Augmented Reality in Healthcare Market Size, Share, Trends and Forecast by Product, Technology, End User, and Region, 2025-2033

Augmented Reality (AR) in Healthcare Market Size and Trends:

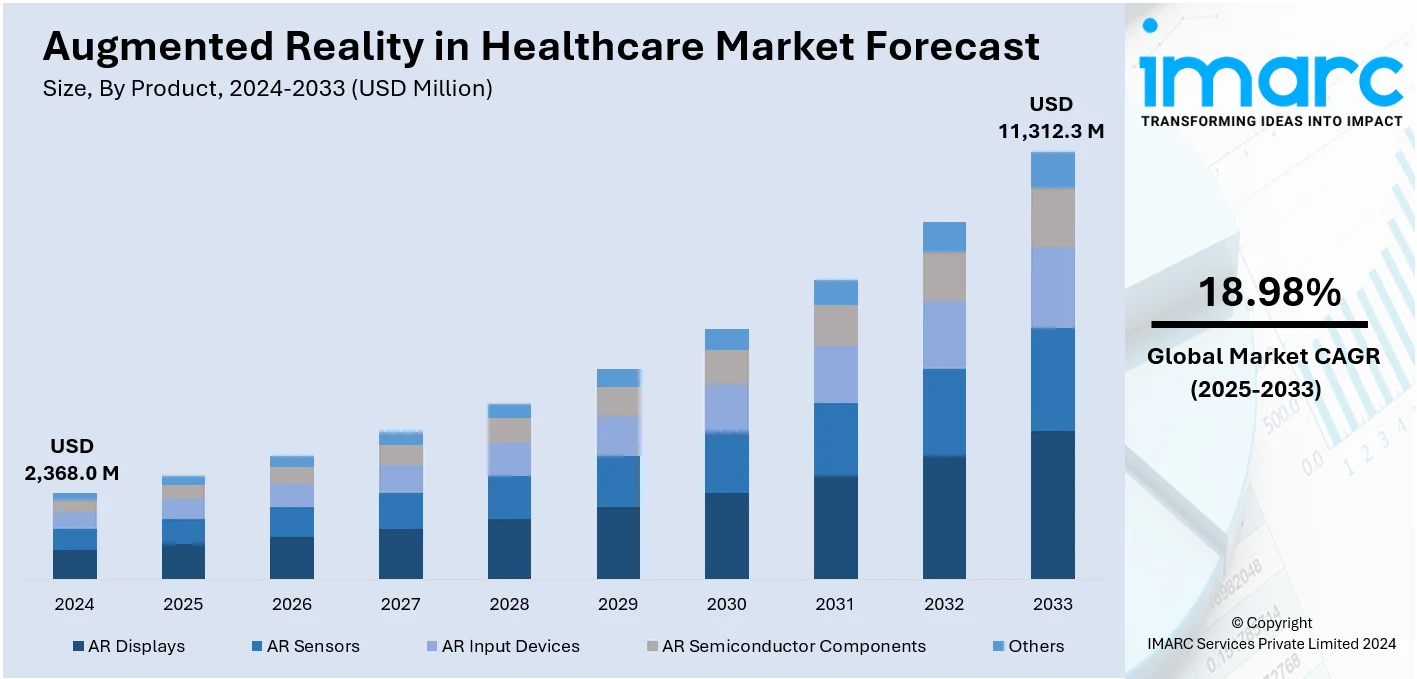

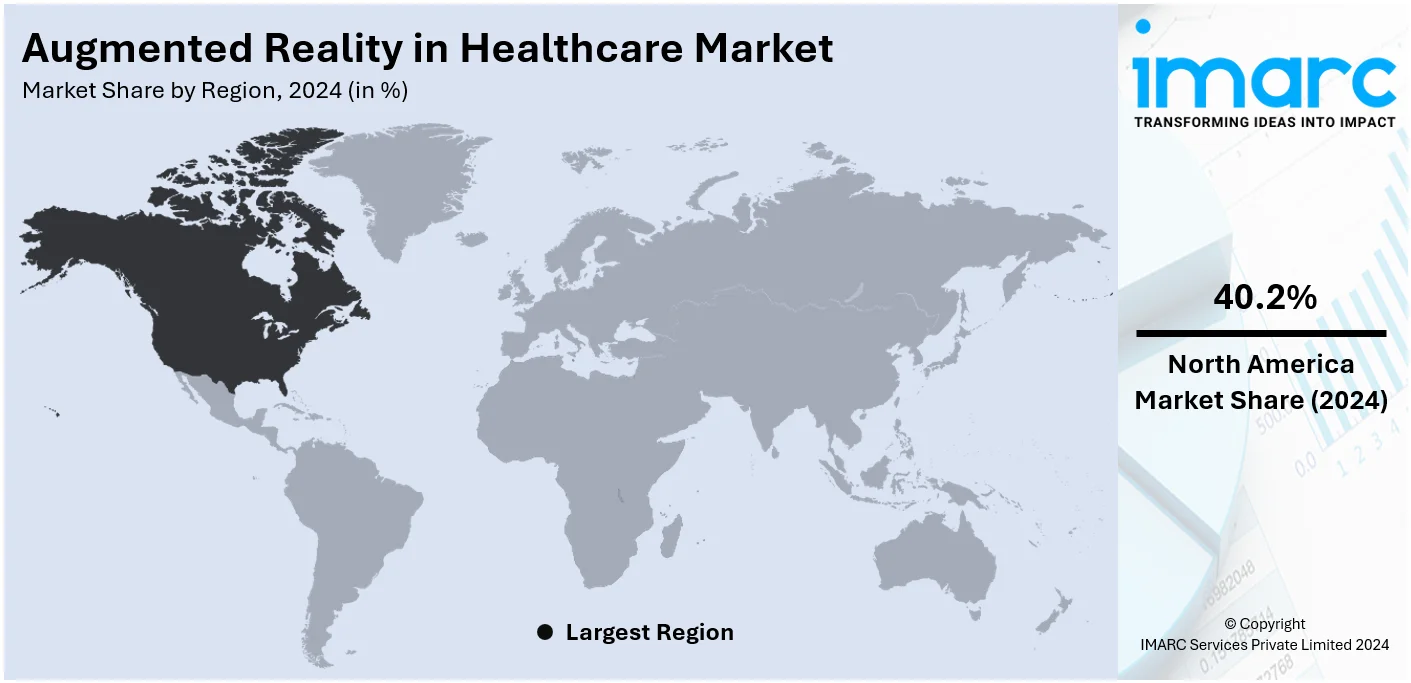

The global augmented reality in healthcare market size was valued at USD 2,368.0 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 11,312.3 Million by 2033, exhibiting a CAGR of 18.98% during 2025-2033. North America currently dominates the market, holding a significant market share of over 40.2% in 2024. The augmented reality in healthcare market share is increasing due to technological advancements, growing adoption in surgeries and training, regulatory support, and increasing demand for precise, innovative, and remote healthcare solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2,368.0 Million |

|

Market Forecast in 2033

|

USD 11,312.3 Million |

| Market Growth Rate (2025-2033) | 18.98% |

The AR in healthcare market is driven by the industry's rapid digitization, which coincides with growing technology improvements. Moreover, AR enhances the visualization of computerized tomography (CT) and magnetic resonance imaging (MRI) data by overlaying stereoscopic projections during a surgical procedure. This information plays a pivotal role in surgeries requiring accurate navigation to a particular organ. Besides this, AR is used in vein visualization, which aids in precisely detecting veins among patients to increase first-attempt accuracy. It is also utilized in dentistry as AR-based smart glasses that superimpose real-time data directly from a dental scanner enabling a dentist to build precise crowns or caps. In addition, AR-enabled tablet-based simulations of different patient scenarios allow nurses to connect better with patients. This, coupled with the rising need for efficient and innovative solutions to enhance clinical and operational outcomes, facilitates market growth. Apart from this, AR can minimize costs by eliminating the need for redundant screens. Furthermore, the increasing prevalence of diseases and the rising focus on improving the overall quality of patient care are impelling the augmented reality in healthcare market growth.

The augmented reality (AR) in healthcare market in the United States is driven by advancements in technology, rising demand for minimally invasive (MI) procedures, and the increasing adoption of AR for medical training and patient education. Rising investments in digital health technologies and the integration of AR with AI are enhancing diagnostic accuracy and surgical precision. The prevalence of chronic diseases, coupled with an aging population, necessitates innovative healthcare solutions. Additionally, government initiatives supporting telemedicine and digital healthcare transformation fuel market growth. For instance, in July 2024, ImmersiveTouch Inc., a prominent digital surgery company, revealed that its innovative augmented reality (AR) technology platform, ImmersiveAR, had obtained 510(k) clearance from the U.S. Food and Drug Administration (FDA) for clinical use in operating rooms. Following the approval, the Chicago-based company swiftly began commercializing the platform nationwide.

Augmented Reality in Healthcare Market Trends:

Enhanced Medical Training and Education

The development of immersive simulations and interactive models, which can help medical professionals visualize complex structures and practice surgical procedures in a risk-free environment is influencing the augmented reality in healthcare market trends. This helps enhance skill development, reduce training costs, and accelerate learning. According to industry reports, significant improvements in surgical skills were observed after AR-based training sessions. Research showed a 20% increase in precision, 33% more timesaving, 60% fewer mistakes, and a 21% increase in procedural success rates. Such improvements thus show the potential of AR technology in optimizing the skills of medical experts, who can safely acquire knowledge and experience to be as confident as they need, without risk. Such results give way to the vast potential for AR to revolutionize surgical education and, in turn, lead to better patient care in everyday clinical practice.

Improved Patient Care and Surgery

AR technology enables the overlay of critical patient information, including imaging scans, on the body of the patient in real-time during procedures. This will increase accuracy, reduce errors, and improve surgical outcomes. Additionally, AR technology enables remote assistance, where experts can guide surgeons in real-time from other locations. To further support the integration of AR in healthcare, the FDA has approved 69 medical devices that combine both augmented reality and virtual reality. This regulatory approval is a testament to the increasing acceptance and application of AR and VR technologies in medical procedures, further driving their adoption in surgical practices and patient care.

Increasing Demand for Remote Healthcare and Telemedicine

Increased telemedicine and remote consultations post-pandemic have increased augmented reality in healthcare demand in virtual patient interactions. The use of AR has allowed healthcare professionals to more easily diagnose, treat, and monitor patients from a distance, due to visual aids and interactive tools that improve communication and decision-making. The number of Medicare visits conducted through telehealth surged 63-fold during the pandemic-from about 840,000 in 2019 to 52.7 million in 2020, according to a report by the US Department of Health and Human Services. This kind of surge shows the growing reliance of telehealth and AR on technologies to enhance virtual care delivery, giving patients as well as healthcare providers power tools to improve outcomes as well as efficiency.

Augmented Reality in Healthcare Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global augmented reality (AR) in healthcare market, along with forecast at the global, regional and country level from 2025-2033. The market Our has been categorized based on product, technology, and end user.

Analysis by Product:

- AR Displays

- AR Sensors

- AR Input Devices

- AR Semiconductor Components

- Others

According to the augmented reality in healthcare market research, AR displays hold the largest share due to their critical role in enabling real-time visualization and interaction during medical procedures. These displays, including head-mounted devices, smart glasses, and handheld screens, enhance precision in surgeries, diagnostics, and training by overlaying vital information directly onto the user's view. Furthermore, their ability to provide immersive, hands-free guidance improves operational efficiency and reduces errors. The increasing adoption of AR displays in medical training, telemedicine, and patient education further drives demand. Additionally, advancements in display technology, such as improved resolution and ergonomics, contribute to their widespread adoption.

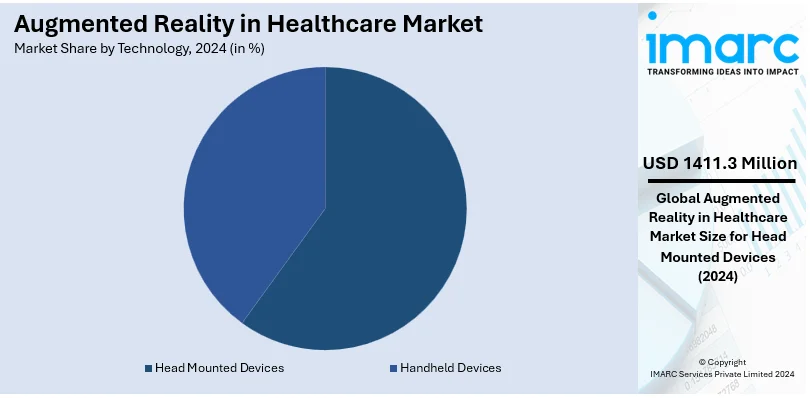

Analysis by Technology:

- Head Mounted Devices

- Handheld Devices

Head mounted devices leads the market with around 59.6% of market share in 2024. Head-mounted devices (HMDs) hold the largest share in the augmented reality (AR) in healthcare market due to their ability to provide immersive, hands-free experiences essential for precision and efficiency. HMDs enable surgeons and healthcare professionals to visualize 3D anatomy, overlay critical data, and perform complex procedures with enhanced accuracy. Their application in surgical navigation, medical training, and remote consultations has gained significant traction. Integrating advanced technologies like AI and 5G with HMDs enhances real-time performance. Additionally, their portability, ergonomic designs, and expanding use in telemedicine and patient care contribute to their dominance in the AR healthcare market.

Analysis by End User:

- Hospitals and Clinics

- Research Laboratories

- Others

Hospitals and clinics lead the market with around 47.9% of the market share in 2024. Hospitals and clinics hold the largest share of the augmented reality (AR) in healthcare market due to their widespread adoption of AR technologies to enhance patient care, surgical precision, and operational efficiency. AR solutions are extensively used in these settings for pre-surgical planning, real-time surgical guidance, diagnostics, and medical training. Hospitals benefit from AR's ability to improve outcomes in minimally invasive procedures and complex surgeries. Additionally, integrating AR in patient education and telemedicine enhances engagement and understanding. The growing focus on digital transformation in healthcare and investments in advanced technologies further drive AR adoption in hospitals and clinics.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 40.2%. The augmented reality (AR) in healthcare market in North America is driven by a significant investment in digital health innovation, the widespread adoption of cutting-edge technologies, and a robust healthcare infrastructure. The region benefits from strong support for AR applications in medical training, surgical procedures, and diagnostics, with increasing FDA approvals for AR devices boosting credibility and usage. The rising prevalence of chronic diseases and demand for minimally invasive procedures further propel adoption. Integration with AI and telemedicine solutions enhances patient outcomes and operational efficiency. Additionally, the presence of major AR technology providers and the growing focus on personalized medicine contribute to market growth. For instance, in February 2024, MediThinQ, a company specializing in medical augmented reality (AR) technology, revealed a strategic collaboration with Medtronic to launch the AR wearable display, Scopeye, in the United States.

Key Regional Takeaways:

United States Augmented Reality in Healthcare Market Analysis

In 2024, the United States accounted for the market share of over 89.00% in North America. According to an industry report, the United States' health sector is highly developed, and with 6,120 plus hospitals across this country. There is new growth driving into the healthcare sector through relatively new technologies. Integration of these technologies AR/VR as a potential medical device gets FDA approvals; currently, there are 69 medical devices approved which gives way for growth within this environment. AR and VR are expected to transform healthcare by offering new and innovative diagnostic tools, treatment options, and better training for medical professionals. The technology is allowing more precise surgeries, better outcomes for patients, and improving the way medical education is provided with immersive simulations. Furthermore, the ability to provide care remotely, especially post-pandemic, has opened up new opportunities for virtual consultations and remote diagnostics. As the demand for more efficient, cost-effective, and precise healthcare solutions is growing, AR and VR will likely revolutionize healthcare delivery in the U.S. They have become essential growth drivers for the U.S. healthcare market by helping to enhance patient care and medical training.

Europe Augmented Reality in Healthcare Market Analysis

The EU4Health programme, which is initially allocated Euro 5.3 Billion (USD 5.6 Billion) for the period 2021-2027, and then reduced to Euro 4.4 billion (USD 4.6 Billion), will be a substantial investment in public health across Europe. This unprecedented funding is, therefore, proof of the EU's commitment to healthcare and the beginning of a European Health Union. With its focus on health priorities, such as the adoption of digital technologies, the EU4Health programme offers an essential base for the growth of augmented reality (AR) in healthcare. The support provided by the EU for AR technologies is expected to transform the way healthcare is delivered, diagnosed, and trained in. As a result, this financial support further empowers the market for AR in healthcare, which pushes the innovation of surgical precision, remote consultations, and training programs in hospitals, clinics, and research laboratories in Europe. The EU's focus on the transformation of digital health aligns with the growing demand for AR-based solutions, further accelerating the adoption of this technology across European healthcare systems.

Asia Pacific Augmented Reality in Healthcare Market Analysis

Asia-Pacific is expected to continue to be the fastest-growing region in healthcare spending, constituting over 20% of global healthcare expenditure in 2030, as per an industry report. Going forward, with the heavy investments in health infrastructure and technologies, augmented reality plays an important role in addressing issues regarding access to care, cost, and quality. The fastest-growing driver in this segment is the aging population, especially in Japan, which has almost 30% of its population above 65 years of age as of 2021, as per an industry report. The percentage is estimated to go beyond 35% by 2040. The need for elderly care and a more efficient method of delivering healthcare is pushing for the use of AR technology. It will be integrated into surgical planning, diagnostics, and remote consultations to improve the quality of care and assist health care providers in providing more precise and cost-effective treatments. AR also supports remote health care solutions, especially for those in underserved areas, thus increasing access to health care. The growth in healthcare spending and the ageing population will make AR a leading enabler of innovation in the Asia-Pacific healthcare sector.

Latin America Augmented Reality in Healthcare Market Analysis

The Brazilian government has a "Digital Health Strategy" released in 2018, where it pushes digital healthcare solutions, such as AR, to be the solution of the health problems in that country. By integrating AR into the medical practice of Brazil, it will look forward to enhancing the diagnosis accuracy, improving the surgical procedures, and increasing access to healthcare services in the country. This drives the growing demand for innovative health technologies in the region. Additionally, 2023 was a significant year for Brazil and Mexico as they became the dominant leaders in the healthtech startup sector in Latin America, with 40% of the region's healthtech startups based in Brazil and 38% based in Mexico, as per an industry news. Both are adopting AR to improve training for medical practitioners, aiding remote patient monitoring, and making clinical procedures easier and faster. This surge of healthtech startup firms targeting AR solutions for these countries signifies an emerging healthtech market for sophisticated technologies, placing them at a significant forefront in the rise of the augmented reality market in healthcare in Latin America.

Middle East and Africa Augmented Reality in Healthcare Market Analysis

According to an industry news report, startups in the Middle East and North Africa (MENA) area raised USD 3.94 billion in 2022 through 795 deals, a 22% increase in the number of deals and a 24% increase in the investment value over 2021. This is an increase in investment that shows the interest in innovative technologies such as AR in the healthcare sector. As healthcare in the region is continually growing and changing, AR solutions continue their advance through better diagnostics and further enhanced surgical precision, remote consultation opportunities, with more money inflows to healthtech start-ups expected to support increased application of AR technology, helping place MENA squarely among leaders in the world augmented reality healthcare market. Government initiatives, a growing demand for digital healthcare solutions, and the development of telemedicine services in countries like the UAE and Saudi Arabia are some other factors that support this growth. This provides a robust foundation for continued growth of AR in healthcare in the Middle East and Africa.

Latest List of Top Companies in Augmented Reality in Healthcare Market:

The augmented reality (AR) in healthcare market is highly competitive, with key players focusing on innovation, strategic collaborations, and regulatory approvals to strengthen their market position. Major companies like Microsoft, Medtronic, Philips, AccuVein, and Magic Leap lead with advanced AR solutions for surgery, diagnostics, and medical training. Startups like Augmedix and ImmersiveTouch bring niche innovations, driving competition. Partnerships between AR developers and healthcare providers are common, fostering tailored solutions. In addition, regulatory approvals, such as FDA clearances, boost credibility and adoption. Furthermore, companies are investing heavily in R&D to integrate AR with AI, telemedicine, and IoT, creating a dynamic and rapidly evolving market. For instance, in April 2024, SimBioSys has formed a strategic partnership with augmented reality (AR) company Magic Leap to enhance cancer surgery outcomes by integrating AI and AR. This collaboration aims to leverage Magic Leap's AR technology alongside SimBioSys' AI-driven medical imaging solution, TumorSight Viz, to improve surgical precision, reduce invasiveness, and ultimately elevate patient quality of life. These efforts are creating a positive augmented reality in healthcare market outlook.

The report provides a comprehensive analysis of the competitive landscape in the augmented reality in healthcare market with detailed profiles of all major companies, including:

- AccuVein Inc.

- Atheer Inc.

- Augmedics

- CAE Inc.

- Google LLC

- Koninklijke Philips N.V.

- Magic Leap Inc.

- Medical Realities Ltd.

- Microsoft Corporation

- Mindmaze

- Orca Health Inc.

- Siemens AG

- Wikitude GmbH (Qualcomm Technologies Inc.)

Latest News and Developments:

- April 2024: The U.S. Food and Drug Administration announced a new program, Home as a Health Care Hub, which has been developed to use the augmented reality and virtual reality that can help improve health equity by reimagining a home environment as part of healthcare systems.

- February 2024: the tech giant unveiled Apple Vision Pro, its first mixed-reality headset. Its 600 new apps combine virtual and augmented reality to give users richer, more immersive experiences, opening new possibilities for improving patient care, expediting clinical procedures, and increasing diagnostic precision.

- July 2023: Augmedics announced it had secured USD 82.5 Million in funding aimed at accelerating the adoption of augmented reality spine surgery and furthering its acquisition of intellectual property and other digital health assets to bolster its AR and AI portfolio.

- February 2023: Google announced a new platform called ARCore for Healthcare to help developers in creating experiences for healthcare applications using AR.

Augmented Reality in Healthcare Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | AR Displays, AR Sensors, AR Input Devices, AR Semiconductor Components, Others |

| Technologies Covered | Head Mounted Devices, Handheld Devices |

| End Users Covered | Hospitals and Clinics, Research Laboratories, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AccuVein Inc., Atheer Inc., Augmedics, CAE Inc., Google LLC, Koninklijke Philips N.V., Magic Leap Inc., Medical Realities Ltd., Microsoft Corporation, Mindmaze, Orca Health Inc., Siemens AG and Wikitude GmbH (Qualcomm Technologies Inc.). |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the augmented reality in healthcare market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global augmented reality in healthcare market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the augmented reality in healthcare industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The augmented reality in healthcare market was valued at USD 2,368.0 Million in 2024.

The augmented reality in healthcare market is estimated to exhibit a CAGR of 18.98% during 2025-2033.

The market is driven by technological advancements, growing adoption in surgeries and training, regulatory support, and increasing demand for precise, innovative, and remote healthcare solutions.

The future trends in the AR healthcare market include enhanced surgical visualization, remote assistance for procedures, AR-guided medical training, and patient education tools. Rehabilitation therapies, mental health treatments, and pre-surgical planning are also being integrated with AR, which is driving innovation and improving patient outcomes.

North America currently dominates the market, driven by a significant investment in digital health innovation, the widespread adoption of cutting-edge technologies, and a robust healthcare infrastructure.

Some of the major players in the augmented reality in healthcare market include AccuVein Inc., Atheer Inc., Augmedics, CAE Inc., Google LLC, Koninklijke Philips N.V., Magic Leap Inc., Medical Realities Ltd., Microsoft Corporation, Mindmaze, Orca Health Inc., Siemens AG and Wikitude GmbH (Qualcomm Technologies Inc.), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)