Asia Pacific Swine Feed Market Size, Share, Trends and Forecast by Product Type, Feed Essence, Feed Additive Type, and Country, 2025-2033

Market Overview:

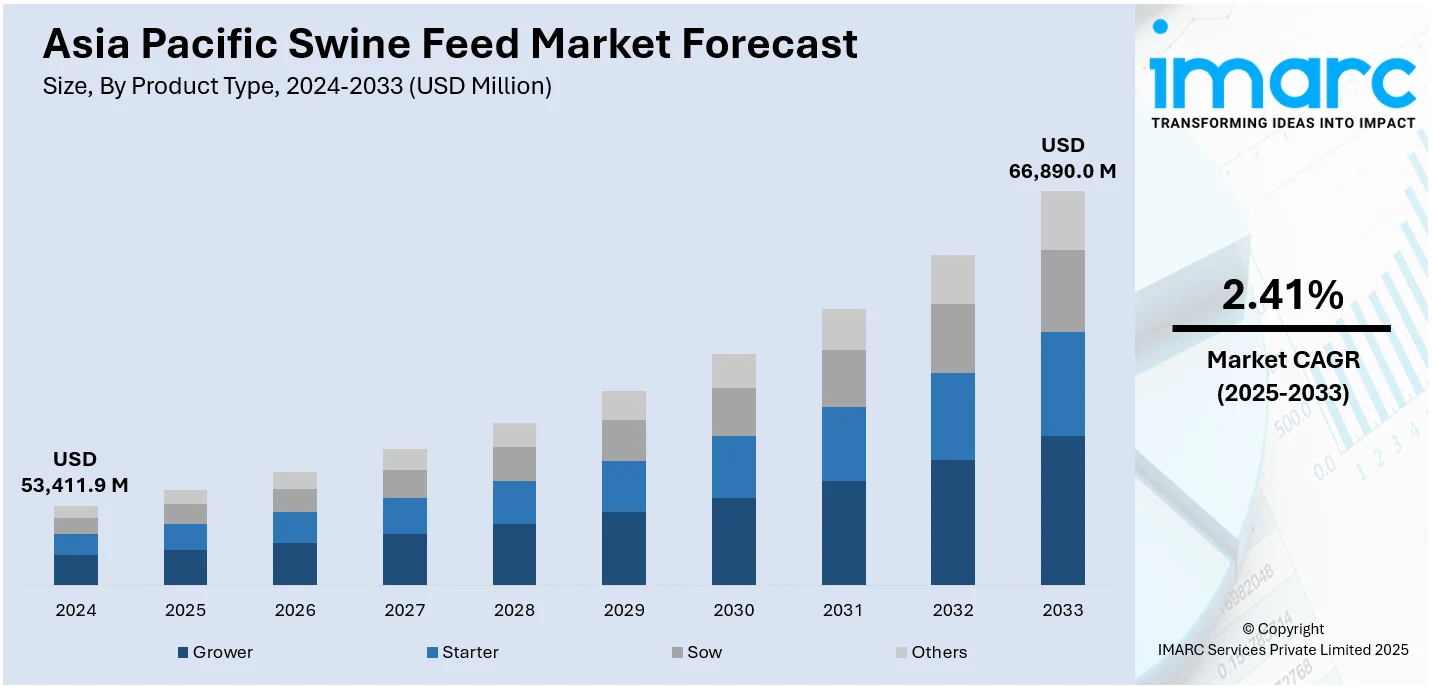

The Asia Pacific swine feed market size reached USD 53,411.9 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 66,890.0 Million by 2033, exhibiting a growth rate (CAGR) of 2.41% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 53,411.9 Million |

|

Market Forecast in 2033

|

USD 66,890.0 Million |

| Market Growth Rate (2025-2033) | 2.41% |

Swine feed refers to a range of processed, semi-processed, and raw food items for pigs that are formulated by combining various essential nutrients. They help in maintaining the health and well-being of pigs. Some of the raw materials used in producing swine feed include natural corn, soybean, and wheat-based ingredients. In the Asia Pacific region, pig farmers use swine feed to promote the growth and acid resistance in pigs and increase the quality of the pork.

To get more information on this market, Request Sample

The Asia Pacific swine feed market is primarily driven by the increasing consumption of pork in countries such as China, Vietnam, the Philippines and Thailand. Due to the growing awareness regarding eating healthy food, there has been rising swine production, which is positively impacting the market growth. Besides this, manufacturers are introducing vitamin supplements and various other nutrients in the feed to improve the quality and texture of the pork, thereby increasing the demand for swine feed among farmers. Additionally, the growing awareness regarding the nutritional benefits of swine feed among small-scale pig farmers has resulted in an increased number of swine feed mills, particularly in countries such as India and Japan.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the Asia Pacific swine feed market report, along with forecasts at the regional and country level from 2025-2033. Our report has categorized the market based on product type, feed essence and feed additive type.

Breakup by Product Type:

- Grower

- Starter

- Sow

- Others

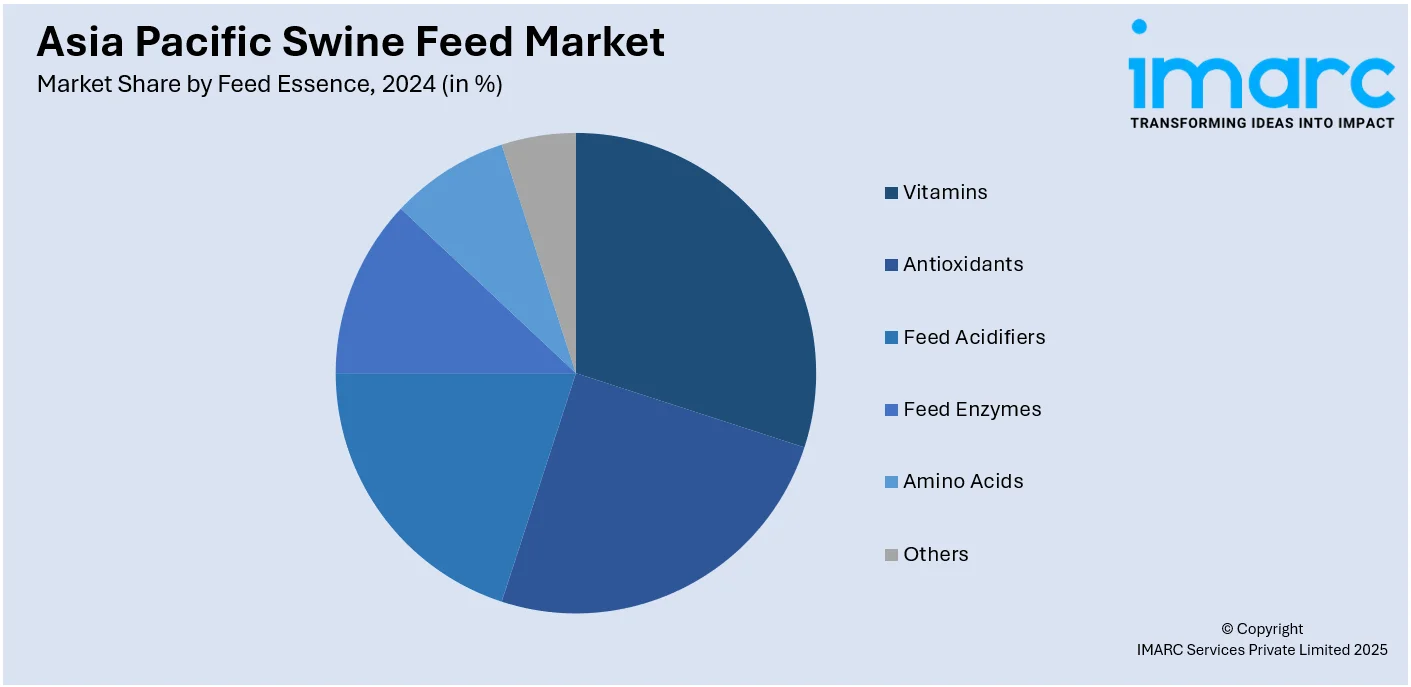

Breakup by Feed Essence:

- Vitamins

- Antioxidants

- Feed Acidifiers

- Feed Enzymes

- Amino Acids

- Others

Breakup by Feed Additive Type:

- Zootechnical Feed Additives

- Sensory Feed Additives

- Nutritional Feed Additives

Breakup by Country:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Segment Coverage | Product Type, Feed Essence, Feed Additive Type, Country |

| Countries Covered | China, Japan, India, South Korea, Australia, Indonesia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Asia Pacific swine feed market was valued at USD 53,411.9 Million in 2024.

We expect the Asia Pacific swine feed market to exhibit a CAGR of 2.41% during 2025-2033

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several Asia Pacific nations, resulting in the temporary restriction on production and supply of livestock, feed, and feed ingredients, thereby negatively impacting the Asia Pacific market for swine feed.

The increasing demand for organic pig meat, along with the introduction of new animal rearing practices and maintenance of high farming standards, is primarily driving the Asia Pacific swine feed market.

Based on the product type, the Asia Pacific swine feed market can be categorized into grower, starter, sow, and others. Currently, grower accounts for the majority of the total market share.

Based on the feed essence, the Asia Pacific swine feed market has been segregated into vitamins, antioxidants, feed acidifiers, feed enzymes, amino acids, and others. Among these, amino acids currently hold the largest market share.

Based on the feed additives type, the Asia Pacific swine feed market can be bifurcated into zootechnical feed additives, sensory feed additives, and nutritional feed additives. Currently, nutritional feed additives exhibit a clear dominance in the market.

On a regional level, the market has been classified into China, Japan, India, South Korea, Australia, Indonesia, and others, where China currently dominates the Asia Pacific swine feed market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)