Australia Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End-User, and Region, 2026-2034

Australia Air Freight Market Size and Share:

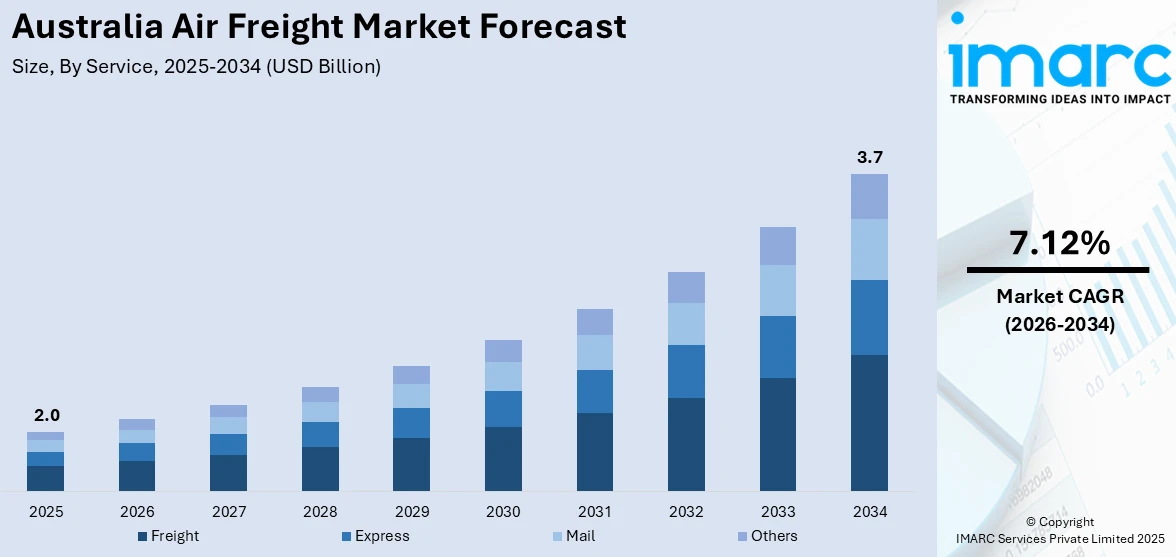

The Australia air freight market size was valued at USD 2.0 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 3.7 Billion by 2034, exhibiting a CAGR of 7.12% from 2026-2034. The market is witnessing significant growth driven by increasing demand for fast, reliable shipping solutions, especially in e-commerce and global trade. Technological advancements, infrastructure improvements, and strategic partnerships are enhancing operational efficiency. Sustainability initiatives, such as the adoption of eco-friendly aircraft and optimized flight paths, are gaining traction, resulting in a positive impact on the overall Australia air freight market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 2.0 Billion |

|

Market Forecast in 2034

|

USD 3.7 Billion |

| Market Growth Rate 2026-2034 | 7.12% |

One of the primary drivers of the Australian air freight sector is increasing demand for online retail and e-commerce. As more consumers adopt the convenience of online shopping, the demand for fast and reliable delivery has picked up speed. Air freight offers an essential solution for the swift transportation of goods, particularly for high-value and time-sensitive products such as electronics and fashion items. To further enhance the efficiency and competitiveness of the sector, key collaborations are emerging between logistics companies and air carriers. For instance, in March 2025, CargoAi announced its partnership with Qantas Freight to enhance air cargo efficiency offering international capacity on selected flights via its CargoMART and CargoCONNECT solutions. The collaboration aims to streamline booking processes and provide real-time rates for freight forwarders expanding access to key trade routes between Australia and several countries. The rise in global trade and demand for expedited shipping services also contributes to the growth of the air freight sector.

To get more information on this market Request Sample

Another significant driver is Australia's strategic geographic location as a central player within the Asia-Pacific region. Strong trade relationships with powerful markets such as China, the U.S., and Europe have grown international air freight services. For instance, in April 2025, China Eastern Air Logistics announced the launch of its South Australia product portfolio in Adelaide. The event, co-hosted with the South Australian Government, featured a procurement MOU with Ferguson Australia. The initiative aims to enhance the import of Australian agricultural products into China and strengthen trade partnerships. Moreover, the development of advanced air cargo infrastructure, including modern airports and cargo terminals, has further facilitated the expansion of the air freight market. These factors contribute to Australia’s growing position in global logistics.

Australia Air Freight Market Trends:

Growing Popularity of E-commerce and Express Delivery Services

With online shopping becoming a preferred mode for purchasing goods in Australia, companies are relying on air freight to meet the rising demand for fast deliveries. Individuals are expecting fast delivery, particularly for items that spoil easily, electronics, and expensive products. This trend is causing an increase in fast delivery services, with air cargo playing a crucial part in making sure items are delivered promptly to their destination. E-commerce giants and logistics providers are improving their air freight capabilities to meet the increasing demand. Additionally, many companies are upgrading their fleets, optimizing routes, and enhancing supply chain integration to offer faster and more reliable services. In 2023, Australia Post introduced a converted Airbus A330-200P2F freighter to its fleet to support the growing demand for e-commerce. The aircraft, operated in collaboration with Qantas Freight, increased capacity by 29% and replaced a Boeing 737 freighter, resulting in a 42% reduction in carbon emissions per kilogram of cargo.

Government Initiatives and Infrastructure Development

Increasing efforts to improve airport infrastructure and logistical abilities by the governing body are bolstering the Australia air freight market growth. Substantial funds are being allocated to major airports like Sydney, Melbourne, Brisbane, and Perth to improve cargo handling capabilities, streamline processes, and upgrade technological infrastructure. These improvements are helping to speed up delivery times, decrease interruptions, and alleviate congestion in shipping services, all of which are essential for meeting the increasing need for effective air freight transportation. The efficiency of air freight operations is being further driven by the construction of new freight terminals, upgraded runway systems, and the implementation of automation in cargo handling. For instance, in 2024, the governing body of Australia revealed USD 102.4 Million funding for Cairns and Mackay airports under the Northern Australia Infrastructure Facility. The funding will help with Cairns' initial notable renovation in three decades and enhance infrastructure at Mackay. These strategic investments in infrastructure development and operational enhancements are creating a positive Australia air freight market outlook, supporting long-term growth and efficiency.

Environmental Concerns and Shift Toward Greener Logistics

Regulators and environmentally conscious individual are encouraging companies to reduce their carbon emissions and adopt greener practices. Several air freight operators are opting for more energy-efficient aircraft in reaction, including those with enhanced fuel efficiency and less noise pollution. Furthermore, businesses are enhancing flight paths to reduce fuel usage and carbon footprint, utilizing advanced technologies, such as artificial intelligence (AI) and big data, to optimize the most effective routes. These efforts are not only addressing environmental concerns but also assisting businesses meet regulatory standards. In 2024, Dovetail Electric Aviation started using Siemens Xcelerator software to create eco-friendly battery and hydrogen-electric propulsion systems for airplanes with zero emissions. This partnership aimed to upgrade existing airplanes in order to decrease operating expenses by as much as 40% and contribute to the decarbonization of air travel. According to Australia air freight market forecast, these innovations are expected to drive substantial growth in the sector as both environmental sustainability and cost efficiency become central priorities for industry players.

Australia Air Freight Market Characteristics:

Geographic Isolation and Long-Distance Connectivity

Australia’s geographic location makes air freight essential for connecting the country to global markets. The vast distances between major cities and international hubs increase the reliance on air transport for high-value and time-sensitive goods. Key export items like pharmaceuticals, electronics, and perishables often require fast delivery, and air freight offers the speed and reliability needed. Major airports in Sydney, Melbourne, and Brisbane act as primary cargo gateways, supported by efficient logistics infrastructure. Additionally, the country’s remoteness means air cargo plays a critical role in maintaining trade with key partners in Asia, the U.S., and Europe.

Focus on High-Value and Perishable Exports

The Australia air freight market demand is largely driven by exports of high-value and time-sensitive goods, including fresh produce, seafood, medical supplies, and precision equipment. These commodities require fast delivery and temperature management, so air transport is the preferred option over seaborne freight. Online shopping and same-day delivery services have also boosted air cargo demand, especially in cities. Exporters use air freight for destinations where speed guarantees product quality, such as in Asia. Demand impacts carrier planning capacity, customized handling facilities, and cold chain integration within airports and distribution centers.

Strong Integration with Asia-Pacific Trade Routes

Australia’s air freight market is deeply integrated with Asia-Pacific supply chains due to the region’s role as a major trading partner. Countries like China, Japan, and Singapore are among the top destinations and origins for Australian air cargo. This proximity supports frequent cargo flights and efficient logistics operations, especially for imports of electronics, machinery, and retail goods. Australia’s Free Trade Agreements (FTAs) with several Asia-Pacific nations have further strengthened these linkages. As a result, freight carriers operate extensive networks between Australia and key Asian cities, enabling faster delivery times and regular cargo movement across commercial sectors.

Challenges of Australia Air Freight Market:

Capacity Constraints and Infrastructure Limitations

Australia faces air freight capacity issues due to limited cargo-only aircraft operations and dependence on passenger flights for freight space. During periods of high demand or border restrictions, these constraints disrupt supply chains and delay deliveries. Regional airports often lack the infrastructure needed for large-scale cargo handling, forcing over-reliance on a few major airports. Congestion, limited cold storage, and outdated cargo facilities add to operational inefficiencies. As e-commerce grows and export volumes rise, modernizing air freight infrastructure across regional and urban airports is critical to meeting the industry’s future demands.

High Operating Costs and Fuel Dependence

The air freight industry in Australia contends with high operational expenses, largely driven by fuel prices, labor costs, and airport handling charges. Australia’s vast geography means longer domestic flight distances, which add to fuel consumption and cost pressures. According to the Australia air freight market analysis, surcharges and fees at major airports can increase total shipping costs, making air cargo less attractive for low-margin goods. These expenses are particularly burdensome for smaller freight operators and exporters. Additionally, fluctuations in global oil prices significantly impact profitability, making the industry vulnerable to external economic shocks and reducing competitiveness against sea freight alternatives.

Environmental Pressures and Regulatory Compliance

The air freight sector is increasingly facing scrutiny over its environmental impact, particularly carbon emissions and noise pollution. As Australia strengthens its climate policies and aligns with global sustainability goals, the industry must invest in cleaner technologies and adopt greener practices. This includes transitioning to more fuel-efficient aircraft, optimizing flight routes, and improving cargo load efficiency. Meeting these requirements can involve high upfront costs and complex regulatory compliance. Smaller operators may struggle to meet environmental benchmarks, and failure to do so can result in penalties or loss of market access, posing long-term sustainability challenges for the sector.

Australia Air Freight Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Australia air freight market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on service, destination, and end user.

Analysis by Service:

- Freight

- Express

- Others

The freight segment is witnessing a significant growth, primarily driven by industrial shipments, retail imports, and mining exports. Businesses rely on air freight for time-sensitive and high-value goods, ensuring efficient logistics and minimal delays. The segment benefits from Australia's trade ties with Asia-Pacific and North America. Continuous growth in e-commerce and manufacturing supports freight demand, maintaining its critical role in the country’s international and domestic logistics network.

The express segment is expanding robustly due to enhanced consumer demand for fast delivery, particularly in online purchases and B2B commerce. Time-sensitive deliveries such as pharmaceuticals, electronics, and time-sensitive documents are strong contributors. Express services offer better tracking and reliability, which meet the needs of both business and consumers. Big logistics firms are expanding their express networks to cover more areas and enhance delivery speed, which is making this segment competitive and technology oriented.

The mail segment, traditionally dominated by postal services, remains relevant despite digital communication alternatives. Air transport is essential for long-distance and international mail delivery across Australia’s vast geography. Government agencies and postal organizations rely on air freight to maintain service efficiency, particularly to and from remote areas. While the segment has seen modest growth compared to others, it continues to play a foundational role in national connectivity and document distribution.

Analysis by Destination:

- Domestic

- International

The domestic air freight market in Australia plays a crucial role in connecting remote regions, urban centers, and industrial zones across the country’s vast landscape. It supports timely delivery of essential goods, medical supplies, and retail products, especially in areas with limited ground transport access. Growth in e-commerce and regional development projects continues to drive domestic freight demand. Airlines and logistics providers are investing in network efficiency to meet rising expectations for faster and more reliable delivery services within Australia.

International air freight forms a vital component of Australia’s trade ecosystem, facilitating the movement of high-value and time-sensitive goods across global markets. Key export items include perishables, pharmaceuticals, and electronics, while imports often consist of machinery, consumer goods, and fashion items. Strong trade links with Asia, North America, and Europe support sustained international freight volume. The sector benefits from global supply chain integration, but remains sensitive to geopolitical shifts, fuel costs, and international regulatory changes.

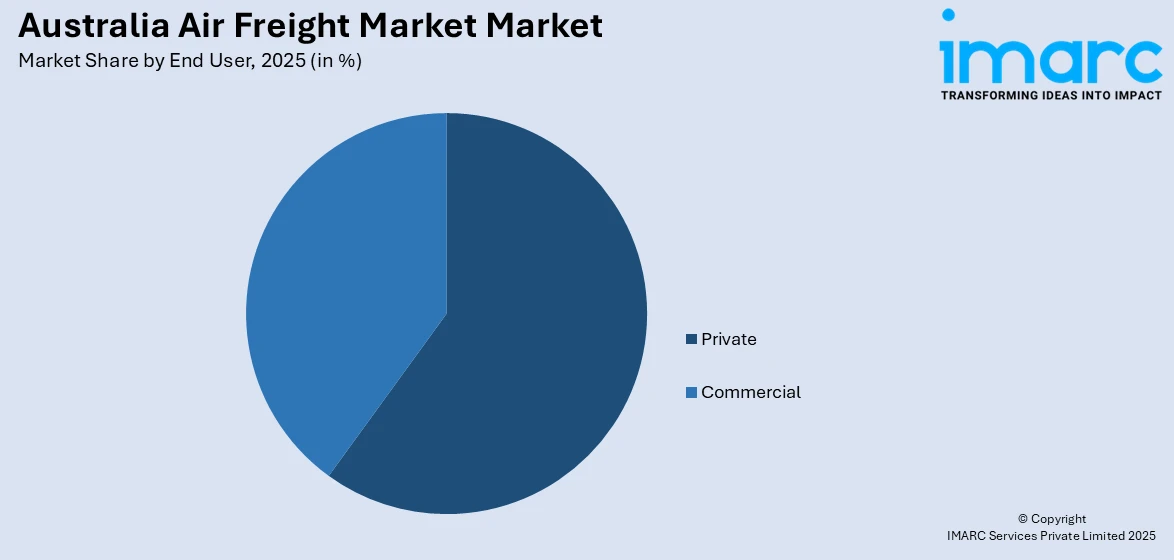

Analysis by End User:

Access the comprehensive market breakdown Request Sample

- Private

- Commercial

The private end-user segment in Australia’s air freight market includes individuals and small-scale shippers who rely on air transport for personal goods, gifts, and urgent deliveries. This segment is supported by the rise of online shopping, international relocation, and personal trade. While smaller in volume compared to commercial use, the private segment values fast, secure, and trackable services. Courier companies and postal services cater to this demand with tailored offerings, especially for time-sensitive or long-distance shipments across and beyond Australia.

The commercial segment represents the largest share of Australia’s air freight market, driven by businesses across sectors such as retail, manufacturing, healthcare, and mining. Companies depend on air freight to ensure the timely delivery of raw materials, finished goods, and high-value or perishable items. Supply chain optimization, global trade activities, and just-in-time inventory systems amplify commercial reliance on air logistics. Growing demand for fast and reliable delivery services continues to fuel innovation and investment in commercial air freight operations.

Regional Analysis:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

New South Wales, anchored by Sydney, serves as a major air freight hub due to its international airport infrastructure and strong economic activity. The region handles high volumes of both domestic and international cargo, supporting trade, e-commerce, and time-sensitive deliveries. The Australia Capital Territory adds strategic importance through government-related freight and administrative logistics.

Victoria, with Melbourne as a central logistics hub, plays a crucial role in handling diverse freight, including perishables and manufacturing goods. Its integrated road-air transport networks support efficient cargo movement. Tasmania, reliant on air freight for urgent goods and medical supplies due to its island geography, complements Victoria's volume with niche, high-priority shipments and regional connectivity.

Queensland's air freight market is driven by its agriculture, mining, and tourism sectors. Brisbane Airport plays a key role in facilitating international exports and imports, particularly to Asia. Regional airports support domestic distribution, especially to remote and northern areas. Demand for fast transport of perishables, pharmaceuticals, and essential supplies strengthens the state’s air freight dynamics.

Northern Territory relies heavily on-air freight due to its vast, remote areas and sparse population, making air transport critical for essential supplies. South Australia, with Adelaide as a key logistics hub, supports wine, defense, and electronics exports. Both regions emphasize efficiency in air logistics to maintain economic activity and ensure timely delivery to remote and urban centers.

Western Australia's air freight demand is driven by its mining, oil and gas, and agriculture sectors. Perth Airport facilitates a significant share of international and domestic cargo, particularly for high-value and time-sensitive goods. The state’s geographic distance from eastern hubs increases its reliance on air freight, ensuring efficient supply chain operations across isolated industrial and population centers.

Competitive Landscape:

The air freight market in Australia is highly competitive, with a variety of global and local companies aiming to address the increasing need for quick and efficient transportation options. Businesses are prioritizing the improvement of operational efficiency by leveraging technological advancements, including automation and real-time tracking systems. Additionally, strategic partnerships between air carriers, logistics providers, and e-commerce platforms are helping to expand market reach. Sustainability is also becoming a key differentiator, with many players adopting eco-friendly aircraft and optimizing flight paths to reduce emissions. Overall, the market remains dynamic, with continuous advancements aimed at improving service delivery and customer satisfaction.

The report provides a comprehensive analysis of the competitive landscape in the Australia air freight market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: China Eastern Air Logistics has introduced its South Australia product line in Adelaide, reinforcing air freight connections with Australian exporters. By utilizing its aviation network, the company seeks to improve cold chain logistics and facilitate the swift import of valuable agricultural products such as seafood and wine.

- April 2025: UK-based Skyports Drone Services acquired Redbird Aero. Known for servicing rural and Indigenous communities, Redbird enhances healthcare delivery via air freight. The acquisition brings advanced drone cargo and vertiport infrastructure expertise into the Australian market.

- March 2025: FlyOnE acquired Rottnest Air Taxi, including its AOC and fleet, to enhance regional air transport. The deal supports FlyOnE’s expansion strategy and paves the way for integrating advanced technology to improve operational safety, efficiency, and sustainability, key factors in modernizing short-haul air freight and passenger services.

- December 2024: US-based GlobalX partnered with ATB Investment to launch an Australian cargo and charter airline using Airbus A321 freighters. Targeting Asia-Pacific air freight growth, the joint venture plans to begin operations in late 2025, reallocating underused GlobalX freighters to meet rising regional cargo and charter demand.

- October 2024: Australia Post added two Airbus A321P2F freighters, operated by Qantas Freight, to meet soaring e-commerce demand. Replacing older 737s, each A321F carries 21,000 parcels nightly across key domestic routes. The upgrade boosts air freight capacity, efficiency, and sustainability during peak parcel seasons like Black Friday and Christmas.

Australia Air Freight Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Freight, Express, Mail, Others |

| Destinations Covered | Domestic, International |

| End Users Covered | Private, Commercial |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia air freight market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Australia air freight market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia air freight industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The air freight market in Australia was valued at USD 2.0 Billion in 2025.

The Australia air freight market is projected to reach a value of USD 3.7 Billion by 2034.

The Australia air freight market is projected to exhibit a CAGR of 7.12% during 2026-2034.

Australia's air freight market growth is driven by booming e-commerce, increasing demand for time-sensitive and high-value goods (like perishables and pharmaceuticals), robust international trade relations, and ongoing investment in airport infrastructure and logistics technology.

Key trends in Australia's air freight market include rapid digitalization and automation (AI, blockchain, IoT for tracking), a strong focus on sustainability with increasing adoption of Sustainable Aviation Fuels (SAF) and eco-friendly practices, and continued growth driven by e-commerce and rising demand for time-sensitive, high-value goods like perishables and pharmaceuticals. Infrastructure development and improved efficiency in customs clearance are also notable.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)