Asia Pacific Welding Consumables Market Size, Share, Trends and Forecast by Product, Welding Technique, End Use Industries, and Country, 2025-2033

Asia Pacific Welding Consumables Market Size and Share:

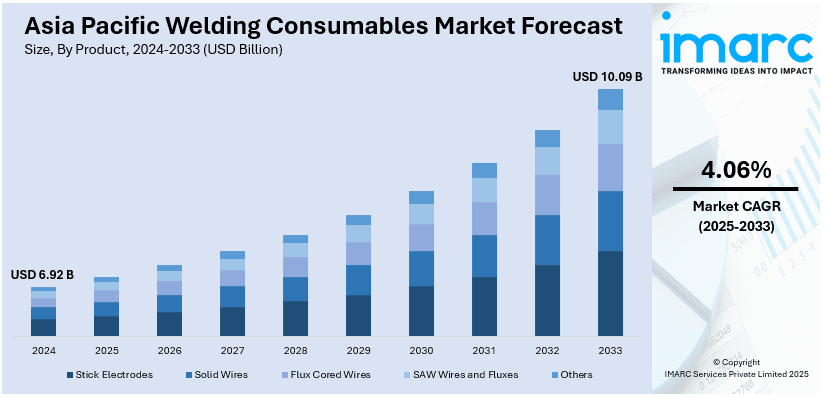

The Asia Pacific welding consumables market size was valued at USD 6.92 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 10.09 Billion by 2033, exhibiting a CAGR of 4.06% from 2025-2033. China currently dominates the market share. The market is primarily driven by significant advancements in precision welding technologies for aerospace and defense, rising demand for high-performance materials in renewable energy projects, and the heightened adoption of sustainable practices, aligning with environmental regulations and fostering innovation in eco-friendly welding solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.92 Billion |

|

Market Forecast in 2033

|

USD 10.09 Billion |

| Market Growth Rate (2025-2033) | 4.06% |

The market in Asia Pacific is majorly driven by rapid industrialization and urbanization in key economies such as China, India, and Southeast Asia. In accordance with this, expanding construction and infrastructure sectors demand extensive welding applications for buildings, bridges, and railways, fueling the Asia Pacific welding consumables market growth. For example, on January 3, 2025, Harbin Electric achieved a major milestone by manufacturing the world’s largest 500 MW impulse turbine runner for China’s Zhala Hydropower Station, showcasing advancements in welding and manufacturing processes that enhance efficiency and safety. Additionally, the automotive and shipbuilding industries significantly contribute to market expansion due to their reliance on welding for fabrication. Innovations in automation and robotics are further encouraging the adoption of advanced consumables, while government initiatives promoting industrial expansion and infrastructure projects create substantial opportunities in the region.

To get more information on this market, Request Sample

Additionally, the growing investments in various renewable energy projects, including solar panels and wind turbines, are driving demand for specialized welding consumables designed to endure harsh conditions. Furthermore, the growing aerospace and defense sectors in Japan and South Korea further contribute to market growth, requiring precision welding solutions for advanced applications. Notably, on March 5, 2024, Dr. Han's team at KERI achieved a breakthrough in electron beam welding technology, developing a high-performance electron gun with world-class power (60 kW) and acceleration voltage (120 kV). This innovation enables defect-free welding of thick materials, reduces reliance on imports, and supports applications in sectors like aerospace, defense, nuclear power, and small modular reactors (SMRs). Moreover, heightened demand from the oil and gas industry for pipeline construction, coupled with eco-friendly welding practices, fosters innovation in consumables, aligning with environmental regulations and expanding the Asia Pacific welding consumables market share.

Asia Pacific Welding Consumables Market Trends:

Technological Integration in Precision Welding

The aerospace and defense sectors in the region are driving the adoption of precision welding technologies and consumables designed to meet rigorous quality and performance standards. Countries like South Korea and Japan are leading advancements in laser and electron beam welding to address aerospace and defense requirements. Asia Pacific welding consumables market trends highlight the increasing integration of automation, robotics, and advanced consumables into welding processes, enhancing accuracy and efficiency. From January 29-31, 2025, Metal Technology Co., Ltd. (MTC) will showcase innovations at TCT Japan 2025, including metal additive manufacturing, non-destructive inspection, and near-net-shape technologies. MTC’s additive manufacturing utilizes electron beam and fiber laser technology to produce complex, high-strength structures for aerospace, automotive, and medical applications, supporting demand for high-quality, reliable manufacturing.

Increasing Demand in Renewable Energy Projects

The Asia Pacific welding consumables market demand is experiencing significant growth, fueled by the expansion of renewable energy projects like wind turbines and solar panels. These applications demand advanced welding materials capable of enduring harsh conditions such as high winds, moisture, and temperature extremes. Key players like China, India, and Japan are driving growth, supported by government policies, incentives, and infrastructure investments. As of January 22, 2025, India added 24.5 GW of solar and 3.4 GW of wind capacity in 2024, bolstered by initiatives like the PM Surya Ghar: Muft Bijli Yojana and various other green hydrogen policies. Further investments in domestic manufacturing and grid development advance India’s 2030 target of 500 GW non-fossil fuel capacity. Technological advancements in corrosion-resistant, high-strength welding materials and green energy initiatives are boosting demand for specialized consumables across the region.

Growing Adoption of Sustainable Welding Practices

The market in the region is focused on sustainable practices, supported by global and regional environmental regulations. Manufacturers are innovating low-spatter electrodes, flux-cored wires, and other consumables to reduce emissions and material waste. This trend is particularly evident in industrially advanced nations like China and India, where stringent environmental policies encourage the adoption of eco-friendly welding technologies. According to the Asia Pacific welding consumables market report, sustainable initiatives are gaining momentum, highlighting innovation in greener welding solutions. For instance, on January 1, 2025, LiuGong celebrated the first anniversary of its Green Alliance, showcasing milestones like Africa's first electric earth-moving machinery and a solar-powered well. LiuGong’s initiatives include VOC-targeted welding projects and autonomous equipment, saving 330,000 tons of carbon emissions. The oil and gas sector’s shift toward sustainable practices further supports the region’s long-term market growth.

Asia Pacific Welding Consumables Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Asia Pacific welding consumables market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product, welding technique, and end use industries.

Analysis by Product:

- Stick Electrodes

- Solid Wires

- Flux Cored Wires

- SAW Wires and Fluxes

- Others

Stick electrodes dominate the market due to their versatility, cost-effectiveness, and suitability for various applications and materials. They are widely used in construction, maintenance, and repair work, as they require minimal equipment and are effective in challenging environments, including outdoor and remote locations. Their ability to work well on dirty, rusty, or painted surfaces adds to their popularity. Stick electrodes are compatible with different metals, including steel, cast iron, and stainless steel, making them a preferred choice across industries such as construction, shipbuilding, and pipelines. Additionally, advancements in stick electrode technology, including low-hydrogen variants, enhance weld quality and safety, thereby positively influencing the Asia Pacific welding consumables market outlook.

Analysis by Welding Technique:

- Arc Welding

- Resistance Welding

- Oxyfuel Welding

- Ultrasonic Welding

- Others

Arc welding leads the market attributed to its widespread applicability, cost efficiency, and ability to produce high-quality, durable welds across various industries. This method is compatible with multiple materials, including steel, stainless steel, and aluminum, making it essential for sectors like construction, automotive, shipbuilding, and pipelines. Its adaptability to diverse conditions, including outdoor and remote environments, enhances its popularity. Advanced techniques, such as MIG, TIG, and submerged arc welding, enable precision and versatility, catering to both large-scale industrial projects and intricate tasks. Additionally, advancements in automation and robotics integrated with arc welding systems improve efficiency and consistency, solidifying its position as the most widely used welding technology in the market.

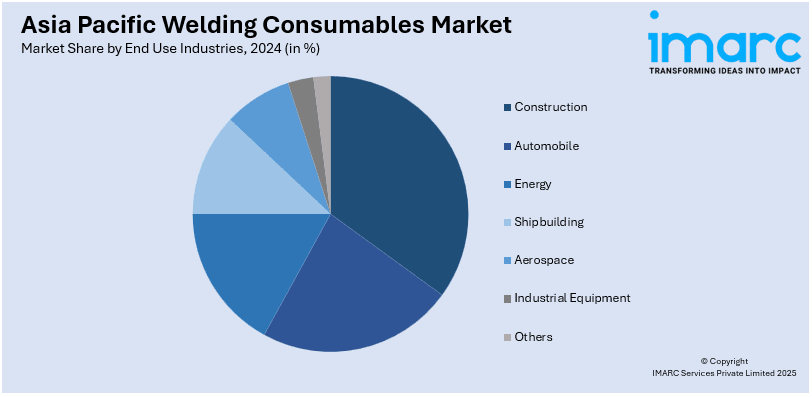

Analysis by End Use Industries:

- Construction

- Automobile

- Energy

- Shipbuilding

- Aerospace

- Industrial Equipment

- Others

Construction holds the largest share in the market driven by its high demand for welding applications in building infrastructure, bridges, and industrial facilities. Welding is integral to structural steel fabrication, reinforcing its importance in construction projects. The sector’s rapid growth, driven by urbanization and infrastructure development in emerging economies, further boosts demand. Technologies like arc welding and flux-cored welding are widely utilized for their efficiency, durability, and ability to handle heavy materials. Additionally, government investments in several large-scale projects, such as highways, railways, and smart cities, amplify the need for welding consumables. The construction industry’s reliance on durable, high-quality welds ensures its dominance in the market.

Country Analysis:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

China accounts for the biggest share in the market propelled by its expansive industrial base and significant investments in infrastructure, manufacturing, and construction. As the world’s largest steel producer and consumer, the country drives demand for welding materials in industries like automotive, shipbuilding, and heavy machinery. Rapid urbanization and government initiatives, such as large-scale infrastructure projects and smart city developments, further augment welding applications. The renewable energy sector, including wind and solar power, also contributes to growth, requiring advanced welding for turbines and panels. Additionally, China’s focus on technological advancements, automation, and eco-friendly welding solutions strengthens its market leadership, catering to diverse domestic and global demands.

Competitive Landscape:

The welding consumables market in Asia Pacific is highly competitive, driven by innovation, sustainability, and cost efficiency. Key players invest in advanced consumables like low-spatter electrodes and corrosion-resistant wires to meet diverse industry demands. Automation and robotic welding technologies enhance precision and productivity across construction, automotive, and aerospace sectors. Regional manufacturers in China, India, and Japan leverage government support for industrial growth and eco-friendly practices, solidifying their market presence. Strategic collaborations and expansions are common as companies aim to strengthen their positions. For example, on October 14, 2024, Cell Impact and ANDRITZ joined forces in a strategic collaboration aimed at advancing the manufacturing process for bipolar flow plates, crucial components in fuel cells and electrolyzers. This partnership focuses on developing high-speed production techniques to enhance the efficiency and scalability of these essential parts while integrating ANDRITZ’s Soucell system, capable of welding one plate per second, to advance sustainable energy solutions.

The report provides a comprehensive analysis of the competitive landscape in the Asia Pacific welding consumables market with detailed profiles of all major companies.

Latest News and Developments:

- January 28, 2025: voestalpine Böhler Welding, a global leader in welding technology, offering a comprehensive range of welding solutions, is expanding its presence in India, investing over €3 million in the last five years to strengthen its production and service capabilities.

- January 28, 2025: KASFAB Tools Private Limited launched India's first manufacturing facility dedicated to building semiconductor equipment for global customers in Doddaballapur, Karnataka. The state-of-the-art facility includes Class 10 and Class 100 cleanrooms, high-precision welding capabilities, and comprehensive testing and validation setups to serve leading global semiconductor equipment manufacturers.

- October 25, 2024: L&T secured a significant order from the ITER Organization to deploy advanced welding technologies for assembling the ITER Tokamak vacuum vessel in France. India, a key ITER partner, continues to contribute significantly to the project. An MoU was signed for technical collaboration, showcasing L&T’s expertise in high-tech manufacturing for sustainable, carbon-free energy development.

- October 24, 2024: PolyU announced innovative welding technology for S960 steel, preserving its mechanical properties by precisely controlling heat input. Debuting in Hong Kong’s Fanling North footbridge project, this advancement enables lighter, sustainable structures, reducing carbon emissions. Led by Prof. Kwok-fai Chung, the technology sets a precedent for modern steel construction in Hong Kong and beyond.

- March 28, 2024: Ador Welding Limited partnered with Hindalco School of Excellence to launch the Training of Trainers (TOT) programme and certify trainees in welding techniques. The two-year MoU includes annual enrollment of 100 Hindalco employees, enhancing welding skills through immersive training in Pune. This collaboration bridges skill gaps, advancing industry standards and workforce excellence.

Asia Pacific Welding Consumables Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Stick Electrodes, Solid Wires, Flux Cored Wires, SAW Wires and Fluxes, Others |

| Welding Techniques Covered | Arc Welding, Resistance Welding, Oxyfuel Welding, Ultrasonic Welding, Others |

| End Use Industries Covered | Construction, Automobile, Energy, Shipbuilding, Aerospace, Industrial Equipment, Others |

| Countries Covered | China, Japan, India, South Korea, Australia, Indonesia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Asia Pacific welding consumables market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Asia Pacific welding consumables market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Asia Pacific welding consumables industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Asia Pacific welding consumables market was valued at USD 6.92 Billion in 2024.

The regional market is largely driven by rapid industrialization, urbanization, and infrastructure development in China, India, and Southeast Asia. Key factors include continual advancements in precision welding for aerospace and defense, renewable energy projects, sustainable practices aligning with regulations, and government support for construction, automotive, and shipbuilding industries. Automation and robotics further stimulate growth.

The Asia Pacific welding consumables market is projected to reach a value of USD 10.09 Billion by 2033, growing at a CAGR of 4.06% from 2025-2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)