Aspirin Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition

Aspirin Price Trend, Index and Forecast

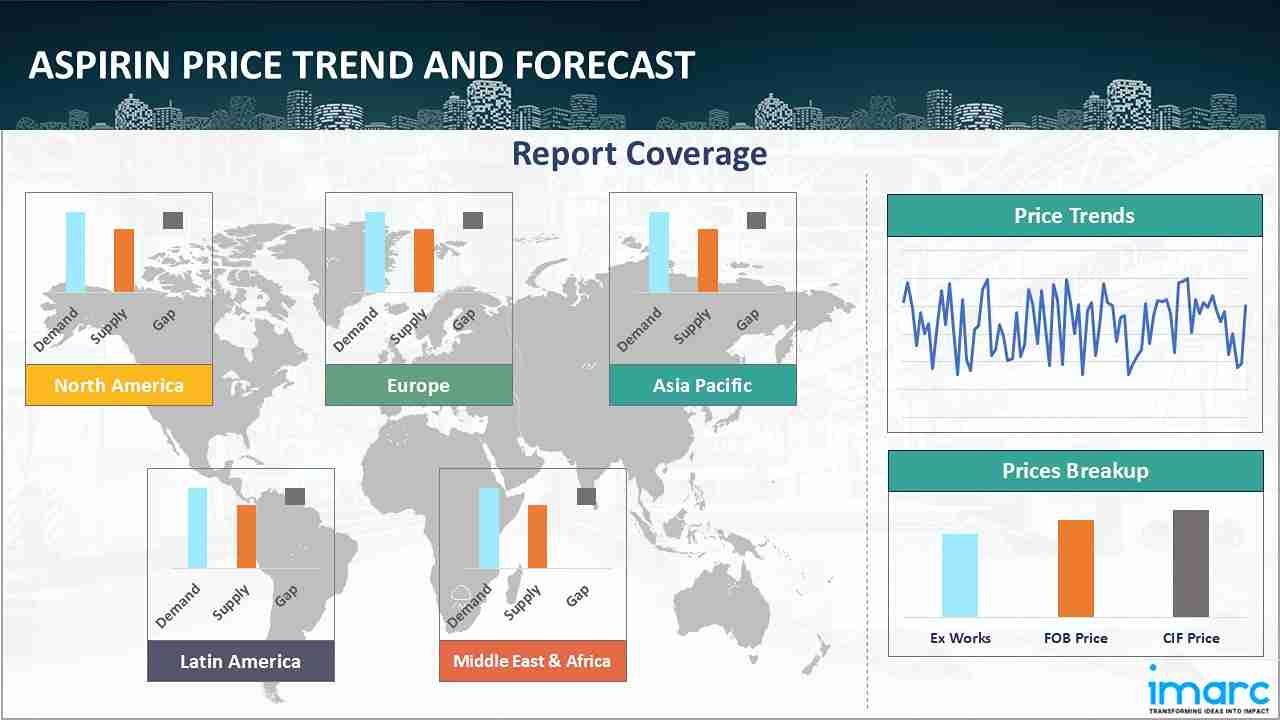

Track the latest insights on aspirin price trend and forecast with detailed analysis of regional fluctuations and market dynamics across North America, Latin America, Central Europe, Western Europe, Eastern Europe, Middle East, North Africa, West Africa, Central and Southern Africa, Central Asia, Southeast Asia, South Asia, East Asia, and Oceania.

Aspirin Prices Outlook Q3 2025

- USA: USD 2865/MT

- China: USD 2480/MT

- Germany: USD 2342/MT

- India: USD 2850/MT

- Italy: USD 2685/MT

Aspirin Price Chart

Get real-time access to monthly/quarterly/yearly prices Request Sample

During the third quarter of 2025, the aspirin prices in the USA reached 2865 USD/MT in September. Market sentiment weakened as demand from downstream pharmaceutical formulations moderated, reducing procurement activity among major drug manufacturers. Feedstock availability improved across domestic producers, softening production costs and easing supply constraints. Logistic operations remained steady, limiting upward pressure on distributor margins.

During the third quarter of 2025, the aspirin prices in China reached 2480 USD/MT in September. Prices trended downward as pharmaceutical manufacturing output grew, keeping supply levels comfortably above domestic consumption needs. Producers benefited from steady access to essential intermediates, enabling consistent manufacturing runs and reducing cost pressures. Export demand softened due to slower order flows from several Asian and European buyers, leading to greater availability in the domestic market.

During the third quarter of 2025, the aspirin prices in Germany reached 2342 USD/MT in September. The market experienced downward pressure as pharmaceutical manufacturers maintained stable operations, contributing to a steady supply within the region. Access to raw materials improved, resulting in reduced production costs that encouraged competitive pricing. Demand from local formulators remained moderate, as procurement strategies leaned toward planned, requirement-based purchasing rather than speculative stocking.

During the third quarter of 2025, the aspirin prices in India reached 2850 USD/MT in September. Market conditions softened due to a steady operating rates among domestic producers, which ensured sufficient volume for both domestic and export channels. Feedstock availability improved, reducing input cost burdens across manufacturing facilities. Downstream pharmaceutical demand remained stable but lacked strong upward momentum, encouraging buyers to limit procurement to near-term requirements.

During the third quarter of 2025, the aspirin prices in Italy reached 2685 USD/MT in September. Prices moved downward as domestic output remained consistent, ensuring balanced supply conditions throughout the quarter. Procurement activity from pharmaceutical manufacturers followed a conservative pattern due to restrained market growth, limiting upward pressure on suppliers. Improved sourcing of raw materials supported cost-efficient production, enabling producers to maintain steady operating margins despite reduced price realizations.

Aspirin Prices Outlook Q2 2025

- USA: USD 3023/MT

- China: USD 2563/MT

- Germany: USD 2463/MT

- India: USD 2965/MT

- Italy: USD 2737/MT

During the second quarter of 2025, the aspirin prices in the USA reached 3023 USD/MT in June. As per the aspirin price chart, prices in April saw a significant drop, driven by a large buildup of inventory in anticipation of a hefty tariff increase. This was prompted by pre-emptive purchasing ahead of the looming tariff on Chinese imports. With the tariff implementation delayed, the heavy stockpiling led to an oversupply situation in the market, which in turn suppressed immediate demand. Despite the high tariffs, market participants largely absorbed the initial shock without passing the full cost onto consumers. This was reflected in a softer product price forecast, as many buyers reduced their prices to move excess inventory.

During the second quarter of 2025, the aspirin prices in China reached 2563 USD/MT in June. Prices saw a notable drop caused by weak international demand, which coincided with a sharp contraction in China's manufacturing Purchasing Managers' Index, indicating a slowdown in industrial activity. In addition to this, port congestion in China caused significant disruptions to pharmaceutical logistics, exacerbating delays in supply chains and further weakening the market's ability to meet global demand. A key element in the price drop was the introduction of a steep US tariff on Chinese pharmaceuticals. This new tariff triggered mass cancellations and delays in orders as foreign buyers turned to alternative markets or drew on their existing inventories, sharply reducing their offtake from Chinese suppliers.

During the second quarter of 2025, aspirin prices in Germany reached 2463 USD/MT in June. In April, the aspirin spot price in Germany saw a decline, attributed mainly to a significant oversupply in the market. This was a result of diversions of US-bound cargo, which caused a surplus of stock in European ports. Additionally, pre-holiday stockpiling amplified the situation, as distributors and buyers sought to secure inventory ahead of seasonal breaks. This glut weakened the price forecast, causing a drop in prices as sellers were compelled to adjust their offers to move excess stock.

During the second quarter of 2025, the aspirin prices in India reached 2965 USD/MT in June. Despite the positive short-term price movements, Indian manufacturers remained cautious about overproduction. The uncertainty in global trade policies and volatile freight conditions kept them from committing to large-scale expansions. This caution helped prevent a significant drop in production costs or a dramatic fluctuation in prices in India.

During the second quarter of 2025, the aspirin prices in Italy reached 2737 USD/MT in June. Italy's aspirin market felt the ripple effects of the supply glut, as reduced shipping capacity in key European ports, including Hamburg and Rotterdam, delayed deliveries. The congestion in these critical hubs led to a temporary oversupply situation, while also increasing the landed costs for Italian importers who were working to secure timely shipments amidst the shipping delays. Despite this, the stable production costs for aspirin in Europe helped prevent any drastic price shifts in Italy, although the overall import prices remained elevated due to shipping complications.

Regional Coverage

The report provides a detailed analysis of the market across different regions, each with unique pricing dynamics influenced by localized market conditions, supply chain intricacies, and geopolitical factors. This includes price trends, price forecast and supply and demand trends for each region, along with spot prices by major ports. The report also provides coverage of FOB and CIF prices, as well as the key factors influencing aspirin prices.

Europe Aspirin Price Trend

Q3 2025:

The aspirin price index in Europe reflected easing sentiment as regional supply remained adequate across major production hubs. Pharmaceutical manufacturers followed cautious procurement strategies, adjusting their purchasing patterns to match moderate downstream formulation demand. Improved feedstock availability reduced production cost burdens, prompting suppliers to adopt more competitive pricing structures. Import inflows from Asia increased, adding additional downward influence on regional offers. Distribution networks performed reliably, limiting logistical volatility and supporting smooth product availability.

Q2 2025:

The aspirin spot price in Germany saw a decline in April 2025, driven by an oversupply situation that stemmed from multiple factors. US-bound cargo diversions and pre-holiday stockpiling efforts led to excess inventory in the market. Furthermore, subdued demand and delays in port operations at major hubs like Hamburg and Rotterdam prompted sellers to reduce prices in an attempt to generate more buying interest. May saw a slight recovery in the price index, as port congestion worsened in Northern Europe. The reduced vessel space due to increased traffic and logistical challenges restricted supply, particularly in Germany. Carriers also redirected vessels to the Trans-Pacific route following adjustments to US tariffs, which further reduced capacity for Asia-Europe routes.

This analysis can be extended to include detailed aspirin price information for a comprehensive list of countries.

| Region | Countries Covered |

|---|---|

| Europe | Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal, and Greece, among other European countries. |

North America Aspirin Price Trend

Q3 2025:

The Q3 aspirin price index in North America signaled a weakening market environment driven by steady domestic production and moderated demand. Downstream pharmaceutical manufacturers maintained consistent yet conservative procurement, avoiding speculative stocking amid subdued market sentiment. Raw material availability improved, easing manufacturing cost pressures and supporting flexible pricing. Import activity contributed to greater supply competition, prompting distributors to adjust offers in response to increased product availability.

Q2 2025:

As per the aspirin price index, in April, prices experienced a substantial decline. This decrease was largely attributed to a large-scale inventory buildup, which had been prompted by preemptive purchasing ahead of the impending tariff on Chinese imports. The anticipation of these tariffs led many suppliers to stockpile aspirin, anticipating higher future costs. This buildup resulted in an oversupply in the market, which suppressed immediate demand. Although the tariffs on Chinese imports were steep, many US buyers managed to absorb the initial impact of the price increase. However, in an effort to offload the excess inventory, buyers reduced their prices. This action helped clear some of the stock but simultaneously softened the product price forecast for the month. The combination of high inventory levels and reduced demand led to a significant correction in prices, which saw a notable drop by the end of April.

Specific aspirin historical data within the United States and Canada can also be provided.

| Region | Countries Covered |

|---|---|

| North America | United States and Canada |

Middle East and Africa Aspirin Price Trend

Q3 2025:

The report explores the aspirin trends and aspirin price chart in the Middle East and Africa, considering factors like regional industrial growth, the availability of natural resources, and geopolitical tensions that uniquely influence market prices.

Q2 2025:

As per the aspirin price chart, the prices in the Middle East and Africa fluctuated due to a complex interplay of factors, primarily driven by supply chain disruptions, seasonal demand shifts, and geopolitical influences.

In addition to region-wise data, information on aspirin prices for countries can also be provided.

| Region | Countries Covered |

|---|---|

| Middle East & Africa | Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco, among other Middle Eastern and African countries. |

Asia Pacific Aspirin Price Trend

Q3 2025:

Asia Pacific aspirin prices exhibited a downward trend as production in key manufacturing economies remained robust. Domestic demand from pharmaceutical formulators was steady but lacked significant expansion, contributing to balanced supply conditions. Export flows moderated, increasing regional product availability and encouraging competitive pricing among suppliers. Access to essential inputs improved, supporting efficient operations and reducing cost pressures for manufacturers. Distribution networks reported consistent throughput, preventing logistical disruptions.

Q2 2025:

In April 2025, prices experienced a notable decline largely attributed to a combination of weak international demand and economic challenges within China. Moreover, severe port congestion disrupted pharmaceutical logistics, hampering the movement of goods and contributing to the price drop. At the same time, production costs for aspirin remained high due to earlier manufacturing spikes that had not been recouped due to poor sales. The inability to recover these costs added pressure on suppliers, forcing them to offer significant discounts in an attempt to reduce their bloated inventories. The overall market sentiment remained subdued, as the outlook for product demand remained weak, preventing a quick recovery.

This aspirin price analysis can be expanded to include a comprehensive list of countries within the region.

| Region | Countries Covered |

|---|---|

| Asia Pacific | China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand, among other Asian countries. |

Latin America Aspirin Price Trend

Q3 2025:

Latin America's aspirin market is predominantly influenced by its rich natural reserves, particularly in countries like Chile and Brazil. However, political instability and inconsistent regulatory frameworks can lead to significant volatility in aspirin prices.

Q2 2025:

Infrastructure challenges and logistical inefficiencies often impact the supply chain, affecting the region's ability to meet international demand consistently. Moreover, the aspirin price index, economic fluctuations, and currency devaluation are critical factors that need to be considered when analyzing aspirin pricing trends in this region.

This comprehensive review can be extended to include specific countries within the region.

| Region | Countries Covered |

|---|---|

| Latin America | Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru, among other Latin American countries. |

Aspirin Pricing Report, Market Analysis, and News

IMARC's latest publication, “Aspirin Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition,” presents a detailed examination of the aspirin market, providing insights into both global and regional trends that are shaping prices. This report delves into the spot price of aspirin at major ports and analyzes the composition of prices, including FOB and CIF terms. It also presents detailed aspirin prices trend analysis by region, covering North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The factors affecting aspirin pricing, such as the dynamics of supply and demand, geopolitical influences, and sector-specific developments, are thoroughly explored. This comprehensive report helps stakeholders stay informed with the latest market news, regulatory updates, and technological progress, facilitating informed strategic decision-making and forecasting.

Aspirin Industry Analysis

The global aspirin market size reached USD 2.58 Billion in 2025. By 2034, IMARC Group expects the market to reach USD 3.51 Billion, at a projected CAGR of 3.48% during 2026-2034. The market is primarily driven by the expanding pharmaceutical consumption, stable production growth, improved access to raw materials, and rising demand for analgesic and anti-inflammatory formulations.

Latest News and Developments:

- December 2025: A new article explaining how aspirin may prevent cancer was published in The New England Journal of Medicine. The review, written by Professors Ruth Langley and Sir John Burn, outlined findings from the SPARC research group, an international collaboration led by UCL. The team reported that low-dose aspirin suppressed platelet activation, a process linked to tumor growth and metastasis. Their work suggests that reducing platelet activity helped limit inflammation and allowed the immune system to better target emerging cancer cells.

- November 2024: Andhra Sugars Ltd. announced that its aspirin production facility in Venkatarayapuran got US FDA approval post a stringent inspection.

- July 2024: A study by RMIT University found that low-dose aspirin can treat flu-induced blood vessel inflammation, thus facilitating better blood flow to the placenta during pregnancy.

Product Description

Aspirin, also known as acetylsalicylic acid, is a broadly used medicine that offers relief from pain, reduction in inflammation and fever. It is esterified by the condensation of acetyl chloride with salicylic acid. Aspirin's mechanism of action derives from its ability to block enzyme cyclooxygenase which subsequently inhibits the formation of prostaglandins, the culprit of pain, inflammation and fevers.

Aspirin, as a medication, is usually produced by the chemical series reactions in the pharmaceutical manufacturing factories. The process involves the use of precise reaction conditions, purification procedures, and manufacturing techniques such as tablets, capsules, and parenteral solutions.

Aspirin is well-known for relief of mild to moderate pain including headaches, muscle aches, toothaches, and diarrhea. Moreover, it is found to be anti-inflammatory agent for the ease of symptoms of diseases like arthritis. Aspirin is no longer only used for the purpose of pain relief, but also in preventing cardiovascular events, such as heart attacks and strokes, by virtue of its inhibition of platelet aggregation.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | Aspirin |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, Aspirin Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece* North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru* Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of aspirin pricing, covering global and regional trends, spot prices at key ports, and a breakdown of Ex Works, FOB, and CIF prices.

- The study examines factors affecting aspirin price trend, including raw material costs, supply-demand shifts, geopolitical impacts, and industry developments, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The aspirin price charts ensure our clients remain at the forefront of the industry.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)