Australia Airlines Market Report by Type of Transport (Domestic, International), Application (Passenger, Freight), and Region 2025-2033

Australia Airlines Market Overview:

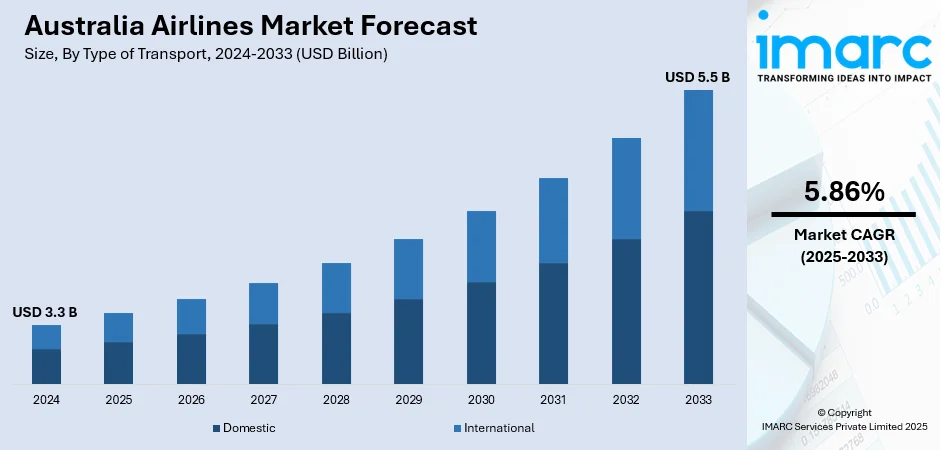

The Australia airlines market size reached USD 3.3 Billion in 2024. Looking forward, the market is projected to reach USD 5.5 Billion by 2033, exhibiting a growth rate (CAGR) of 5.86% during 2025-2033. The market is primarily driven by the increased domestic travel demand, renewed international tourism, significant investments in infrastructure and technology, enhancing operational efficiency and passenger experience across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.3 Billion |

| Market Forecast in 2033 | USD 5.5 Billion |

| Market Growth Rate 2025-2033 | 5.86% |

Key Trends of Australia Airlines Market:

Growing Domestic Travel Demand

The Australian domestic airline sector is experiencing a significant uptick in growth, primarily driven by a resurgence in domestic travel demand. As per the Bureau of Infrastructure and Transport Research Economics (BITRE), in June 2024, Australian domestic commercial aviation, which includes charter operations, transported 4.93 million passengers, which increased by 0.2% from the 4.92 million passengers in June 2023. This number also represents a 0.3% increase from the pre-COVID passenger count of 4.92 million in June 2019. Additionally, regular public transport (RPT) flights in June 2024 saw a modest 0.2% increase in passenger volume, carrying 4.60 million passengers compared to the same month in the previous year. Besides this, the removal of COVID-19-related restrictions has caused a surge in pent-up demand, as many Australians just want to travel after extended lockdowns and years of travel restrictions, thus propelling the domestic tourism growth. Apart from this, the greater flexibility regarding working from home has led more and more Australians to take domestic trips either for a workation or holiday, hence increasing the airline traffic. Hence, this trend underpins revenue streams of local carriers, enabling them to expand routes and increase frequencies of flights, which in turn support job growth in the industry and other related industries like hospitality and retail sectors, reinforcing the overall economic momentum.

To get more information on this market, Request Sample

International Travel Growth

On the international front, the reopening of Australia's borders has catalyzed a recovery in international travel, with Australian Bureau of Statistics (ABS) data indicating a substantial growth, for April 2022, the data showed 1.2 million international border crossings to and from Australia. This marks a significant increase from the 710,000 crossings recorded in March 2022 and a substantial increase compared to the same period last year, which saw only 118,000 movements. This is crucial for airlines, as international routes typically offer higher margins than domestic flights. Moreover, the revitalization of international tourism and business travel is filling airplanes, leading to higher load factors and profitability for carriers. Furthermore, the global reconnection is attracting foreign tourists, whose expenditure contributes significantly to the Australian economy. Besides, airlines are responding by reinstating pre-pandemic routes and introducing new ones to capitalize on emerging travel trends, such as increased interest in outdoor and less-crowded destinations. Furthermore, the renewal of international partnerships and agreements is also enhancing connectivity, making Australia a more accessible and appealing destination.

Rising Preference for Low-Cost Carriers

The demand for budget-friendly travel options is significantly boosting the growth of low-cost carriers in the Australia airlines market. These airlines are drawing a diverse range of travelers, particularly those more sensitive to price, including students, families, and short-haul business travelers. They provide competitive fares, essential services, and flexible alternatives that resonate with today’s travelers who prioritize value over luxury. As domestic travel sees a resurgence and intercity routes become more prominent, low-cost airlines are broadening their reach by adding more routes and increasing flight frequencies. This trend is prompting traditional airlines to rethink their pricing strategies and introduce offerings that cater to economy-focused passengers. The consistent rise in demand for affordable air travel is facilitating the growth of low-cost airlines within the Australia airlines market share.

Growth Drivers of Australia Airlines Market:

Infrastructure Development

Australia is experiencing substantial investments in its airport infrastructure, featuring upgraded terminals, longer runways, and advanced air traffic control systems. These enhancements are elevating the passenger experience with quicker check-in processes, improved amenities, and greater operational efficiency. Improved regional connectivity is also making air travel more attainable for remote and underserved areas. With these upgraded facilities, airlines can boost flight frequencies and launch new routes, meeting the increasing demands of both leisure and business travelers. These advancements promote domestic and international travel and contribute to long-term industry resilience. Consequently, modernizing airports is crucial in bolstering Australia airlines market demand.

Growing Business and Corporate Travel

As in-person meetings, conferences, and corporate collaborations come back, the business travel sector in Australia is steadily recovering. Organizations are re-engaging in face-to-face interactions to enhance client relations, build new partnerships, and finalize deals, all of which require dependable interstate air service. Airlines are adjusting by offering flexible schedules, loyalty programs, and specialized business-class services to cater to changing corporate requirements. Moreover, the emergence of hybrid work arrangements is facilitating short, frequent travel rather than lengthy trips. This resurgence in business travel is revitalizing crucial city routes and premium offerings. According to the Australia airlines market analysis, the increased activity and customized services play a significant role in the recovery.

Increased Online and Mobile Bookings

The digital transformation is revolutionizing how Australians plan and secure their flights. With mobile applications and intuitive airline websites, travelers benefit from smooth booking processes, seat choices, check-ins, and real-time alerts. The introduction of personalized deals, loyalty initiatives, and packaged services further enhances the attractiveness of online booking platforms. These advancements lessen the reliance on travel agents and allow travelers to tailor their travel experience anytime and anywhere. Additionally, tech-savvy younger travelers are driving the shift towards digital solutions, solidifying this trend. The convenience and effectiveness of online and mobile platforms are significantly boosting passenger numbers, making them a primary factor in Australia airlines market growth.

Opportunities of Australia Airlines Market:

Growth in Sustainable Aviation Solutions

As environmental issues take center stage for consumers and regulators alike, Australian airlines have a prime opportunity to excel through sustainable aviation initiatives. Investing in fuel-efficient aircraft, embracing sustainable aviation fuels (SAFs), and optimizing flight paths to minimize emissions can considerably decrease carbon footprints. Airlines prioritizing environmentally friendly operations are more likely to attract eco-conscious travelers and corporate clients. Additionally, aligning with global sustainability objectives can open doors to future government incentives and partnerships. Focusing on green innovation enhances long-term operational efficiency and builds brand credibility, positioning airlines as pioneering leaders in the rapidly evolving aviation sector.

Development of Air Cargo Services

With the rapid growth of e-commerce and the demand for fast logistics, airlines in Australia have the chance to bolster and expand their air cargo capabilities. By maximizing the use of underused belly cargo space and investing in dedicated freighter aircraft, carriers can respond to the increasing demand for both domestic and global shipping. This strategy reduces dependence on passenger traffic and contributes to steady year-round revenue. Efficient cargo services are especially crucial for connecting remote locations, facilitating the transport of medical supplies, perishable goods, and high-value items. As consumer expectations for quick delivery rise, robust cargo infrastructure provides airlines with a competitive advantage while supporting the overarching growth of Australia's logistics and trade sectors.

Partnerships with Tourism Boards and Airports

Collaborations between airlines, tourism boards, and airport authorities present a valuable opportunity to boost inbound travel and brand awareness. Joint campaigns promoting specific destinations, seasonal travel offers, and bundled vacation packages can stimulate demand across both domestic and international markets. These partnerships help airlines align flight schedules with key events and tourism peaks, improving load factors and operational efficiency. Additionally, co-investment in promotional activities expands visibility without bearing the full cost. By leveraging local knowledge and shared goals, airlines can position themselves as key contributors to regional tourism growth, creating win-win outcomes that enhance connectivity, brand loyalty, and long-term profitability.

Challenges of Australia Airlines Market:

High Operating and Fuel Costs

Fuel costs are among the highest operational expenses for airlines, with fluctuations in global oil prices significantly influencing their cost structures. In Australia, extended domestic routes and remote regional operations further escalate fuel reliance. Maintenance, leasing, and insurance expenses also contribute to financial burdens, particularly for smaller or low-cost carriers that struggle with limited economies of scale. Rising operational costs make it challenging for airlines to remain competitive while ensuring profitability. In highly competitive fare situations, it's not always feasible to pass these costs on to consumers. Consequently, airlines must continually seek ways to enhance efficiency, optimize their fleets, and explore alternative fuel options to manage expenses effectively and sustain financial viability critical for long-term stability in the Australian airline market.

Regulatory and Compliance Complexity

The airline industry in Australia must adhere to strict aviation regulations designed to guarantee passenger safety, environmental responsibility, and compliance across borders. Carriers are required to navigate a maze of rules from various authorities that address aircraft airworthiness, flight operations, emissions standards, and health protocols. The costs—both administrative and financial associated with compliance can be substantial, particularly when they have to adapt to swiftly changing regulations, such as those prompted by global crises. Smaller and regional airlines often lack the necessary internal resources to effectively manage these complexities, resulting in delays or operational constraints. Additionally, international carriers must comply with the regulations of destination countries, creating even more complexity. While this regulatory framework is essential for ensuring safety and sustainability, it consistently challenges operational agility and growth.

Limited Workforce Availability

There is an increasing concern over the shortage of skilled aviation professionals in Australia, particularly pilots, aircraft engineers, and trained ground staff. This issue has been exacerbated by workforce departures during global disruptions, leading to many professionals either retiring or transitioning to other sectors. Training new employees involves significant time and financial investment, and current channels are failing to keep pace with the industry's recovery speed. Labor shortfalls can lead to delays in flights, reduced service frequency, and limitations in expanding routes or services. In a competitive market, such workforce shortages can also negatively affect customer service quality and operational reliability. Tackling this challenge necessitates long-term strategies, such as improved training initiatives, enhanced career incentives, and cooperation between government and industry to guarantee a sustainable talent pipeline.

Government Support of Australia Airlines Market:

Regional Aviation Funding

The Australian government plays an essential role in ensuring air connectivity to remote and regional areas through targeted aviation funding programs. These initiatives assist airlines in operating routes that may not be financially viable but are crucial for community access to healthcare, education, and business opportunities. The funding typically covers operational costs, route subsidies, and waivers for landing fees to promote consistent services. By providing reliable air transport particularly in sparsely populated or geographically isolated areas the government enhances mobility, economic inclusion, and regional development. This support is especially vital for smaller carriers that would otherwise struggle to remain profitable. Ultimately, regional aviation funding is crucial for maintaining national unity and upholding the important role of airlines in linking Australia's diverse landscapes.

Infrastructure Investment

Investment by the government in aviation infrastructure is a fundamental pillar for the development and modernization of the Australian airline market. By financing upgrades to airports, expansions of terminals, and improvements to runways, authorities enable enhanced operational efficiency, increased passenger capacity, and elevated safety standards throughout the aviation network. Investments also encompass air traffic control systems and navigation technologies that facilitate safer and more efficient flight management. These enhancements empower airlines to grow their route networks, minimize delays, and address the rising demand for both domestic and international travel. Modernized airports also elevate the traveler experience, boost tourism, and support regional economies. In the long run, infrastructure funding ensures that the industry maintains resilience, competitiveness, and the ability to tackle future challenges in aviation.

Subsidies During Disruptions

In times of crisis such as pandemics, bushfires, or geopolitical disruptions the Australian government frequently provides temporary financial subsidies to support airline operations. Such subsidies may include wage assistance, payments for route maintenance, or operational grants aimed at preserving connectivity and preventing airline insolvencies. Given that the industry relies heavily on passenger volumes, this financial support can stabilize cash flow and help retain critical staff. Subsidies also allow carriers to continue their operations without major interruptions. By ensuring continuity during unforeseen events, this support mitigates long-term damage to the aviation ecosystem and protects the broader economic impact of lost air connectivity. Such measures reinforce the government's role in sustaining aviation resilience.

Australia Airlines Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type of transport and application.

Type of Transport Insights:

- Domestic

- International

The report has provided a detailed breakup and analysis of the market based on the type of transport. This includes domestic and international.

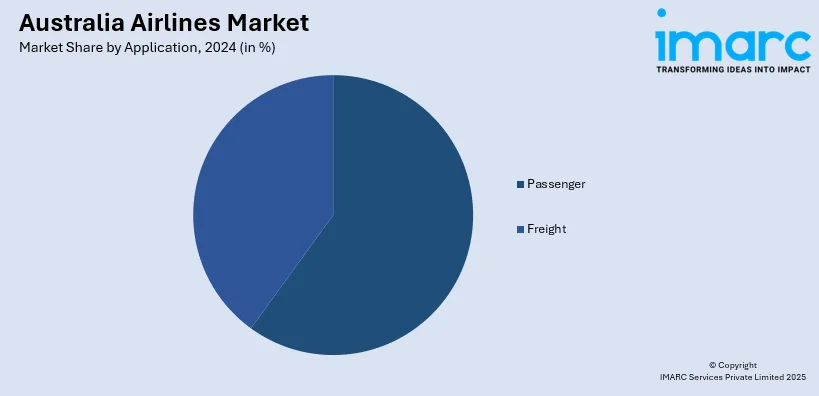

Application Insights:

- Passenger

- Freight

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes passenger and freight.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Airnorth

- Alliance Airlines

- ASL Airlines Australia

- FlyPelican (Pelican Airlines Pty Ltd)

- Qantas Airways Limited

- Rex Airlines

- Virgin Australia Airlines Pty Ltd

Australia Airlines Market News:

- In July 2025, ASL Airlines Australia expanded its fleet with a second Boeing 737-800BCF, enhancing capacity and sustainability in air cargo. Scheduled to join the network in late July 2025, this aircraft supports the rising demand for efficient express deliveries across Australasia, aligning with ASL's net-zero emissions goal by 2050.

- In July 2025, Ethiopian Airlines announced its plans to launch its first-ever direct flights from Australia to Addis Ababa, connecting Melbourne, Sydney, and Brisbane. This milestone enhances intercontinental travel and cultural ties, positioning Ethiopian Airlines as a key player in global connectivity. The airline is evaluating aircraft options and seeking regulatory approvals for the service.

- In June 2025, Australia and Qatar Airways launched a strategic airline alliance, enhancing global connectivity and offering new nonstop routes from Brisbane, Perth, and Melbourne. Travelers can expect improved onboard experiences, special promotional fares, and expanded loyalty benefits for Virgin Australia’s Velocity Frequent Flyers, significantly boosting Australia’s economy and creating new jobs.

- In August 2024, Koala Airlines, a company traditionally known for its air tours and charter services, has announced its intention to transition into the low-cost carrier sector in Australia. The airline, with a history spanning over five decades, revealed its plan to initiate operations with Boeing 737 aircraft. Besides, it remains to be seen whether it has secured an air operators certificate (AOC).

- In August 2024, Australia's new aviation regulators will handle airline ticket refunds and address noise complaints. The government introduced 56 measures in its aviation white paper aimed at boosting fairness and competition. Passengers will have better rights for refunds, while residents near airports will be able to raise concerns with a new aircraft noise ombudsman. Moreover, a proposed aviation industry ombudsman will enforce a passenger rights charter, which could offer compensation for cancelled or delayed flights.

Australia Airlines Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types of Transport Covered | Domestic, International |

| Applications Covered | Passenger, Freight |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Airnorth, Alliance Airlines, ASL Airlines Australia, FlyPelican (Pelican Airlines Pty Ltd), Qantas Airways Limited, Rex Airlines, Virgin Australia Airlines Pty Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia airlines market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia airlines market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia airlines industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The airlines market in Australia was valued at USD 3.3 Billion in 2024.

The Australia airlines market is projected to exhibit a compound annual growth rate (CAGR) of 5.86% during 2025-2033.

The Australia airlines market is expected to reach a value of USD 5.5 Billion by 2033.

The major trend of the Australia airlines market is a shift toward digital transformation, with increased adoption of contactless services, mobile apps, and real-time updates. There is also rising interest in sustainable aviation, premium economy offerings, and enhanced regional connectivity, along with greater focus on personalized in-flight experiences.

The market is driven by growing domestic tourism, infrastructure upgrades, and supportive government policies for regional air travel. Expanding low-cost carrier networks, increasing disposable incomes, and recovery in business travel are further fueling the demand. Additionally, airline efforts to modernize fleets and improve operational efficiency are accelerating overall market growth across both metro and remote regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)