Astrocytoma Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035

Market Overview:

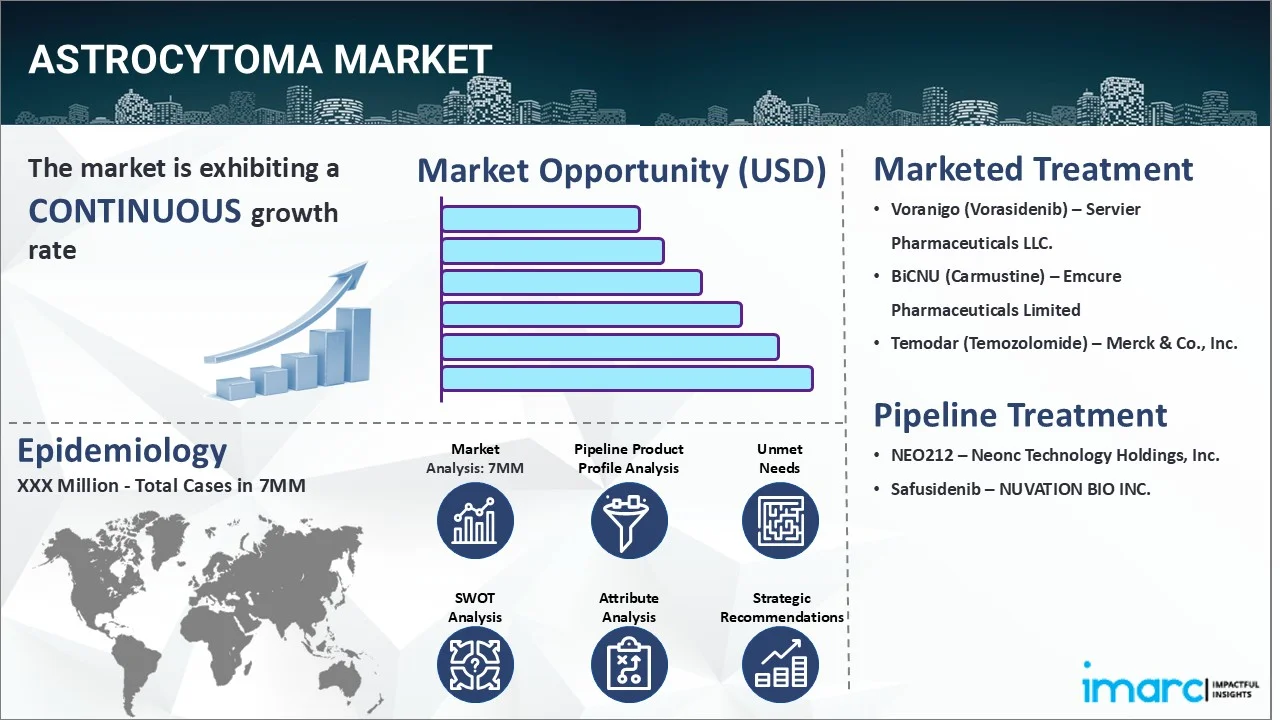

The top 7 (US, EU4, UK, and Japan) astrocytoma markets are expected to exhibit a CAGR of 4.26% during 2025-2035.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2035

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate 2025-2035 | 4.26% |

The astrocytoma market has been comprehensively analyzed in IMARC's new report titled "Astrocytoma Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035". Astrocytoma refers to a type of brain tumor that originates from astrocytes, which are a form of glial cell present in the central nervous system. Glial cells provide support and nourishment to neurons and play various roles in maintaining the normal functioning of the brain. Some of the common symptoms associated with the ailment include persistent headaches, seizures, changes in cognitive function, personality or behavior alterations, weakness or numbness in limbs, difficulty with balance and coordination, vision or hearing problems, speech difficulties, etc. The diagnosis of astrocytoma involves a comprehensive evaluation by medical professionals. It typically includes a combination of imaging studies, such as magnetic resonance imaging (MRI) and computed tomography (CT) scans, which help in visualizing the brain and identifying the presence of a tumor. In some cases, a biopsy is necessary to obtain a sample of the tumor tissue for microscopic examination to determine the tumor type and grade. Various other diagnostic tests, including neurological studies and cognitive assessments, may also be conducted to evaluate the patient's overall brain function and identify any specific deficits or abnormalities associated with the tumor.

To get more information on this market, Request Sample

The escalating incidence of genetic mutations that lead to alterations in cellular metabolism and contribute to tumor development and progression is primarily driving the astrocytoma market. In addition to this, the rising cases of exposure to high levels of ionizing radiation, such as radiation therapy for other medical conditions or occupational exposure in certain industries, which cause damage at the cellular level, are also creating a positive outlook for the market. Moreover, the widespread adoption of proton therapy that delivers higher doses of radiation to the tumor while minimizing damage to the surrounding healthy tissues is further bolstering the market growth. Apart from this, the inflating application of targeted therapy to selectively inhibit specific molecules or signaling pathways involved in tumor growth and progression is also acting as another significant growth-inducing factor. Additionally, the ongoing advancements in surgical techniques, such as the introduction of awake craniotomy, intraoperative MRI, fluorescence-guided surgery, neuronavigation systems, etc., which aid surgeons in achieving maximal tumor removal and preserving neurological function, are expected to drive the astrocytoma market during the forecast period.

IMARC Group's new report provides an exhaustive analysis of the astrocytoma market in the United States, EU4 (Germany, Spain, Italy, and France), United Kingdom, and Japan. This includes treatment practices, in-market, and pipeline drugs, share of individual therapies, market performance across the seven major markets, market performance of key companies and their drugs, etc. The report also provides the current and future patient pool across the seven major markets. According to the report, the United States has the largest patient pool for astrocytoma and also represents the largest market for its treatment. Furthermore, the current treatment practice/algorithm, market drivers, challenges, opportunities, reimbursement scenario, unmet medical needs, etc., have also been provided in the report. This report is a must-read for manufacturers, investors, business strategists, researchers, consultants, and all those who have any kind of stake or are planning to foray into the astrocytoma market in any manner.

Time Period of the Study

- Base Year: 2024

- Historical Period: 2019-2024

- Market Forecast: 2025-2035

Countries Covered

- United States

- Germany

- France

- United Kingdom

- Italy

- Spain

- Japan

Analysis Covered Across Each Country

- Historical, current, and future epidemiology scenario

- Historical, current, and future performance of the astrocytoma market

- Historical, current, and future performance of various therapeutic categories in the market

- Sales of various drugs across the astrocytoma market

- Reimbursement scenario in the market

- In-market and pipeline drugs

Competitive Landscape:

This report also provides a detailed analysis of the current astrocytoma marketed drugs and late-stage pipeline drugs.

In-Market Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

Late-Stage Pipeline Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

| Drugs | Company Name |

|---|---|

| Voranigo (Vorasidenib) | Servier Pharmaceuticals LLC. |

| BiCNU (Carmustine) | Emcure Pharmaceuticals Limited |

| Temodar (Temozolomide) | Merck & Co., Inc. |

| NEO212 | Neonc Technology Holdings, Inc. |

| Safusidenib | NUVATION BIO INC. |

*Kindly note that the drugs in the above table only represent a partial list of marketed/pipeline drugs, and the complete list has been provided in the report.

Key Questions Answered in this Report:

Market Insights

- How has the astrocytoma market performed so far and how will it perform in the coming years?

- What are the markets shares of various therapeutic segments in 2024 and how are they expected to perform till 2035?

- What was the country-wise size of the astrocytoma across the seven major markets in 2024 and what will it look like in 2035?

- What is the growth rate of the astrocytoma across the seven major markets and what will be the expected growth over the next ten years?

- What are the key unmet needs in the market?

Epidemiology Insights

- What is the number of prevalent cases (2019-2035) of astrocytoma across the seven major markets?

- What is the number of prevalent cases (2019-2035) of astrocytoma by age across the seven major markets?

- What is the number of prevalent cases (2019-2035) of astrocytoma by gender across the seven major markets?

- What is the number of prevalent cases (2019-2035) of astrocytoma by type across the seven major markets?

- How many patients are diagnosed (2019-2035) with astrocytoma across the seven major markets?

- What is the size of the astrocytoma’ patient pool (2019-2024) across the seven major markets?

- What would be the forecasted patient pool (2025-2035) across the seven major markets?

- What are the key factors driving the epidemiological trend of astrocytoma?

- What will be the growth rate of patients across the seven major markets?

Astrocytoma: Current Treatment Scenario, Marketed Drugs and Emerging Therapies

- What are the current marketed drugs and what are their market performance?

- What are the key pipeline drugs and how are they expected to perform in the coming years?

- How safe are the current marketed drugs and what are their efficacies?

- How safe are the late-stage pipeline drugs and what are their efficacies?

- What are the current treatment guidelines for astrocytoma drugs across the seven major markets?

- Who are the key companies in the market and what are their market shares?

- What are the key mergers and acquisitions, licensing activities, collaborations, etc. related to the astrocytoma market?

- What are the key regulatory events related to the astrocytoma market?

- What is the structure of clinical trial landscape by status related to the astrocytoma market?

- What is the structure of clinical trial landscape by phase related to the astrocytoma market?

- What is the structure of clinical trial landscape by route of administration related to the astrocytoma market?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Request Customization

Request Customization

.webp)

.webp)