Australia Alcoholic Beverages Market Size, Share, Trends and Forecast by Category, Alcoholic Content, Flavor, Packaging Type, Distribution Channel, and Region, 2026-2034

Australia Alcoholic Beverages Market Overview:

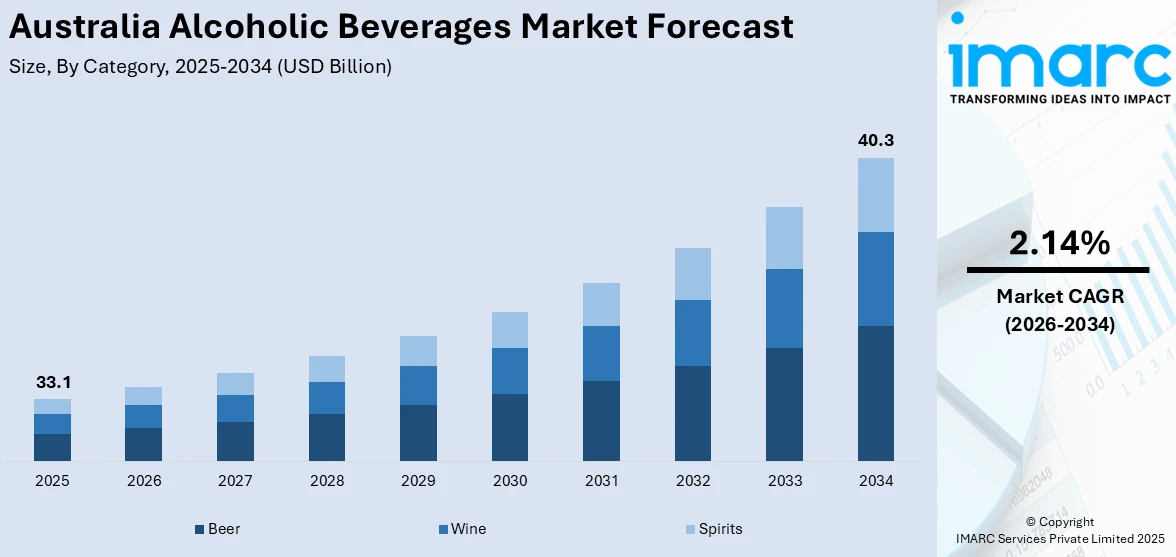

The Australia alcoholic beverages market size reached USD 33.1 Billion in 2025. Looking forward, the market is projected to reach USD 40.3 Billion by 2034, exhibiting a growth rate (CAGR) of 2.14% during 2026-2034. Australia's market is witnessing steady growth due to rising demand for premium spirits, low-alcohol options, and craft drinks. Health-conscious consumers are driving interest in low-calorie and natural ingredient-based products, while e-commerce continues to support wider product access and convenience.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 33.1 Billion |

| Market Forecast in 2034 | USD 40.3 Billion |

| Market Growth Rate 2026-2034 | 2.14% |

Key Trends of Australia Alcoholic Beverages Market:

Growing Popularity of Flavored Alcohol Drinks

Australia's alcoholic beverages market has been witnessing a strong shift toward flavored ready-to-drink (RTD) options, particularly among millennials and Gen Z consumers. This preference is being driven by a demand for convenience, lower alcohol content, and more diverse flavor choices. Consumers are increasingly drawn to beverages that blend taste, portability, and brand appeal. The RTD category is no longer limited to traditional mixes; brands are now experimenting with botanicals, fruit infusions, and dessert-style notes, making the segment more vibrant. Major companies are expanding their footprints to capture this growing Australia alcoholic beverages market demand. In December 2024, The Coca-Cola Company announced its acquisition of Billson's, a well-established Australian flavored alcohol RTD brand. This acquisition gave Coca-Cola immediate access to a fast-growing category and added a strong local name to its portfolio. It signaled Coca-Cola's serious commitment to building a stronger presence in the alcoholic drinks space, especially within Australia. The flavored RTD trend continues to attract new players while encouraging legacy brands to innovate. With health-conscious consumers seeking alternative alcohol experiences that are both lighter and more flavorful, this segment is set for sustained growth. Strong competition and product experimentation are expected to keep driving market evolution.

To get more information on this market Request Sample

Premiumization Fueling Independent Retail Support

Australia's premium spirits category has gained momentum as drinkers become more selective, looking for superior quality, brand heritage, and exclusivity. Consumers are willing to explore international brands, especially those that offer a unique story or limited-edition appeal. This demand is influencing both import strategies and retail shelf curation, thereby driving the Australia alcoholic beverages market growth. Rather than opting for mass-market products, many buyers now prefer premium vodkas, tequilas, and whiskeys that showcase craftsmanship. Independent retailers are playing a key role in meeting this demand by offering niche and imported products unavailable in mainstream outlets. In June 2024, Tovaritch! Premium Vodka officially launched in the Australian market. Brought in by ALM Liquor and distributed through Independent Beverage Partners, the brand introduced unique 1-litre and 20cl formats. Its exclusive availability through independent retailers offered them a fresh edge in the premium vodka segment, helping them compete with larger retail chains. This type of brand entry supports a broader trend of empowering smaller players through premium, limited-access products. As more consumers turn toward boutique experiences and well-crafted spirits, independent stores are becoming the go-to destination. The trend is reinforcing diversity in the alcohol retail space and expanding consumer choice across Australia's spirits segment.

Cultural Shift Toward Moderate Consumption

AIn recent years, a noticeable shift has emerged in drinking habits, particularly among younger consumers who are leaning toward lighter and more balanced options. This shift is gradually influencing the overall Australia alcoholic beverages market share, as traditional high-alcohol drinks see slower demand growth compared to sessionable beverages. Young adults are increasingly seeking drinks that allow them to enjoy social experiences without excessive consumption, favoring low-alcohol beers, spritzers, and flavored seltzers. The focus on moderation is closely tied to wellness and lifestyle choices, as consumers value balance and mindful drinking. This trend has encouraged manufacturers to diversify their portfolios with low-ABV and alcohol-free alternatives that do not compromise on taste. According to Australia alcoholic beverages market analysis, this cultural change is expected to remain a key growth driver, reshaping long-term demand patterns across product categories.

Australia Alcoholic Beverages Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on category, alcoholic content, flavor, packaging type, and distribution channel.

Category Insights:

- Beer

- Wine

- Still Light Wine

- Sparkling Wine

- Spirits

- Baijiu

- Vodka

- Whiskey

- Rum

- Liqueurs

- Gin

- Tequila

- Others

The report has provided a detailed breakup and analysis of the market based on the category. This includes beer, wine (still light wine and sparkling wine), and spirits (baijiu, vodka, whiskey, rum, liqueurs, gin, tequila, and others).

Alcoholic Content Insights:

- High

- Medium

- Low

The report has provided a detailed breakup and analysis of the market based on the alcoholic content. This includes high, medium, and low.

Flavor Insights:

- Unflavored

- Flavored

The report has provided a detailed breakup and analysis of the market based on the flavor. This includes unflavored and flavored.

Packaging Type Insights:

- Glass Bottles

- Tins

- Plastic Bottles

- Others

The report has provided a detailed breakup and analysis of the market based on the packaging type. This includes glass bottles, tins, plastic bottles, and others.

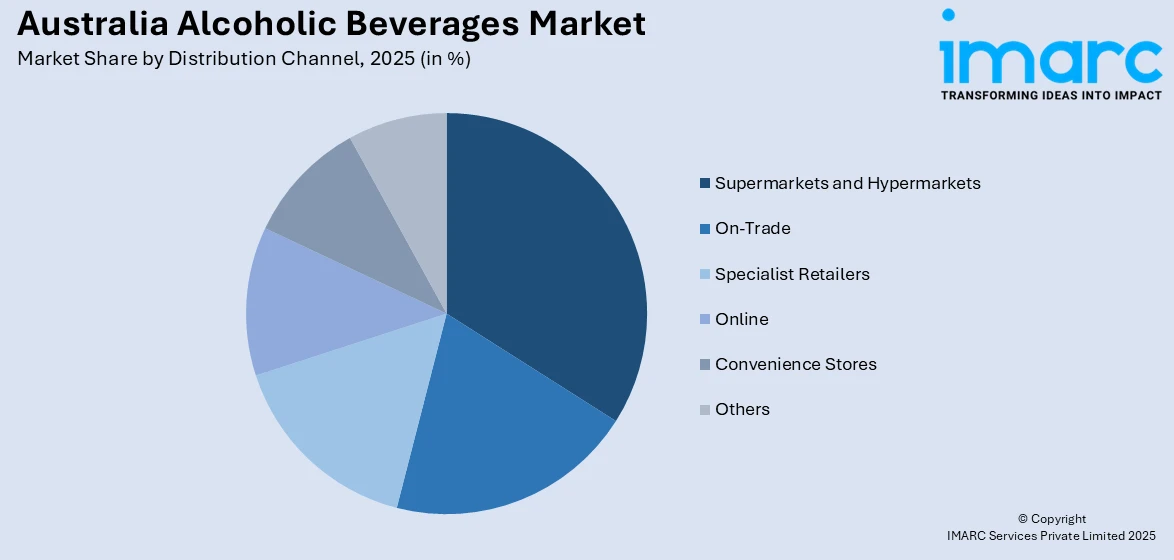

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- On-Trade

- Specialist Retailers

- Online

- Convenience Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, on-trade, specialist retailers, online, convenience stores, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Alcoholic Beverages Market News:

- March 2025: XXXX, a renowned Queensland beer brand, entered the alcoholic ginger beer segment with a 3.5% ABV drink. This marked its first product in the category, diversifying Australia's alcoholic beverages industry and boosting competition in the low-alcohol flavored drinks segment.

- March 2025: Lyre’s partnered with Amber Beverage Group as its exclusive distributor in Australia. The move strengthened Lyre’s market presence, expanded access to its 14 non-alcoholic spirits and RTD range, and supported rising demand for alcohol-free alternatives driven by health-conscious Australian consumers.

Australia Alcoholic Beverages Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Categories Covered |

|

| Alcoholic Contents Covered | High, Medium, Low |

| Flavors Covered | Unflavored, Flavored |

| Packaging Types Covered | Glass Bottles, Tins, Plastic Bottles, Others |

| Distribution Channels Covered | Supermarkets And Hypermarkets, On-Trade, Specialist Retailers, Online, Convenience Stores, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia alcoholic beverages market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia alcoholic beverages market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia alcoholic beverages industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The alcoholic beverages market in Australia was valued at USD 33.1 Billion in 2025.

The Australia alcoholic beverages market is projected to exhibit a compound annual growth rate (CAGR) of 2.14% during 2026-2034.

The Australia alcoholic beverages market is expected to reach a value of USD 40.3 Billion by 2034.

The Australia alcoholic beverages market is witnessing trends such as growing demand for premium craft products, increasing popularity of ready-to-drink formats, sustainability-driven innovations, and digital retail expansion. Younger consumers are also shaping preferences through lighter drinking habits and openness to unique flavors and packaging formats.

Key growth drivers include rising disposable incomes supporting premium purchases, evolving consumer lifestyles favoring convenience-based beverages, and growing preference for healthier low-calorie and low-alcohol alternatives. Tourism and hospitality sector growth, coupled with expanding product innovations, are fueling broader market adoption and strengthening category penetration across diverse consumer groups.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)