Asia Pacific Soda Ash Market Size, Share, Trends and Forecast by Application, and Country, 2025-2033

Market Overview:

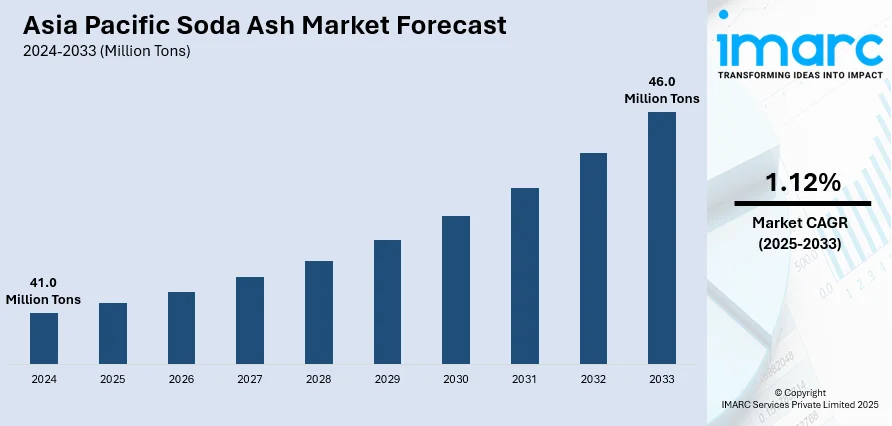

The Asia Pacific soda ash market size reached 41.0 Million Tons in 2024. Looking forward, IMARC Group expects the market to reach 46.0 Million Tons by 2033, exhibiting a growth rate (CAGR) of 1.12% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

41.0 Million Tons |

|

Market Forecast in 2033

|

46.0 Million Tons |

| Market Growth Rate 2025-2033 | 1.12% |

Soda ash, or sodium carbonate, is a white crystalline solid that is a member of the Chlor-alkali chemical family. It is an anhydrous powdered or granular substance that is refined from the mineral trona. It can also be found in naturally occurring sodium carbonate-bearing brines. Soda ash competes with caustic soda as an alkaline source in various processes. Commercially used soda ash is highly purified and sold in various grades, which differ in bulk density.

To get more information on this market, Request Sample

Asia Pacific is one of the largest soda ash markets in the world. The market is primarily driven by the vast array of soda ash applications. In the glass industry, soda acts as a fluxing agent, breaking the Si-O bonds of silica, thus reducing the viscosity of the melt and lowering the temperature required to form the glass. It is also incorporated in the production of powdered soaps, detergents, and various specialty cleaning products for household, industrial, and commercial applications. Besides this, soda ash is used as a substitute for sodium hydroxide for lyeing in cooking. The region meets its soda ash demand by importing the majority of the product as the regional capacity is small relative to its consumption. Furthermore, the stringent regulations by several governments regarding the use of soda ash for wastewater treatment and other environmental applications to improve the alkalinity of lakes and the pH value of the water are also propelling the growth of the market.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the Asia Pacific soda ash market report, along with forecasts at the regional and country level from 2025-2033. Our report has categorized the market based on application.

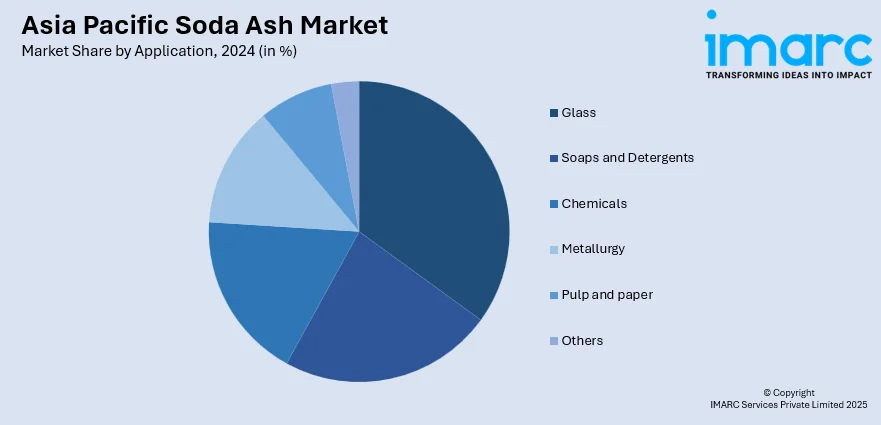

Breakup by Application:

- Glass

- Soaps and Detergents

- Chemicals

- Metallurgy

- Pulp and paper

- Others

Breakup by Country:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Segment Coverage | Application, Country |

| Countries Covered | China, Japan, India, South Korea, Australia, Indonesia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Asia Pacific soda ash market reached a volume of 41.0 Million Tons in 2024.

We expect the Asia Pacific soda ash market to exhibit a CAGR of 1.12% during 2025-2033.

The rising demand for soda ash as a fluxing agent, as it aids in reducing the viscosity of the melt and lowering the temperature required to form the glass, is primarily driving the Asia Pacific soda ash market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several Asia Pacific nations, resulting in the temporary halt in numerous production activities for soda ash.

Based on the application, the Asia Pacific soda ash market can be bifurcated into glass, soaps and detergents, chemicals, metallurgy, pulp and paper, and others. Currently, glass holds the largest market share.

On a regional level, the market has been classified into China, Japan, India, South Korea, Australia, Indonesia, and others, where China currently dominates the Asia Pacific soda ash market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)