Asia Pacific Stylus Pen Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Application, End User, and Country, 2025-2033

Asia Pacific Stylus Pen Market Size and Share:

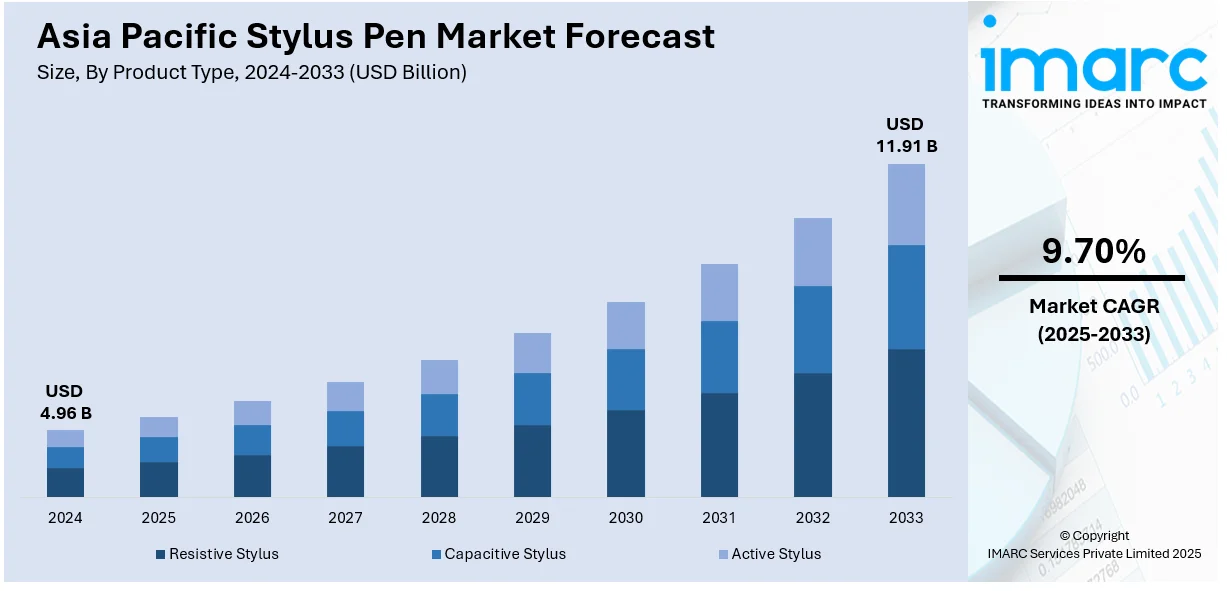

The Asia Pacific stylus pen market size was valued at USD 4.96 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 11.91 Billion by 2033, exhibiting a CAGR of 9.70% from 2025-2033. The Asia Pacific stylus pen market share is increasing due to the growing adoption of digital devices, surging demand for e-learning and remote work solutions, increasing digital notetaking and design tool preferences, improving stylus pen technology, and the expansion of industries such as education, creative design, and gaming.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.96 Billion |

|

Market Forecast in 2033

|

USD 11.91 Billion |

| Market Growth Rate (2025-2033) | 9.70% |

The Asia Pacific stylus pen market growth is attributed mainly to the rising adoption of tablets, smartphones, and hybrid laptops across the region. Increasing education, remote working, and other professional design-oriented activities on those devices have stimulated a strong requirement for stylus pens, considering that they increase precision and performance over traditional forms of input. Even more, the use of stylus pens for digital notetaking, drawing, and interactive learning is further boosted by the ever-growing e-learning and EdTech industries in many countries such as India, China, and South Korea. According to a report by the Internet and Mobile Association of India and Grant Thornton Bharat, Indian EdTech, valued at USD 7.5 Billion, currently has the potential to grow up to USD 29 Billion by 2030, as stated by the India Brand Equity Foundation. So, with growth in this EdTech domain, digital devices such as stylus pens also gained acceptance to be used at educational institutions for teaching and studying purposes. This factor of style-enabled apps for graphic design, gaming, and productivity has further increased the usability of styluses for professionals and for students.

To get more information on this market, Request Sample

Digitally educated initiatives and smart classroom programs initiated by the government also helped the growth of the market. Improvements in stylus pen technology are such that it supports a high level of pressure sensitivity and palm rejection features and connectivity via wireless and hence increases its adoption across Asia Pacific. Major players in the tech industry are entering the market by offering affordable, feature-rich products and catering to varied consumer groups. In addition, the growing penchant for digital content creation among the younger generation creates a demand for stylus pens that are specialized for artistic purposes and creative functionalities. The employment of AI and machine learning techniques in stylus-enabled devices has improved handwriting recognition and gesture controls, thus aiding in the growth of the market further. With the fast pace of digital transformation in the region, along with growing disposable incomes and increased awareness about advanced digital tools, the stylus pen market in Asia Pacific is expected to experience robust growth shortly.

Asia Pacific Stylus Pen Market Trends:

Rising demand for hybrid learning and work solutions

The Asia Pacific stylus pen market trend is influenced by hybrid learning and work models are increasingly being adopted. Every educational institution and business have realized that the efficiency, interactivity, and collaboration that individuals engage in will depend on digitalized tools. A stylus pen has become an extension of an e-learner's arm. They can annotate, sketch, and make notes with much ease on digital devices. Professionals across various sectors, including graphic design, architecture, and engineering, make use of stylus pens in their daily activities: digital whiteboarding, design creation, and collaborative meetings. This trend is in line with the rapid digital transformation of the region, as shown by the Asia Pacific e-learning market, which reached a size of US$ 74.6 Billion in 2024. According to the IMARC Group, the market is projected to reach an impressive US$ 211.6 Billion by 2033, underscoring the growing demand for digital education solutions. Countries such as India, China, and South Korea lead this trend owing to large investments in digital infrastructure and smart education. With this hybrid model in learning and working, the scope for stylus pens will witness a further increase.

Technological advancements with stylus pen features

The stylus pen technology in Asia Pacific is significantly changing the pace of the market. Manufacturers are launching stylus pens with advanced features such as pressure sensitivity, palm rejection, and tilt recognition to meet the changing needs of the consumer. AI integration has led to smarter features like handwriting recognition, gesture control, and contextual shortcuts, which make stylus pens more intuitive and user-friendly. In addition, improvements in wireless connectivity through Bluetooth and magnetic charging capabilities enhance the convenience and appeal of stylus pens. Stylus pens are also becoming affordable for the mass market, as leading companies make them cheaper without compromising quality. Such developments are making creative professionals, students, and gamers adopt it more and boost the Asia Pacific stylus pen demand.

Sustainability and eco-friendly innovations

The region's governments are coming together to create innovative solutions for better digital inclusivity and environmental responsibility. Currently, Economic and Social Commission for Asia and the Pacific states that while 96% of Asia and the Pacific is covered by mobile broadband networks, attention turns to the better use of the Internet for productivity since only a third of the population is productively using such services. Indeed, up to 40% are still lagging with their basic digital skills, a dire need that points to having available and usable digital tools for these people. Stylus pens, as integral components of digital learning and professional tools, are playing a pivotal role in this transformation. They enable seamless interaction with digital devices, particularly in education and skill-building initiatives aimed at underserved communities. Simultaneously, the market is witnessing eco-friendly innovations, with manufacturers launching stylus pens using recycled materials and showcasing energy-efficient designs. These developments reflect broader government priorities to deal with both the digital divide and sustainability goals. This is how Asia-Pacific countries have been able to drive digital transformation while making these developments environmentally friendly, paving the way for sustainable, long-term growth.

Asia Pacific Stylus Pen Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Asia Pacific stylus pen market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type, distribution channel, application, and end user.

Analysis by Product Type:

- Resistive Stylus

- Capacitive Stylus

- Active Stylus

Active stylus pens dominate the market due to their advanced functionality, including pressure sensitivity, palm rejection, and programmable buttons, which enhance the user experience for tasks like digital art, graphic design, and note-taking. Widely preferred by professionals in creative industries, educators, and students, active styluses enable precise input and greater control compared to passive styluses. Growth is supported by the increase in the adoption of tablets and hybrid laptops supporting active styluses. The region has also seen technological advancements, such as wireless charging and AI-enabled handwriting recognition, fueling demand. This robust digital infrastructure is also seen, from mid-2024, based on the information available from International Trade Administration reports, Asia Pacific now hosts over 650 Million smartphone users and internet subscribers amounting to more than 950 Million in total. As a government measure, promoting digital inclusion while enhancing sustainability at the same time are some actions by governments here. These efforts, coupled with the consumers' affinity for innovative and environmentally friendly styluses, are taking the market into long-term growth and change.

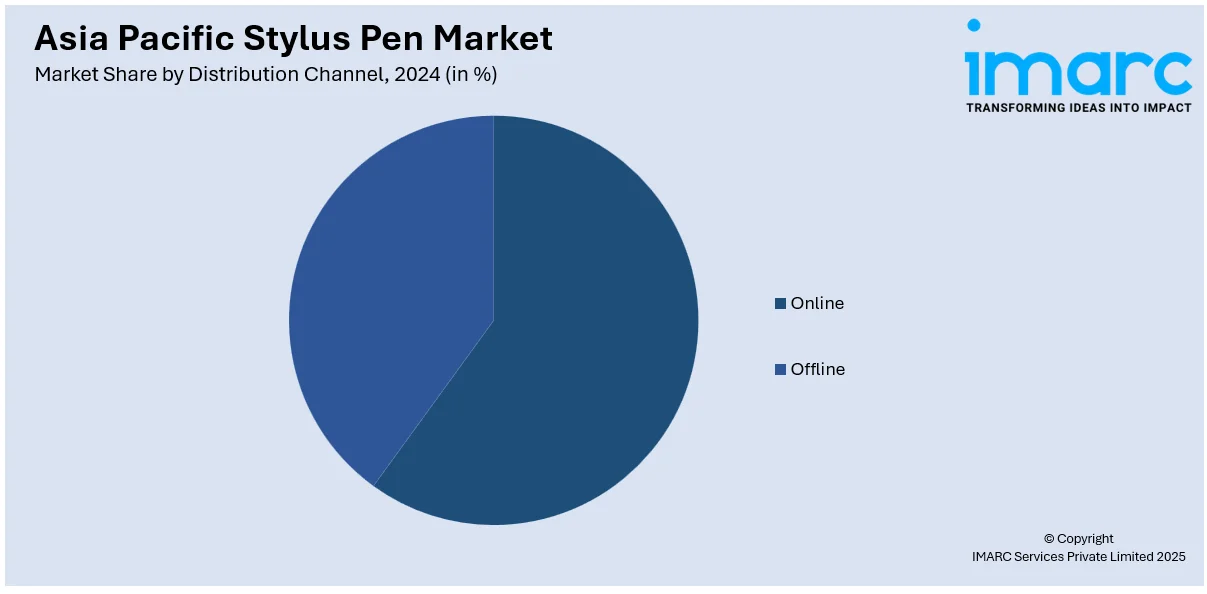

Analysis by Distribution Channel:

- Online

- Offline

Offline channels remain the most preferred channels by customers for their ability to offer a physical shopping experience, especially specialty electronics stores, brand-exclusive outlets, and retail chains. Customers, most of the time, seek to test the stylus pen for compatibility, grip, and functionality before purchasing, an aspect that can be easily handled in physical stores. These outlets also offer individualized support, product demos, and post-sales support, which helps to build consumer confidence and loyalty. In such countries as China, Japan, and India, the network of retail outlets leaves a robust impression on the offline distribution segment. This widespread retail presence ensures immediate product availability and enhanced customer engagement, contributing to the sustained success of offline channels. While e-commerce continues to gain traction, offering convenience and a broader reach, the offline segment remains indispensable for its unique ability to deliver a hands-on experience, particularly for products like stylus pens, where physical interaction significantly influences purchasing decisions.

Analysis by Application:

- Smart Phones

- Tablets

- Interactive Whiteboards

Tablets represent another significant category, with education, business, and creative industries using them intensively, and the demand for stylus pens designed for digital drawing, annotations, and document editing is huge. The smartphone segment is showing robust growth due to the high demand for big-screen devices and stylus-compatible models. The pens are widely used for precise navigation, note-taking, and creative tasks, making the user's life more productive. The interactive whiteboard segment is also in increasing demand, especially in educational and corporate sectors where interactive and collaborative teaching or presentation methods are preferred. The stylus pen further adds to the usability of these whiteboards and makes them versatile and intuitive for users. Investment in digital infrastructure and education across the region helps aid this growth. For example, Japan's market for digital learning was recorded to be at USD 4.5 Billion in 2024 and is likely to reach USD 9.4 Billion in 2033 as per IMARC Group. With all three applications, such as the usage of smartphones, tablets, and interactive whiteboards, witnessing further growth due to technological advancements and changing user demands, hybrid learning and work models are going to be on the rise.

Analysis by End User:

- OEM

- Retail

Manufacturers bundle stylus pens with devices like tablets and smartphones to enhance the value proposition of their products. Companies like Samsung, Apple, and Microsoft include stylus pens as an integral part of their product ecosystems to ensure seamless compatibility and richer user experiences. This bundling strategy massively contributes to the growth of the OEM segment, especially with consumers looking for devices that comply with hybrid work, education, and creative requirements. On the other hand, the retail segment is growing rapidly with the availability of standalone stylus pens catering to different consumer preferences. With these being sold at different prices, it has allowed users the flexibility to upgrade or replace their styluses conveniently. The growing internet commerce sites also helped to strengthen this category, making stylus pens easily available to customers with multiple characteristics and available designs. This is also consistent with higher retail growth across the country.

Regional Analysis:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

China leads the market driven by the country's enormous electronics manufacturing industry, high penetration of smartphones, and growing digital education tools adoption. The country's strong growth is further supported by the development in its electronic information manufacturing sector, where value-added industrial output increased 13.8% year over year in the first five months of 2024, the State Council of the People's Republic of China reported. Close to this ranking is Japan, wherein sophisticated technological infrastructure and an emphasis on innovative precision tools support creative and business applications. On the other hand, India has been growing fast, driven by the increased demand for digital learning tools and government initiatives to grow e-learning and smart education. South Korea, a location for innovation, records a high percentage rate of stylus pen adoption, especially by professionals and gamers. In Australia, there is a rising inclination toward digital tools in education and business settings. Indonesia is emerging as a significant market due to the rising smartphone adoption and expanding middle-class population.

Competitive Landscape:

Market players focus on advanced features and strategic collaborations to maintain their competitive edge. Companies are adding cutting-edge functionalities such as pressure sensitivity, tilt recognition, and AI-enabled handwriting recognition to cater to the needs of professional and creative users. Furthermore, partnerships with device manufacturers to bundle stylus pens with tablets, smartphones, and laptops are picking up steam, enhancing brand visibility and driving adoption across different consumer segments. With sustainability emerging as a key consumer priority, market players are investing in eco-friendly and durable designs to meet the increasing demand for environmentally responsible products. To make the product more accessible, companies are using e-commerce platforms for wider distribution, while offline stores remain pivotal for providing personalized customer experiences, including product demonstrations and hands-on testing. India is a good example of this dynamic market environment with rapid internet penetration and digital transformation. As of March 2024, India had 954.4 Million internet subscriptions, according to the India Brand Equity Foundation. Edtech companies are expanding into tier II and III cities, offering affordable, customized content and driving demand for stylus pens as essential tools for digital learning. These activities reflect a positive Asia Pacific stylus pen market outlook.

The report provides a comprehensive analysis of the competitive landscape in the Asia Pacific stylus pen market with detailed profiles of all major companies.

Latest News and Developments:

- April 2024: Xiaomi launched its Redmi Pad Pro in China, equipped with a 12.1-inch 2.5K LCD with a 120Hz refresh rate and stylus pen support that magnetically attaches to the tablet. It comes powered by a Snapdragon 7s Gen 2 processor and supports up to 8GB RAM, Dolby Atmos speakers, and a 10,000mAh battery. It starts at CNY 1,499, which is approximately $234.

- March 2024: The Doogee T30 Max tablet with a 12.4-inch 4K display, running on Android 14, with a stylus pen that supports 4,096 pressure levels for precise input. It is powered by a MediaTek Helio G99 chipset, 8GB RAM, and 512GB storage. The tablet is priced at $329, with discounts available.

- December 2024: The Xiaomi Pad 7 was released in India on 10 January. The tablet sports 11.2-inch of display with a 144Hz refresh rate, powered by the Snapdragon 7 Plus Gen 3 chip. The Pad 7 is to come with up to 12GB RAM and 256GB storage alongside a stylus pen and folio keyboard.

- September 2024: Samsung launched the Galaxy Tab S10+ and Tab S10 Ultra in India that sport 120Hz Dynamic AMOLED 2X panel displays. Powered by MediaTek Dimensity 9300+, these tablets support S Pen for note-taking applications. The Ultra model had a 14.6-inch screen, an 11,200mAh battery, and dual selfie cameras, while both offered 45W fast charging.

- August 2024: The Poco Pad 5G went for sale on August 23, 2024, with a 12.1-inch 120Hz display, Snapdragon 7s Gen 2 processor, and 10,000mAh battery. It supported a stylus pen and keyboard, so it was both a killer in the mid-range market and an attractive device for students and professionals alike due to its impressive specs.

Asia Pacific Stylus Pen Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Resistive Stylus, Capacitive Stylus, Active Stylus |

| Distribution Channels Covered | Online, Offline |

| Applications Covered | Smart Phones, Tablets, Interactive Whiteboards |

| End Users Covered | OEM, Retail |

| Countries Covered | China, Japan, India, South Korea, Australia, Indonesia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Asia Pacific stylus pen market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Asia Pacific stylus pen market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Asia Pacific stylus pen industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Asia Pacific stylus pen market was valued at USD 4.96 Billion in 2024.

The Asia Pacific stylus pen market is driven by growing adoption of digital devices, surging demand for e-learning and remote work solutions, increasing digital notetaking and design tool preferences, improving stylus pen technology, and the expansion of industries such as education, creative design, and gaming.

The Asia Pacific stylus pen market is estimated to exhibit a CAGR of 9.70% during 2025-2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)