Athletic Footwear Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End User, and Region, 2026-2034

Athletic Footwear Market Size & Share:

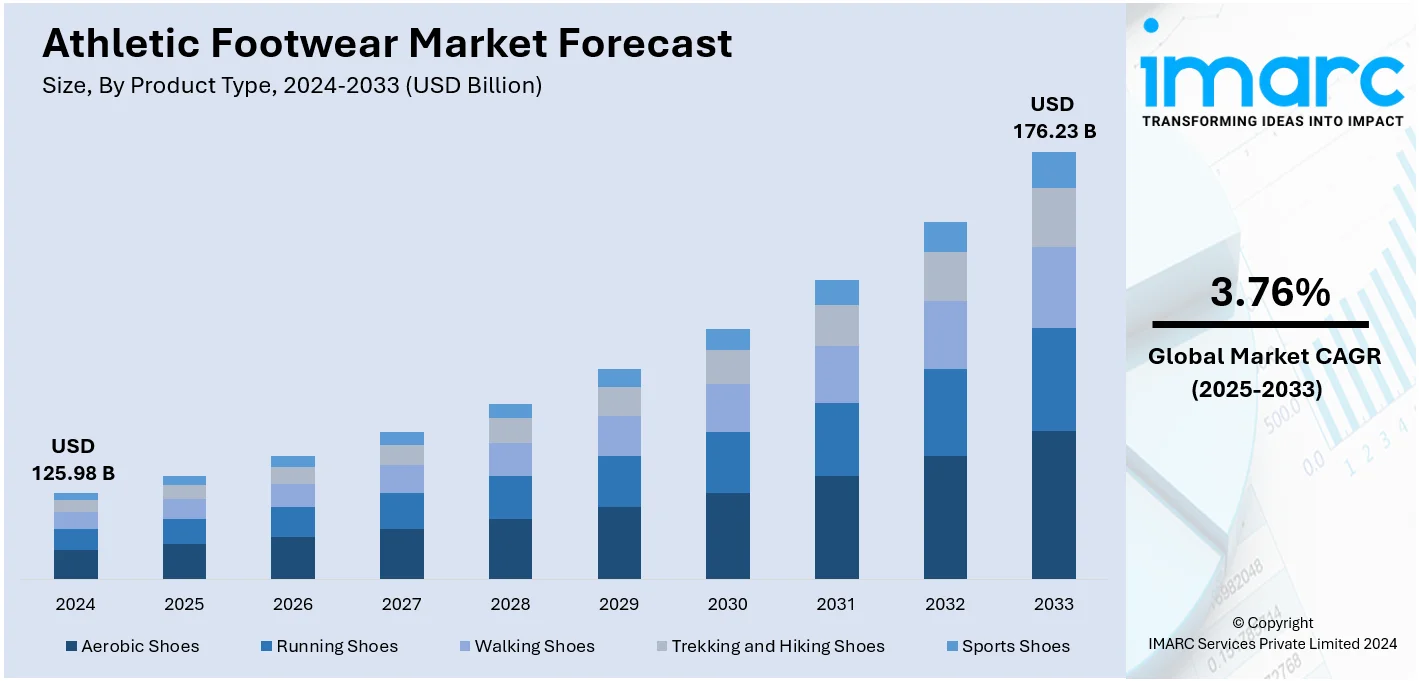

The global athletic footwear market size was valued at USD 125.98 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 176.23 Billion by 2034, exhibiting a CAGR of 3.76% during 2026-2034. In 2024, North America leads the market, accounting for more than 36.9% of the athletic footwear market share. The growing popularity of sports and fitness regimens among the masses, the increasing significance of fashion and lifestyle, the rising number of professional athletes and sports teams endorsing and sponsoring products, and technological improvements are some of the key factors impelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 125.98 Billion |

|

Market Forecast in 2034

|

USD 176.23 Billion |

| Market Growth Rate (2026-2034) | 3.76% |

The athletic footwear market is driven by several key factors. The growing health awareness and increasing participation in sports, fitness activities, and outdoor adventures fuel the demand for performance-oriented footwear. The rising popularity of athleisure, blending fashion with comfort, has expanded the market to casual consumers. Technological innovations that accommodate a range of tastes and requirements include improved cushioning, lightweight materials, and intelligent functions. Increased disposable income and urbanization, especially in emerging nations, are factors driving up sales. Buyers now have greater accessibility and convenience due to the advent of e-commerce and direct-to-consumer tactics. Celebrity and athlete endorsements also increase brand awareness and customer confidence. Consumer choices are also influenced by an increasing focus on sustainability and environmentally friendly products, which are aligned with worldwide environmental concerns.

To get more information on this market, Request Sample

In the United States, the athletic footwear market is driven by increasing health consciousness, participation in sports, and the growing fitness culture. The rise of athleisure as a fashion trend has expanded the market to casual and lifestyle consumers. Technological innovations, such as performance-enhancing materials and smart footwear, attract fitness enthusiasts and athletes. For instance, in February 2024, lululemon launched its 2024 spring and summer footwear lineup, which includes its first men's collection as well as new casual and performance innovations. On February 13, lululemon announced the launch of its first new model, the Cityverse, a casual sneaker. Additionally, lululemon unveiled the Beyondfeel and Beyondfeel Trail running models, which formally debuted on March 19 and May, respectively. Both men's and women's styles from the collection are offered online and in a few chosen retailers in North America, Europe, and the Chinese mainland. Accessibility is increased by e-commerce and omnichannel retail techniques, while luxury purchases are made possible by increased disposable income. Athletes' and celebrities' endorsements contribute significantly to brand loyalty. Demand for new products is further fueled by sustainability trends in the U.S. market, where consumers are seeking eco-friendly solutions.

Athletic Footwear Market Trends:

Increasing Global Interest in Sports and Fitness Activities

The increasing popularity of various sports and fitness regimens among the masses is leading to the creation of footwear specifically made for such activities. Athletes and active individuals are looking for footwear that offers comfort and support to maximize their performance and reduce the chance of injury. The rising recognition among individuals about the advantages of regular exercise is contributing to athletic footwear market growth. In April 2024, Adidas introduced 49 styles of shoes to choose from, mirroring the nine sponsored nations, 41 disciplines, and the 2024 Olympic and Paralympic Games in Paris.

Rising Influence of Fashion and Lifestyle Trends

Sports shoes and sneakers are combining fashion and utility to create a statement in footwear. There is need for stylish and attractive designs as sports footwear is being worn with regular clothing. Influencers, celebrities, and fashion designers are collaborating with brands to improve the appeal of sports footwear. According to reports, social media, engaging 64% of the global population, sees 68% of users actively following brands alongside friends, showcasing a surge in influencer-driven marketing across platforms like Facebook, Instagram, and Twitch. For example, Asics partnered with Naruto Shippuden in 2023 to create the GEL-NYC sneakers, which were designed to appeal to fans of the popular anime. The Uzumaki Clan and Hidden Leaf Village symbols, as well as other well-known anime icons, are included in the black design of these sneakers with orange highlights. The growing popularity of personalized athletic footwear among individuals to showcase personal style is positively influencing the athletic footwear market growth.

Advancements in Technology

Improvements in manufacturing processes, materials, and cushioning systems are enhancing the overall support, energy return, and shock absorption of footwear. Lightweight materials minimize the strain on shoes, improving dexterity and quickness. Comfort and ventilation are enhanced with moisture-wicking materials and breathable clothing. Improvements in outsole structure offer better resilience and traction. Integration of wearable technology also makes it possible to collect and analyze performance data on an individual basis. Technological innovations improve sports performance and attract buyers looking for innovative features. Adidas launched the Solarthon golf shoe in 2021, which supports the End Plastic Waste campaign of the company and offers lightweight comfort due to a Primeblue textile upper composed of at least 50% recycled plastic. With a spikeless Fishscale Traxion outsole and a full-length Boost midsole, it offers improved stability and grip on the course.

Athletic Footwear Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global athletic footwear market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on product type, distribution channel, and end user.

Analysis by Product Type:

- Aerobic Shoes

- Running Shoes

- Walking Shoes

- Trekking and Hiking Shoes

- Sports Shoes

Running shoes stand as the largest component in 2024, holding around 37.6% of the market. Running shoes are created to provide higher support, stability, and cushioning to runners. They offer durable outsoles with improved grip, breathable uppers, and cutting-edge cushioning technology. The growing interest in running as a leisure and fitness activity among the masses as well as their involvement in marathons and races, is driving the demand for running shoes. In May 2022, to appeal to both professional athletes and casual runners, Nike launched the Alphafly 3, their latest running super shoe, which broke the world record for marathon running. The shoe has innovations, including an expanded high-stack midsole and better comfort aspects. Walking shoes are intended for people who like to take strolls or indulge in regular walking. Shock absorption, support, and comfort are given top priority in these shoes. Their flexible outsoles, breathable fabrics, and cushioned insoles provide a comfortable and seamless walking experience.

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Brand Outlets

- Online Channels

Specialty stores, including sports retailers and dedicated athletic shoe shops, are influencing the market growth. These retailers provide a customized shopping experience with their targeted selection of sports footwear alternatives and their experienced personnel. They provide professional guidance, fitting services, and a carefully chosen assortment of performance-oriented footwear, all with an emphasis on meeting the demands of athletes and sports enthusiasts. Specialty stores establish themselves as a destination for buyers looking for premium athletic shoes owing to their specialized knowledge and customized products. Brand outlets, which display latest collections and exclusives from specific brands, are important market drivers. These stores provide clients with a direct route to genuine, branded athletic footwear. Brand shops frequently create a distinctive retail environment by showcasing promotions and displays with a brand theme that draw enthusiasts and brand loyalists. People interact with the brand identity, innovations, and product offers through them. Specific sports footwear brands are more in demand among buyers and have a stronger market presence.

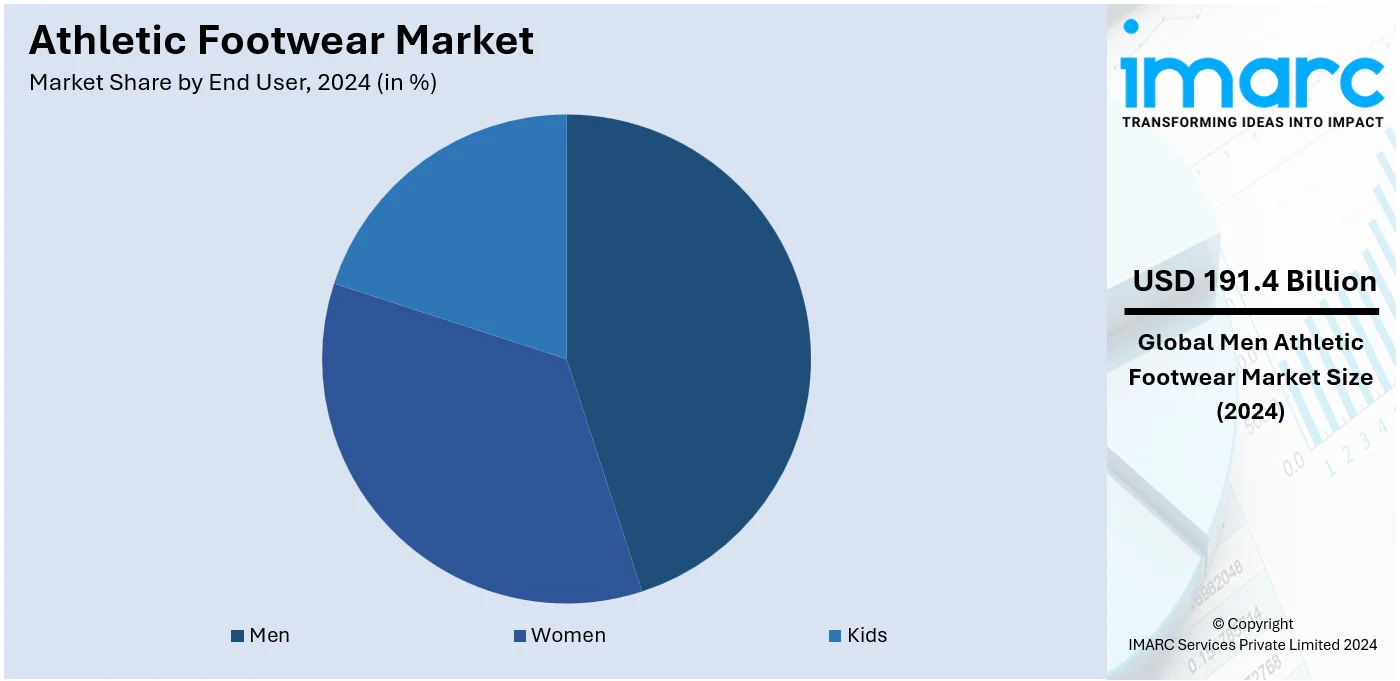

Analysis by End User:

- Men

- Women

- Kids

Men leads the market with around 58.9% of athletic footwear market share in 2024. Presently, there is a notable rise in the popularity of athletic footwear among men. Men have historically been associated with sports and athletic activities, and they continue to be a significant consumer group for athletic footwear. Men indulge in various sport activities, such as basketball, soccer, running, tennis, and more, needing particular athletic shoes designed for their needs. Because of this, many athletic shoe-makers now provide a large selection of alternatives for men, giving stability, durability, and performance-enhancing qualities top priority when choosing sports footwear.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 36.8%. The region is characterized by a rapidly expanding fitness-conscious population, supported by the growth of urban centres that encourage active lifestyles. Rising disposable incomes are enabling consumers to invest in quality footwear tailored to specific fitness and recreational needs. For instance, India's per capita disposable income is projected to reach approximately USD2,576 in FY24, reflecting an 8% growth, which, alongside rising disposable incomes, is expected to boost demand for athletic footwear. Gross national disposable income is also set to rise 8.9%, supporting consumer spending trends. Traditional preferences are evolving, as younger generations are increasingly drawn to sportswear and performance-oriented products. Local production capabilities and cost-effective manufacturing processes ensure competitive pricing, making premium and mid-range options accessible to broader audiences. Digital transformation and widespread smartphone adoption have accelerated online shopping trends, enabling the sale of athletic footwear through e-commerce platforms. Regional governments are actively investing in recreational infrastructure, such as parks and stadiums, which further boosts engagement in physical activities. Partnerships with local retailers and the integration of innovative features in product offerings are driving interest. Moreover, the cultural embrace of athletic styles for casual and professional settings has bolstered demand, blending fashion and functionality seamlessly.

Key Regional Takeaways:

North America Athletic Footwear Market Analysis

North America drives the market for athletic footwear with its robust sports culture and fitness-conscious population. The region has a high participation rate in sports and recreational activities, creating a significant demand for athletic footwear. Major sports events, such as the Super Bowl and NBA championships, further boost the market. Additionally, the presence of prominent athletic footwear brands and a robust retail infrastructure contribute to the market growth. According to Sports & Fitness Industry Association (SFIA) data, team sports participation grew by 1.8% from 67 Million in 2020 to 68.3 Million in 2021. Basketball continues to be the most popular team sport in the US, with 27.1 Million players as of 2021. Additionally, the market is driven by North American manufacturers' ongoing technological and material innovation, which guarantees a large selection of performance-enhancing choices for athletes and fitness enthusiasts.

United States Athletic Footwear Market Analysis

In 2024, the United States accounted for the market share of over 82.10%. The market benefits from a highly developed infrastructure for sports and fitness, enabling extensive participation in athletic activities. Public facilities like gyms, parks, and recreational areas encourage physical activity, creating a need for specialized footwear. Educational institutions promote sports at various levels, further increasing demand for functional and performance-oriented products. A strong emphasis on wellness initiatives has inspired individuals to adopt healthier lifestyles, fostering purchases of footwear designed for specific activities. According to reports, a record 242 Million Americans, nearly 80% of those aged 6 and older, engaged in sports or fitness activities in 2023, a 2.2% rise from 2022, driving demand for athletic footwear as participation grows annually. Additionally, the widespread culture of organized sports boosts the demand for shoes tailored to meet different sporting requirements. Retail environments, both physical and online, are highly advanced, offering a seamless shopping experience with efficient delivery services. Innovation in manufacturing processes and the presence of advanced research hubs are contributing to the production of cutting-edge products. Moreover, widespread promotional events and collaborations with sporting communities create opportunities for market expansion.

Europe Athletic Footwear Market Analysis

The region is distinguished by a long-standing focus on physical fitness and recreational sports, fostering widespread adoption of activity-specific footwear. Local governments prioritize public health through policies and investments that encourage active lifestyles, increasing the demand for performance-enhancing shoes. Consumers in this region often seek products that combine aesthetics with superior functionality, aligning with the preference for premium offerings. Additionally, a robust emphasis on sustainability drives interest in eco-friendly footwear crafted from recyclable or biodegradable materials. According to survey by EU, 77% of Europeans are willing to pay more for eco-friendly products, benefiting industries like athletic footwear. The retail landscape supports diverse purchasing options, from luxury boutiques to online stores offering curated collections. Organized sports, from football to outdoor running, have a strong cultural foundation, creating consistent demand for specialized gear. Moreover, innovations in footwear technology, such as enhanced traction for colder climates, cater to the diverse environmental conditions found across the region. Fitness enthusiasts are also increasingly inclined toward versatile designs suitable for both athletic and casual use, bolstered by the growing athleisure trend.

Latin America Athletic Footwear Market Analysis

Fitness culture is on the rise, with increasing participation in sports and recreational activities driving the demand for durable and comfortable footwear. Economic development in the region has led to improved consumer spending power, enabling purchases of both entry-level and high-performance options. For instance, Brazil's population grew by 6.5% between 2010 and 2022, reaching 203.1 Million, with 61% living in urban areas. This expanding urban demographic and economic growth are fuelling demand for athletic footwear. The influence of urbanization has shaped preferences toward versatile designs suitable for multiple purposes. Promotional campaigns targeted at active individuals and youth segments have created an aspirational appeal, further driving sales. The diverse terrain in the region has also fostered demand for specialized shoes designed for outdoor sports. Local production capabilities ensure affordability while maintaining quality standards, supporting market growth effectively.

Middle East and Africa Athletic Footwear Market Analysis

The athletic footwear market is gaining momentum due to the growing emphasis on health and fitness activities, particularly among younger demographics. Expanding sports participation is further amplified by supportive infrastructure development and lifestyle changes. In the Middle East, investments in fitness-oriented real estate projects, including multipurpose arenas and fitness hubs, are encouraging footwear adoption. According to reports, there has been heavy investment by Middle Eastern stakeholders in major sports assets across football, motorsport, golf, tennis, and more, aiming to secure a prominent place in the global sporting calendar. This growth is expected to boost demand for athletic footwear, benefiting from the expanding market for high-end properties and recreational facilities. In Africa, improving retail networks and access to modern e-commerce platforms are simplifying product availability. The rising influence of athleisure trends is also driving demand for versatile footwear that suits both casual and athletic needs. Additionally, government-backed initiatives promoting physical activity are creating opportunities for footwear brands to align with evolving consumer preferences.

Competitive Landscape:

The athletic footwear market is highly competitive, driven by major players like Nike Inc., adidas India Marketing Pvt. Ltd, PUMA India Ltd, and Under Armour Inc., alongside emerging brands. Key strategies include product innovation, celebrity endorsements, and strategic collaborations to strengthen brand loyalty. Companies focus on advanced materials, sustainability, and customization to meet evolving consumer preferences. E-commerce platforms and direct-to-consumer models are reshaping distribution and enhancing accessibility. Regional players leverage local trends to gain market share, especially in Asia-Pacific, a fast-growing market. Intense competition fosters continuous innovation in design, functionality, and marketing. Overall, leading brands maintain dominance, but niche players gain traction through differentiation and targeting specific consumer segments.

The report has also analysed the competitive landscape of the market with some of the key players being:

- adidas India Marketing Pvt. Ltd

- ASICS Corporation

- Fila India

- K-Swiss

- New Balance

- Nike Inc.

- PUMA India Ltd

- Reebok International Ltd.

- Saucony

- Skechers USA Inc.

- Under Armour Inc.

- VF Corporation

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- October 2025: Cricket icon Sachin Tendulkar introduced ‘10XU,’ a sportswear and athleisure brand based in Bengaluru. Co-founded by Tendulkar, Karthik Gurumurthy, and Karan Arora, and supported by Peak XV and Whiteboard Capital, 10XU provided a variety of footwear, clothing, and a unique cricket collection intended for both athletes and anyone passionate about movement and play.

- September 2025: Lehar Footwear Limited, a prominent player in India's footwear sector, unveiled its latest sports and athleisure brand, RANNR. This signified the company's foray into the performance footwear sector, extending beyond its primary range of sandals and slippers. The brand intended to satisfy increasing demand for fashionable and long-lasting sports shoes, especially among young professionals, fitness lovers, students, and lifestyle-oriented buyers.

- August 2025: Red Chief ventured into athletic footwear with the introduction of Red Chief Sports Shoes. This fresh category appealed to young individuals who prioritized style, performance, and comfort throughout the day.

- February 2025: Nike, Inc. and SKIMS collaborated to transform the global fitness and activewear market through the introduction of NikeSKIMS, a new brand set to provide cutting-edge innovations. The partnership would unveil a broad range of products that would encourage more athletes and women to engage in sports and physical activities. The brand's collective vision honored all aspects of athleticism, encompassing both elite and everyday athletes.

Athletic Footwear Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Aerobic Shoes, Running Shoes, Walking Shoes, Trekking And Hiking Shoes, Sports Shoes |

| Distribution Channels Covered | Supermarkets and hypermarkets, Specialty stores, Brand outlets, Online channels |

| End Users Covered | Men, Women, and Kids |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | adidas India Marketing Pvt. Ltd, ASICS Corporation, Fila India, K-Swiss, New Balance, Nike Inc., PUMA India Ltd, Reebok International Ltd., Saucony, Skechers USA Inc., Under Armour Inc., VF Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the athletic footwear market from 2020-2034.

- The athletic footwear market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the athletic footwear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Athletic footwear refers to shoes specifically designed for sports and physical activities. These include running shoes, basketball sneakers, soccer cleats, and more, tailored to enhance performance, provide comfort, and prevent injuries. Made with durable materials, they feature cushioning, arch support, and traction to suit various sports, training, and fitness needs.

The athletic footwear market was valued at USD 125.98 Billion in 2024.

IMARC estimates the global athletic footwear market to exhibit a CAGR of 3.76% during 2025-2033.

The key factors driving the global athletic footwear market include rising health awareness, increasing participation in sports and fitness activities, and the growing trend of athleisure. Innovations in footwear technology, such as lightweight materials and enhanced cushioning, along with brand endorsements and e-commerce growth, also contribute to expanding market demand.

According to the report, running shoes represented the largest segment by product type, due to their versatile use, increasing fitness trends, and demand for everyday comfort.

Specialty stores lead the athletic footwear market by offering expert guidance, diverse product ranges, personalized services, and premium brand experiences.

Men leads the market by end user due to higher participation in sports, and fitness activities, and strong demand for performance-oriented footwear.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global athletic footwear market include adidas India Marketing Pvt. Ltd, ASICS Corporation, Fila India, K-Swiss, New Balance, Nike Inc., PUMA India Ltd, Reebok International Ltd., Saucony, Skechers USA Inc., Under Armour Inc., VF Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)