Asia Pacific Tire Market Size, Share, Trends and Forecast by Radial/Bias Tires, End-Use, Vehicle Type, Size, Distribution Channel, and Country, 2025-2033

Asia Pacific Tire Market Size and Share:

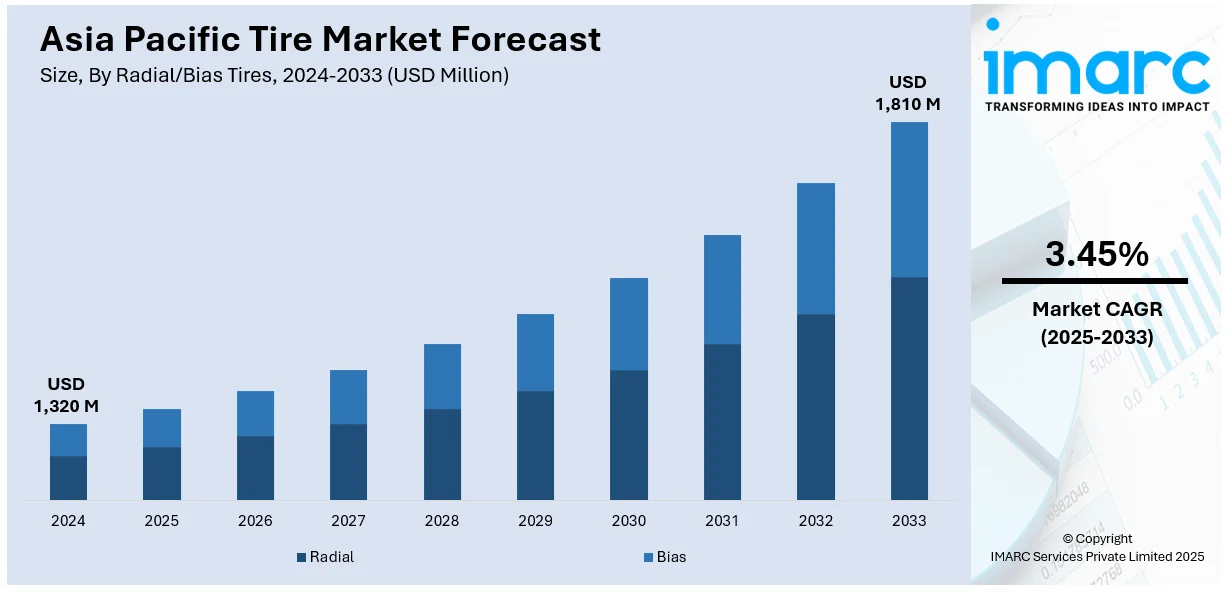

The Asia Pacific tire market size was valued at USD 1,320 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,810 Million by 2033, exhibiting a CAGR of 3.45% from 2025-2033. The Asia Pacific tire market share is increasing due to rising vehicle production and growing demand for replacement tires. Government initiatives supporting infrastructure and electric vehicle (EV) adoption, along with technological advancements in tire manufacturing, are impelling the market growth. Expanding logistics, e-commerce, and regulatory standards for fuel efficiency and safety are further contributing to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,320 Million |

|

Market Forecast in 2033

|

USD 1,810 Million |

| Market Growth Rate (2025-2033) | 3.45% |

The rising number of vehicles, particularly passenger cars and light commercial vehicles, represents one of the key factors propelling the market growth in Asia Pacific. Additionally, expanding highway networks, government-driven road development projects, and the robust e-commerce are increasing freight transport. This is catalyzing the demand for commercial vehicle tires, including those for trucks, buses, and trailers. Furthermore, manufacturers are investing in next-generation tires, such as smart tires with embedded sensors for real-time monitoring, fuel-efficient low-rolling-resistance tires, and airless tires for durability. Innovations in materials, like sustainable rubber alternatives and reinforced tread patterns, are improving tire performance. The growing awareness about environmental issues and fuel efficiency is prompting individuals and manufacturers to invest in tires that offer lower rolling resistance, contributing to better fuel economy and reduced emissions.

To get more information on this market, Request Sample

In addition to this, regulatory authorities throughout the area are enforcing tougher rules regarding tire quality, fuel efficiency, and safety standards. These rules motivate producers to create and provide superior tires that comply with the standards, fostering the overall expansion of the market. Apart from this, the growing interest in electric vehicles (EVs) is boosting the need for specialized tires able to manage the distinct features of EVs, like higher weight and torque. Moreover, the increasing appeal of e-commerce sites for tire sales is facilitating online tire purchases for buyers. The growth of online sales platforms, coupled with home delivery and fitting services, is boosting tire sales and broadening market accessibility, particularly in isolated regions.

Asia Pacific Tire Market Trends:

Growing Preference for High-Performance and Specialty Tires

With rising awareness about tire impact on vehicle performance, buyers are prioritizing premium radial tires, low rolling resistance variants, and run-flat technology for added safety and longevity. Moreover, the increasing appeal of sports utility vehicles (SUVs), crossovers, and luxury automobiles is boosting the demand for all-terrain and ultra-high-performance (UHP) tires that provide enhanced grip, handling, and noise suppression. Specialty tires designed for winter, all-season, and off-road use are increasingly popular, particularly in regions facing severe weather conditions. Moreover, people are seeking eco-friendly tires that reduce noise and include advanced silica materials to enhance fuel efficiency. Tire producers are reacting by putting money into innovative tread patterns, strengthened sidewalls, and adaptive tire materials that adapt to various road conditions, improving both the driving experience and overall safety. In 2024, Bridgestone India launched the Dueler All-Terrain (A/T) 002 tire, designed for outstanding performance in both on-road and off-road conditions. The tire features 5 Rib-technology for enhanced grip, traction, and extended durability, ideal for SUVs and 4x4 vehicles. Bridgestone's commitment to excellence is clear in the tire's functionality in both dry and wet conditions, ensuring a smooth and quiet ride.

Technological Advancements

Advancements in tire technology are greatly reshaping the industry, as producers incorporate cutting-edge materials and digital innovations to improve performance, safety, and efficiency. The use of smart tires fitted with built-in sensors allows for real-time tracking of tire pressure, tread wear, and temperature, assisting fleet managers and individuals in avoiding unexpected breakdowns and enhancing maintenance planning. The employment of machine learning (ML) and artificial intelligence (AI) in tire design is enhancing traction, durability, and road grip. Moreover, digital fleet management systems along with predictive analytics are vital in enhancing tire replacement intervals, lowering operational expenses, and boosting road safety. These innovations in technology are fueling the need for next-generation tires that provide better performance, extended durability, and improved connectivity. In 2024, BANF, a startup from Korea, is creating smart tire technology that employs triaxis sensors to assess tire condition, cargo weight, and road situations with 90% precision. The technology, combining ML with real-time Bluetooth data transfer, seeks to enhance fuel efficiency and fleet safety, potentially saving as much as $4,500 per truck each year.

Sustainability Initiatives

The increasing focus on sustainability is encouraging tire manufacturers to adopt eco-friendly materials and greener production methods. Companies are investing in bio-based alternatives such as natural rubber from sustainable plantations, soybean oil, and silica derived from rice husks to reduce reliance on petroleum-based compounds. The development of circular economy solutions, including tire retreading, recycling, and reprocessing of end-of-life tires, is further minimizing environmental impact and resource wastage. Additionally, manufacturers are exploring non-pneumatic (airless) tire technology, which enhances durability and eliminates the need for frequent replacements, particularly in industrial and military applications. Stricter government regulations on carbon emissions and waste disposal are driving the industry toward more sustainable practices, with incentives promoting the use of recycled and renewable materials. In 2024, Michelin introduced the fuel-efficient Michelin X Multi Energy Z+ tire in India, tailored for regional road and load conditions. This tire provided as much as 15% fuel efficiency and decreased carbon emissions by nearly 8 tons. It sought to tackle elevated fuel expenses in logistics while also backing Michelin's CO2 reduction objectives for 2030.

Asia Pacific Tire Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Asia Pacific tire market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on radial/bias tires, end-use, vehicle type, size, and distribution channel.

Analysis by Radial/Bias Tires:

- Radial

- Bias

Radial represents the largest segment because of its superior durability, fuel efficiency, and performance advantages compared to bias tires. Radial tires offer improved grip, heat management, and tread durability, positioning them as the favored option for passenger cars, commercial trucks, and off-road uses. The rising need for fast and long-range travel motivates vehicle owners and fleet operators to choose radial tires for enhanced safety and stability. Automakers are installing radial tires as standard on new vehicles because they offer improved ride comfort and reduced rolling resistance. The sector for commercial vehicles is moving towards radial tires, especially in logistics and transportation, where efficiency and cost reduction are essential. Moreover, government rules encouraging fuel efficiency and vehicle safety aid in the extensive use of radial tires in various vehicle types. Progress in radial tire technology, such as strengthened sidewalls and smart tire connectivity, enhances market penetration and user choice in both urban and rural areas.

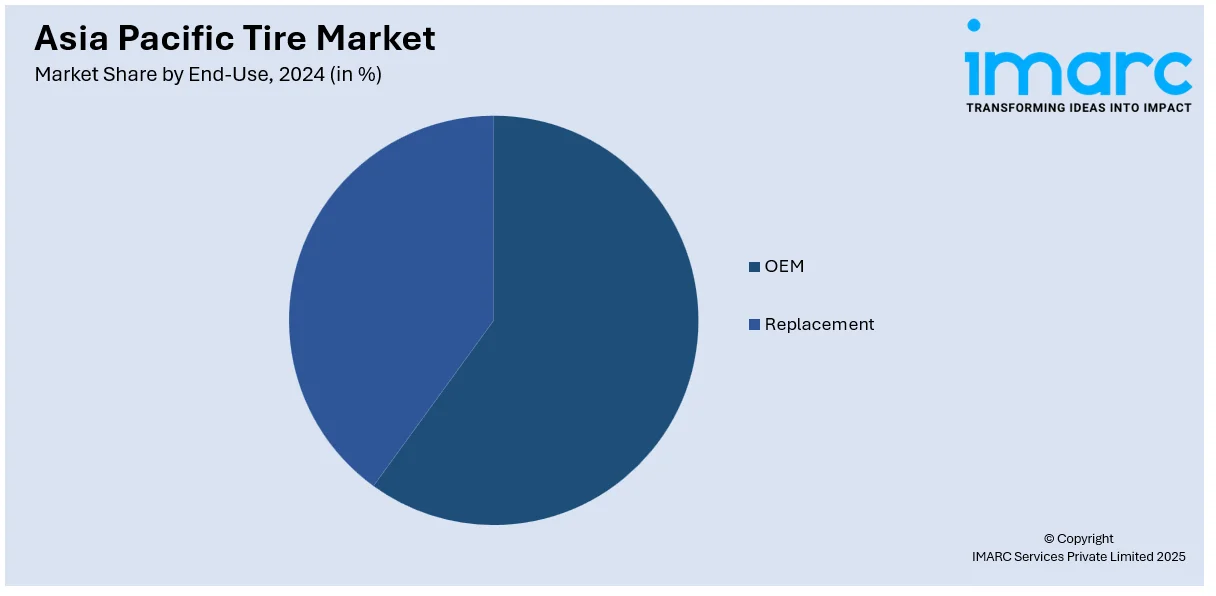

Analysis by End-Use:

- OEM

- Replacement

Replacement exhibits a clear dominance in the market due to the ongoing deterioration of vehicle tires, road conditions, and user inclination towards premium aftermarket products. Vehicle owners desire tires that are durable, fuel-efficient, and enhance performance, resulting in a rise in demand for premium and specialty choices. The increasing number of passenger vehicles, motorcycles, and commercial transports heightens the demand for frequent tire changes, enhancing both retail and wholesale sales. Improvements in tread design, puncture durability, and year-round performance are affecting buying decisions. Tire producers work together with retailers and service stations to broaden their accessibility, providing value-added services such as complimentary installation, warranties, and financing alternatives. The emergence of e-commerce platforms offers people easy access to numerous tire brands and models, thereby enhancing market expansion. Additionally, road safety rules and inspections necessitate regular tire changes, guaranteeing adherence to governmental standards. Fleet operators and logistics firms focus on affordable and durable replacement tires to enhance operational efficiency.

Analysis by Vehicle Type:

- Passenger Cars

- Light Commercial Vehicles

- Medium and Heavy Commercial Vehicles

- Two-Wheelers

- Off-The-Road (OTR)

- Three- Wheelers

Passenger cars represent the largest segment due to growing vehicle ownership, expanding road infrastructures, and heightened demand for high-performance and fuel-efficient tires. Individuals place importance on safety, longevity, and riding comfort, promoting the use of radial and tubeless tires featuring sophisticated tread patterns. Car manufacturers and tire companies concentrate on technological innovations, like run-flat and low rolling resistance tires, to improve fuel efficiency and driving stability. The increasing trend towards electric and hybrid cars is driving the need for specialized tires that provide reduced noise and enhanced traction. Sales of premium and ultra-high-performance tires are growing because of the increasing quantity of high-end and luxury cars. The aftermarket sector is growing as people look for dependable alternatives to enhance fuel efficiency and durability. Car manufacturers and dealerships work together with tire makers to provide package deals, boosting original equipment (OE) sales.

Analysis by Size:

- Passenger Cars

- Market Breakup by Rim Size

- Market Breakup by Tire Size

- Market Breakup by Price Range

- Light Commercial Vehicles

- Market Breakup by Rim Size

- Market Breakup by Tire Size

- Market Breakup by Price Range

- Medium and Heavy Commercial Vehicles

- Market Breakup by Rim Size

- Market Breakup by Tire Size

- Market Breakup by Price Range

- Two-Wheelers

- Market Breakup by Rim Size

- Market Breakup by Tire Size

- Market Breakup by Price Range

- Three- Wheelers

- Market Breakup by Rim Size

- Market Breakup by Tire Size

- Market Breakup by Price Range

- Off-The-Road (OTR)

- Market Breakup by Rim Size

- Market Breakup by Tire Size

- Market Breakup by Price Range

Passenger cars hold a significant Asia Pacific tire market share due to increasing vehicle ownership and rising demand for fuel-efficient and high-performance tires. Individuals prioritize safety, durability, and comfort, driving advancements in tread design, low rolling resistance, and run-flat technology. Tire manufacturers focus on radial and tubeless options, offering enhanced grip and longevity.

Light commercial vehicles (LCVs) segment is expanding due to the increasing need for efficient transportation solutions in logistics, last-mile delivery, and trade-related activities. Fleet operators prioritize durable and fuel-efficient tires to optimize operational costs and enhance vehicle performance. Additionally, OEMs and aftermarket suppliers offer a range of LCV tires tailored to specific usage patterns, ensuring reliability and safety.

Medium and heavy commercial vehicles segment is driven by the increasing demand for high-performance and long-lasting tires in freight transportation, construction, and mining sectors. Radialization is gaining prominence, offering improved load-bearing capacity, fuel savings, and reduced heat generation. Fleet operators require tires with enhanced durability and retreading potential to optimize costs and reduce downtime.

The two-wheelers segment benefits from increasing mobility demand, particularly in urban and semi-urban areas where motorcycles and scooters serve as primary transportation modes. Tire manufacturers focus on grip, stability, and puncture resistance to enhance rider safety and comfort. The demand for tubeless tires is growing, offering better safety, reduced rolling resistance, and improved fuel efficiency.

The three-wheelers segment remains critical for last-mile connectivity and commercial transport services across urban and rural regions. This segment demands durable and puncture-resistant tires capable of withstanding heavy loads and frequent stop-and-go movement. Bias tires remain prevalent due to their ability to handle uneven terrains and prolonged usage without significant wear.

Off-the-road (OTR) tires cater to construction, mining, agriculture, and industrial applications, requiring specialized heavy-duty tires with superior durability and traction. These tires operate under extreme conditions, necessitating reinforced structures, deep treads, and resistance to cuts and abrasions.

Analysis by Distribution Channel:

- Offline

- Online

The offline segment leads the market due to the strong presence of authorized dealerships, retail outlets, and service centers offering installation and maintenance support. Individuals prefer offline channels for personalized recommendations, quality assurance, and after-sales services, particularly for high-performance and premium tires. Local tire shops and multi-brand outlets dominate sales, catering to replacement demand from passenger and commercial vehicle owners. Fleet operators and logistics companies rely on offline channels for bulk purchases, warranty benefits, and customized tire solutions. Numerous producers are increasing their dealership networks and service facilities to enhance accessibility in both city and countryside areas. Brick-and-mortar retailers also provide financing choices and promotional deals, appealing to price-conscious shoppers. The existence of large-format retailers with vast stock ensures instant product access, minimizing waiting periods for clients. The strength of offline distribution is further supported by solid connections among tire manufacturers, distributors, and retailers, which guarantees a reliable supply chain and user confidence.

Country Analysis:

- China

- India

- Japan

- Australia

- South Korea

- Thailand

- Indonesia

- Malaysia

- Pakistan

- Others

China leads the market due to its robust car manufacturing foundation, expansive road systems, and substantial vehicle ownership. The nation's demand is propelled by the swift growth of commercial fleets, governmental initiatives encouraging electric mobility, and the rising inclination for high-performance and all-season tires. Top tire producers are allocating resources to research efforts aimed at improving durability, fuel efficiency, and road safety. Strict regulatory requirements for vehicle emissions and safety adherence are driving innovation in tire materials and manufacturing techniques. The increasing popularity of electric and hybrid cars is driving the need for specialized low-rolling-resistance tires. Furthermore, businesses are reinforcing distribution channels and retail networks to enhance accessibility in both urban and rural regions. In 2024, Continental marked the official launch of the fourth expansion phase at its tire facility in Hefei, China. The growth will boost manufacturing capability to 18 million tires each year by 2027 and generate 400 new jobs. The facility additionally incorporates cutting-edge automation and sustainable practices, aiding Continental's objective of achieving climate neutrality by 2050.

Competitive Landscape:

Major participants in the market are concentrating on increasing capacity, advancing technology, and implementing sustainability efforts. They are putting money into smart tire technologies, innovative tread patterns, and fuel-efficient materials to address changing user needs and regulatory requirements. Collaborative efforts and strategic alliances with vehicle manufacturers and fleet managers are enhancing market presence. Furthermore, research and development (R&D) initiatives are promoting advancements in tire resilience, safety, and performance. Investments in eco-friendly materials, circular economy projects, and strategies to reduce carbon footprints are in accordance with environmental regulations. For instance, during the 2024 China International Import Expo (CIIE), Michelin showcased its 71% eco-friendly tire, made from materials like natural rubber, recycled carbon black, and orange peels. The company has also launched the Michelin Air X Skylight aviation tire along with the Michelin Lunar Wheel for space exploration. This event highlights Michelin's commitment to environmentally friendly innovation and sustainable development in the automotive industry.

The report provides a comprehensive analysis of the competitive landscape in the Asia Pacific tire market with detailed profiles of all major companies, including:

- Michelin

- Bridgestone Corporation

- Continental AG

- Goodyear Tire & Rubber Company

- Sumitomo Corporation

- Pirelli C. S.p.A.

- Yokohama Tire Corporation

- Hankook Tire & Technology Co., Ltd.

- Toyo Tire Corporation

- Kumho Tire Co., Ltd.

Latest News and Developments:

- November 2024: Goodyear Tire & Rubber Company launched its ElectricDrive Sustainable-Material (EDS) tire at the 7th China International Import Expo (CIIE). This tire, intended for EVs, is made with more than 70% sustainable materials, including recycled polyester and carbon black.

- October 2024: Michelin unveiled a new Michelin Tire Service (MTS) store in Navi Mumbai, in collaboration with NX Sanghi Tyres. The 2000 sq. ft. facility offered a range of premium tire solutions and services for passenger cars. This launch highlighted Michelin's commitment to customer convenience, sustainability, and service excellence in India.

- August 2024: Continental launched the ExtremeContact XC7, a flagship tire featuring ContiSeal and ContiSilent technologies. This self-sealing tire can close punctures up to 5mm, while reducing noise with built-in polyurethane foam. Only offered on Tuhu, the largest auto retail platform in China, this tire prioritizes safety and comfort, particularly in wet weather.

- July 2024: Yokohama revealed intentions to establish a new passenger car tire factory in Hangzhou, China, featuring an initial output capacity of 9 million tires per year. The facility is set to commence production in the second quarter of 2026, boosting Yokohama's capacity in China by 3 million units.

- March 2024: SK Chemicals, Hyosung Advanced Materials, and Hankook Tire revealed the launch of South Korea's inaugural tire made from chemically recycled PET. The "iON" tire, designed specifically for electric vehicles, utilizes 45% sustainable materials, featuring circular recycled PET fiber cords.

- February 2024: Bridgestone revealed its strategic change to concentrate solely on the premium passenger vehicle tire market in China. In its Mid-Term Business Plan (2024-2026), the company plans to stop the production and sales of tires for trucks and buses to boost its earning potential.

Asia Pacific Tire Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Radial/Bias Tires Covered | Radial, Bias |

| End-Uses Covered | OEM, Replacement |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Medium and Heavy Commercial Vehicles, Two-Wheelers, Off-The-Road (OTR), Three- Wheelers |

| Sizes Covered |

|

| Distribution Channels Covered | Offline, online |

| Countries Covered | China, India, Japan, Australia, South Korea, Thailand, Indonesia, Malaysia, Pakistan, Others |

| Companies Covered | Michelin, Bridgestone Corporation, Continental AG, Goodyear Tire & Rubber Company, Sumitomo Corporation, Pirelli C. S.p.A., Yokohama Tire Corporation, Hankook Tire & Technology Co., Ltd., Toyo Tire Corporation, Kumho Tire Co., Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Asia Pacific tire market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Asia Pacific tire market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Asia Pacific tire industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The tire market in the Asia Pacific was valued at USD 1,320 Million in 2024.

The tire market in the Asia Pacific region is expanding due to rising vehicle production and increasing demand for replacement tires. Government initiatives supporting infrastructure and EV adoption, along with technological advancements in tire manufacturing, are further contributing to the market growth.

IMARC estimates the Asia Pacific tire market to exhibit a CAGR of 3.45% during 2025-2033, reaching a value of USD 1,810 Million by 2033.

In 2024, radial holds the biggest market share due to its superior durability, fuel efficiency, and performance benefits over bias tires

Replacement exhibits a clear dominance in the market in 2024, owing to the continuous wear and tear of vehicle tires, road conditions, and user preference for high-quality aftermarket products.

Some of the major players in the Asia Pacific tire market include Michelin, Bridgestone Corporation, Continental AG, Goodyear Tire & Rubber Company, Sumitomo Corporation, Pirelli C. S.p.A., Yokohama Tire Corporation, Hankook Tire & Technology Co., Ltd., Toyo Tire Corporation, Kumho Tire Co., Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)