Australia Accounting Services Market Report by Type (Payroll Services, Tax Preparation Services, Bookkeeping, Financial Auditing, and Others), End User (Finance Sector, Manufacturing and Industrial Sector, Retail Sector, Public Sector, IT and Telecom Industry, and Others), and Region 2026-2034

Australia Accounting Services Market Size and Share:

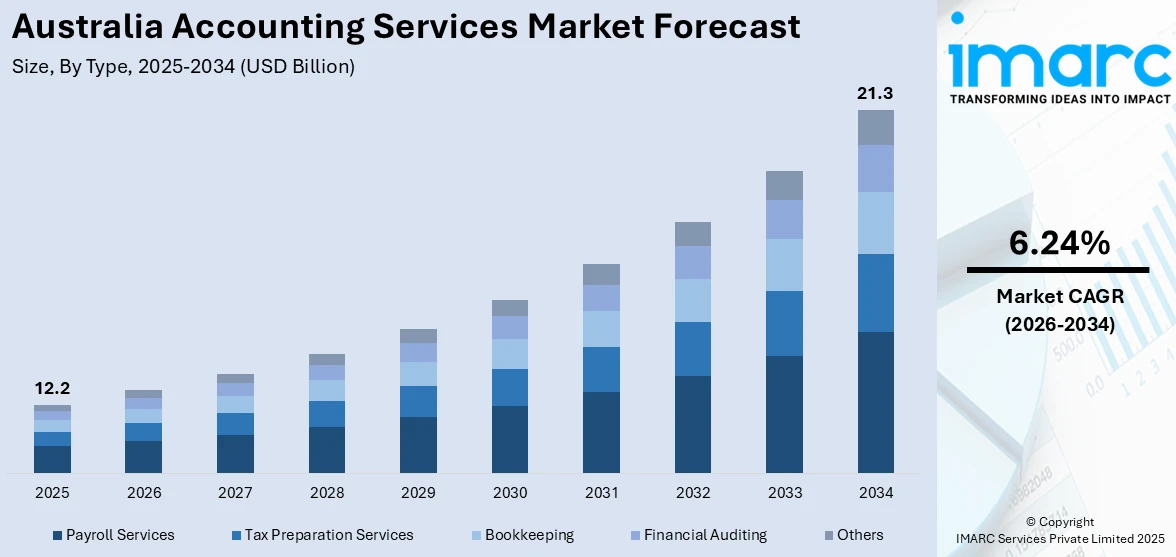

The Australia accounting services market size reached USD 12.2 Billion in 2025. Looking forward, the market is projected to reach USD 21.3 Billion by 2034, exhibiting a growth rate (CAGR) of 6.24% during 2026-2034. The market is driven by the increasing investments in startups, the rising focus on sustainability and ESG reporting, continual innovations in data security measures, increasing costs of internal accounting departments, rapid expansion of multinational corporations, the escalating need for strategic advisory services.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 12.2 Billion |

| Market Forecast in 2034 | USD 21.3 Billion |

| Market Growth Rate (2026-2034) | 6.24% |

Key Trends of Australia Accounting Services Market:

Increasing regulatory compliance

Among the major reasons contributing toward the growth of the accounting services market in Australia is the increase in complexity concerning regulatory compliances. As business entities are working within a constantly changing legal and regulatory environment, government agencies and regulatory authorities have to monitor them closely. This has raised the demand for professional accounting services that avail various compliance necessities. Furthermore, the regulatory frameworks in Australia, such as the standards set by the Australian Accounting Standards Board (AASB), the Australian Securities and Investments Commission (ASIC), and the Australian Taxation Office (ATO), impose stringent requirements regarding reporting and auditing practices. Companies are compelled to be extra prudent with regard to these regulations so as not to be faced with fines and other judicial penalties. Such complexity compels businesses to seek the expertise of specialized accounting firms that possess a comprehensive range of skills in regulatory compliance. Moreover, with new regulations, such as changes in tax law or financial reporting, accounting practices always have to be updated and adapted accordingly.

To get more information on this market Request Sample

Rising complexity of financial transactions

The rising complexity of financial transactions is a major factor propelling the accounting services market in Australia. As businesses engage in more intricate financial activities, the demand for specialized accounting services has to manage these complexities effectively. Modern financial transactions often involve multifaceted elements such as cross-border investments, complex financial instruments, and intricate revenue recognition methods. Multinational corporations face increasing challenges due to foreign currency exchanges, complex investment structures, and varying regulatory environments. Managing these transactions demands advanced accounting skills to ensure compliance and accurate reporting. The rise of digital financial platforms, blockchain transactions, and sophisticated financial products like cryptocurrencies and derivatives adds to this complexity, requiring specialized expertise in valuation, auditing, and regulatory standards. Furthermore, the integration of technology in financial operations, such as automated systems and data analytics, also contributes to transaction complexity. While these technologies offer efficiency, they require advanced accounting skills to interpret and manage large volumes of data accurately. This is resulting in businesses seeking professional accounting services to leverage these tools effectively and ensure robust financial management.

Digital Transformation

The swift embrace of cloud-based accounting systems and AI-powered tools is changing the way businesses in Australia handle their financial operations. These innovations facilitate real-time financial reporting, automate data input, and reduce errors significantly boosting both efficiency and precision. Cloud solutions offer scalability and flexibility making them appropriate for companies of any size from startups to large corporations. The integration of AI also enhances predictive analytics, fraud detection, and more informed decision-making. This technological shift encourages improved collaboration between clients and accountants through secure remote access to financial information. As companies focus on innovation and efficiency digital transformation is emerging as a critical factor in increasing the Australia accounting services market share, establishing technology as a foundational element for future growth.

Growth Drivers of Australia Accounting Services Market:

Rising Business Formation

The ongoing expansion of SMEs and startups in Australia is significantly driving the need for accounting services. Newly established businesses require dependable assistance in areas such as bookkeeping, payroll management, tax filing, and compliance, creating consistent opportunities for accounting professionals. There is a high demand for affordable, scalable solutions as small companies strive to optimize their financial operations while managing costs effectively. Professional accounting services enable startups to concentrate on growth while ensuring they comply with regulations effectively. This trend underscores how the rise in entrepreneurial activity is propelling strong Australia accounting services market demand, establishing the sector as a critical partner for sustainable business development across various industries.

Complex Taxation System

Australia's intricate and regularly changing taxation framework serves as a significant factor driving the usage of accounting services. Many businesses face challenges in navigating evolving tax legislation, reporting mandates, and compliance timelines. Professional accounting services offer the essential expertise needed to tackle these issues, mitigate risks, and ensure precision in tax planning. Companies are also looking for strategic advice on optimizing their tax frameworks to lower liabilities while remaining compliant. This reliance on accountants for timely knowledge and dependable reporting emphasizes the industry's importance in maintaining financial stability. As regulations continue to change, this complexity guarantees ongoing Australia accounting services market growth, reinforcing the sector's crucial role in business operations.

Increasing Outsourcing Adoption

Outsourcing has emerged as a vital strategy for businesses in Australia aiming to streamline financial operations and reduce costs. Organizations are increasingly opting to delegate payroll processing, bookkeeping, and compliance tasks to specialized accounting service providers. This transition allows companies to concentrate on their core activities while ensuring accuracy and efficiency in financial management. Outsourcing also provides access to skilled expertise without the financial burden of maintaining in-house teams. Additionally, businesses benefit from advanced accounting software and cloud solutions offered by service providers. According to Australia accounting services market analysis, the trend of increased outsourcing adoption is expected to grow, driven by cost optimization strategies, technology integration, and a greater reliance on professional financial management solutions.

Opportunities of Australia Accounting Services Market:

Advisory and Consulting Services

The accounting industry in Australia is experiencing a notable shift from traditional bookkeeping to advisory and consulting services. Organizations are increasingly looking for expert advice in areas such as financial planning, investment strategies, mergers, acquisitions, and risk management. Accountants are ideally suited to provide insights that foster long-term growth and sustainability. By delivering tailored solutions, firms can assist clients in optimizing profitability, managing resources, and making informed decisions. This transition enhances client relationships and broadens revenue streams beyond compliance-focused services. As competition grows, the need for advisory services offers substantial opportunities for accounting firms to evolve into strategic business partners, addressing the wider financial and operational requirements of companies across various sectors.

Sustainability and ESG Reporting

Sustainability and ESG (Environmental, Social, and Governance) reporting are becoming significant growth opportunities for the Australian accounting sector. With businesses under increasing pressure from investors, regulators, and consumers to showcase responsible practices, accurate ESG reporting has become crucial. Accounting firms can play a vital role in aiding organizations to incorporate sustainability metrics into their financial reporting frameworks. This includes monitoring carbon footprints, social impact initiatives, and governance standards. Offering expertise in sustainability compliance provides accounting firms with an opportunity to expand their service offerings and access a rapidly growing market segment. As ESG factors gain importance, accountants who provide reliable and transparent reporting solutions are set to seize considerable new opportunities.

Automation and AI Integration

Automation and AI integration offer extensive prospects for the Australian accounting services market. Advanced technologies can optimize routine tasks such as data entry, reconciliations, and payroll processing, allowing firms to concentrate on higher-value advisory offerings. AI-driven tools also improve accuracy in fraud detection, predictive analytics, and real-time financial monitoring, enhancing decision-making for clients. By embracing these technologies, accounting firms can increase efficiency, lower costs, and deliver more innovative solutions to businesses of all sizes. Furthermore, automation supports scalability, simplifying the management of expanding client bases without a proportional rise in workload. The incorporation of AI improves service quality and positions accounting providers as forward-thinking partners in a technology-oriented financial landscape.

Challenges of Australia Accounting Services Market:

High Competition

The accounting services market in Australia is characterized by fierce competition, with a wide range of firms, from large, established companies to small independent practices, all vying for clients. This rivalry has resulted in competition primarily based on pricing, which puts considerable strain on profit margins. To stay ahead, firms need to set themselves apart through value-added services, personalized client support, and innovative solutions like advisory and consulting services. Nevertheless, continuous pressure on pricing can prevent smaller firms from expanding and investing in advanced technologies. Additionally, this competitive landscape raises client expectations for superior service at lower costs, complicating matters further. It is vital for accounting service providers to strike a balance between affordability, innovation, and expertise to achieve growth and maintain relevancy in this saturated market.

Technology Adoption Barriers

Although automation, AI, and cloud technologies are revolutionizing the accounting industry, many smaller firms in Australia encounter obstacles in embracing these advancements. The high initial investment costs limited financial resources, and a lack of technical know-how hinder their capability to effectively utilize advanced tools. This situation creates a gap between larger firms that can innovate and smaller competitors that find it challenging to keep up. Furthermore, a reluctance to change and an adherence to traditional practices can hinder the process of digital transformation. As clients demand more real-time financial reporting and digital accessibility, firms that cannot adapt risk falling behind. Tackling these barriers is essential for fostering inclusiveness in the market and allowing smaller firms to seize opportunities in a technology-driven environment.

Cybersecurity Risks

The growing dependence on digital platforms, cloud services, and AI-powered accounting solutions has elevated cybersecurity threats within the Australian accounting services sector. The sensitive nature of financial information, which includes client records and tax details, positions accounting firms as prime targets for cyber threats and data breaches. Even minor security oversights can damage client trust and lead to regulatory repercussions. Smaller firms, in particular, may lack the necessary infrastructure to enforce strong data protection protocols, making them more susceptible to risks. As the industry increasingly leans on technology, investing in robust cybersecurity measures, training for employees, and compliance with data protection regulations is crucial. Addressing these challenges is essential for preserving client confidence and ensuring the sustainable growth of accounting services.

Australia Accounting Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type and end user.

Type Insights:

- Payroll Services

- Tax Preparation Services

- Bookkeeping

- Financial Auditing

- Others

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes payroll services, tax preparation services, bookkeeping, financial auditing, and others.

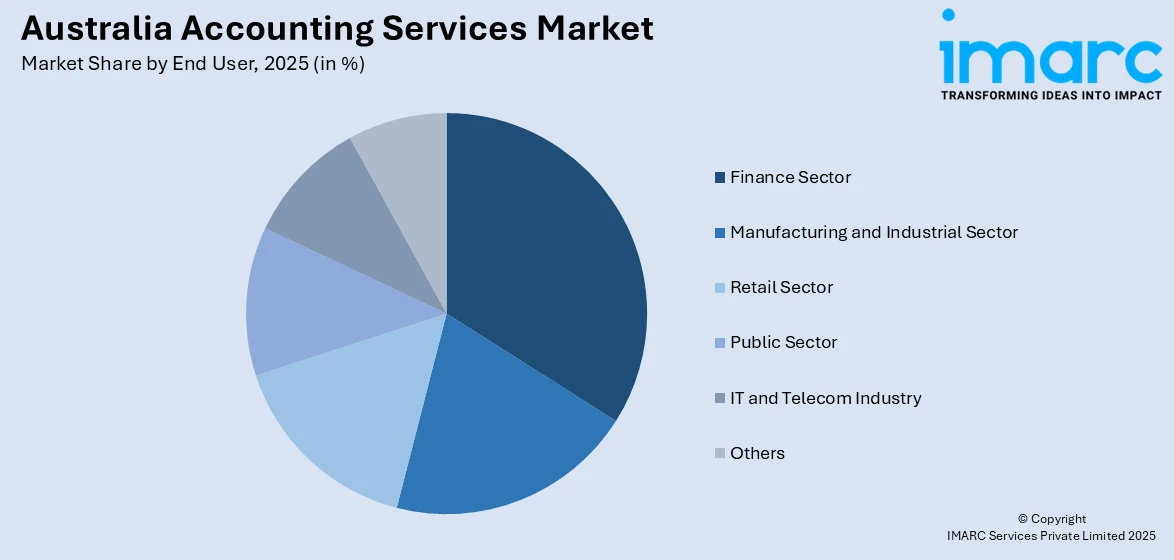

End User Insights:

Access the comprehensive market breakdown Request Sample

- Finance Sector

- Manufacturing and Industrial Sector

- Retail Sector

- Public Sector

- IT and Telecom Industry

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes finance sector, manufacturing and industrial sector, retail sector, public sector, IT and telecom industry, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- BDO International Ltd

- Crowe Australasia

- Deloitte Australia

- Ernst & Young Global Limited

- Grant Thornton Australia Limited

- KPMG Australia

- Pitcher Partners

- PKF Australia

- PwC Australia

- RSM Australia Pty Ltd

- SW Accountants & Advisors

Australia Accounting Services Market News:

- In July 2025, Carbon Group, based in Perth, acquired The Outsource Group to enhance its bookkeeping and CFO services. This follows its earlier 2025 acquisition of KPI Business Advisory. The collaboration aims to support small businesses while The Outsource Group’s clients will gain access to Carbon Group’s broader resources.

- In March 2025, Acclime strengthened its Australian operations by acquiring Sydney-based accounting firm Bedford. This acquisition enhances Acclime's service offerings and expands its presence in Australia to over 200 staff across three cities. Acclime aims to become one of Australia’s largest professional service firms, focusing on client service and international expansion.

- In January 2025, Advancetrack, a UK-based outsourcing provider, expanded into Australia, led by former EY partner Craig McKell. The firm focuses on tailored offshore accounting services, aiming to enhance local accounting firms' operations. Advancetrack also launched 'podsourcing', a flexible team-based solution for complex accounting tasks, boosting efficiency and growth.

- August 18, 2024, HLB Mann Judd, an Australasian accounting and advisory network comprising independent firms that provide a range of services including accounting, launched a Sustainability Steering Committee to enhance internal initiatives and better assist clients with their ESG (Environmental, Social, and Governance) objectives. The committee will guide businesses in sustainability reporting, regulatory compliance, and adopting sustainable practices, addressing the growing demand for sustainability expertise within Australia's accounting services market.

- June 14, 2024, William Buck, a mid-tier Australasian accounting and advisory firm, announced that it is expanding into Canberra through its acquisition of Link Capital Partners, a boutique accounting firm based in the city. Effective from 1 July, this is a strategic move by the firm to enhance its expertise in public sector accounting and advisory services. This expansion reflects the growing demand for specialized accounting services in government-related work within Australia.

Australia Accounting Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Payroll Services, Tax Preparation Services, Bookkeeping, Financial Auditing, Others |

| End Users Covered | Finance Sector, Manufacturing and Industrial Sector, Retail Sector, Public Sector, IT and Telecom Industry, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | BDO International Ltd, Crowe Australasia, Deloitte Australia, Ernst & Young Global Limited, Grant Thornton Australia Limited, KPMG Australia, Pitcher Partners, PKF Australia, PwC Australia, RSM Australia Pty Ltd, SW Accountants & Advisors, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia accounting services market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia accounting services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia accounting services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The accounting services market in Australia was valued at USD 12.2 Billion in 2025.

The Australia accounting services market is projected to exhibit a compound annual growth rate (CAGR) of 6.24% during 2026-2034.

The Australia accounting services market is expected to reach a value of USD 21.3 Billion by 2034.

The Australia accounting services market is witnessing growing integration of sustainability reporting, expansion of advisory roles, and demand for real-time insights through automation. Firms are embracing data analytics, offering tailored solutions, and focusing on industry-specific expertise to enhance client relationships and drive long-term value creation.

Rising globalization of businesses, increasing demand for transparent financial reporting, and the expanding gig economy are driving the market. Heightened investor scrutiny and demand for accurate reporting further accelerate reliance on professional accounting services in Australia.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)