ATCA CPU Blades Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

ATCA CPU Blades Market Size and Share:

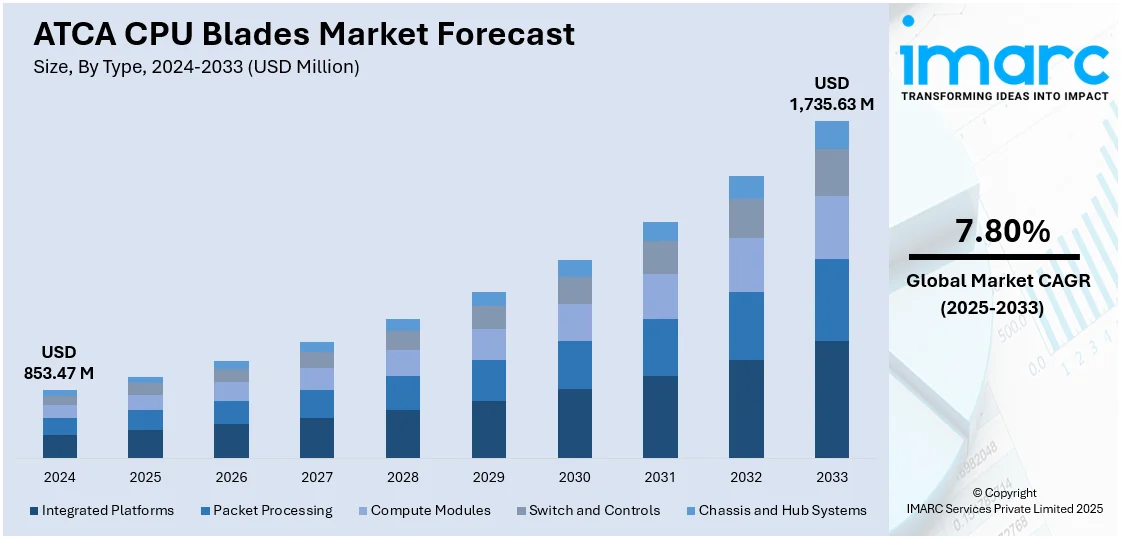

The global ATCA CPU blades market size was valued at USD 853.47 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,735.63 Million by 2033, exhibiting a CAGR of 7.80% from 2025-2033. Asia Pacific is the current market leader, with a market share of more than 34.7% in 2024, driven by robust demand in the telecommunications, defense, and data center markets. The region's high investments in 5G technology, digitalization, and smart infrastructure projects are propelling sustained market growth and technological innovation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 853.47 Million |

|

Market Forecast in 2033

|

USD 1,735.63 Million |

| Market Growth Rate 2025-2033 | 7.80% |

The growth of the ATCA CPU blades market is primarily driven by the enhancing need for exceptional, high-performance computing systems in telecommunications, defense, and data center industries. With the rise in data traffic, the need for robust, scalable, and efficient systems to support complex applications is escalating. ATCA CPU blades, known for their high processing power, modular design, and reliability, are essential in managing large-scale data and supporting next-generation 5G networks. Furthermore, as industries embrace digital transformation, the adoption of ATCA CPU blades is expected to increase for applications like real-time data processing, network infrastructure, and cloud services.

In the United States, the ATCA CPU blades market is poised for significant expansion due to the country's advanced telecommunications infrastructure and the growing demand for 5G network implementation. The U.S. government’s ongoing investments in defense and national security systems, along with the increasing requirement for high-speed internet connectivity, is driving the adoption of ATCA CPU blades. For instance, as per industry reports, the 2024 National Defense Authorization Act (NDAA) mandated the U.S. government to establish private 5G networks at military bases. It allocated USD 179 Million for research, significantly impacting the development of secure, advanced communication technologies for defense operations. Additionally, the presence of key market players in the U.S. contributes to innovations and system advancements, further strengthening the market outlook.

ATCA CPU Blades Market Trends:

Growth of 5G Infrastructure

The advent of 5G technology is changing the face of the telecommunications industry with a growing requirement for high performance and low-latency solutions. According to the Wireless Infrastructure Association (WIA), as of the end of 2022, there were approximately 142,100 cellular towers in operation across the United States. As a result, the demand for high-performance solutions, such as ATCA CPU blades, is increasing. ATCA or Advanced Telecommunications Computing Architecture CPU blades have come to play an important role in this changeover as they possess the computing ability that is essential for processing 5G's complexity in the infrastructure. This is because they are used for processing large data, high-speed communication, and low latency networks. As telecom operators and service providers are rolling out 5G networks, the requirement for scalable and efficient platforms to support the high-bandwidth requirements increases, thereby making ATCA systems essential for next-generation base stations and core networks. Besides, ATCA blades are used with network function virtualization (NFV) and software-defined networking (SDN), which forms a subset of 5G operations. With increasing investment in 5G deployment globally, it is likely that demand for ATCA CPU blades will be strong-as they represent a crucial component in the future evolution of telecommunications infrastructure.

Shift Toward Cloud Computing and Edge Networks

As more and more industries implement cloud computing and edge networking to process huge amounts of data and make decisions within real-time, the necessity for scalable and high-performance computing solutions is mounting. According to the U.S. National Institute of Standards and Technology (NIST), by 2025, edge computing is expected to support around 75% of enterprise data. The needs of managing cloud-based applications and processing data at the edge can be met through ATCA CPU blades-a flexible approach, modular in configuration, which also saves a lot on costs. Cloud providers demand high-throughput processing power to keep up with tasks like machine learning, data storage, and customer interaction. In contrast, edge networks require low-latency solutions to process data closer to the source to ensure responsiveness. For such critical functions, demand is high for reliability and performance from ATCA CPU blades. Furthermore, they are optimized for the virtualization and distributed computing frameworks required by cloud infrastructures, enabling seamless integration into large data centers and edge computing environments. As the edge computing market continues to grow, ATCA blades will remain at the forefront of providing computational power for real-time, data-intensive applications.

Advancements in High-Performance Processing

The U.S. Department of Defense (DoD) is making substantial investments in high-performance computing to support AI-driven applications and simulation tasks. In fiscal year 2025, the DoD requested approximately USD 1.8 billion for artificial intelligence (AI) initiatives, which aligns with the funding levels from the previous fiscal year. This allocation reflects the growing importance of AI in military operations, particularly for enhancing data analysis, autonomous systems, and real-time decision-making capabilities. The DoD's overall science and technology funding request for fiscal 2025 is USD 17.2 billion, with significant portions dedicated to AI, autonomy, space, and integrated sensing and cyber capabilities. As AI applications in defense continue to evolve, high-performance computing systems, including ATCA CPU blades, are integral in providing the processing power needed to handle these advanced technologies. The constant developments of high-performance processing technologies are the driving force behind surging demand in the ATCA CPU blades market. Semiconductor manufacturing has especially improved with multi-core processors, advanced chipsets, and high-speed interconnects, making ATCA blades more efficient in handling complex computational tasks. These advancements have made ATCA blades perfect for mission-critical applications in various industries such as defense, aerospace, and finance. For example, in sectors such as finance, there has been an upsurge of the use of artificial intelligence and big data analytics and high frequency trading that need faster, reliable data processing. ATCA CPU blades are also getting better on energy efficiency, thus allowing organizations to meet their sustainability targets without compromising on high processing power. As these changes continue unfolding, ATCA CPU blades would remain one of the enablers for the industries involved in seeking the highest kind of computing performance and reliability.

ATCA CPU Blades Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global ATCA CPU blades market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type and application.

Analysis by Type:

- Integrated Platforms

- Packet Processing

- Compute Modules

- Switch and Controls

- Chassis and Hub Systems

Packet processing leads the market in 2024, due to the increasing need for high-speed data transmission and efficient network management. ATCA CPU blades are pivotal in managing and processing large volumes of data packets in telecommunications, cloud computing, and defense sectors. These blades are designed to handle complex packet forwarding, routing, and switching tasks with high performance and low latency, essential for supporting 5G networks and other next-generation technologies. The growing demand for faster, more efficient data processing is pushing the adoption of ATCA CPU blades in packet processing applications, making them integral to modern communication infrastructures.

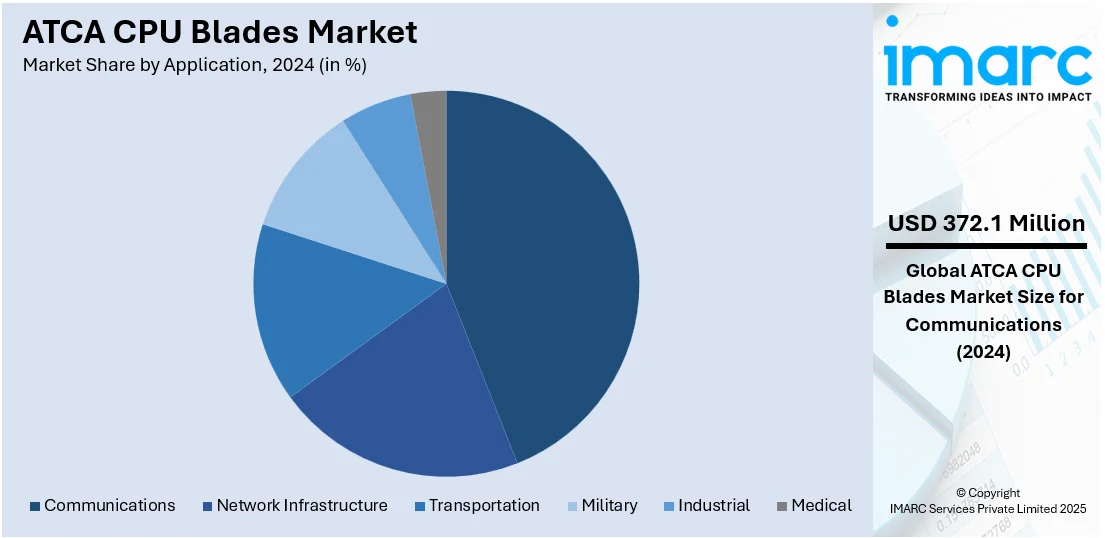

Analysis by Application:

- Communications

- Network Infrastructure

- Transportation

- Military

- Industrial

- Medical

Communications leads the market with around 43.6% of market share in 2024. This segment is driven by the growing demand for high-performance, reliable, and scalable solutions in telecommunications. ATCA CPU blades enable efficient processing of data traffic, enhancing communication infrastructure in 5G networks, data centers, and cloud computing environments. Their ability to support high-bandwidth, low-latency applications makes them crucial for next-generation communication technologies. These solutions are increasingly used in base stations, routers, and network processing units, allowing telecom operators to meet the rising demands for faster, more efficient data transmission. As the global reliance on seamless connectivity intensifies, ATCA CPU blades continue to play a critical role in enabling advanced communication systems.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 34.7%. This strong presence is supported by rapid advancements in telecommunications, defense, and data center industries. The growing demand for high-performance computing systems is significantly contributing to market growth. Additionally, the region's ongoing investments in 5G network infrastructure and the expansion of smart cities are increasing the need for advanced processing capabilities. For instance, industry reports state that in 2024, China, South Korea, and Japan contribute over 60% of global 5G connections, with China exceeding 1.2 billion users. It further projects that by 2025, Asia-Pacific will surpass 1.4 billion 5G connections, making it the world's fastest-growing 5G region. Furthermore, the presence of key manufacturers and a rising focus on digital transformation further enhance Asia Pacific’s dominance in the ATCA CPU blades market, positioning it for continued growth.

Key Regional Takeaways:

United States ATCA CPU Blades Market Analysis

In 2024, United States accounted for 77.90% of the market share in North America. There is growth in the U.S. ATCA CPU blades market because there is also an increase in demand within the data center and defense-related applications. The United States Government Accountability Office stated that the Technology Modernization Fund has allotted more than USD 1.23 billion for federal agencies to replace its outdated IT systems. The initiative, which has supported 37 modernizing federal IT projects, will drive demand for sophisticated computing infrastructure such as ATCA CPU blades. The commercial sector is also a major consumer, with data center expansions in areas like Silicon Valley. New technological trends, including artificial intelligence and machine learning, are further driving demand. Key players like Intel and AMD lead the market, ensuring competition through innovation. The U.S. market is well-positioned for consistent growth, as demand continues from both defense contractors and commercial enterprises focused on data processing capabilities. The government's pressure for cybersecurity improves the adoption of advanced computing infrastructure, thus expanding the market further.

North America ATCA CPU Blades Market Analysis

The North America ATCA CPU blades market is driven by increasing demand for high-performance computing solutions in telecommunications, defense, and data centers. The region benefits from advanced infrastructure, government investments in national security, and rapid adoption of 5G technology. For instance, as per industry reports, in 2024, North America achieved 264 million 5G connections by the end of the third quarter, with 22 million new connections added during the quarter. The market is further bolstered by technological advancements in processing power, energy efficiency, and the growing need for scalable, flexible solutions. Key players in North America are enhancing product portfolios through strategic partnerships and innovations, ensuring a competitive edge. Additionally, the presence of major telecom and defense companies fuels the expansion of ATCA CPU blades in the region.

Europe ATCA CPU Blades Market Analysis

The European ATCA CPU blades market is experiencing growth as the rising defense budgets increase the demand for efficient IT infrastructure. The European Defense Agency recently stated that Europe's defense expenditure has increased to EUR 279 billion (USD 304.9 billion) in 2023. Defense spending across the region continues to be highly focused on enhancing military technologies. There is an increase in the commercial demand for high-performance computing solutions as leading industries in the region implement Industry 4.0 initiatives. Germany, France, and the UK are the forerunners in defense-related IT up gradation, that includes the purchase of ATCA CPU blades for use in military systems. Underpinned by advances from the likes of Ericsson and Airbus, the pace of digital transformation from the EU is further accelerating the implementation of these solutions. Moreover, the carbon-neutral push for data centers opens up more opportunities for energy-efficient ATCA CPU blades.

Asia Pacific ATCA CPU Blades Market Analysis

The Asia Pacific ATCA CPU blades market is developing dramatically and is primarily driven by technological improvements and increasing defense spending in both military and commercial sectors. According to the Stockholm International Peace Research Institute, in 2023, China's military expenditure was estimated to be about USD 296 billion, thus forming 1.7% of the overall GDP the country has. According to 2024 study report, China's aggregate military spending will amount to USD 471 billion in 2024. Increased focus on military modernization pushes further the demand for advanced computing infrastructures such as ATCA CPU blades. In India, it has allocated its defense budget for 2023-2024 to be at USD 75 billion while stressing technology-based solutions for applications in defense. There are rapid digital transformations happening in countries such as Japan, South Korea, and Australia. This adds to the growing demand for high-performance computing systems. The rising demand for artificial intelligence and efforts toward 5G infrastructure accelerate the market potential. Local firms such as Huawei, in association with global entities, are contributing to technology exchanges that advance innovation in products.

Latin America ATCA CPU Blades Market Analysis

ATCA CPU blades have witnessed growth within the Latin America region due to an increase in both defense expenditures and commercial digitization. Industry report shows the total defense spendings of 2023 as USD 22.9 billion by Brazil and mostly focused towards military IT structure upgradation such as high computing power acquisition, where the digital commercial sector that grows within Latin America, specially within finance and telecommunications, continues to fuel demands for ATCA CPU blades. Mexico and Argentina countries lead the way by investing heavily in digital infrastructure. Furthermore, regional local manufacturers, such as Brazil's Embraer, increasingly partner with various global suppliers to better their technological capabilities. Governmental initiatives aiming at innovation and development are also of significant importance for the region's market's trajectory.

Middle East and Africa ATCA CPU Blades Market Analysis

The Middle East and Africa ATCA CPU blades market is driven by both modernization in the defense sector and the growing demand for digital infrastructure. According to an industry report, Saudi Arabia's defense budget for 2023 was estimated to be around USD 66.1–USD 75.8 billion, with a focus on improving military capabilities with cutting-edge computing technology, including ATCA CPU blades. Strong demand for high-performance computing solutions by the commercial sectors of UAE and South Africa drives investments in the data centers sector. Demand from the IT sector, specifically as governments focus increasingly on cybersecurity and smart cities initiatives, has augmented demand for state-of-the-art IT infrastructure in the region. Key market participants are the locals like EOH from South Africa and du of UAE who along with the international companies push innovations to fill out the needs rising.

Competitive Landscape:

The ATCA CPU blades market is highly competitive, with major players leading innovation and the supply of high-performance computing solutions. These companies focus on delivering cutting-edge technologies, such as modular and scalable systems, to meet the growing demand in telecommunications, defense, and data centers. Competition is driven by advancements in processing power, energy efficiency, and support for 5G networks. Additionally, market players are expanding their product portfolios through strategic partnerships and acquisitions, enhancing their market presence and providing tailored solutions for various industry applications. For instance, in February 2024, Nokia partnered with NVIDIA to enhance AI-ready radio access network (RAN) solutions. The collaboration integrates NVIDIA Grace CPUs and GPUs with Nokia’s In-Line Layer 1 accelerator technology, advancing Cloud RAN capabilities and supporting faster, more flexible 5G network deployments. Furthermore, this dynamic intensifies competition and drives further industry advancements.

The report provides a comprehensive analysis of the competitive landscape in the ATCA CPU blades market with detailed profiles of all major companies, including:

- ADLINK Technology Inc.

- Advantech Co. Ltd.

- Kontron AG

Latest News and Developments:

- December 2024: Kontron secured a EUR 165 million (USD 169.20 Million) defense order from a European firm for VPX computing units used in mobile and stationary surveillance. The high-performance, military-grade system ensures reliability under extreme conditions. Kontron, a NATO-exclusive partner, reinforces its defense technology leadership.

ATCA CPU Blades Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Integrated Platforms, Packet Processing, Compute Modules, Switch and Controls, Chassis and Hub Systems |

| Applications Covered | Communications, Network Infrastructure, Transportation, Military, Industrial, Medical |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ADLINK Technology Inc., Advantech Co. Ltd., and Kontron AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the ATCA CPU blades market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global ATCA CPU blades market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the ATCA CPU blades industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ATCA CPU blades market was valued at USD 853.47 Million in 2024.

IMARC estimates the global ATCA CPU blades market to reach USD 1,735.63 Million in 2033, exhibiting a CAGR of 7.80% during 2025-2033.

The market is driven by increasing demand for high-performance computing in telecommunications, defense, and data center sectors. Key factors include the growing adoption of 5G networks, advancements in processing power and energy efficiency, and the need for scalable, modular systems to support complex, data-intensive applications.

Asia Pacific currently dominates the market, holding a market share of over 34.7% in 2024. This competitive edge is due to rapid 5G adoption, robust telecommunications infrastructure, and significant defense sector investments. The region’s technological advancements and increasing demand for high-performance computing solutions drive continued market growth.

Some of the major players in the ATCA CPU blades market include ADLINK Technology Inc., Advantech Co. Ltd., Kontron AG, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)