Asia Pacific Secondhand Luxury Goods Market Size, Share, Trends and Forecast by Product Type, Demography, Distribution Channel, and Country, 2025-2033

Market Overview

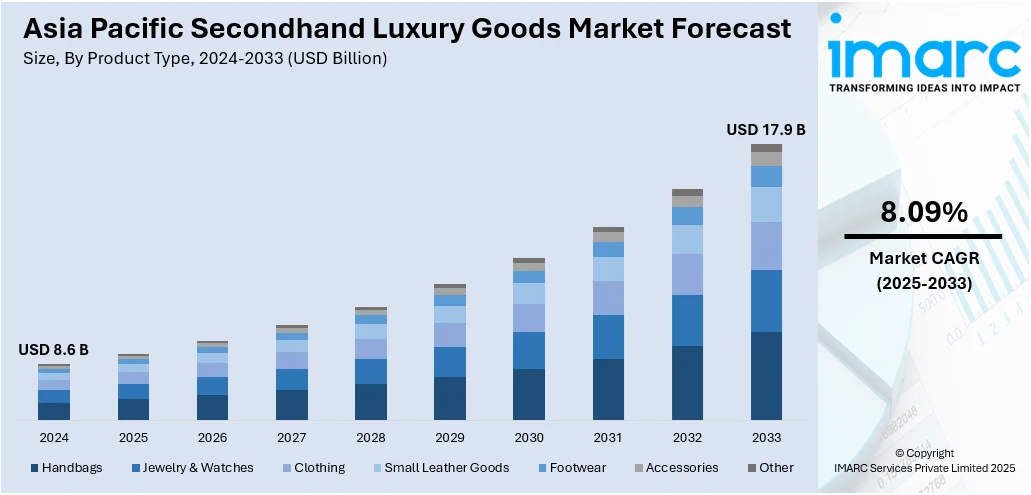

The Asia Pacific secondhand luxury goods market size reached USD 8.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 17.9 Billion by 2033, exhibiting a growth rate (CAGR) of 8.09% during 2025-2033. The rising middle-class demand, digital platform adoption, sustainability awareness, cultural value, rarity, and exclusivity appeals, along with personalized offline experiences are among the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 8.6 Billion |

|

Market Forecast in 2033

|

USD 17.9 Billion |

| Market Growth Rate 2025-2033 | 8.09% |

Secondhand luxury goods refer to high-end products, typically associated with luxury brands, that have been previously owned and used by individuals before being resold in the market. These items retain their premium quality, craftsmanship, and brand reputation despite being pre-owned. The secondhand luxury goods market encompasses a wide range of products, including fashion apparel, accessories, watches, jewelry, and more. Consumers are drawn to secondhand luxury goods for their potential cost savings, environmental considerations, and the opportunity to own sought-after brands at a more accessible price point. This market's growth is influenced by evolving consumer attitudes towards sustainability and the circular economy.

To get more information on this market, Request Sample

The region's expanding middle class with inflating disposable income is fueling the demand for prestigious brands at more affordable prices, primarily driving the Asia Pacific secondhand luxury goods market. Besides this, the prevalence of digital platforms and e-commerce in the region has facilitated the accessibility of secondhand luxury goods, broadening their reach to a larger and more diverse consumer base, thereby creating a positive outlook for market expansion. Moreover, the younger demographic in the region values sustainable practices and uniqueness, making pre-owned luxury items an attractive choice. The allure of owning well-crafted, iconic brands, coupled with environmental awareness, is contributing to the market's growth. In addition to this, the expanding penetration of social media and influencers normalizes the concept of secondhand luxury, encouraging aspirational buyers to participate in the market. Furthermore, the evolving consumer preferences and technological advancements in the Asia Pacific are presenting lucrative opportunities for market expansion.

Asia Pacific Secondhand Luxury Goods Market Trends/Drivers:

Rising middle-class demand

The burgeoning middle class of the Asia Pacific region is a pivotal driver behind the surge in the secondhand luxury goods market. As economies in this region experience rapid growth, more individuals are moving up the income ladder, resulting in increased disposable income. This expanding middle class aspires to own prestigious luxury brands at comparatively affordable prices, which, in turn, is contributing to the increasing demand for secondhand luxury goods. This demand is particularly prominent among younger consumers who are looking to project a certain lifestyle and social status without straining their finances. The appeal of luxury brands, combined with affordability, is acting as another significant growth-inducing driver for the market.

Widespread adoption of digital platforms

The Asia Pacific region has witnessed exponential growth in digitalization and e-commerce. In line with this, the proliferation of online platforms has significantly contributed to the accessibility and popularity of secondhand luxury goods. These platforms provide a convenient and seamless way for buyers to browse, compare, and purchase pre-owned luxury items. The digital landscape has transcended geographical barriers, enabling consumers from remote areas to access a diverse array of secondhand luxury goods. Apart from this, the adoption of social media and influencer marketing has amplified the visibility of secondhand luxury, normalizing the concept and influencing consumer behavior. Consequently, the digital revolution has democratized the luxury market, making it easier for buyers to find and acquire pre-owned luxury items.

Asia Pacific Secondhand Luxury Goods Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Asia Pacific secondhand luxury goods market report, along with forecasts at the regional and country levels from 2025-2033. Our report has categorized the market based on product type, demography and distribution channel.

Breakup by Product Type:

- Handbags

- Jewelry & Watches

- Clothing

- Small Leather Goods

- Footwear

- Accessories

- Other

Handbags represent the biggest market segment

The report has provided a detailed breakup and analysis of the market based on the product type. This includes handbags, jewelry & watches, clothing, small leather goods, footwear, accessories, and other. According to the report, handbags represented the largest segment.

The handbags segment is dominating the Asia Pacific secondhand luxury goods market due to several reasons. Apart from the allure of prestigious brands at accessible prices, the rarity and exclusivity associated with certain vintage or limited-edition handbags significantly attract buyers, strengthening the market. Additionally, these bags often hold historical and cultural value, making them sought-after collector's items, creating a positive outlook for market expansion. Moreover, the resale market offers an avenue for consumers to acquire discontinued designs that may not be available through primary retail channels. Concurrent with this, the increasing awareness of sustainable fashion practices and the desire for unique pieces align with the appeal of pre-owned luxury handbags, impelling their demand even further in the market.

Breakup by Demography:

- Women

- Men

- Unisex

Women account for the majority of the market share

A detailed breakup and analysis of the market based on the demography has also been provided in the report. This includes women, men, and unisex. According to the report, women accounted for the largest market share.

The evolving preference of women represents one of the key factors fueling the demand for secondhand luxury goods in the Asia Pacific region. Beyond cost savings, women are drawn to the sentiment of owning iconic brands and styles that hold cultural and personal significance. The ability to curate a distinct and varied wardrobe with a range of luxury items at a fraction of the original cost appeals to their desire for self-expression, bolstering the market growth. Furthermore, the growing influence of sustainability and ethical consumption contributes to this trend as women seek alternatives to fast fashion. Embracing pre-owned luxury aligns with their values and enables them to make fashion choices that reflect their individuality while minimizing environmental impact.

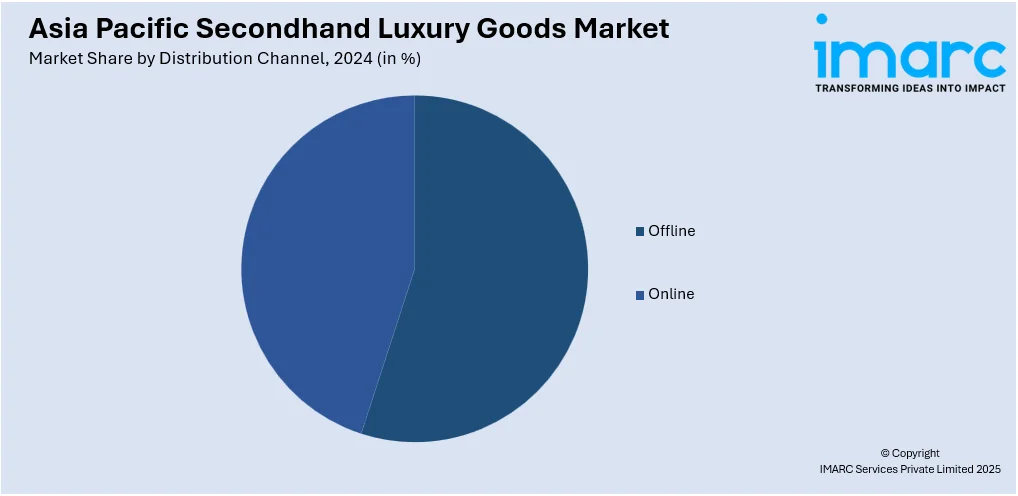

Breakup by Distribution Channel:

- Offline

- Online

Offline represents the biggest market segment

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes offline and online. According to the report, offline represented the largest segment.

The increasing inclination towards tactile experiences and personalized interactions is propelling the sales of secondhand luxury goods through offline channels. This hands-on experience is particularly crucial in the luxury sector, where craftsmanship and quality are paramount. In addition to this, offline stores provide a space for curated displays and themed events, creating a sense of exclusivity and discovery that resonates with luxury consumers. Apart from this, the ability to consult with knowledgeable staff and receive expert advice on selecting and caring for pre-owned luxury items further enhances the appeal of offline channels in the secondhand luxury goods market.

Breakup by Country:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

China exhibits a clear dominance, accounting for the largest Asia Pacific secondhand luxury goods market share

The report has also provided a comprehensive analysis of all the major regional markets, which include China, Japan, India, South Korea, Australia, Indonesia, and others. According to the report, China accounted for the largest market share.

As Chinese consumers become more discerning and brand-conscious, the appeal of prestigious luxury items remains strong, fueling the demand for luxury goods in the country. However, a shift in mindset towards sustainability and value-consciousness has fueled the adoption of pre-owned luxury goods. The younger generation, in particular, seeks unique and rare items that reflect their individuality, contributing to the surge in demand for secondhand luxury. Moreover, China's rapidly expanding middle class, coupled with the increasing disposable income of individuals, creates a larger consumer base with a growing appetite for luxury goods, thereby bolstering the market growth. In addition to this, the rise of digital platforms and e-commerce in China has significantly increased the accessibility of secondhand luxury items, especially in regions where physical luxury stores might be limited. As a result, the China secondhand luxury goods market is poised for constant growth, driven by evolving consumer behaviors and market dynamics.

Competitive Landscape:

The competitive landscape of the Asia Pacific secondhand luxury goods market is characterized by a diverse range of players, each contributing to the market's vibrancy. Established online marketplaces dominate the digital sphere, offering extensive selections of authenticated pre-owned luxury items. These platforms leverage their user-friendly interfaces, secure payment systems, and global shipping networks to attract a wide customer base. Additionally, luxury brands are increasingly entering the secondhand market, either through partnerships with resale platforms or by launching their own authenticated pre-owned sections. This strategic move capitalizes on the circular economy trend and enables brands to retain some control over their products' resale value. As the market evolves, the collaboration between established players, innovative startups, and luxury brands will shape the competitive dynamics of the Asia Pacific secondhand luxury goods market.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Asia Pacific Secondhand Luxury Goods Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Handbags, Jewelry & Watches, Clothing, Small Leather Goods, Footwear, Accessories, Other |

| Demographies Covered | Women, Men, Unisex |

| Distribution Channels Covered | Offline, Online |

| Countries Covered | China, Japan, India, South Korea, Australia, Indonesia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Asia Pacific secondhand luxury goods market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Asia Pacific secondhand luxury goods market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Asia Pacific secondhand luxury goods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Asia Pacific secondhand luxury goods market was valued at USD 8.6 Billion in 2024.

We expect the Asia Pacific secondhand luxury goods market to exhibit a CAGR of 8.09% during 2025-2033.

The increasing consumer inclination towards high-end fashion accessories at lower prices, along with the emerging trend of re-selling unwanted luxury goods, is primarily driving the Asia Pacific secondhand luxury goods market.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of secondhand luxury goods across several Asia Pacific nations.

Based on the product type, the Asia Pacific secondhand luxury goods market can be categorized into handbags, jewelry & watches, clothing, small leather goods, footwear, accessories, and other. Currently, handbags account for the majority of the market share.

Based on the demography, the Asia Pacific secondhand luxury goods market has been segregated into women, men, and unisex. Among these, women currently hold the largest market share.

Based on the distributional channel, the Asia Pacific secondhand luxury goods market can be bifurcated into offline and online. Currently, offline exhibits a clear dominance in the market.

On a regional level, the market has been classified into China, Japan, India, South Korea, Australia, Indonesia, and others, where China currently dominates the Asia Pacific secondhand luxury goods market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)