Asthma Therapeutics Market Size, Share, Trends and Forecast by Drug Class, Product Type, Treatment Type, Route of Administration, and Region, 2025-2033

Asthma Therapeutics Market Size And Trends:

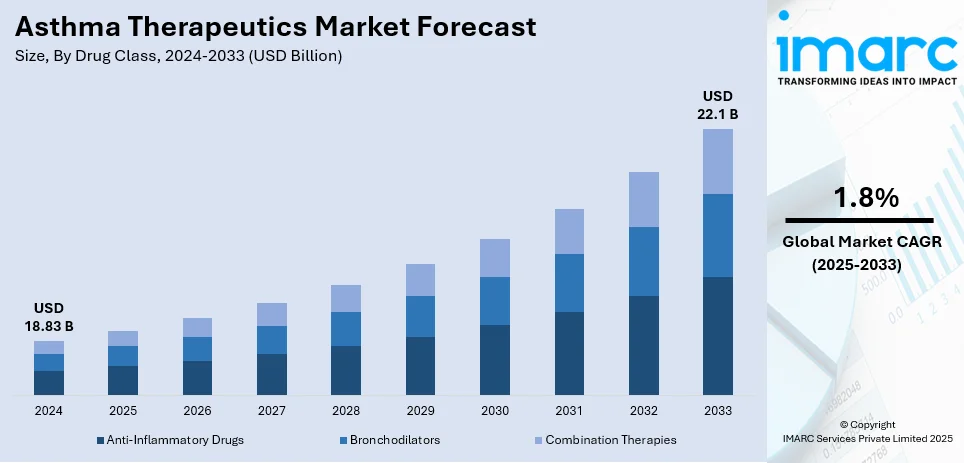

The global asthma therapeutics market size was valued at USD 18.83 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 22.1 Billion by 2033, exhibiting a CAGR of 1.8% from 2025-2033. North America currently dominates the market, holding a market share of over 50.0% in 2024. The growth of the North American market is driven by advanced healthcare infrastructure, high asthma prevalence, innovative treatment options, and strong investment in research and development. The region holds a significant asthma therapeutics market share because of the extensive use of advanced biologics and combination therapies, coupled with supportive regulatory frameworks that favor new product approvals.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 18.83 Billion |

|

Market Forecast in 2033

|

USD 22.1 Billion |

| Market Growth Rate (2025-2033) | 1.8% |

The increasing incidence of asthma globally, linked to environmental influences like air pollution, allergens, and climate shifts, along with genetic factors, is creating a demand for more sophisticated treatments. Additionally, the emergence of new treatments, such as biologics and combination medications, is transforming asthma care. These therapies target inflammation and bronchoconstriction, providing enhanced effectiveness and customized options for moderate to severe instances, particularly for individuals who do not respond to standard treatments. Furthermore, the increasing utilization of sophisticated biologics and combination treatments, especially for severe asthma situations, is offering a favorable asthma therapeutics market outlook. These therapies, including monoclonal antibodies, provide precise options that greatly enhance patient results. In addition, government bodies and non-governmental organizations (NGOs) are vigorously running awareness initiatives regarding the significance of early detection and effective management of asthma, motivating patients to pursue prompt treatment and follow prescribed therapies.

The United States is a crucial segment in the market, driven by the success of clinical trials demonstrating the efficacy of novel treatments. Positive trial results often lead to the approval of groundbreaking therapies that address unmet medical needs, particularly in reducing severe exacerbations and improving long-term management. These innovations set new standards in treatment efficacy. In 2024, AstraZeneca reported favorable outcomes from the BATURA Phase III trial, indicating that its rescue inhaler AIRSUPRA® (albuterol/budesonide) considerably lowered the likelihood of severe asthma attacks in individuals with intermittent or mild persistent asthma. The trial was halted prematurely because of remarkable effectiveness. AIRSUPRA is the inaugural anti-inflammatory rescue treatment authorized in the US for managing asthma.

Asthma Therapeutics Market Trends:

Increasing Prevalence of Asthma

The rising incidence of asthma globally, particularly in developed and urbanized regions, is a significant factor driving the asthma therapeutics market demand. The World Health Organization (WHO) states that in 2019, 262 million individuals suffered from asthma, leading to 455,000 fatalities. Environmental factors such as air pollution, allergens, and climate changes, coupled with modern lifestyle habits, have intensified the prevalence of asthma, especially in high-income nations and rapidly urbanizing regions. Increased disease burden creates a need for a variety of treatments ranging from conventional inhalers to advanced biologics and targeted therapies treating both mild and severe asthma patients. Moreover, the emphasis on personalized medicine, treatment approaches aimed at specific individuals, has acted as a major driver of innovations in drug discovery. With continuous endeavors to reduce hospitalization and improve the quality of life for asthma patients, the market is only expected to grow further, supported by continued investments in research and improved healthcare access worldwide.

Advancements in Treatment Options

Development of innovative asthma therapeutics, particularly biologics and targeted therapies, is advancing treatment options significantly and improving patient outcomes. The solutions are reducing airway inflammation while enhancing lung function, making the management of asthma in patients with different levels of severity more effective. Additionally, the increase in awareness about the benefits of biologics by health care providers and patients through increased efficacy and decreased exacerbation rates has resulted in its increased adoption. The high prevalence of asthma highlights the necessity for these therapies. For instance, as per the 2021 report by the US Centers for Disease Control and Prevention, 7.5% of children between the ages of 5 and 11 experienced asthma. Ongoing research initiatives, coupled with regulatory authorizations for groundbreaking medications, are influencing a competitive environment, fostering progress, and addressing the unfulfilled requirements of asthma sufferers globally.

Increasing Awareness and Early Diagnosis

Rising awareness about the management of asthma and the early detection of asthma have driven the asthma therapeutics market. As the awareness has improved with the accessibility of information and advanced diagnostic equipment, the patient has been seeking timely treatment and therefore a high demand for proper treatments. Healthcare organizations and the government develop educational programs that increase education on asthma control measures, making it even more a periodic check and following up with given therapies. The advancement in technology through digital health platforms and smart inhalers is enabling patients to be proactive in disease management. With the launch of new products, unmet medical needs continue to get addressed in the market. For example, in September 2023, the European Union approved AstraZeneca's Tezspire (tezepelumab) for the treatment of severe asthma in patients aged 12 and older who are inadequately controlled with high-dose inhaled corticosteroids. These developments underline the role of innovation and awareness in supporting the asthma therapeutics market growth.

Asthma Therapeutics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global asthma therapeutics market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on drug class, product type, treatment type, and route of administration.

Analysis by Drug Class:

- Anti-Inflammatory Drugs

- Bronchodilators

- Combination Therapies

Combination therapies lead the market because of their effectiveness in tackling various aspects of asthma management in one treatment. These treatments often merge inhaled corticosteroids (ICS) with long-acting beta-agonists (LABAs), providing anti-inflammatory advantages and prolonged bronchodilation. Their dual-action mechanism offers both instant relief from airway constriction and diminishes chronic inflammation, rendering them very effective for moderate to severe asthma instances. The ease of having one therapy improves patient adherence and streamlines treatment plans, especially for individuals with ongoing symptoms. Improvements in formulation technology have facilitated the creation of more focused and long-lasting combination treatments, enhancing clinical results and reducing side effects. Pharmaceutical companies are focusing on launching new products, like triple-combination therapies, to enhance treatment choices. Regulatory approvals and favorable clinical data have strengthened healthcare providers' confidence in these therapies, reinforcing their position as the favored option for thorough asthma management.

Analysis by Product Type:

- Inhalers

- Dry Powder Inhalers

- Metered Dose Inhalers

- Soft Mist Inhalers

- Nebulizers

- Pneumatic Nebulizers

- Ultrasonic Nebulizers

- Mesh Nebulizers

Inhalers (dry powder inhalers, metered-dose inhalers, and soft mist inhalers), hold the biggest asthma therapeutics market share because of their extensive application and efficacy in directly administering medications to the lungs. Metered-dose inhalers are favored for their small size and accurate medication delivery, whereas dry powder inhalers provide user-friendliness without requiring propellants. Soft mist inhalers, featuring a fine mist and reliable dosing, serve patients who need a more gentle delivery method. The use of inhalers is motivated by their capacity for quick relief and sustained control, rendering them essential in the management of asthma. Innovations in technology, including smart inhalers equipped with digital tracking features, have improved treatment adherence and patient results. Furthermore, continuous advancements in formulation and device design are enhancing usability and effectiveness, making inhalers the preferred option for healthcare professionals and patients in asthma management.

Analysis by Treatment Type:

- Quick-Relief Medications

- Long-Term Asthma Control Medications

Long-term asthma control medications dominate the market due to their efficacy in controlling chronic asthma and decreasing both the occurrence and intensity of flare-ups. These drugs, such as inhaled corticosteroids, long-acting beta-agonists (LABAs), leukotriene modifiers, and biologics, aim to tackle the root inflammation and ensure stable lung performance over time. Their capacity to deliver reliable symptom control and enhance patients' quality of life establishes them as the foundation of asthma management approaches. Heightened awareness regarding the significance of consistent and preventive care has led to their common utilization. Improvements in biological treatments aimed at severe asthma cases, like monoclonal antibodies, have enhanced the segment's attractiveness by providing personalized and targeted solutions for patients not responding to conventional therapies. Pharmaceutical firms are actively funding research and development to launch novel combination medications and delivery systems, improving both effectiveness and patient compliance. Regulatory endorsements and broadened uses for biologics reinforce the sector's dominance in asthma treatments.

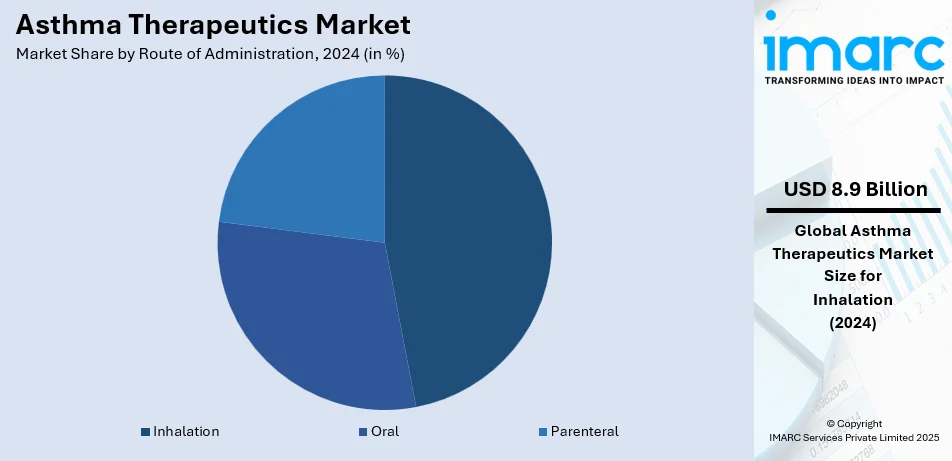

Analysis by Route of Administration:

- Inhalation

- Oral

- Parenteral

Inhalers represent the largest segment, accounting 47.0% of the market share in 2024. Inhalation is the largest segment because it effectively administers medications straight to the lungs, providing quick symptom relief and improved treatment results. Inhaled treatments, such as corticosteroids, bronchodilators, and combination medications, are commonly favored for their targeted effects, which reduce systemic side effects relative to alternative methods of administration. The presence of different inhalation devices, including metered-dose inhalers, dry powder inhalers, and nebulizers, has enhanced patient compliance by providing choices suited to personal requirements. Advancements in technology, like smart inhalers equipped with digital tracking features, have increased the adoption of inhalation therapies by facilitating better asthma control through real-time monitoring of how medications are used. Regulatory approvals for novel formulations and the introduction of biosimilars in the inhalation sector have strengthened its dominance. Continual efforts by pharmaceutical companies to enhance the efficacy and convenience of inhaled medications strengthen their position as the primary choice for asthma treatment.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America held the largest market share, totaling 50.0%. North America dominates the market due to its strong healthcare infrastructure, significant research efforts, and widespread use of advanced medical technologies. The area gains from a significant presence of major pharmaceutical firms and solid regulatory structures that ease the approval and marketing of groundbreaking asthma therapies. Supportive healthcare policies and substantial government investment in respiratory disease research also enhance market expansion. Furthermore, the increasing incidence of asthma, influenced by environmental and genetic factors, has heightened the need for efficient treatment options. Furthermore, partnerships between academic institutions and industry stakeholders are driving the creation of innovative biologics and personalized medicine strategies, reinforcing North America's dominance in the asthma therapeutics sector. In 2024, Jasper Therapeutics announced that they have administered the first dose to a patient in the Phase 1b/2a ETESIAN clinical trial for briquilimab, a monoclonal antibody targeting c-Kit, designed for allergic asthma. The research will enroll 30 individuals from seven locations in Canada to evaluate the drug's efficacy, emphasizing mast cell reduction and respiratory response. The initial results are expected by the end of 2025.

Key Regional Takeaways:

United States Asthma Therapeutics Market Analysis

In North America, the United States represented 90.00% of the overall market share. In fact, the US asthma therapeutics market is growing with increased prevalence among people across different demographic categories. As highlighted by the CDC in 2020, almost 25 million people were estimated to be living with asthma in the U.S., further confirming the large number of affected populations. Also, adult women suffer disproportionately from asthma more than men do, indicating a need for individualized treatments for this demographic segment. More to this, children form a susceptible group, as per the Asthma and Allergy Foundation of America, where there are 5 million children asthmatic in the United States.

The high prevalence of asthma in adults and children is driving the demand for effective management strategies, including advanced inhalers, biologics, and combination therapies. Increased awareness about the importance of asthma control and early diagnosis has also encouraged more patients to seek medical intervention. These factors, coupled with ongoing innovation in asthma therapeutics, contribute to the expanding market in the United States, addressing the diverse needs of asthmatic patients across age groups.

Europe Asthma Therapeutics Market Analysis

The rising prevalence of asthma is fueling the asthma therapeutics market in Europe. Over 30 million adults and children are suffering from asthma in Europe, as has been reported by the European Lung Foundation, which clearly underlines the burden this chronic respiratory condition imposes. Women suffer more from asthma than men. This means there is a need for specific therapies that address the needs of this gender. Children, on the other hand, still form a susceptible population. The chronic illness, asthma, stands out as the most common condition among children in the region.

With the importance of early diagnosis and effective management surfacing awareness on advanced treatments such as biologics, combination therapies, and new inhalers, the overall need for this increase is coming out. Controlling asthma as proposed by national healthcare initiatives in Europe coupled with guidelines reinforces controlling asthma. Overall, along with the evolution in therapeutic options that are developing at a continued rate, asthma therapeutics demand will continue growing for all different groups of ages that suffer from it.

Asia Pacific Asthma Therapeutics Market Analysis

The Asia Pacific asthma therapeutics market is expanding fast, due to the increased incidence of asthma within the region. In China, asthma rates increased from 0.69% in 1984 to 5.30% in 2021, and it is estimated that they will rise up to 9.76% by 2050, according to BMC Public Health. The sharp increase indicates a great demand for the management of asthma in one of the region's largest populations. India also has a significant asthma burden. According to the NIH, 34.3 million cases of asthma have been reported in India, accounting for 13.09% of the global disease burden.

With prevalence continuously on the rise, asthma is a strongly developing market, in terms of need for advance therapy, in form of biologics and combination therapies. It is supplemented with next generation inhalers also. Greater emphasis towards early stage diagnosis and subsequent treatment has ensured their adoption, not to speak of government sponsored health care provisions and an up rising middle class looking forward to enhance access to care. All such factors together placed Asia Pacific region at the highest.

Latin America Asthma Therapeutics Market Analysis

The Latin America asthma therapeutics market is currently witnessing healthy growth due to a high and continuously rising prevalence of asthma in the region. Data published by industry reports in 2023 indicates that the overall prevalence of asthma in Latin America is about 17%, and the rates go up to as high as 30% in countries like Costa Rica. Thus, this area reflects a major unmet need for asthma management solutions appropriately addressed to the heterogeneous populations of the region.

With increased awareness of asthma as a chronic condition and its impact on quality of life, the demand for advanced therapeutics, such as inhalers, biologics, and combination therapies, has been increasing. Improved healthcare infrastructure and access to medical facilities in many Latin American countries further support the adoption of these therapies. The importance of early diagnosis and preventive care by governments and healthcare providers are significant factors that can mitigate asthma. Together, these aspects make the asthma therapeutic market in Latin America continue to grow.

Middle East and Africa Asthma Therapeutics Market Analysis

The asthma therapeutics market in the Middle East and Africa (MEA) is experiencing significant growth because of the high incidence of asthma and severe asthma in many nations throughout the region. According to industry reports, severe asthma rates are significantly high in African nations, with Kenya and Uganda showing 27% and Ethiopia at 19.9%. These statistics have created a significant burden of asthma-related health issues in the area, raising the need for efficient asthma management strategies.

Greater awareness of asthma as a chronic disease, coupled with better access to healthcare facilities, is driving adoption of advanced therapeutic options, such as inhalers, biologics, and targeted therapies. In addition, the increased interest in early diagnosis and personalized treatment plans, especially in urbanized regions, has helped manage asthma better. Such factors, coupled with the upgrading of healthcare infrastructure and government policies, are supporting the growth of the asthma therapeutics market in the Middle East and Africa.

Competitive Landscape:

Major market participants are concentrating on innovation, strategic alliances, and geographic growth to strengthen their market presence. They are making significant investments in research and development to launch advanced biologics and combination therapies that enhance efficacy and patient adherence. Businesses are also utilizing digital health technologies, like smart inhalers and mobile apps, to better monitor and manage asthma symptoms. Regulatory authorizations for new formulations and biosimilars are being sought to enhance product portfolios. Collaborative alliances with academic institutions and biotech firms are aiding in the discovery of new therapeutic approaches. In 2024, Teva Pharmaceuticals announced a clinical collaboration with Abingworth, securing as much as $150M in funding to advance TEV-248, a late-stage asthma rescue inhaler that combines ICS/SABA for adult and pediatric patients. Launch Therapeutics will carry out clinical trials, while Teva will focus on production and marketing. This aligns with Teva’s "Pivot to Growth" strategy, emphasizing the pipeline's expansion.

The report provides a comprehensive analysis of the competitive landscape in the asthma therapeutics market with detailed profiles of all major companies, including:

- AstraZeneca PLC

- Abbott Laboratories

- Amgen Inc.

- Biogen Inc.

- Boehringer Ingelheim International GmbH

- F. Hoffmann-La Roche Ltd.

- GlaxoSmithKline Plc

- Merck Sharp & Dohme Corp.

- Novartis International AG

- Sunovion Pharmaceuticals Inc.

- Teva Pharmaceutical Industries Ltd.

Latest News and Developments:

- January 2024: GSK Plc agreed to the acquisition of clinical-stage biopharma Aiolos Bio, Inc. Focused on finding treatments for conditions related to inflammation and the lung, it contains AIO-001 that, upon acquiring this, adds another respiratory biologic to its collection and tackles an even greater majority of asthma sufferers.

- July 2023: Teva Pharmaceuticals announced a deal with Alvotech regarding the new biosimilars launch in the USA market. This will help Teva solidify its position in the biosimilars segment and facilitate access to treatments.

- March 2023: Teva Pharmaceuticals joins forces with the company Rimidi to deploy a respiratory patient monitoring program by Desert Oasis Healthcare in California. The program incorporates data from the Digihaler System offered by Teva to help enhance patient care and monitor patients better.

Asthma Therapeutics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drug Classes Covered | Anti-Inflammatory Drugs, Bronchodilators, Combination Therapies |

| Product Types Covered |

|

| Treatment Types Covered | Quick-Relief Medications, Long-Term Asthma Control Medications |

| Route of Administrations Covered | Inhalation, Oral, Parenteral |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AstraZeneca PLC, Abbott Laboratories, Amgen Inc., Biogen Inc., Boehringer Ingelheim International GmbH, F. Hoffmann-La Roche Ltd., GlaxoSmithKline Plc, Merck Sharp & Dohme Corp., Novartis International AG, Sunovion Pharmaceuticals Inc. and Teva Pharmaceutical Industries Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the asthma therapeutics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global asthma therapeutics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the asthma therapeutics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The asthma therapeutics market was valued at USD 18.83 Billion in 2024.

IMARC estimates the asthma therapeutics market to exhibit a CAGR of 1.8% during 2025-2033, reaching a value of USD 22.1 Billion by 2033.

The asthma therapeutics market is driven by rising asthma prevalence, advancements in biologics, and growing awareness of disease management. Increasing air pollution and lifestyle changes contribute to the disease burden, while innovative drug formulations, such as inhaled corticosteroids and biologics targeting severe asthma, support the market growth.

North America holds the largest share of the asthma therapeutics market, driven by advanced healthcare infrastructure, high prevalence of asthma, strong adoption of innovative treatments, and significant investments in research and development by key pharmaceutical companies.

Some of the major players in the asthma therapeutics market include AstraZeneca PLC, Abbott Laboratories, Amgen Inc., Biogen Inc., Boehringer Ingelheim International GmbH, F. Hoffmann-La Roche Ltd., GlaxoSmithKline Plc, Merck Sharp & Dohme Corp., Novartis International AG, Sunovion Pharmaceuticals Inc. and Teva Pharmaceutical Industries Ltd.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)