and state-level subsidies. Governments across Victoria, NSW, South Australia, and federal initiatives offer grants, reduced registration and stamp duty, and rebates for EV buyers, igniting consumer adoption. These incentives are complemented by the upcoming New Vehicle Efficiency Standard (January 2025), designed to lower fleet emissions and incentivize manufacturers to prioritize low- and zero-emission vehicles. With policies targeting 50% EVs by 2030 and full electric sales by 2035 in some jurisdictions, the regulatory environment provides clarity and motivation for both consumers and automakers. Strengthening the charging infrastructure further eases consumer concerns. Together, these dynamics are fueling Australia's shift towards electrified mobility.

Robust Aftermarket Demand and Vehicle Retention Trends

Australia’s automotive aftermarket is flourishing as drivers keep their vehicles longer and rack up more kilometers, boosting demand for repairs, parts, and servicing. An aging fleet requires maintenance or upgrades, particularly for tyres, brakes, and suspension systems. Consumers also embrace customization through accessories and infotainment enhancements as incomes rise. Furthermore, the integration of telematics, predictive maintenance tools, and digital platforms for service scheduling is modernizing the sector, creating new revenue streams and increasing aftermarket revenues. This combination of longer vehicle ownership, higher usage, and tech-savvy customization is cementing a resilient aftermarket ecosystem in Australia.

Diversified Vehicle Portfolio and Consumer Financing Options

The Australian automotive landscape now spans an extensive palette of vehicle models—from city hatchbacks to luxury performance sedans and UTEs—catering to varied consumer tastes. Amid economic fluctuations, flexible financing products such as competitive loans, leases, and BNPL schemes have broadened access, especially among younger demographics. These financing trends, coupled with a rising preference for premium features, safety tech, and connected vehicles, have driven sales across multiple segments. The expanding selection of body styles and price tiers, including hybrid and fuel-efficient variants, is opening the market to a wider consumer base, reinforcing long-term growth potential.

Opportunities of Australia Automotive Market:

Local Critical Mineral Processing for EV Supply Chains

Australia’s wealth of critical mineral reserves (lithium, nickel, cobalt, rare earths) positions it to capitalize on EV battery supply chains. By investing in downstream processing and refining, Australia can transition from raw export to value-added production, strengthening national automotive manufacturing capabilities. This opportunity aligns with global EV growth, particularly as Chinese brands (e.g., BYD) expand in Australia via affordability and brand strategy. Developing domestic processing facilities supports job creation and stabilizes battery supply chains. It also appeals to automakers seeking reliable, local sources for their EV components, offering competitive advantages and reducing exposure to geopolitical supply chain risks.

Aftermarket Innovation in Digital Services and Connected Vehicles

Rising vehicle connectivity creates a ripe environment for aftermarket innovation. Telematics, IoT-enabled diagnostics, and remote vehicle monitoring enable subscription-based predictive maintenance and early fault detection services. Independent workshops and digital parts platforms are tapping into this trend by integrating online booking, part tracking, and over-the-air updates. Meanwhile, e-commerce penetration for parts is growing, attracting younger, tech-savvy consumers who enjoy convenience. According to the Australia automotive market analysis, this shift promotes higher vehicle lifespan, lower total cost of ownership, and opens lucrative recurring revenue streams, especially as EVs and advanced ICE vehicles become more prevalent. Businesses that embrace digital-first strategies can capture this evolving consumer behavior.

Autonomous Utility Vehicles for Specialized Applications

Australia holds opportunities in niche vehicle segments like autonomous utility and robotic vehicles for mining, delivery, and municipal services. Firms such as Applied EV are pioneering partnerships (e.g., Suzuki) to develop rugged autonomous platforms suited to remote or dangerous work environments. These systems can enhance safety, reduce labor costs, and deliver operational efficiencies in sectors overlooked by passenger EV adoption. Australia’s industrial landscape, mining operations, and regional delivery routes provide a practical testbed and demand base. Given global interest and local talent, this niche represents a strategic growth area, offering differentiation from saturated passenger segments and reinforcing Australia's position in next-gen automotive technologies.

Australia Automotive Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Australia automotive market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on type and application.

Analysis by Type:

- Passenger

- Commercial Vehicles

The passenger vehicle segment in Australia is driven by rising consumer demand for fuel-efficient, hybrid, and electric models. The sales market belongs to SUVs because these vehicles provide excellent versatility alongside safety and spacious design features. Furthermore, the rising government EV incentives combined with rising urban populations, and enhanced features such as ADAS and connected systems despite production interruptions are significantly contributing to the market expansion.

The commercial vehicle market in the region is expanding, driven by the growing e-commerce, construction, and mining industries. The market preferences for light LCVs and heavy-duty trucks have increased because businesses focus on fuel efficiency and sustainability. In addition, the market trends toward fleet electrification are supported by government programs and autonomous technology development alongside supply chain limitations that affect product availability and market costs, fostering the market growth.

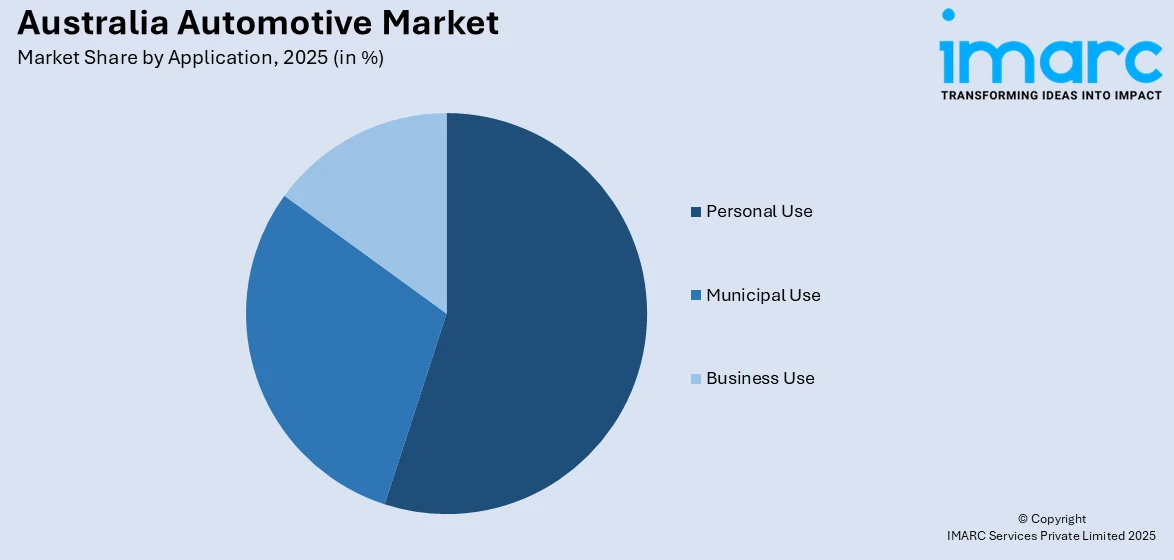

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Personal Use

- Municipal Use

- Business Use

The personal vehicle market in the region is witnessing robust growth, due to the rising consumer interest in SUVs, hybrid, and EV options. Users make their vehicle selection based on fuel efficiency, high safety features, and connectivity capabilities. Additionally, the adoption of EVs is driven by the increasing government incentives and increasing interest in smart mobility solutions as they affect the purchasing choices, driving the market forward.

Municipal vehicle demand is growing due to sustainability initiatives and fleet electrification. Local authorities from government agencies invest funding into electric bus purchases as well as waste management trucks and emergency vehicles. Besides this, the growth of charging facilities and reduction targets for emissions promote the adoption of environmentally friendly municipal transportation solutions in the region, which is providing an impetus to the market.

In Australia, businesses depend on commercial vehicles to cover their needs in logistical operations, construction activities, and service delivery. The market demand for electric and fuel-efficient fleet solutions is expanding because businesses need to cope with increasing fuel prices along with environmental restrictions. Apart from this, modern telematic technology along with autonomous systems helps businesses achieve optimal fleet functioning while reducing costs, strengthening the market share.

Regional Analysis:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

In New South Wales, the growing adoption of EVs is fueling the market growth, driven by the rising government backing and growing charging networks throughout the state and especially in Sydney. The densely populated area along with the improving urban mobility programs drives the demand for electric automobiles, hybrid vehicles and connected vehicles thus catalyzing the market growth.

Victoria, particularly Melbourne, is experiencing strong demand for passenger and commercial vehicles, with increasing EV adoption and infrastructure investment. Besides this, the sustainable initiative focus in Tasmania leads to increased sales of hybrid and electric cars. As a result, both areas are witnessing significant market expansion in cleaner transport solutions because of government policies that support such solutions.

The market demand in Queensland is growing due to the high demand for SUVs, utes, and EVs, supported by government rebates and infrastructure projects. The large stretches of rural land make off-road-capable and fuel-efficient vehicles the preferred choice. Moreover, the commercial vehicle market is supported by logistics operations and mining developments, aiding the market demand.

In South Australia, the market demand is surging, as the region excels in EV adoption because of renewable energy (RE) sources while the Northern Territory demands vehicles designed for off-road usage. Furthermore, public sector programs to electrify government fleets along with infrastructure projects enhance developments specifically within Adelaide and Darwin urban areas, boosting the market expansion.

The automotive market of Western Australia focuses on sturdy utes, SUVs, and heavy-duty trucks which serve primarily mining and agricultural sectors. Apart from this, the number of EV owners is rising in Perth because of the expanding charging network development, as the consumers in the region mainly purchase fuel-efficient vehicles with excellent performance, thereby propelling the market forward.

Competitive Landscape:

The Australia automotive market is highly competitive, driven by innovation, evolving consumer preferences, and regulatory policies. The passenger vehicle segment sees strong demand for fuel-efficient, hybrid, and electric models, while commercial vehicles are essential for logistics, construction, and mining industries. Moreover, ongoing advancements in technology, including connected features and autonomous capabilities, influence the market trends. Additionally, the expanding charging infrastructure and government incentives fuel the transition to electric mobility. Furthermore, competitive pricing, dealership networks, and after-sales services play a crucial role in consumer decisions. Apart from this, supply chain disruptions, semiconductor shortages, and fluctuating material costs continue to challenge market growth and vehicle availability.

The report provides a comprehensive analysis of the competitive landscape in the Australia automotive market with detailed profiles of all major companies.

Latest News and Developments:

- In January 2025, Swedish electric vehicle (EV) brand Polestar opened its first dealership in South Australia, located in Adelaide. This expansion aims to meet the increasing demand for EVs in the region, enhancing accessibility and consumer choice.

- In January 2025, Australian company Applied EV is creating autonomous electric vehicles designed for monotonous and hazardous tasks, such as street sweeping and garbage removal. This innovation addresses labor shortages and promotes safety in various industries.

- In November 2024, IAG announced its plan to acquire 90% of RACQ's insurance division for $855 million, expanding its market presence and leveraging synergies to enhance service offerings in the automotive insurance sector.

- In November 2024, Chinese automotive manufacturer Geely Auto committed to the Australian and New Zealand markets, planning to establish new dealerships and launch the EX5 electric vehicle in the first half of 2025. This move enhances competition and offers consumers more EV options.

- In October 2024, Porsche announced a partnership with Penske Automotive Australia to acquire Porsche Centre Melbourne. This collaboration aims to elevate customer experiences and set new standards in luxury automotive retail.

Australia Automotive Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Units |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Passenger, Commercial Vehicles |

| Applications Covered | Personal Use, Municipal Use, Business Use |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia automotive market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Australia automotive market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia automotive industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive market in Australia was valued at 1.3 Million Units in 2025.

Key factors driving the Australia automotive market include rapid urbanization, expanding infrastructure development, rising fleet electrification, increasing ride-sharing services, stricter emissions regulations, and strong investments in smart mobility solutions.

IMARC estimates the automotive market in Australia to exhibit a CAGR of 7.45% during 2026-2034, reaching a value of 2.6 Million Units by 2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)